Table of Contents

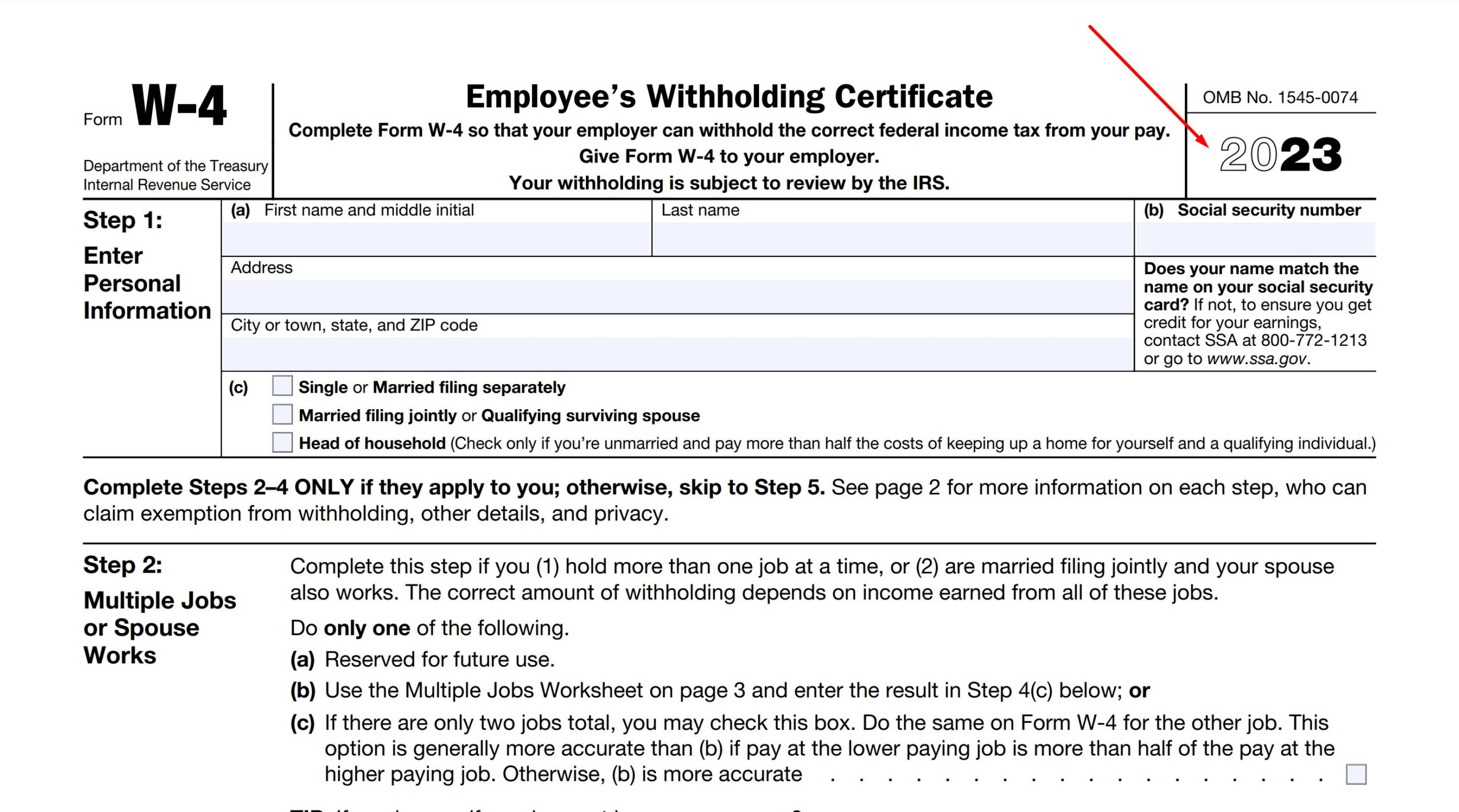

IRS W-4 Form 2023 – The W-4 form is a document that employees fill out when they start a new job to determine the amount of tax that should be withheld from their paychecks. It is important for employees to fill out the form accurately because it helps ensure that they do not have too much or too little tax withheld from their paychecks. This can help prevent surprises at tax time when employees may owe additional taxes or may have overpaid their taxes and are owed a refund.

New Article: W4 Form 2025.

Here is everything you need to know about the W-4 form:

What is the W-4 form?

The W-4 form is a tax form that is used by employers to determine the amount of federal income tax to withhold from an employee’s pay. The form is used to calculate the employee’s tax withholding based on their personal circumstances, such as their filing status and the number of dependents. The form is completed by the employee and submitted to the employer, who uses it to determine the appropriate amount of tax to withhold from the employee’s paychecks.

Why is the W-4 form important?

The W-4 form is important because it determines the amount of tax that is withheld from an employee’s pay. If the form is completed accurately, it can help prevent overpayment or underpayment of taxes. Overpayment of taxes can occur when too much tax is withheld from an employee’s pay, resulting in a tax refund when the employee files their tax return. Underpayment of taxes can occur when too little tax is withheld from an employee’s pay, resulting in a tax bill when the employee files their tax return.

By accurately completing the W-4 form, employees can help ensure that the correct amount of tax is withheld from their pay and that they do not owe taxes or receive a tax refund when they file their tax return.

What information is needed to complete the W-4 form?

To complete the W-4 form, employees will need to provide information about their personal circumstances, such as their filing status and the number of dependents. They will also need to provide information about any additional income, such as interest or dividends, that they receive outside of their job.

The W-4 form includes a series of worksheets that employees can use to calculate their tax withholding. These worksheets help employees determine their tax withholding based on their personal circumstances and any additional income they receive.

What are the different parts of the W-4 form?

The W-4 form consists of several different parts:

- Personal Allowances Worksheet: This worksheet helps employees determine the number of personal allowances they are entitled to claim. Personal allowances are used to reduce the amount of tax withheld from an employee’s pay. The number of personal allowances an employee is entitled to claim depends on their filing status and the number of dependents.

- Deductions and Adjustments Worksheet: This worksheet helps employees determine the number of deductions and adjustments they are entitled to claim. Deductions and adjustments can also reduce the amount of tax withheld from an employee’s pay. Examples of deductions and adjustments include charitable contributions and certain types of business expenses.

- Additional Withholding: This section allows employees to request additional tax withholding from their pay. Employees may want to request additional withholding if they have additional income that is not subject to withholding, such as self-employment income or rental income.

- Multiple Jobs or Spouse Worksheet: This worksheet is for employees who have more than one job or a working spouse. It helps employees determine the appropriate amount of tax withholding for their multiple jobs or combined income.

- Signature and Date: Employees must sign and date the W-4 form when they submit it.

IRS Has Released The Current W4 Form 2023

You can download, print and fill out the W4 Form 2023 right now.