Table of Contents

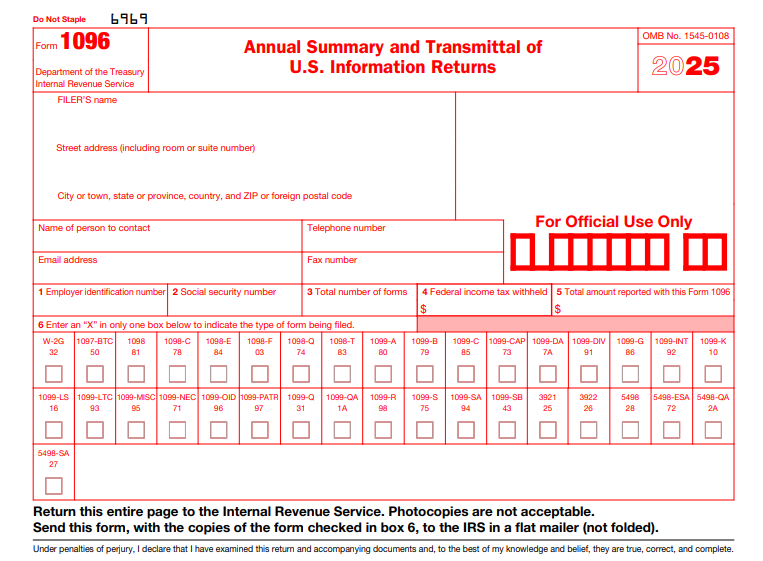

IRS Form 1096 – Annual Summary and Transmittal of U.S. Information Returns – If you’re a business owner, freelancer, or anyone making reportable payments to others, staying compliant with IRS reporting requirements is crucial to avoid penalties and ensure smooth tax processing. One key form in this process is IRS Form 1096, the Annual Summary and Transmittal of U.S. Information Returns. This form acts as a cover sheet for transmitting paper copies of various information returns, such as Forms 1099, to the IRS.

In this comprehensive guide, we’ll cover everything you need to know about Form 1096 for the 2025 tax year: what it is, who must file it, step-by-step instructions, deadlines, e-filing rules, and more. Whether you’re searching for “what is IRS Form 1096” or “how to file Form 1096,” this article has you covered with the latest IRS guidance.

What Is IRS Form 1096?

IRS Form 1096 is a summary and transmittal form used to send paper versions of U.S. information returns to the Internal Revenue Service (IRS). It provides a high-level overview of the total number of forms, amounts reported, and federal tax withheld, helping the IRS process your submissions efficiently.

Primarily, Form 1096 accompanies Copy A (the IRS copy) of the following information returns:

- Form 1097-BTC (Bond Tax Credit)

- Forms 1098 series (Mortgage Interest Statement, etc.)

- Forms 1099 series (e.g., 1099-MISC, 1099-NEC, 1099-INT, and the new Form 1099-DA for digital asset proceeds)

- Forms 3921 and 3922 (Exercise of Stock Options)

- Forms 5498 series (IRA Contribution Information)

- Form W-2G (Certain Gambling Winnings)

Without Form 1096, your paper filings won’t be accepted. It’s essentially the “packaging slip” for your information returns.

Key Update for 2025: The form has been revised to include Form 1099-DA, introduced under the Infrastructure Investment and Jobs Act (P.L. 117-58) to report proceeds from digital asset broker transactions, such as cryptocurrency sales. This ensures better tracking of digital economy payments.

Who Must File IRS Form 1096 in 2025?

You must file Form 1096 if you’re required to submit paper information returns listed above to the IRS. This typically includes:

- Businesses paying non-employee compensation (e.g., freelancers via Form 1099-NEC)

- Financial institutions reporting interest or dividends (Forms 1099-INT/DIV)

- Real estate professionals reporting sales (Form 1099-S)

- Anyone handling reportable payments over certain thresholds, like $600 for non-employee compensation

Note: If you’re filing 10 or more information returns of any type, e-filing is mandatory—no paper Form 1096 needed. Sole proprietors without an EIN use their SSN, but an EIN is preferred for consistency.

Even if you’re a nominee (e.g., reporting payments on behalf of others), you may need to file separate Forms 1099 and transmit them with Form 1096. Spouses aren’t required to file nominee returns for each other.

IRS Form 1096 Filing Deadlines for 2025

Timely filing is essential to avoid penalties. Deadlines for Form 1096 align with the underlying information returns for the 2025 calendar year (filed in 2026):

| Information Return Type | Paper Filing Deadline (with Form 1096) | E-Filing Deadline | Recipient Copy Deadline |

|---|---|---|---|

| Most Forms 1099 (e.g., 1099-MISC, 1099-INT) | March 2, 2026 | March 31, 2026 | January 31, 2026 |

| Form 1099-NEC (Nonemployee Compensation) | January 31, 2026 | March 31, 2026 | January 31, 2026 |

| Forms 5498 series (IRA Contributions) | June 1, 2026 | June 1, 2026 | May 31, 2026 |

| Form 1099-DA (Digital Assets) | March 2, 2026 | March 31, 2026 (via IRIS portal only) | February 17, 2026 |

Pro Tip: Use the IRS’s designated private delivery services (PDS) for mailing to meet deadlines—check the latest PDS list on IRS.gov. Leap years don’t extend deadlines.

