Table of Contents

IRS Form 8453-TE – Tax Exempt Entity Declaration and Signature for E-file – In an era where digital efficiency is king, tax-exempt organizations are increasingly mandated to e-file their returns to streamline IRS processing and reduce errors. Enter IRS Form 8453-TE, the “Tax Exempt Entity Declaration and Signature for Electronic Filing”—a critical authentication tool that verifies the integrity of your electronic submission. For tax year 2024 (filed in 2025), this form ensures compliance for nonprofits, foundations, and trusts, authorizing everything from third-party transmissions to electronic payments.

With e-filing now required for most tax-exempt entities under the Taxpayer First Act, understanding Form 8453-TE filing requirements is non-negotiable. This SEO-optimized guide covers eligibility, deadlines, step-by-step instructions, and tips to avoid penalties. Whether you’re filing a Form 990 or 990-T, download the 2024 form at IRS.gov/Form8453TE and stay ahead of the curve.

What Is IRS Form 8453-TE?

Form 8453-TE serves as the official declaration and signature for electronically filed tax-exempt returns, confirming that the filer has reviewed the return and authorizes its transmission. It’s not a standalone tax return but a supporting document that:

- Authenticates the Return: Verifies the electronic Forms 990, 990-EZ, 990-PF, 990-T, 1120-POL, 4720, 8868, 5227, 5330, and 8038-CP.

- Authorizes Transmissions: Permits an Electronic Return Originator (ERO) or Intermediate Service Provider (ISP) to send the return via a third-party transmitter.

- Enables Electronic Payments: Allows direct debit for taxes owed on Forms 990-PF, 990-T, 1120-POL, 4720, 5330, or 8868 with payment.

For 2024 filings, the form aligns with expanded e-filing mandates from the Taxpayer First Act (P.L. 116-25), covering more entities than ever. No major structural changes for 2025, but always check IRS.gov for updates as of February 19, 2025.

Who Must File Form 8453-TE in 2025?

Any tax-exempt entity e-filing one of the specified forms must complete and retain Form 8453-TE. This includes:

- Nonprofits and Charities: Filing Forms 990, 990-EZ, or 990-T (e.g., for unrelated business income).

- Private Foundations: Submitting Form 990-PF.

- Political Organizations: Using Form 1120-POL.

- Trusts and Plans: For Forms 5227 (split-interest trusts), 4720 (excise taxes), 5330 (pension plans), or 8038-CP (continuing care entities).

- Extension Requests: Form 8868 with electronic payment.

Key rule: If using an ERO for signing, opt for Form 8879-TE instead. Retain the signed 8453-TE for 3 years—don’t mail it unless requested. Foreign entities or those with paper attachments (e.g., Schedules K) may need to paper-file the entire package.

Form 8453-TE Applicability Table (Tax Year 2024)

| Form Type | E-File Required? | 8453-TE Needed? | Notes |

|---|---|---|---|

| Form 990/990-EZ | Yes (most orgs) | Yes | Authenticates annual info returns. |

| Form 990-PF | Yes | Yes | Includes payment authorization. |

| Form 990-T | Yes ($1,000+ UBTI) | Yes | For unrelated business income tax. |

| Form 8868 | Yes (with payment) | Yes | Extension with electronic debit. |

| Form 8879-TE Alternative | N/A | No | For ERO electronic signature. |

E-filing is mandatory for returns with total assets ≥$10M or ≥250 returns annually.

When Is Form 8453-TE Due in 2025?

Submit the electronic return (with 8453-TE authentication) by the due date of the underlying form. Retain your copy—no mailing required. For calendar-year filers: May 15, 2025 (Forms 990 series); April 15, 2025 (trusts like 5227).

Key 2025 Filing Deadlines Table

| Form | Original Due Date (Calendar-Year) | Extended Due Date (Form 8868) |

|---|---|---|

| Forms 990, 990-EZ, 990-PF, 990-T | May 15, 2025 | November 17, 2025 |

| Form 1120-POL | March 17, 2025 | September 15, 2025 |

| Forms 4720, 5227, 5330 | November 15, 2025 (if fiscal June 30) | 6 months from original |

| Form 8868 (Extension) | Same as underlying form | N/A (extends return) |

| Form 8038-CP | Varies by issuance | 6 months |

*Notes: Holidays/weekends shift to next business day. E-file extensions via Form 8868 don’t require 8453-TE unless payment is due.

IRS Form 8453-TE Download and Printable

Download and Print: IRS Form 8453-TE

How to Complete IRS Form 8453-TE: Step-by-Step (2024 Form)

The 2024 Form 8453-TE is a simple 3-page document. Complete it after preparing the electronic return but before transmission. Use black ink; sign manually (no electronic signature here—use 8879-TE for that).

