Table of Contents

IRS Form W-2GU – Guam Wage and Tax Statement – If you’re a Guam employer or employee navigating tax season, understanding IRS Form W-2GU is essential. This specialized form, known as the Guam Wage and Tax Statement, ensures accurate reporting of wages and taxes specific to Guam’s tax system. Unlike the standard Form W-2 used for U.S. mainland wages, Form W-2GU focuses on local Guam income tax withholding while coordinating with federal social security and Medicare requirements.

In this comprehensive guide, we’ll break down everything you need to know about Form W-2GU for the 2025 tax year—including who must file it, how to complete it, key deadlines, and tips to avoid penalties. Whether you’re an employer preparing statements or an employee verifying your income, this article has you covered.

What Is IRS Form W-2GU?

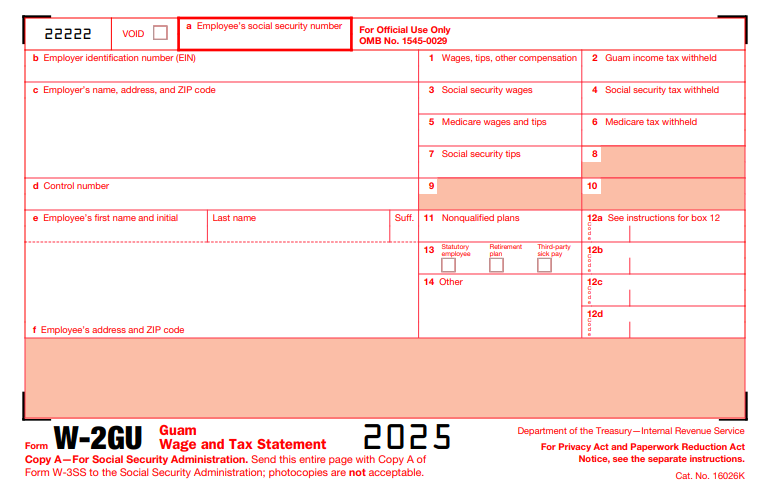

IRS Form W-2GU is a wage and tax statement designed exclusively for Guam employers to report compensation paid to employees working in Guam. It captures total wages, tips, other compensation, and withholdings for Guam income tax, social security, and Medicare taxes. Importantly, do not use Form W-2GU to report wages subject to U.S. federal income tax withholding—those go on the standard Form W-2 instead.

This form plays a critical role in Guam’s mirror tax system, which aligns closely with U.S. federal tax rules but handles local income taxes separately. For 2025, the form includes updates from the SECURE 2.0 Act, affecting retirement plan reporting and other deferred compensation details. The OMB control number has also been revised to 1545-0029.

Key differences from the standard W-2 include:

- Box 2: Reports Guam income tax withheld, not federal income tax.

- Inapplicable boxes: 8 (allocated tips), 10 (dependent care benefits), and 15–20 (state/local tax info) are not used.

- Territorial focus: It supports Guam’s unique filing requirements under Pub. 570 (Tax Guide for Individuals With Income From U.S. Possessions).

Employees use Copy B of the form when filing their Guam income tax return, while keeping Copy C for personal records.

Who Needs to File Form W-2GU?

Guam employers must issue Form W-2GU to any employee from whom Guam income tax, social security, or Medicare tax was withheld during the year. This applies even if the employee is related to the employer or if no federal income tax was withheld.

- Employers: Any business or trade in Guam paying $600 or more in remuneration (including noncash payments) must file. This includes tips and other compensation.

- Employees: Guam residents or those earning Guam-sourced income. Nonresident aliens may have special rules under the Military Spouses Residency Relief Act (MSRRA).

- Exceptions: Clergy or religious workers exempt from social security/Medicare, and wages already reported on a standard W-2 for U.S. tax purposes.

If you’re unsure, consult IRS Publication 15 (Circular E) for territorial employment guidance.

