Table of Contents

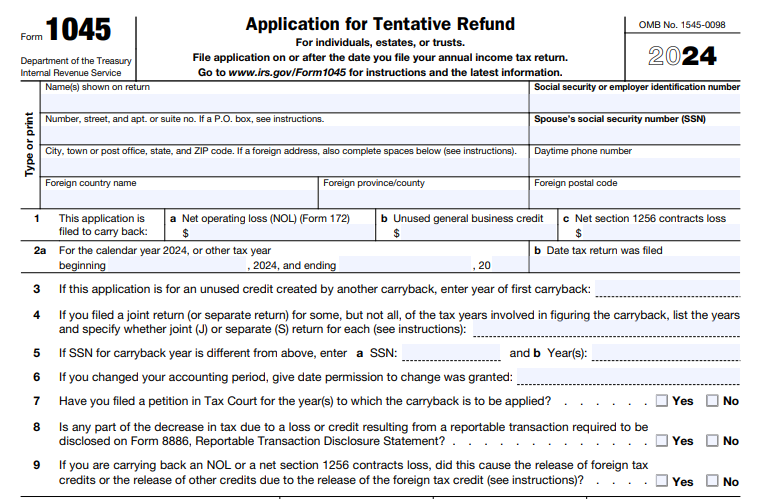

IRS Form 1045 – Application for Tentative Refund – Discovering a net operating loss (NOL), unused business credit, or other carryback-eligible item on your 2024 tax return? Don’t wait years for a refund—IRS Form 1045 lets you apply for a “tentative” refund within 90 days, putting cash back in your pocket faster than an amended return. For tax year 2024 (filed in 2025), this form is newly e-fileable, with NOL calculations now handled via the separate Form 172. Whether you’re an individual hit by business setbacks or an estate navigating losses, Form 1045 can accelerate refunds up to thousands.

This SEO-optimized guide details Form 1045 filing requirements for 2025, eligibility, deadlines, step-by-step instructions, and recent changes like electronic filing. Maximize your recovery with trusted IRS resources—always verify at IRS.gov/Form1045.

What Is IRS Form 1045?

Form 1045, “Application for Tentative Refund,” is a streamlined claim for a quick IRS refund based on carryback adjustments. Filed by individuals, estates, and trusts (corporations use Form 1139), it processes faster than Form 1040-X, delivering refunds in as little as 90 days. Key triggers include:

- Net Operating Loss (NOL) Carryback: Offset prior-year income (limited post-2020 rules).

- Unused General Business Credit: Carry back credits like R&D or investment (Form 3800).

- Net Section 1256 Contracts Loss: From futures/options trading (Form 6781).

- Claim of Right Adjustment: Overpayment under Section 1341(b)(1) for repaid income.

The refund is “tentative”—the IRS may audit later, but you get funds upfront. Attach Form 172 for NOLs (new for 2024). For 2025 filings, expect processing by July 2025 for timely submissions.

Who Must File Form 1045 in 2025?

File if you have a carryback-eligible item from your 2024 return that reduces prior-year taxes. Eligible filers:

- Individuals: Self-employed, farmers, or traders with NOLs/credits.

- Estates/Trusts: With business losses or unused credits (tax-exempt trusts use Form 990-T).

- Joint Filers: Both spouses sign; allocate carrybacks if separate returns.

Form 1045 vs. Alternatives Table (2025)

| Scenario | Use Form 1045? | Alternative | Processing Time |

|---|---|---|---|

| NOL Carryback (Farmers/Insurers) | Yes | Form 1040-X | 90 days vs. 16+ weeks |

| Unused Business Credit | Yes | Form 1040-X | 90 days |

| Section 1256 Loss | Yes | Amended Schedule D | 90 days |

| Claim of Right | Yes | Form 1040-X | 90 days |

| No Carryback (Forward Only) | No | Form 1040 Schedule 1 | N/A |

Not for carrybacks to Section 965(a) years (use amended return). Elect to waive carryback on Form 172.

When Is Form 1045 Due in 2025?

File within 1 year of the loss/credit year-end—for 2024, by December 31, 2025. Submit after your 2024 return (filed by April 15, 2025, or extended October 15). Processing starts within 90 days of the later: filing date or extended 2024 due date.

Disaster extensions apply (IRS.gov/DisasterTaxRelief). Mail separately—don’t attach to your 1040.

