Table of Contents

IRS Form 1042-T – Annual Summary and Transmittal of Forms 1042-S – In the world of international tax compliance, accurately reporting U.S.-source income paid to foreign persons is crucial for withholding agents. Enter IRS Form 1042-T, the essential transmittal document for paper submissions of Form 1042-S—the form that details foreign persons’ U.S. source income subject to withholding. Whether you’re a U.S. business paying royalties to overseas partners or a financial institution handling dividends for nonresident aliens, understanding Form 1042-T filing requirements can prevent costly penalties and ensure smooth IRS processing.

This SEO-optimized guide breaks down everything you need to know about IRS Form 1042-T for tax year 2025, including who must file, deadlines, step-by-step instructions, and recent updates. Drawing from official IRS resources, we’ll help you navigate this form efficiently. If you’re searching for “Form 1042-T instructions” or “how to file Form 1042-T,” you’ve come to the right place.

What Is IRS Form 1042-T?

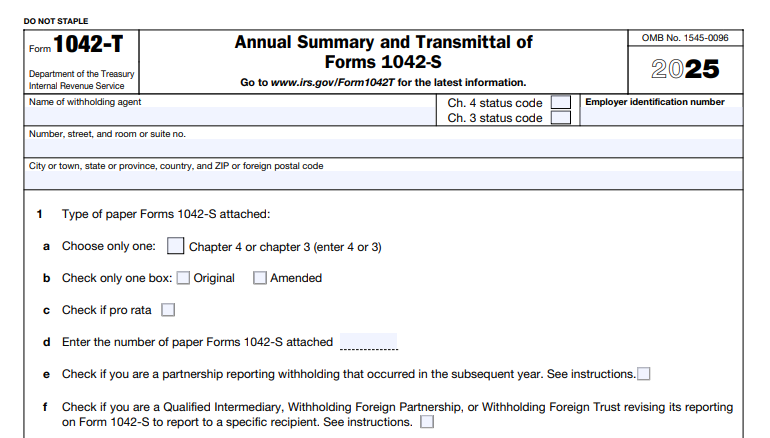

Form 1042-T, titled Annual Summary and Transmittal of Forms 1042-S, serves as a cover sheet for transmitting paper copies of Form 1042-S to the Internal Revenue Service (IRS). It summarizes the totals from the attached 1042-S forms and ensures the IRS receives organized batches of these reports.

Unlike Form 1042 (the annual withholding tax return summarizing all withholdings under Chapters 3 and 4 of the Internal Revenue Code), Form 1042-T doesn’t report tax liability—it’s purely a transmittal tool. It doesn’t replace electronic filing options for 1042-S, which are mandatory in many cases. A key rule: Use a separate Form 1042-T for each distinct type of 1042-S you’re submitting, such as originals vs. amendments or Chapter 3 vs. Chapter 4 withholdings.

This form is part of the broader ecosystem for reporting fixed, determinable, annual, or periodical (FDAP) income—like interest, dividends, rents, or royalties—paid to non-U.S. persons. Even if no tax was withheld due to a tax treaty, reporting is often required.

Who Must File IRS Form 1042-T in 2025?

Not every withholding agent needs to file Form 1042-T—it depends on your filing method and volume. Here’s who qualifies:

- Withholding Agents Filing Paper 1042-S Forms: If you’re submitting paper Forms 1042-S (e.g., fewer than 10 forms, qualifying for a waiver), you must attach them to a Form 1042-T. This includes U.S. or foreign entities acting as withholding agents under IRC Sections 1441, 1442, or 1471–1474.

- Qualified Intermediaries (QIs), Withholding Foreign Partnerships (WPs), or Withholding Foreign Trusts (WTs): These entities must file if transmitting paper 1042-S revisions to specific recipients under their agreements (e.g., Rev. Proc. 2022-43 for QIs).

- Partnerships Reporting Subsequent-Year Withholding: If you’re a partnership withholding on a foreign partner’s share of prior-year undistributed income after March 15 of the following year, check the relevant box on 1042-T.

Exemptions apply if you e-file your 1042-S forms directly—no 1042-T needed. For 2025, withholding agents filing more than 10 Forms 1042-S must e-file them, per IRS rules. Foreign withholding agents are also exempt from e-filing Form 1042 itself in 2025 under Notice 2024-26.

In short: If you’re paper-filing 1042-S, you must file Form 1042-T. Always cross-reference with Form 1042 to reconcile totals.

When Is Form 1042-T Due for Tax Year 2025?

Timing is everything in tax reporting. For income paid in calendar year 2025:

- Filing Deadline: March 15, 2026. Submit Form 1042-T with attached Copy A of your paper 1042-S forms by this date. If March 15 falls on a weekend or holiday, the deadline shifts to the next business day.

- Extensions: No automatic extension for 1042-T, but you can request one via Form 7004 (up to October 15, 2026) if eligible. Note: Extensions don’t extend payment deadlines for any withheld taxes reported on Form 1042.

- Multiple Submissions: You can send multiple 1042-T packages before filing your Form 1042, as long as totals reconcile later.

Late filings trigger penalties (detailed below), so mark your calendar. For reference, the 2024 deadline was March 17, 2025 (adjusted for weekend).

Paper vs. Electronic Filing: Do You Need Form 1042-T?

