Table of Contents

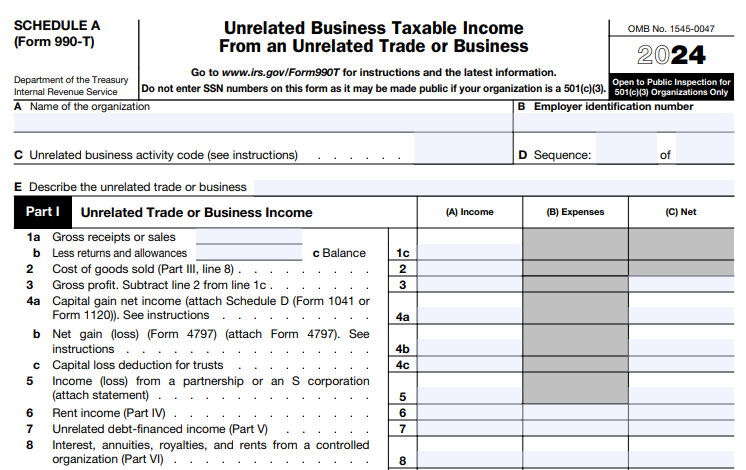

IRS Form 990-T (Schedule A) – Unrelated Business Taxable Income From an Unrelated Trade or Business – Tax-exempt organizations like nonprofits, charities, and trusts often generate income from activities outside their mission—think advertising sales, facility rentals, or merchandise vending. While exempt from federal income tax on mission-related revenue, unrelated business taxable income (UBTI) is fair game for the IRS. Enter IRS Form 990-T Schedule A, the mandatory attachment to Form 990-T that breaks down UBTI for each separate unrelated trade or business, ensuring accurate taxation and compliance.

For tax year 2024 (filed in 2025), Schedule A consolidates prior schedules (e.g., for advertising or parking income) into one streamlined form, with new lines for credit adjustments. This SEO-optimized guide covers Form 990-T Schedule A filing requirements, who must file, deadlines, step-by-step instructions, and updates. Nonprofits with $1,000+ in gross UBTI: Don’t risk penalties—e-file by May 15, 2025. Download the 2024 form at IRS.gov/Form990T.

What Is IRS Form 990-T Schedule A?

Schedule A (Form 990-T), “Unrelated Business Taxable Income From an Unrelated Trade or Business,” calculates UBTI separately for each distinct activity under Regulations section 1.512(a)-6. This “silo” approach—mandated since 2020—prevents losses from one business offsetting profits in another, potentially increasing your tax bill.

Key purposes:

- Report Gross Income & Deductions: By NAICS code, for activities like sales, rentals, or investments.

- Compute Net UBTI: Subtract allowable expenses; aggregate positives on Form 990-T, Part I, line 1.

- Handle Specifics: Includes sections for exploited activities, controlled entities, and advertising.

Unlike Form 990-T (the main return for UBIT liability), Schedule A is filed one per unrelated trade or business. For 2024, it integrates all prior sub-schedules, simplifying prep while adding lines for nonrefundable credits.

Who Must File Form 990-T Schedule A in 2025?

Any tax-exempt organization filing Form 990-T for $1,000+ gross UBTI must attach a separate Schedule A for each unrelated trade or business. This includes:

- 501(c)(3) Charities: E.g., museum gift shops or event sponsorships.

- 501(c)(4)–(c)(7) Groups: Social clubs with bar sales.

- Title-Holding Corporations: Under section 501(c)(2).

- Trusts & IRAs: 401(a) trusts, IRAs, Roth IRAs, ESAs, or Archer MSAs with passive income.

- State Colleges/Universities: Dorm rentals or concessions.

Exceptions: No Schedule A if filing only for proxy tax (lobbying) or certain refunds (e.g., RIC/REIT gains). Consolidated filers (e.g., under section 1501) aggregate but still silo by business.

Who Files Schedule A? Quick Threshold Table (Tax Year 2024)

| Organization Type | Gross UBTI Threshold | Schedule A Required? | Notes |

|---|---|---|---|

| 501(c)(3) Charities | $1,000+ | Yes (per business) | Includes parking, advertising. |

| Social Clubs (501(c)(7)) | $1,000+ | Yes | Bar/facility income. |

| IRAs/401(a) Trusts | $1,000+ | Yes | Passive investments. |

| Proxy Tax Only | $0 | No | Complete Form 990-T, lines 1–3 only. |

| No UBTI | N/A | No | No Form 990-T needed. |

File even if net UBTI is zero—gross triggers reporting.

When Is Form 990-T Schedule A Due in 2025?

Attach to Form 990-T: 15th day of the 5th month after your tax year ends (most: May 15, 2025 for calendar-year). Trusts/IRAs: 15th day of the 4th month (April 15, 2025). E-file mandatory for tax years ending after Dec. 31, 2020.

