Table of Contents

IRS Form 1120-POL – U.S. Income Tax Return for Certain Political Organizations – In the world of political advocacy and nonprofit operations, staying compliant with IRS regulations is crucial for maintaining tax-exempt status and avoiding penalties. One key form that often flies under the radar is IRS Form 1120-POL, the U.S. Income Tax Return for Certain Political Organizations. This form ensures that political groups and related exempt entities report any taxable income accurately, particularly from investments rather than core political activities.

If you’re managing a political organization, newsletter fund, or section 501(c) entity with political arms, understanding Form 1120-POL is essential for tax year 2025 filings. In this comprehensive guide, we’ll break down everything from who needs to file to step-by-step instructions, due dates, and tips for compliance. Whether you’re preparing your first return or refining your process, this article covers the latest IRS guidelines to help you file confidently.

What Is IRS Form 1120-POL?

IRS Form 1120-POL is an annual income tax return specifically designed for political organizations under section 527 of the Internal Revenue Code. It reports political organization taxable income—typically investment earnings like interest, dividends, rents, royalties, and capital gains—and calculates any associated income tax liability. Unlike general exempt function income (such as contributions or dues used for political campaigns), this form focuses solely on non-exempt revenue that could trigger taxation.

The form also applies to certain exempt organizations treated as having political taxable income under section 527(f)(1), such as section 501(c) groups with political separate segregated funds. For tax year 2025, the form emphasizes transparency in reporting to uphold the integrity of political funding.

Key takeaway: Form 1120-POL isn’t for all political spending—it’s targeted at taxable side income to prevent misuse of exempt funds.

Who Must File Form 1120-POL in 2025?

Not every political group needs to file this form. The IRS requires submission only if your organization meets specific thresholds for taxable income. Here’s a breakdown:

- Political Organizations: Any party, committee, association, fund, or similar entity organized and operated primarily for influencing the selection, nomination, election, or appointment of candidates to public office. This includes newsletter funds (for circulating candidate newsletters) and separate segregated funds maintained by 501(c) organizations.

- Exempt Organizations: Section 501(c) entities (not inherently political) that have political activities generating taxable income under section 527(f)(1).

Filing Threshold: You must file if political organization taxable income exceeds $100 after the specific deduction (note: newsletter funds don’t get this $100 deduction). Taxable income is calculated as gross income (excluding exempt function income) minus directly connected deductions, with no net operating loss carryovers or special corporate deductions allowed.

Exceptions and Exemptions:

- No filing if taxable income is $0 or less (though voluntary filing can start the statute of limitations).

- Qualified state or local political organizations (QSLPOs) may have reduced reporting under Rev. Rul. 2003-49.

- Failure to file Form 8871 (Notice of Section 527 Status) timely can force inclusion of exempt function income in taxable calculations, increasing your liability.

| Organization Type | Filing Required If… | Key Exemption Notes |

|---|---|---|

| Political Organization (Section 527) | Taxable income > $100 after $100 deduction | Excludes exempt function income like contributions |

| Newsletter Fund | Any specified taxable income (no $100 deduction) | Limited to newsletter circulation activities |

| Section 501(c) with Political Fund | Net investment income or exempt function expenditures exceed thresholds | Lesser of net investment or aggregate political spending |

| QSLPO | Gross receipts < $100,000 | Potential waiver from Form 990/990-EZ |

If your group qualifies, download the 2025 Form 1120-POL directly from the IRS website for accurate reporting.

What Is Political Organization Taxable Income?

At its core, political organization taxable income is the excess of non-exempt gross income over allowable deductions. Exempt function income—such as member dues, political contributions, or proceeds from campaign events—is fully excluded.

Included Income Sources:

- Interest and dividends.

- Gross rents and royalties.

- Capital gains (attach Schedule D (Form 1120)).

- Other investment earnings not tied to political activities.

Specified Taxable Income for Exempt Orgs: The lesser of net investment income or total exempt function expenditures.

Deductions Allowed: Only those directly connected to producing taxable income, like broker fees for managing investments. You cannot deduct campaign-related expenses, such as salaries for political staff or advertising for elections.

For 2025, remember to adjust for any post-2024 tax law changes when using the 2024 form version if the 2025 edition isn’t yet available.

IRS Form 1120-POL Download and Printable

Download and Print: IRS Form 1120-POL

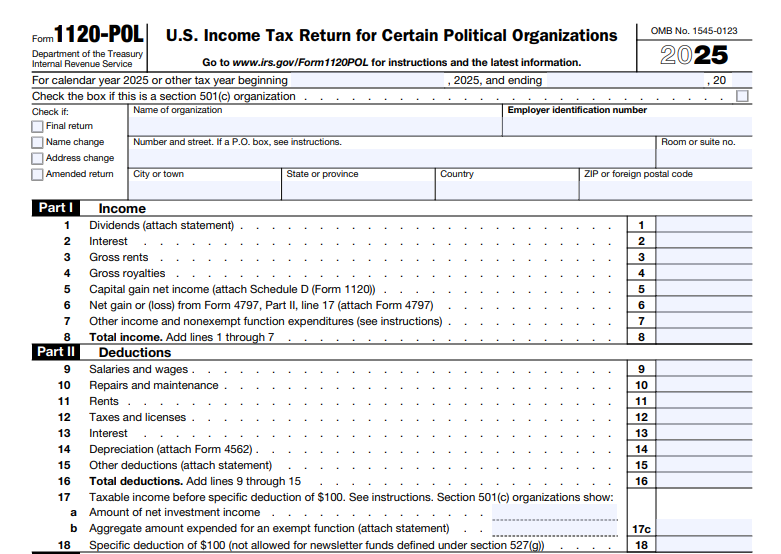

Step-by-Step Instructions: How to Complete Form 1120-POL for Tax Year 2025

Filling out Form 1120-POL requires precision to avoid audits or penalties. Use the official 2025 instructions for line-by-line guidance. Here’s a simplified walkthrough:

