Table of Contents

IRS Form 1041-T – Allocation of Estimated Tax Payments to Beneficiaries (Under Code section 643(g)) – Managing the tax affairs of an estate or trust can be intricate, especially when it comes to distributing income and payments to beneficiaries. IRS Form 1041-T, Allocation of Estimated Tax Payments to Beneficiaries, empowers fiduciaries to shift the credit for estimated tax payments from the estate or trust to its beneficiaries under Internal Revenue Code (IRC) Section 643(g). This irrevocable election helps beneficiaries apply these credits against their personal tax liabilities, optimizing overall tax efficiency.

In this SEO-optimized guide for the 2025 tax year (filed in 2026), we’ll demystify Form 1041-T—from eligibility and completion steps to deadlines and potential pitfalls. Whether you’re a trustee navigating a complex trust or an executor finalizing an estate, understanding Form 1041-T ensures compliant allocation and avoids underpayment penalties. Sourced from the latest IRS resources, including the 2025 Form 1041-T and Instructions for Form 1041, this article delivers up-to-date insights as of December 2025.

What Is IRS Form 1041-T?

IRS Form 1041-T is a one-page IRS form that allows the fiduciary of a trust or a decedent’s estate (in its final tax year) to elect under IRC Section 643(g) to treat any portion of the entity’s estimated tax payments as payments made directly by the beneficiaries. This shifts the credit for those payments to the beneficiaries, who can then claim them on their individual returns via Schedule K-1 (Form 1041), Box 13, Code A.

The election applies only to estimated tax payments—not withheld income taxes—and must be made timely to be valid. Once elected, it’s irrevocable for that tax year. This mechanism is particularly useful for trusts with high estimated payments, as it reduces the estate’s or trust’s tax burden while crediting beneficiaries proportionally to their income shares.

Key benefit: Beneficiaries treat the allocated amount as an estimated tax payment on the last day of the tax year, potentially lowering their underpayment penalties on Form 2210. Download the 2025 Form 1041-T from IRS.gov, available since late 2025.

Who Must File IRS Form 1041-T?

Form 1041-T is elective, not mandatory, but it’s required for fiduciaries wishing to make the Section 643(g) election. Eligible filers include:

- Fiduciaries of domestic trusts (simple, complex, or grantor trusts) that made estimated tax payments during the year.

- Executors of decedent’s estates in their final tax year, if estimated payments were made.

You don’t need to file if:

- No estimated tax payments were made (e.g., only withholdings).

- The election isn’t beneficial (e.g., small payments or beneficiaries in low brackets).

- The trust or estate is exempt from estimated taxes.

The allocation must be reasonable, typically based on each beneficiary’s share of distributable net income (DNI). Nonresident alien beneficiaries may complicate allocations—consult IRS Publication 519 for U.S. possessions rules, though Section 643(g) focuses on domestic entities.

Pro tip: Only trusts or final-year estates qualify; ongoing estates cannot elect.

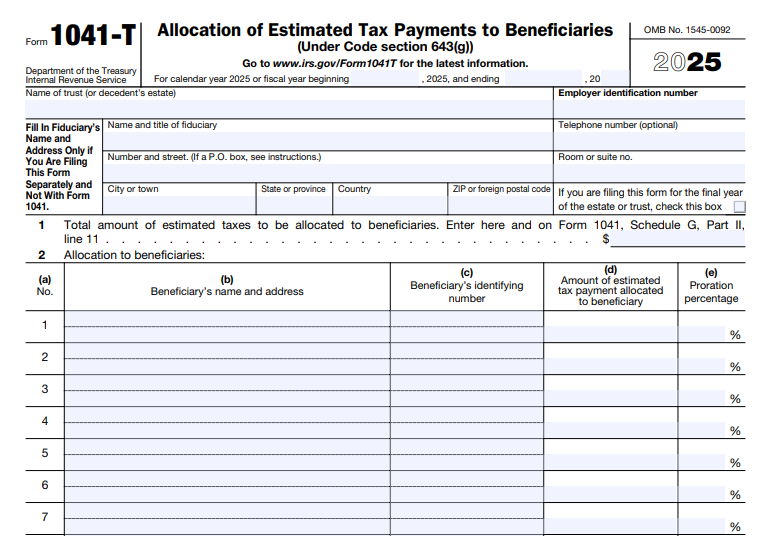

IRS Form 1041-T Download and Printable

Download and Print: IRS Form 1041-T

Step-by-Step Instructions: How to Complete IRS Form 1041-T

The 2025 Form 1041-T is straightforward, mirroring the 2024 version. Prepare it after calculating estimated payments on Form 1041-ES. Here’s a line-by-line guide from the official instructions:

Header Section

- Name and Address: Enter the estate’s or trust’s name, address, and Employer Identification Number (EIN) as on Form 1041.