E-Filing vs. Paper Filing: What You Need to Know

- E-Filing: Required for 10+ returns. Use the IRS FIRE System or IRIS Taxpayer Portal (mandatory for Form 1099-DA). No Form 1096 is needed for electronic submissions—instead, totals are reported digitally.

- Paper Filing: Allowed for fewer than 10 returns. Mail Copy A forms with Form 1096 to the appropriate IRS Submission Processing Center (e.g., Austin for Alabama/Arizona; Kansas City for Alaska/California). Use flat mailers, number packages, and include Form 1096 in Package 1.

Request a waiver from e-filing only if you qualify (e.g., undue hardship). Keep records for 3–4 years.

Step-by-Step Guide: How to Complete IRS Form 1096

Download the latest Form 1096 from IRS.gov (do not print from the website for filing, as it may not scan properly—order scannable copies from the IRS).

Use a separate Form 1096 for each type of return (e.g., one for all 1099-MISC, another for 1099-INT). Here’s how to fill it out:

- Filer’s Information (Top Section):

- Enter your business name, street address (including suite), city/state/ZIP, contact name, phone, email, and fax.

- Box 1: Employer Identification Number (EIN): Enter your EIN (preferred for businesses).

- Box 2: Social Security Number (SSN): Use only if you’re a sole proprietor without an EIN. Do not enter both Box 1 and 2.

- Box 3: Total Number of Forms: Count only correctly completed forms (exclude blanks/voids or the Form 1096 itself).

- Box 4: Federal Income Tax Withheld: Total backup withholding (24%) from all transmitted forms.

- Box 5: Total Amount Reported: Sum specific boxes from your forms (e.g., Box 1d + 13 from Form 1099-B; Box 1f from Form 1099-DA). No entry for Forms 1098-T, 1099-A, or 1099-G.

- Box 6: Type of Form Being Filed: Check one box (e.g., “1099-MISC” or “1099-DA”).

- Signature Section: Sign under penalty of perjury, include title and date. Agents sign “For: (Payer’s Name).”

For corrections, mark “CORRECTED” and file new returns—don’t mix originals and corrections unless same type.

Penalties for Late or Incorrect Filing of Form 1096

Failing to file correctly or on time can trigger significant penalties under IRC Sections 6721 and 6722. For 2025:

| Days Late | Penalty per Return/Statement | Maximum Annual Penalty (Small Businesses) | Maximum Annual Penalty (Large Businesses) |

|---|---|---|---|

| Up to 30 days | $60 | $1,290,500 | $1,290,500 |

| 31 days to August 1 | $130 | $2,606,000 | $2,606,000 |

| After August 1 or not filed | $330 | $3,882,000 | $3,882,000 |

| Intentional Disregard | $660+ | No maximum | No maximum |

Small businesses (average gross receipts ≤ $5M) get lower caps. De minimis exceptions apply for minor errors (e.g., $100 for incorrect dollar amounts). Agents signing don’t relieve payers of liability.

IRS Form 1096 Download and Printable

Download and Print: IRS Form 1096

Common Mistakes to Avoid When Filing Form 1096

- Mismatched TINs: Ensure your EIN/SSN matches other returns (e.g., Form 945).

- Incorrect Totals: Double-check Box 5 sums—errors lead to processing delays.

- Mixing Form Types: Always use separate Forms 1096 per category.

- Forgetting 1099-DA: New filers of digital assets must include it.

- Paper Quality: Use red-ink scannable forms; downloaded PDFs won’t work.

Tip: Use tax software for accuracy, and retain copies for audits.

Frequently Asked Questions (FAQs) About IRS Form 1096

What if I have zero forms to file?

Submit a Form 1096 marked with zeros if required—contact the IRS for guidance.

Can I e-file Form 1096 directly?

No, e-filing replaces it entirely for qualifying filers.

What’s the transition rule for Form 1099-K in 2025?

Third-party settlement organizations report Form 1099-K only if payments exceed $2,500 (rising to $600 in 2026).

Where do I mail paper Forms 1096?

Depends on your state—see Pub. 1220 on IRS.gov.

Final Thoughts: Stay Compliant with Form 1096

Filing IRS Form 1096 correctly ensures your information returns are processed without hitches, helping the IRS verify income and combat tax evasion. For the 2025 tax year, pay special attention to the new Form 1099-DA for digital assets and e-filing mandates.

Consult a tax professional for complex situations, and always reference official IRS resources. Download forms and instructions at IRS.gov/Form1096. File on time to keep your business penalty-free!

Last updated: December 2025. This guide is for informational purposes only—not tax advice.