Table of Contents

IRS Form 8839 – Qualified Adoption Expenses – Adopting a child is a joyful milestone, but the costs—averaging $30,000–$50,000 for domestic adoptions and up to $60,000 for international—can strain finances. Enter the Adoption Tax Credit, a powerful federal incentive that offsets qualified expenses dollar-for-dollar. For tax year 2025 (filed in 2026), the maximum credit rises to $17,280 per eligible child, with up to $5,000 refundable under recent expansions from the One Big Beautiful Bill Act (OBBBA). This makes it more accessible for lower-income families.

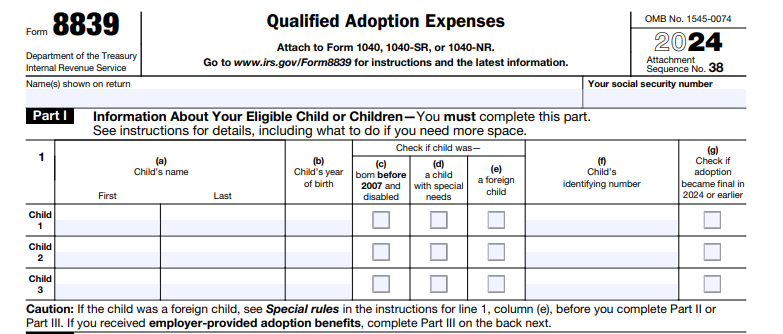

IRS Form 8839, “Qualified Adoption Expenses,” is the essential tool to calculate and claim this credit, plus exclude employer-provided benefits from income. Whether pursuing domestic, foster, or international adoption, this nonrefundable (mostly) credit—phased out above $259,190 MAGI—can deliver significant relief. In this SEO-optimized guide, learn eligibility, limits, step-by-step filing, and tips to maximize your refund. Always consult IRS.gov/Form8839 for the latest.

What Is IRS Form 8839?

Form 8839 helps taxpayers compute the Adoption Credit (claimed on Schedule 3, Form 1040, line 6c) and exclude up to $17,280 in employer-sponsored adoption assistance from gross income (Form 1040, line 1). It’s for adoptions of eligible children under age 18 (or incapable of self-care) finalized in 2025, or expenses paid in prior years for ongoing efforts.

Key features for 2025:

- Credit Type: Partially refundable (up to $5,000; remainder nonrefundable, carries forward 5 years).

- Maximum Benefit: $17,280 per child (inflation-adjusted; up from $16,810 in 2024).

- Employer Exclusion: Up to $17,280 tax-free; subtract from credit-eligible expenses.

File with your 2025 return by April 15, 2026 (or October 15 extended). Even unsuccessful adoptions qualify if expenses were for a specific child.

Who Qualifies for the Adoption Tax Credit in 2025?

Eligibility hinges on the child, expenses, and your income. Married couples must file jointly; single filers and heads of household qualify.

Eligible Child Criteria

- Under 18 at adoption finalization.

- U.S. citizen/resident or foreign resident (Hague Convention rules apply for international).

- Special Needs: State-determined (e.g., foster subsidies); full $17,280 credit even without expenses.

Qualified Expenses Table (2025)

| Expense Type | Eligible? | Examples/Notes |

|---|---|---|

| Adoption Fees | Yes | Agency fees, matching services. |

| Court/Attorney Costs | Yes | Legal representation, filings. |

| Travel/Lodging | Yes | Required trips (e.g., international pickup). |

| Medical (Pre-Adoption) | Yes | Exams, immunizations. |

| Post-Adoption Fees | No | Only if for finalization. |

| Surrogacy/Gamete | No | Not adoption-related. |

| Tuition/School | No | Ongoing education. |

Expenses must be “reasonable and necessary” for legal adoption; reimbursements (e.g., employer) reduce credit base.

Income Phaseout Table (Tax Year 2025)

| MAGI Range | Credit Available |

|---|---|

| $0 – $259,190 | Full ($17,280) |

| $259,191 – $299,190 | Partial (phased out) |

| Over $299,190 | None |

*MAGI: Adjusted gross income + exclusions/add-backs (e.g., foreign income). Special needs: Full credit regardless of income/expenses.

When Is Form 8839 Due in 2026?