IRS Form W-2GU Download and Printable

Download and Print: IRS Form W-2GU

How to Fill Out IRS Form W-2GU: Step-by-Step Instructions

Form W-2GU mirrors the layout of the standard W-2 but tailors reporting to Guam’s system. Download the 2025 fillable PDF from IRS.gov or order scannable copies for official filing. Use black ink for non-SSA copies and red for Copy A.

Header Section

- Box a: Employee’s full Social Security Number (SSN). Truncate to last four digits on employee copies for privacy, but use the full SSN for Copy A.

- Box b: Employer’s EIN.

- Box c: Employer’s name, address, and ZIP code.

- Box d: Optional control number for tracking.

- Boxes e and f: Employee’s name and address.

Wage and Tax Boxes

- Box 1: Total wages, tips, and other compensation (taxable for Guam purposes).

- Box 2: Guam income tax withheld—crucial for employee refunds or credits.

- Box 3: Social security wages (up to $176,100 for 2025).

- Box 4: Social security tax withheld (6.2% on Box 3).

- Box 5: Medicare wages and tips (no wage cap).

- Box 6: Medicare tax withheld (1.45% standard + 0.9% additional on wages over $200,000).

- Box 7: Social security tips.

- Box 11: Nonqualified plan distributions (include in Box 1 if taxable).

- Box 12 (a–d): Coded items like elective deferrals (Code D: up to $23,500; catch-up $7,500 for age 50+), Roth contributions (Code AA/BB), or health coverage costs (Code DD, nontaxable).

- Box 13: Checkboxes for statutory employee, retirement plan, or third-party sick pay.

- Box 14: Other—use for miscellaneous info like union dues.

File corrections using Form W-2c if errors occur, and notify employees promptly.

Filing Deadlines and Requirements for 2025

Timely filing is key to avoiding penalties, which can reach $310 per form for late furnishing to employees (increasing after December 31, 2025).

- Furnish to Employees: Send Copies B, C, and 2 by February 2, 2026 (or request a short extension via Form 15397).

- File with SSA: Submit Copy A and Form W-3SS by February 2, 2026. E-file if filing 10+ returns (mandatory; waivers via Form 8508).

- File with Guam: Send Copy 1 to Guam Department of Revenue and Taxation, P.O. Box 23607, Barrigada, GU 96921.

- Extensions: 30-day SSA extension via Form 8809 in extraordinary cases.

E-filing is encouraged through SSA’s Business Services Online (BSO) for faster processing and error checks. Paper filers must use scannable red-ink Copy A.

Common Mistakes to Avoid When Handling Form W-2GU

- Mixing Forms: Never report U.S. income tax on W-2GU—use W-2 for that.

- SSN Errors: Verify SSNs to prevent mismatches; correct via W-2c.

- Incomplete Codes: Miss Box 12 entries (e.g., retirement deferrals) at your peril—limits apply.

- Late Delivery: Employees need forms by February 2, 2026, for timely Guam returns.

- Privacy Oversights: Truncate SSNs on employee copies but not official filings.

For excess social security tax over $10,918.20, employees can claim refunds via Form 843.

FAQs About IRS Form W-2GU

What if I work in Guam but live on the mainland?

Report Guam wages on W-2GU for local taxes, but use W-2 for federal withholding. See Pub. 570 for possession income rules.

Can I e-file Form W-2GU?

Yes, via SSA’s BSO if required (10+ returns). It’s free and reduces errors.

What’s new for 2025?

Updated OMB number, SECURE 2.0 adjustments for retirement reporting, and higher penalty tiers post-2025.

Where do I get Form W-2GU?

Download from IRS.gov or order from the Online Ordering system.

Staying compliant with Form W-2GU ensures smooth tax processing for Guam’s workforce. For personalized advice, consult a tax professional or the Guam Department of Revenue and Taxation. Bookmark this guide for next year’s filings!