IRS Form 1045 Download and Printable

Download and Print: IRS Form 1045

Key 2025 Form 1045 Deadlines Table

| Event | Deadline | Notes |

|---|---|---|

| File 2024 Return | April 15, 2025 (or Oct. 15 extended) | Prerequisite |

| Form 1045 Submission | December 31, 2025 | 1-year window |

| Expected Processing | July 2025 (for early filers) | 90 days from later of filing/extended return |

| Audit/Adjustment Window | Anytime after refund | File Form 1040-X for final claim if needed |

How to Complete IRS Form 1045: Step-by-Step (2024 Form for 2025 Filings)

Use the 2024 form (OMB No. 1545-0098). It’s two pages; e-file available starting 2025. Gather your 2024 return, prior-year returns, and Form 172 (for NOLs). Report per carryback year in “Before” and “After” columns.

Step 1: Heading and Line 1

- Enter name, SSN/EIN, address, filing status.

- Line 1: Check boxes for NOL (a), unused credit (b), Section 1256 loss (c), or claim of right (d). Enter carryback years (e.g., “2nd” for 2022).

Step 2: Lines 2–10 (Income and Deductions)

- Lines 2–10: Refigure prior-year income/deductions after carryback (e.g., AGI on line 11).

- Use Form 172 for NOL amount; attach allocation if partial-year.

Step 3: Lines 11–28 (Tax Computation)

- Line 11: Refigured AGI.

- Lines 12–15: Deductions (standard/itemized; zero exemptions 2018–2025).

- Line 16: Taxable income.

- Lines 17–28: Taxes/credits (e.g., child tax credit on line 21 for 2021; no CTC on line 22 per 2024 update). Compute decrease per year.

Step 4: Lines 29–33 (Totals and Refund)

- Line 29–31: Decrease in tax per year.

- Line 32: Total decrease (refund amount).

- Line 33: Section 1341 overpayment (if applicable; attach computation).

Step 5: Sign and Attach

- Sign/date (both spouses if joint).

- Required Attachments: 2024 Form 1040/Schedules; Form 172 (NOL); prior-year forms (e.g., 3800 for credits, 6781 for 1256); K-1s; elections; detailed computations.

Pro Tip: Use worksheets for refiguring QBI (Form 8995), AMT (Form 6251), and phaseouts. E-file via approved software for faster processing.

Recent Changes to Form 1045 for 2025 Filings

The 2024 form (filed in 2025) introduces:

- Form 172 Integration: Schedules A/B removed; compute NOL on new Form 172 and attach.

- E-Filing Debut: First year for electronic submission (2024 returns in 2025).

- NOL Rules: Post-2020, carryback limited to 2 years for farmers/insurers only; 80% taxable income limit (no carryback for most).

- Credit Updates: No child tax credit on line 22 (correction from prior editions); include excess advance CTC on line 17 for 2021.

- Excess Business Losses: Disallowed through 2028 (Section 461(l)).

No inflation adjustments noted; personal exemptions remain zero through 2025.

Penalties for Late or Incomplete Form 1045 Filing

- Late Filing: Disallowed if beyond 1-year window; no penalty but lose quick refund—file Form 1040-X instead (3-year statute).

- Incompleteness: 90-day disallowance if math/omissions not fixed; IRS bills excesses as errors.

- Interest: On under-refunds (if audited); no penalty on over-refunds (IRS repays with interest).

Reasonable cause (e.g., disaster) extends deadlines; amend via 1040-X anytime.

Best Practices for Form 1045 Success in 2025

- File Post-Return: Wait for 2024 acceptance to avoid delays.

- E-File When Possible: Speeds to 90 days; use TurboTax or IRS Free File partners.

- Double-Check Attachments: Omissions kill processing—include all refigurations.

- Track Farmers/Insurers: Only they get 2-year NOL carryback; others carry forward.

- Professional Help: CPA for complex credits/NOLs; retain records 3+ years.

- Monitor Status: Use IRS “Where’s My Refund?” after 90 days.

Conclusion: Accelerate Your 2024 Refund with Form 1045 in 2025

IRS Form 1045 is your fast-track to refunds from NOLs, credits, or adjustments—processed in 90 days vs. months for amendments. With e-filing new for 2025 and Form 172 streamlining NOLs, now’s the time to review your 2024 return for carryback opportunities before the December 31, 2025, deadline.

Download the 2024 form and instructions at IRS.gov/Form1045. Questions? Call 800-829-1040 or consult Pub. 536 (NOLs). Claim your tentative refund—cash flow relief awaits.

Last updated: December 2025. Verify official IRS sources for personalized advice.