Attach to your 2025 Form 1040 by April 15, 2026. Extensions (Form 4868) push to October 15, 2026, but pay any owed tax by April to avoid penalties. Claim expenses in the year paid (up to finalization year); carryforwards from 2020 expire after 2025.

IRS Form 8839 Download and Printable

Download and Print: IRS Form 8839

Key 2025–2026 Adoption Tax Deadlines Table

| Action | Deadline |

|---|---|

| Expenses Paid (Claim Year) | 2025 (filed 2026) |

| Form 8839 Filing | April 15, 2026 |

| Extension Request | April 15, 2026 |

| Amended Return (Prior Years) | 3 years from original |

How to Complete IRS Form 8839: Step-by-Step (2025 Form)

Use the 2025 draft form; report per child (up to 3 lines in Part I). Gather receipts, finalization decrees, and Form W-2 (employer benefits in box 12, code T). Complete Part III (exclusions) before Part II (credit).

Part I: Information on Child

- Line 1: Child’s name, SSN/ATIN/ITIN, relationship, months eligible, special needs (yes/no), finalization year, U.S./foreign child.

- Columns (a)–(h): Track per child; enter prior-year credits on line 3.

Part II: Adoption Credit

- Line 2: $17,280 max per child (prorate if shared adoption).

- Line 3: Prior credits claimed (from last Form 8839).

- Line 4: Line 2 minus line 3.

- Line 5: Qualified expenses (total paid; subtract employer reimbursements from Part III).

- Line 6: Smaller of line 4 or 5.

- Lines 7–10: Total eligible credit before phaseout.

- Line 11–16: MAGI phaseout (use worksheet; subtract $40,000 range over threshold).

- Line 17: Tentative credit (line 10 minus phaseout).

- Line 18–28: Carryforward worksheet (5-year limit; apply to tax liability on Form 1040).

Part III: Employer-Provided Adoption Benefits

- Line 19–28: Report benefits received (W-2 code T); exclude up to $17,280 (phased out same as credit); taxable excess on Form 1040, line 8.

Pro Tip: For foreign adoptions, finality is Hague decree or U.S. re-adoption year. Use ATIN (Form W-7A) if no SSN yet; paper-file if needed.

E-Filing Form 8839

E-file with your 1040 via IRS Free File, TurboTax, or H&R Block—mandatory for most (10+ forms). Software auto-calculates phaseouts; attach PDFs of decrees/receipts if audited.

Recent Changes to Form 8839 for 2025 Filings

- Credit Increase: $17,280 max (from $16,810); $5,000 refundable (new under OBBBA).

- Phaseout Adjustment: Starts at $259,190 MAGI (up from $252,150).

- Refundability: First $5,000 cash back even if no tax owed (indexed post-2025).

- No Major Form Tweaks: Aligns with Rev. Proc. 2024-40; special needs full credit intact.

Penalties for Errors on Form 8839

- Late Filing: 5% monthly on unpaid tax (max 25%).

- Inaccurate Claims: 20% accuracy penalty; audits common for international/special needs.

- No TIN: Return rejected; $290 penalty per return.

Amend with Form 1040-X within 3 years; reasonable cause waives.

Best Practices for Maximizing Form 8839 in 2025

- Document Everything: Retain receipts/decrees 7 years; use adoption agency summaries.

- Employer Check: Ask HR for benefits (up to $17,280 exclusion + credit on remainder).

- Carryforward Strategy: Apply oldest first; track via IRS worksheet.

- Special Needs Tip: Confirm state determination for full credit sans expenses.

- Software/Pros: TurboTax guides; CPA for complex international cases.

- State Credits: Stack with federal (e.g., CA up to $2,500).

Conclusion: Unlock Up to $17,280 with Form 8839 in 2025

The Adoption Tax Credit via IRS Form 8839 transforms adoption costs into savings, with $17,280 max and $5,000 refundable for 2025—easing the journey for 135,000+ annual U.S. adoptions. Start tracking expenses now for your April 15, 2026, filing.

Download the 2025 form/instructions at IRS.gov/Form8839. For help, call 800-829-1040 or consult Pub. 968. Build your family—claim your credit.

Last updated: December 2025. Verify IRS sources for advice.