- Tax Year: Specify the beginning and ending dates (e.g., calendar year 2025).

Part I: Total Estimated Tax Payments

- Line 1: Total estimated tax payments made by the trust or estate for the tax year (from Form 1041, Line 25d, excluding overpayments applied from prior years). Do not include withholdings.

Part II: Allocation to Beneficiaries

Use the table to allocate portions of Line 1:

- Column (a): Beneficiary’s name.

- Column (b): Beneficiary’s address.

- Column (c): Beneficiary’s Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). Optionally include spouse’s SSN if filing jointly.

- Column (d): Amount allocated to this beneficiary (must sum to Line 1 total).

Allocations should reflect DNI shares from Schedule B (Form 1041). For each beneficiary, report the amount in Schedule K-1 (Form 1041), Box 13, Code A.

Signature

- The fiduciary signs and dates under penalties of perjury, declaring the accuracy of the allocation.

Attach Form 1041-T to Form 1041 if filing together; otherwise, mail separately. E-filing is available via Modernized e-File (MeF) for Form 1041, including attachments.

Filing Deadlines and Where to Submit IRS Form 1041-T

The election is valid only if Form 1041-T is filed by the 65th day after the close of the tax year. For calendar-year filers (ending December 31, 2025), this is March 6, 2026 (65 days from January 1). If it falls on a weekend or holiday, file the next business day. Fiscal-year entities follow suit (e.g., June 30, 2025 end date: September 4, 2025).

- With Form 1041: Attach to your return due April 15, 2026 (or extended to September 30 via Form 7004)—but this doesn’t extend the 65-day deadline.

- Separately: Mail to Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0048 (no payment enclosed).

- E-file: Through IRS-approved software; the 65-day rule still applies.

Late filing invalidates the election, treating payments as the entity’s only. Amended elections aren’t allowed—timeliness is key.

Common Mistakes to Avoid When Filing Form 1041-T

Fiduciaries often overlook nuances—avoid these to prevent IRS scrutiny:

- Missing the Deadline: The 65-day window is strict; calendar it immediately after year-end.

- Including Withholdings: Only estimated payments qualify—exclude Form 1041, Line 25c amounts.

- Unequal Allocations: Base on DNI, not arbitrarily; mismatches trigger audits.

- Forgetting K-1 Reporting: Omit Box 13, Code A, and beneficiaries can’t claim credits.

- No Signature: Unsigned forms are invalid.

Penalties? Potential underpayment interest for the entity (up to 8% annually) if the election fails, plus accuracy-related fines up to 20%.

Recent Changes to IRS Form 1041-T (2024-2025)

The 2025 Form 1041-T remains unchanged structurally from 2024, with no major legislative impacts from the Tax Cuts and Jobs Act extensions or inflation adjustments affecting Section 643(g). However, broader Form 1041 updates include a raised capital gains threshold to $15,450 for the 20% rate and XML schema enhancements for e-filing (v5.0 released November 2025). The 65-day deadline holds firm, and estimated tax vouchers (Form 1041-ES) reflect 2025 brackets. Check IRS.gov/Form1041T for drafts, last revised January 29, 2025.

FAQs About IRS Form 1041-T and Section 643(g) Elections

Is the Form 1041-T election revocable?

No—once made for a tax year, it’s irrevocable.

Can estates other than final-year ones file Form 1041-T?

No—only trusts or final-year estates qualify under Section 643(g).

How do beneficiaries report the allocation?

On Schedule K-1, Box 13, Code A; treat as estimated tax on Form 2210.

What if the trust has no DNI?

Allocation is still possible but limited to reasonable shares—consult a tax advisor.

Final Thoughts: Optimize Trust and Estate Taxes with Form 1041-T

IRS Form 1041-T under Section 643(g) is a powerful, irrevocable tool for fiduciaries to equitably distribute estimated tax credits, easing beneficiary burdens while streamlining compliance. With the 65-day deadline looming for 2025 filers (March 6, 2026), review payments now and prepare accordingly.

For complex scenarios, engage a tax professional or contact the IRS at 1-800-829-1040. Monitor IRS.gov for updates—tax strategies evolve, but precise elections endure.

This article is for informational purposes only and not tax advice. Always consult official IRS sources.