Part I: Taxable Income

- Line 1–8: Report gross income sources (e.g., dividends, interest, rents).

- Line 9–15: Enter deductions like compensation, repairs, taxes, interest, depreciation (attach Form 4562), and other expenses tied to income production.

- Line 16: Total deductions (sum lines 9–15).

- Line 17: Taxable income before $100 deduction (lines 1–8 minus line 16).

- Line 18: Subtract the $100 specific deduction (or show net investment income for 501(c) orgs).

- Line 19: Final taxable income (line 17 minus line 18). If ≤0, no tax due, but consider filing anyway.

Part II: Tax Computation

- Line 20: Calculate income tax (generally 21% flat rate for corporations, but confirm for your entity).

- Line 21: Claim tax credits (e.g., foreign tax credit via Form 1118 or general business credit via Form 3800).

- Line 22: Total tax (line 20 minus line 21).

- Line 23: Enter estimated tax payments and credits.

- Line 24: Overpayment or balance due.

Part III–IV: Additional Information

- Line 25: Sign and date the return.

- Line 26–27: Answer yes/no questions on foreign accounts (attach Form 8938 if needed) and trusts (Form 3520).

Attachments Checklist:

- Schedule D for capital gains.

- Form 8997 for qualified opportunity fund investments.

- Form 8992 for GILTI if applicable.

- Any credit forms (e.g., Form 3800).

- Explanations for amendments on separate sheets.

Assemble in order: Form 4136 (if claiming fuel credits) after page 2, then schedules alphabetically and forms numerically.

Due Date and Electronic Filing Requirements for 2025

Filing Deadline: Submit by the 15th day of the 4th month after your tax year ends. For calendar-year organizations (ending December 31, 2025), that’s April 15, 2026. Fiscal-year filers adjust accordingly.

Extensions: File Form 7004 for an automatic 6-month extension, but pay any owed tax by the original due date to avoid interest.

Electronic Filing Mandate: Mandatory if your organization files 10 or more returns (including W-2s, 1099s, etc.) in the calendar year. Effective for tax years ending on or after December 31, 2023—paper filings in these cases are invalid. Waivers are available for hardship; request via Regulation section 301.6012-2.

Tools like TaxBandits or IRS e-file partners simplify electronic submission for 2025.

Penalties for Late Filing or Non-Compliance

Missing the deadline can be costly. For 2025 returns:

- Late Filing Penalty: 5% of unpaid tax per month (up to 25%), with a minimum of $510 if more than 60 days late (smaller of tax due or $510).

- Late Payment Penalty: 0.5% per month (up to 25%).

- Interest: Accrues at the section 6621 rate on unpaid amounts.

- Other Risks: Negligence (20% of underpayment), substantial understatement (20%), or fraud (75%) penalties under sections 6662/6663.

Respond to IRS notices promptly with reasonable cause explanations to abate penalties.

Recent Changes and Updates for Tax Year 2025

As of December 2025, no major structural changes to Form 1120-POL have been announced beyond inflation adjustments to penalties (e.g., the $510 minimum late fee). However:

- Use the 2024 form for short tax years spanning into 2025, marking the appropriate year and incorporating any new laws effective post-2024.

- Enhanced electronic filing rules from T.D. 9972 remain in effect.

- Check IRS.gov/Form1120POL for post-publication updates, such as those on foreign account reporting or opportunity zones.

Tips for Accurate Filing and Common Mistakes to Avoid

- Track Investments Closely: Use accounting software to separate exempt vs. taxable income early.

- Consult a Professional: Tax experts familiar with section 527 can maximize deductions and ensure Form 8871/8872 compliance.

- Avoid These Pitfalls: Don’t deduct political expenses; forgetting attachments; ignoring e-filing mandates.

- Amend if Needed: File Form 1120-X for corrections, attaching explanations.

By prioritizing accuracy, your organization can focus on its mission without tax distractions.

Conclusion: Stay Compliant with IRS Form 1120-POL in 2025

Navigating IRS Form 1120-POL ensures your political organization remains on the right side of tax law while supporting democratic processes. With a clear understanding of taxable income, filing requirements, and deadlines, you’re equipped to handle 2025 submissions seamlessly. Always refer to the latest IRS resources for personalized advice—deadlines like April 15, 2026, approach quickly.

Ready to file? Download Form 1120-POL and instructions from IRS.gov today. For complex cases, partner with a CPA to safeguard your exempt status.

This article is for informational purposes only and not tax advice. Consult a qualified professional for your situation.