Table of Contents

IRS Form 1099-DA – Digital Asset Proceeds From Broker Transactions – In the rapidly evolving world of digital assets, staying compliant with IRS reporting requirements is more crucial than ever. If you’re trading cryptocurrencies, non-fungible tokens (NFTs), or other digital assets through a broker in 2025, you’ll likely encounter IRS Form 1099-DA, Digital Asset Proceeds from Broker Transactions. This new form, introduced as part of the Infrastructure Investment and Jobs Act (IIJA) of 2021, standardizes reporting for crypto sales and exchanges, helping both taxpayers and the IRS track taxable events more accurately. As digital asset transactions surge—with global crypto market capitalization exceeding $2 trillion in 2025—understanding Form 1099-DA can prevent costly penalties and simplify your tax filing.

This SEO-optimized guide breaks down everything you need to know about Form 1099-DA: its purpose, who must file it, what it reports, and how it impacts your 2025 taxes. Whether you’re a casual investor or a high-volume trader, read on to ensure compliance and optimize your crypto tax strategy.

What Is IRS Form 1099-DA?

Form 1099-DA is the IRS’s dedicated information return for reporting proceeds from the sale or exchange of digital assets facilitated by brokers. Unlike the general Form 1099-B used for securities, this form specifically targets digital assets, including cryptocurrencies like Bitcoin and Ethereum, NFTs, and certain tokenized assets.

Launched in response to the IIJA, Form 1099-DA aims to close the gap in crypto tax compliance. A 2023 IRS review revealed only about 25% voluntary compliance for digital asset gains, prompting this structured reporting to boost accuracy and deter underreporting. Brokers must issue the form for transactions starting January 1, 2025, with statements due to recipients by February 17, 2026, and filings to the IRS by March 31, 2026 (electronic) or February 28, 2026 (paper).

Key takeaway: Form 1099-DA reports gross proceeds (the total amount received from a sale), not your net gain or loss. You’ll still need to calculate and report capital gains on your Schedule D (Form 1040).

Why Was Form 1099-DA Introduced? The Shift in Crypto Tax Reporting

The rise of digital assets has outpaced traditional tax frameworks, leading to fragmented reporting. Prior to 2025, many crypto brokers used Form 1099-B or no form at all, resulting in incomplete IRS data. The IIJA amended Internal Revenue Code §6045 to mandate broker reporting for digital asset dispositions, effective for 2025 transactions.

Final regulations (TD 9992) issued in June 2024 phase in requirements:

- 2025: Mandatory gross proceeds reporting; basis reporting voluntary.

- 2026 and later: Full basis reporting for “covered securities” (digital assets acquired after 2025).

This phased approach provides transitional relief: No penalties for good-faith efforts in 2025, per Notice 2024-56. The goal? Equip taxpayers with clearer data while enabling the IRS to verify returns via automated matching, reducing audit risks for compliant filers.

Who Needs to File Form 1099-DA? Defining a “Digital Asset Broker”

Not every crypto user files Form 1099-DA—it’s the broker’s responsibility. The IRS broadly defines a digital asset broker as any entity that:

- Regularly provides services effectuating sales (e.g., exchanges like Coinbase).

- Accepts digital assets as payment for services.

- Operates kiosks or processes payments with knowledge of proceeds.

Examples include:

- Centralized exchanges and trading platforms.

- Hosted wallet providers.

- Payment processors and real estate entities accepting crypto.

Decentralized (non-custodial) brokers are exempt for now, with future rules pending. If you’re a broker, file one Form 1099-DA per transaction type (e.g., separate for crypto vs. NFTs).

| Broker Type | Required to File 1099-DA? | Examples |

|---|---|---|

| Centralized Exchanges | Yes | Coinbase, Binance.US |

| Hosted Wallets | Yes | Custodial services like Gemini |

| Payment Processors | Yes (if they know proceeds) | BitPay |

| Decentralized Platforms | No (for now) | Uniswap (non-custodial) |

| Real Estate Brokers | Yes (for crypto payments) | Title companies accepting BTC |

What Transactions Are Reportable on Form 1099-DA?

Form 1099-DA covers sales, exchanges, or dispositions of digital assets for cash, other digital assets, or property. Reportable events include:

- Selling crypto for fiat (e.g., BTC to USD).

- Exchanging one digital asset for another (e.g., ETH to SOL).

- Using crypto to buy goods/services (if brokered).

- Certain NFT sales, including first sales by creators (optional aggregated reporting).

Exemptions (per Notice 2024-57) include:

- Dispositions for NFTs or real property (pending further guidance).

- Rewards/airdrops (reportable as income elsewhere).

- Non-custodial trades.

Stablecoins and specified NFTs may qualify for aggregated reporting in Box 11a if proceeds are minimal.