Key 2025 Filing Deadlines Table (Tax Year 2024)

| Organization Type | Original Due Date | Extended Due Date (Form 8868) |

|---|---|---|

| Calendar-Year Charities/Clubs | May 15, 2025 | November 17, 2025 |

| Calendar-Year Trusts/IRAs | April 15, 2025 | October 15, 2025 |

| Fiscal-Year End June 30, 2024 | November 17, 2024 | May 15, 2025 |

| Fiscal-Year End Sept. 30, 2024 | February 17, 2025 | August 15, 2025 |

*Notes: Weekends/holidays shift to next business day. Pay 100% tax by original due to avoid penalties; extension via Form 8868 (now elective for territories/states). Estimated tax if $500+ owed.

IRS Form 990-T (Schedule A) Download and Printable

Download and Print: IRS Form 990-T (Schedule A)

How to Complete Form 990-T Schedule A: Step-by-Step (2024 Form)

Use the 2024 Schedule A; one per NAICS-coded business (Item C: 6-digit code, e.g., 541800 for advertising). Complete all Schedules A first, then sum positives on Form 990-T, Part I, line 1. Accrual method preferred; attach statements for details.

Part I: Unrelated Business Activity

- Item A: Unrelated business code (NAICS, e.g., 711100 for sports events).

- Item B: Description (e.g., “Concession sales at games”).

- Item C: 6-digit NAICS code.

Part II: Income

- Lines 1–5: Gross receipts ($), cost of goods sold, etc. (e.g., Line 3: Gross profit).

- Lines 6–10: Investment income (dividends, interest); exclude related-party.

- Line 11: Total gross income (sum lines 3–10).

Part III: Expenses

- Lines 12–17: Deductions (salaries, repairs, depreciation—attach Form 4562).

- Line 18: Net UBTI (line 11 minus line 17; positive to Form 990-T).

Parts IV–X: Specific Adjustments

- Part IV: NOL deduction (separate silos; carryforward only).

- Part V: Charitable contributions (up to 10% UBTI).

- Part VI: Controlled entities (50%+ ownership; include rents).

- Part VII: Exploited exempt activities (e.g., trade shows; report net).

- Part VIII: Advertising in periodicals (circulation >500; 80% reader-supported).

- Part IX: Other (e.g., parking lots; attach computation).

Pro Tip: Use Form 2220 for underpayment penalty. Software like Tax990 auto-generates from books.

E-Filing Requirements for Schedule A

Mandatory e-filing for Form 990-T (and attachments) since 2021—use IRS-approved providers (e.g., Tax990, ExpressTaxExempt). Paper rejected; benefits: Faster refunds (6–8 weeks), error validation.

Recent Changes to Form 990-T Schedule A for 2025 Filings

The 2024 form (filed 2025) streamlines with:

- Credit Lines: Part II line 4a (reducible UBTI) and Part III line 3a (non-reducible) for nonrefundable credits (e.g., Form 3800).

- Extension Update: Form 8868 now covers territories/states; elective payment election.

- AMT Exception: No Form 4626 for exempt orgs (Oct. 2024 relief).

- No Major Overhauls: Core silos intact; monitor for 2025 inflation (e.g., NOL limits).

Penalties for Late or Incomplete Schedule A Filing

- Failure to File: $25/day (max $15,000 or 5% gross income); minimum $510 if >60 days late.

- Late Payment: 0.5% monthly (max 25%) + 7% interest.

- Incomplete Silos: IRS reclassifies, increasing tax; 20% accuracy penalty.

- Revocation Risk: 3-year non-filing revokes exempt status.

Abate for reasonable cause (e.g., disaster); state UBIT may add fees.

Best Practices for Schedule A Compliance in 2025

- Silo Early: Track activities by NAICS quarterly; use software for NOL silos.

- Deduct Aggressively: Allocate direct expenses; indirect via reasonable method.

- E-File Proactively: Providers like TaxZerone auto-include Schedule A.

- Audit-Proof: Retain 7+ years of records; consult CPA for controlled entities.

- Minimize UBTI: Structure rentals as mission-related; review investments.

Conclusion: Master UBTI Reporting with Schedule A in 2025

IRS Form 990-T Schedule A ensures tax-exempt orgs pay their due on unrelated income—potentially $1,000s in liability if silos aren’t managed. With May 15, 2025, deadlines and e-filing mandates, prepare now to avoid penalties and focus on your mission.

Download the 2024 form/instructions at IRS.gov/Form990T. For help, call the Exempt Organizations hotline at 877-829-5500 or see Pub. 598. Compliant filing: Tax-smart philanthropy.

Last updated: December 2025. Verify IRS sources for advice.