Table of Contents

IRS Form 8689 – Allocation of Individual Income Tax to the U.S. Virgin Islands – If you’re a U.S. citizen or resident alien earning income from the U.S. Virgin Islands (USVI) but not living there full-time, navigating your tax obligations can feel like charting uncharted waters. Enter IRS Form 8689, the essential tool for allocating your individual income tax to the USVI. This form ensures you pay the right amount to both the IRS and the USVI Bureau of Internal Revenue, avoiding double taxation while claiming credits where due.

In this comprehensive guide, we’ll break down everything you need to know about IRS Form 8689—from eligibility and step-by-step instructions to filing deadlines and common pitfalls. Whether you’re dealing with rental income from St. Thomas or business earnings from St. Croix, understanding Form 8689 is key to compliant, stress-free tax filing. Updated for the 2024 tax year (filed in 2025), this article draws from official IRS resources to keep you informed.

What Is IRS Form 8689?

IRS Form 8689, officially titled “Allocation of Individual Income Tax to the U.S. Virgin Islands,” is a one-page IRS form designed to prorate your U.S. federal income tax liability based on income sourced from the USVI. The USVI operates under a “mirror” tax system, where its tax laws generally align with the U.S. Internal Revenue Code. However, taxes paid to the USVI go directly to the territory’s treasury—not the U.S. Treasury.

This form calculates the portion of your total U.S. tax that should be allocated (and paid) to the USVI, allowing you to claim a dollar-for-dollar credit on your federal return for taxes actually paid to the territory. Without Form 8689, you risk overpaying or facing penalties for underpayment.

Key fact: The form applies only to non-bona fide USVI residents. Bona fide residents (those meeting the IRS’s physical presence test) file directly with the USVI and generally aren’t subject to U.S. income tax on USVI-sourced income.

Who Must File IRS Form 8689?

Not everyone with USVI ties needs this form. Here’s who qualifies:

- U.S. citizens or resident aliens (including green card holders) who are not bona fide residents of the USVI.

- Individuals with income from USVI sources, such as:

- Wages, salaries, or self-employment income earned in the USVI.

- Rental income from USVI properties.

- Dividends, interest, or capital gains tied to USVI investments.

- Income effectively connected to a trade or business conducted in the USVI.

If your USVI income exceeds the filing threshold for your filing status (e.g., $13,850 for single filers in 2024), you’ll likely need to file. Use IRS Publication 570, Tax Guide to U.S. Citizens and Resident Aliens With Income From U.S. Possessions, to determine income sourcing rules under IRC Sections 861-865.

Exception: Spouses in community property states may need to file even if only one has USVI income—consult the form instructions for details.

Pro tip: If you’re unsure about your residency status, the IRS defines a “bona fide resident” as someone present in the USVI for at least 183 days in a tax year, with no closer connection to the U.S. mainland.

Step-by-Step Instructions: How to Complete IRS Form 8689

Form 8689 is straightforward but requires pulling data from your Form 1040 or 1040-SR. Download the latest version from IRS.gov (the 2024 form is available as of late 2024). Here’s a line-by-line walkthrough:

Header Section

- Enter your name and Social Security Number (SSN) as shown on your Form 1040. Tax software like TurboTax or TaxAct auto-populates this.

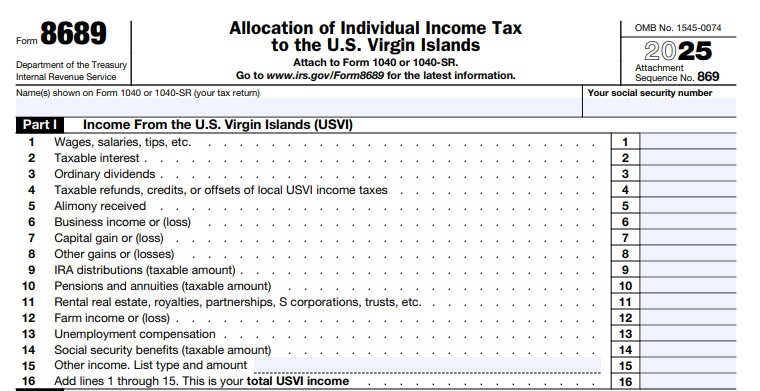

Part I: Income From the U.S. Virgin Islands (USVI)

This section identifies your USVI-sourced income. Total it on Line 16.

- Lines 1-15: Report specific USVI income items (e.g., wages on Line 1, business income on Line 3). Use IRS Pub 570 for sourcing guidance—e.g., personal services income is USVI-sourced if performed there.

- Line 16: Total USVI income.

Part II: Adjusted Gross Income (AGI) From the USVI

Calculate your USVI-attributable AGI.