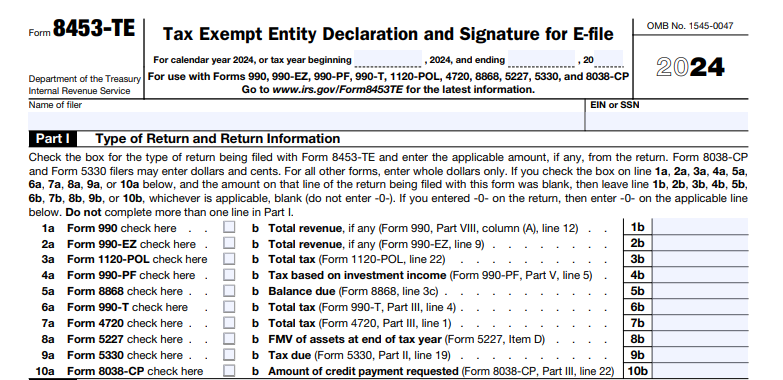

Part I: Type of Return and Return Information

- Line 1: Check the box for your form (e.g., Form 990).

- Line 2: Enter EIN, name, address.

- Line 3: Total assets (from return, e.g., Form 990 Part X line 16, column B).

- Line 4: Tax period (e.g., 2024).

- Line 5: Amount from return (e.g., Form 990 line 15 for revenue).

Part II: Declaration of Officer or Person Subject to Tax

- Line 6: Officer’s name, title, SSN/ITIN, phone.

- Line 7: Signature and date—certify review and accuracy.

- Line 8: Check for state disclosure consent (IRS Fed/State program).

Part III: Declaration of Electronic Return Originator (ERO) and Paid Preparer (If Any)

- Line 9: ERO’s name, EIN/PTIN, firm details, phone.

- Line 10: ERO signature and date.

- Line 11: Paid preparer’s name, PTIN, firm details, signature, date.

Pro Tip: Scan and retain the signed form as a PDF. For electronic funds withdrawal (EFW), enter bank routing/account in the software—8453-TE authorizes it. Use tax software like Tax990 for auto-population.

E-Filing Requirements for Form 8453-TE

Mandatory e-filing applies to all listed forms under the Taxpayer First Act (since 2020). Use IRS-approved providers (e.g., ExpressTaxExempt, Tax990) via Modernized e-File (MeF). Benefits: Faster acknowledgments (24–48 hours), reduced errors, and secure transmission. Paper filing only if granted a waiver (rare; apply via Rev. Proc. 2018-17).

Recent Changes to Form 8453-TE for 2025 Filings

As of February 19, 2025, no major revisions to the 2024 form—it’s stable for 2025 use. Key notes:

- Expanded Scope: Taxpayer First Act added Forms 5227, 5330, and 8038-CP.

- No 2025 Updates: IRS confirms no changes; 2024 PDF current.

- Digital Signatures: Shift to Form 8879-TE for EROs using IP PINs.

- EFW Enhancements: Direct debit for extensions with payment.

Monitor IRS.gov for drafts post-February 2025.

Penalties for Late or Incomplete Form 8453-TE Filing

Errors can cascade:

- Late E-File: $20–$120/day (max $12,000–$60,000 based on size).

- Unauthorized Transmission: Return rejection; refile penalties.

- Missing Signature: Invalid filing; 5% monthly on tax due (max 25%).

- EFW Mismatch: Bounced payment fees + interest (7% compounded).

Reasonable cause (e.g., technical glitch) may abate; request via letter.

Best Practices for Form 8453-TE Compliance in 2025

- Review Thoroughly: Officer must verify return accuracy before signing.

- Choose Wisely: Use 8879-TE for ERO electronic signing; 8453-TE for ISP-only.

- Software First: Tools like TurboTax Nonprofit auto-generate and e-file.

- Retain Securely: Store signed PDF 3+ years; respond to IRS requests within 10 days.

- Train Staff: Ensure officers understand declarations to avoid personal liability.

- State Sync: Check for state e-file mandates (e.g., CA, NY require copies).

Proactive e-filing cuts processing from 8–12 weeks (paper) to 2–4 weeks.

Conclusion: Streamline Your E-File with Form 8453-TE in 2025

IRS Form 8453-TE is the secure handshake between your tax-exempt entity and the IRS, enabling fast, compliant e-filing for Forms 990 and beyond. With May 15, 2025, deadlines for most nonprofits, prepare now—authorize transmissions, sign declarations, and authorize payments to avoid delays.

Download the 2024 form and instructions at IRS.gov/Form8453TE. For assistance, contact the Exempt Organizations hotline at 877-829-5500. E-file smarter: Compliance without the hassle.

Last updated: December 2025. Consult official IRS sources for tailored advice.