The IRS strongly encourages electronic filing for efficiency, but paper options remain for smaller filers. Here’s the breakdown:

Paper Filing with Form 1042-T

- When to Use: If you’re exempt from e-filing (e.g., 10 or fewer 1042-S forms) or prefer paper for amendments.

- How to Submit: Mail flat (unfolded) packages to:

Ogden Service Center

P.O. Box 409101

Ogden, UT 84409 - Pros: Simpler for low-volume filers.

- Cons: Slower processing; higher error risk.

Electronic Filing (No 1042-T Required)

- Mandatory For: Over 10 1042-S forms in 2025. Use the IRS’s FIRE system or approved software.

- Benefits: Faster, more secure, and eligible for waivers on penalties for reasonable cause.

- Modernized e-File (MeF): Now available for Form 1042 in 2025, streamlining the process.

For 2025, the IRS updated e-filing exemptions for foreign agents on Form 1042, promoting flexibility. Always check IRS.gov/Form1042T for the latest.

How to Complete and File Form 1042-T: Step-by-Step Guide

Filling out Form 1042-T takes about 12 minutes per the IRS’s Paperwork Reduction Act estimate. Download the 2025 version from IRS.gov. Here’s a detailed walkthrough:

Step 1: Gather Required Information

- Withholding agent details: Name, address, EIN, Chapter 3 and 4 status codes (must match your 1042-S and 1042 forms).

- Attached 1042-S totals: Gross income (Box 2), federal tax withheld (Boxes 10/11).

- Form type: Original/amended, Chapter 3/4, pro rata/non-pro rata.

Step 2: Fill Out the Form

Use black ink for paper; ensure accuracy to avoid rejections.

- Header: Enter your name, address, EIN, and status codes.

- Line 1: Type of Forms 1042-S Attached

- 1a: Enter “4” (Chapter 4) or “3” (Chapter 3)—no mixing.

- 1b: Check “Original” or “Amended.”

- 1c: Check if pro rata allocation applies.

- 1d: Number of attached 1042-S forms.

- 1e: Check for partnership subsequent-year withholding (Box 7c on 1042-S checked).

- 1f: Check for QI/WP/WT revisions under specific revenue procedures.

- Line 2: Total gross income from all attached 1042-S Box 2 amounts.

- Line 3: Total Federal Tax Withheld

- 3a: Chapter 4 withholding (if Line 1a is 4).

- 3b: Chapter 3 withholding (if Line 1a is 3).

- Final Return Box: Check “X” if no more 1042-S filings (including amendments) for 2025.

- Signature: Sign under penalties of perjury, include title, date, and phone number.

Step 3: Attach and Mail

Staple Copy A of 1042-S behind the 1042-T. Mail in a flat envelope—no folding.

Pro Tip: Use IRS-approved software for validation before submission.

Penalties for Late or Incorrect Filing of Form 1042-T

Compliance isn’t optional—mistakes cost money. Tied to Form 1042-S penalties since 1042-T is its transmittal:

- Failure to File Timely: Up to $310 per 1042-S form (adjusted for inflation). For Form 1042, it’s 5% of unpaid tax per month, up to 25%.

- Late Payment/Deposit: Interest plus 0.5% per month on underpayments.

- Incorrect Information: $60–$310 per form for intentional disregard.

- Failure to E-File: Separate penalty if required but ignored.

Reasonable cause (e.g., natural disasters) can waive penalties—file Form 8809 for e-file waivers. In 2025, focus on timely reconciliation to avoid cascading errors.

Handling Amendments and Corrections on Form 1042-T

Errors happen. For amendments:

- Check “Amended” on Line 1b.

- Submit a new 1042-T with revised paper 1042-S.

- If totals change Form 1042 lines (e.g., gross income or withheld tax), file an amended 1042.

No limit on amendments, but notify recipients of corrected 1042-S Copy B.

Recent Updates for IRS Form 1042-T in 2025

The 2025 Form 1042-T (released May 2025) includes minor clarifications:

- Enhanced guidance on partnership withholding (Line 1e) for post-March 15 adjustments.

- Alignment with QI/WP/WT rules for recipient-specific revisions (Line 1f).

- E-file exemptions for foreign agents on Form 1042 via Notice 2024-26, indirectly easing 1042-T burdens for paper filers.

No major structural changes, but check IRS.gov for post-release updates. The IRS also expanded MeF for Form 1042, benefiting integrated filings.

Frequently Asked Questions (FAQs) About IRS Form 1042-T

1. Can I file Form 1042-T electronically?

No—1042-T is paper-only for transmittals. E-file 1042-S directly.

2. What if I have both Chapter 3 and 4 withholdings?

Use separate 1042-T forms—one per chapter.

3. Is Form 1042-T required if no tax was withheld?

Yes, if reporting zero-withheld 1042-S on paper.

4. How do I request an extension for Form 1042-T?

File Form 7004 by March 15, 2026.

5. Where can I get the 2025 Form 1042-T PDF?

Download from IRS.gov/pub/irs-pdf/f1042t.pdf.

For personalized advice, consult a tax professional. Stay compliant—your international operations depend on it. Questions? Leave a comment below!

Last updated: December 2025. Sources: IRS.gov and official publications.

IRS Form 1042-T Download and Printable

Download and Print: IRS Form 1042-T