- Lines 17-29: Enter USVI-related adjustments (e.g., educator expenses on Line 17). Subtract from Line 16 to get USVI AGI on Line 30.

- Lines 31-34: Mirror your total U.S. AGI from Form 1040, Line 11.

Part III: Allocation of Tax to the USVI

This prorates your tax liability.

- Line 35: Allocation percentage = (Line 30 ÷ Line 34). Round to three decimals (max 1.000).

- Line 36: USVI-allocated tax = Line 33 (your total tax from Form 1040) × Line 35.

- Lines 37-40: Adjust for alternative minimum tax (AMT) if applicable.

Part IV: Payments of Income Tax to the USVI

Track payments and overpayments.

- Lines 41-46: Enter USVI withholdings, estimated payments, and calculate net USVI tax due (Line 47) or overpayment (Line 42).

- Line 48: Credit for taxes paid to USVI—add to Schedule 3 (Form 1040), Line 1.

Part V: Tax Due or Overpayment

- Line 49: Total U.S. tax after allocation.

- Line 50-53: Final overpayment or amount due.

Double-check calculations—errors here can trigger audits. For complex cases (e.g., self-employment tax), reference the full instructions on IRS.gov.

IRS Form 8689 Download and Printable

Download and Print: IRS Form 8689

Filing Deadlines and Where to Mail IRS Form 8689

Align Form 8689 with your Form 1040 deadline: April 15, 2025, for 2024 taxes (or October 15 with extension). No separate e-filing for USVI-related returns—paper file if your address is in a U.S. possession.

You must file identical tax returns with both the IRS and USVI:

- To the IRS (original return + Form 8689):

- No payment: Department of the Treasury, Internal Revenue Service, Austin, TX 73301-0215.

- With payment: Internal Revenue Service, P.O. Box 1303, Charlotte, NC 28201-1303.

- To the USVI (signed copy of return + all schedules + Form 8689): Virgin Islands Bureau of Internal Revenue, 6115 Estate Smith Bay, Suite 225, St. Thomas, VI 00802.

The USVI treats your signed U.S. copy as their original. Amended returns? File Form 1040-X with both entities.

Claiming the USVI Tax Credit on Your Federal Return

The magic of Form 8689 is the credit on Line 48—report it on Schedule 3 (Form 1040), Line 1, as a foreign tax credit (though it’s domestic). This offsets your U.S. liability dollar-for-dollar, but only for taxes actually paid to the USVI. No credit for unpaid amounts.

Example: If Line 36 shows $5,000 allocated and you’ve paid it to the USVI, claim $5,000 on your Form 1040, reducing your federal bill.

Common Mistakes to Avoid When Filing Form 8689

Even pros slip up—here’s how to stay compliant:

- Mis-sourcing income: Not all USVI-tied earnings qualify (e.g., U.S.-based pensions aren’t USVI-sourced).

- Forgetting dual filing: Omitting the USVI copy invites penalties up to 25% of unpaid tax.

- Ignoring AMT: Part III adjustments are crucial if you’re subject to alternative minimum tax.

- Unsigned copies: The USVI requires a wet signature on their copy.

- Outdated forms: Use the 2024 version—2025 updates may reflect inflation adjustments.

Penalties for errors? Interest accrues at 5-8% annually, plus failure-to-file fines.

Recent Changes to IRS Form 8689 (2024-2025)

As of 2024, no major structural changes to Form 8689, but note the Health Coverage Tax Credit (HCTC) expired December 31, 2021 (IRS update: May 3, 2024). Tax rates mirror federal brackets: 10-37% for 2024. Check IRS.gov/Form8689 for 2025 revisions, expected late 2024. Always verify against IRC §1.932-1 for coordination rules.

FAQs About IRS Form 8689 and USVI Tax Allocation

Do bona fide USVI residents need Form 8689?

No—they file Form 1040 with the USVI and skip U.S. filing for USVI income.

Can I e-file Form 8689?

Yes, with your Form 1040, but USVI addresses block e-filing—paper only.

What if I have USVI income under $400?

You may still need to file if total income hits thresholds; consult Pub 570.

How does Form 8689 differ from Form 1116?

Form 1116 is for foreign tax credits; 8689 is USVI-specific allocation.

Final Thoughts: Simplify Your USVI Tax Journey with Form 8689

Mastering IRS Form 8689 unlocks accurate tax allocation, credits, and peace of mind for U.S. taxpayers with USVI income. Whether you’re a remote worker, investor, or vacation homeowner, proper filing prevents costly surprises. Download the form, gather your Form 1040 data, and file by April 15, 2025.

For personalized advice, consult a tax professional or the IRS at 1-800-829-1040. Stay updated via IRS.gov—tax laws evolve, but compliance doesn’t have to be complicated.

This article is for informational purposes only and not tax advice. Verify with official sources.