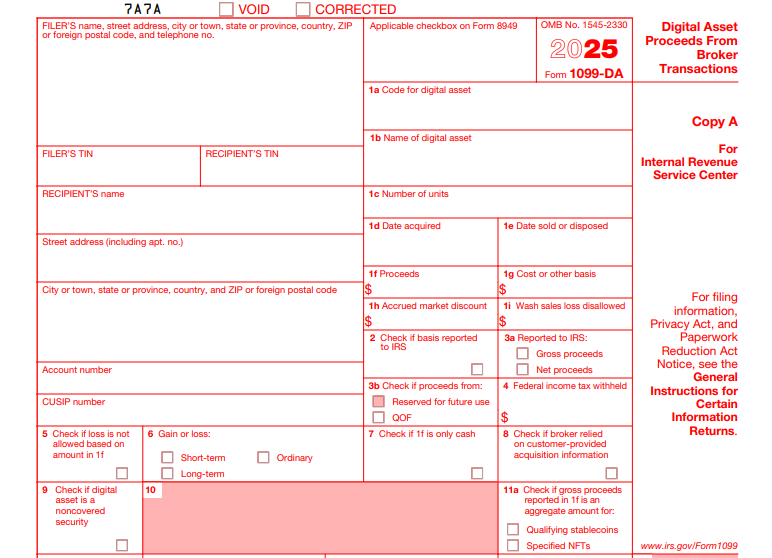

Breaking Down the Boxes on Form 1099-DA

The 2025 draft form includes detailed fields for transparency. Here’s a quick overview:

| Box | Description | 2025 Requirement |

|---|---|---|

| 1a–1c | Digital Token ID (DTIF), asset name, units sold | Mandatory |

| 1d–1e | Acquisition date, sale date | Mandatory |

| 1f | Gross proceeds | Mandatory |

| 1g–1i, 2, 6 | Cost basis, adjustments, gain/loss type | Voluntary |

| 7 | Cash-only proceeds | Check if applicable |

| 8 | Customer-provided basis | Check if used |

| 9 | Noncovered security | Check for pre-2026 assets |

| 11a–11c | Aggregated proceeds for stablecoins/NFTs | Optional for qualifying sales |

| 12a–12b | Transfer-in units and date | For certain inflows |

Source: IRS Draft Form 1099-DA (2025). Use the DTIF code (like a CUSIP for crypto) to identify assets precisely.

IRS Form 1099-DA Download and Printable

Download and Print: IRS Form 1099-DA

2025 Reporting Deadlines and Penalties for Form 1099-DA

- Furnish to recipients: February 17, 2026.

- File with IRS: March 31, 2026 (e-file); February 28, 2026 (paper).

- Extensions: 30 days via Form 8809.

Penalties start at $60 per form for late/inaccurate filing, up to $630 for intentional disregard (no cap). Good-faith relief applies in 2025, but accuracy is key—mismatches trigger IRS notices like CP2000.

How Does Form 1099-DA Affect Taxpayers? Calculating Your Crypto Taxes

As a recipient, expect your 1099-DA by mid-February 2026. It reports gross proceeds, so:

- Subtract your cost basis (purchase price + fees) to find gain/loss.

- Classify as short-term (≤1 year: ordinary rates) or long-term (>1 year: 0–20%).

- Report on Form 8949 and Schedule D.

Pro Tip: Track basis at the wallet level per Revenue Procedure 2024-28—don’t rely solely on the form, as 2025 versions omit it. Tools like CoinTracker can reconcile multi-exchange data.

Example: You sell 1 BTC bought at $40,000 for $60,000 in 2025. Form 1099-DA shows $60,000 proceeds. Your short-term gain: $20,000 (taxed at your income rate).

Common Mistakes to Avoid with Form 1099-DA and Crypto Reporting

- Forgetting non-cash exchanges: Crypto-to-crypto swaps are taxable.

- Zero basis assumption: Without records, IRS may tax full proceeds.

- Overlooking state reporting: Boxes 14–16 capture local taxes.

- Ignoring DeFi: Future rules may expand to non-custodial, but self-report now.

Preparing for Form 1099-DA: Actionable Steps for 2025

- Gather Records: Download transaction histories from exchanges.

- Choose Basis Method: FIFO, LIFO, or HIFO—document consistently.

- Consult a Pro: Tax software or CPAs specializing in crypto (e.g., via Gordon Law Group).

- Monitor Updates: Check IRS.gov/Form1099DA for final instructions.

Conclusion: Stay Ahead of Crypto Tax Changes with Form 1099-DA

As 2025 wraps up, Form 1099-DA marks a pivotal step toward mainstreaming digital asset taxation. By reporting gross proceeds accurately, brokers empower taxpayers to file confidently, while the IRS gains tools to ensure fairness. Don’t let mismatched forms derail your return—proactive tracking now saves headaches later.

For the latest on IRS Form 1099-DA requirements, visit IRS.gov or consult a tax advisor. Ready to optimize your 2025 crypto taxes? Start reconciling your portfolio today.

This article is for informational purposes only and not tax advice. Always consult a qualified professional for personalized guidance.