Table of Contents

IRS Form 8824 – Like-Kind Exchanges – In the world of real estate investing, few strategies offer the tax advantages of a like-kind exchange under Section 1031 of the Internal Revenue Code. By swapping one investment property for another of similar nature, you can defer capital gains taxes, preserving capital for reinvestment. However, to claim this deferral, accurate reporting is essential—and that’s where IRS Form 8824 comes in. This form is the key to documenting like-kind exchanges, calculating deferred gains, and ensuring IRS compliance.

If you’re a real estate investor, business owner, or property manager exploring a 1031 exchange in 2025, understanding Form 8824 is crucial. This SEO-optimized guide breaks down everything from eligibility to step-by-step filing instructions, drawing on the latest IRS resources. Whether you’re filing for tax year 2024 (due in 2025) or planning ahead, read on to master like-kind exchanges and avoid costly pitfalls.

What Is a Like-Kind Exchange?

A like-kind exchange, also known as a 1031 exchange, allows you to defer taxes on gains from the sale of business or investment real property when you reinvest the proceeds into similar property. Instead of paying immediate capital gains tax (up to 20% federally, plus state taxes and the 3.8% net investment income tax), you postpone the liability until you sell the replacement property without exchanging it.

This provision promotes economic growth by encouraging property upgrades and portfolio diversification. However, not all swaps qualify—properties must be “like-kind,” held for productive use in trade or business, or investment (not personal use or inventory). Exchanges involving cash or non-like-kind property may trigger partial recognition of gain, known as “boot.”

Key Benefits of Like-Kind Exchanges

- Tax Deferral: Preserve 100% of your equity for larger investments.

- Wealth Building: Upgrade properties without tax erosion.

- Inflation Hedge: Adjust basis to current market values over time.

For 2025 filings, note that the Tax Cuts and Jobs Act (TCJA) of 2017 permanently limited 1031 exchanges to real property only—no personal property like vehicles or equipment. A transitional rule applied to pre-2018 transactions, but all current exchanges must involve real estate.

Who Must File IRS Form 8824?

You must file Form 8824 if you completed a like-kind exchange of business or investment real property in the tax year. This includes:

- Real estate investors exchanging rental properties.

- Businesses swapping commercial buildings.

- Partnerships or corporations involved in property trades.

Even if no gain is recognized (e.g., a straight swap with equal value), disclosure is required. Partnerships and S corporations report at the entity level but issue Schedule K-1 to partners/shareholders, who may need to file individually.

Special cases:

- Related-Party Exchanges: Extra scrutiny applies if swapping with family, controlled entities, or affiliates.

- Deferred Exchanges: Using a qualified intermediary (QI) is common, but timing rules are strict.

- Part IV Users: Federal executive branch members or judicial officers deferring gains from conflict-of-interest sales.

File one Form 8824 per exchange, or a summary with attachments for multiples. Attach it to your Form 1040, 1065, 1120, or other return. E-filers benefit from new 2024 updates streamlining lines for non-like-kind details.

Changes to Like-Kind Exchanges Under the TCJA

The TCJA reshaped 1031 exchanges effective January 1, 2018:

- Real Property Only: Personal and intangible property (e.g., machinery, patents) no longer qualify. A transition rule grandfathered pre-2018 deals.

- Definition of Real Property: Final regulations (T.D. 9935) clarify: Tangible items like land, buildings, and structural components; intangibles like easements if tied to real estate. State/local law guides classification.

- Incidental Personal Property: In deferred exchanges, personal items (e.g., appliances) bundled with real property are ignored if their fair market value (FMV) ≤15% of the replacement property’s FMV.

No major 2025 updates are announced, but monitor IRS announcements for inflation adjustments or legislative tweaks. Proposed limits (e.g., $500,000 deferral cap) from prior years haven’t passed.

IRS Form 8824 Download and Printable

Download and Print: IRS Form 8824

Step-by-Step Guide: How to Complete IRS Form 8824

Form 8824 has four parts. Use the 2024 instructions (applicable for 2025 filings) for details. Gather: Property descriptions, dates, FMVs, adjusted bases, liabilities, and expenses.

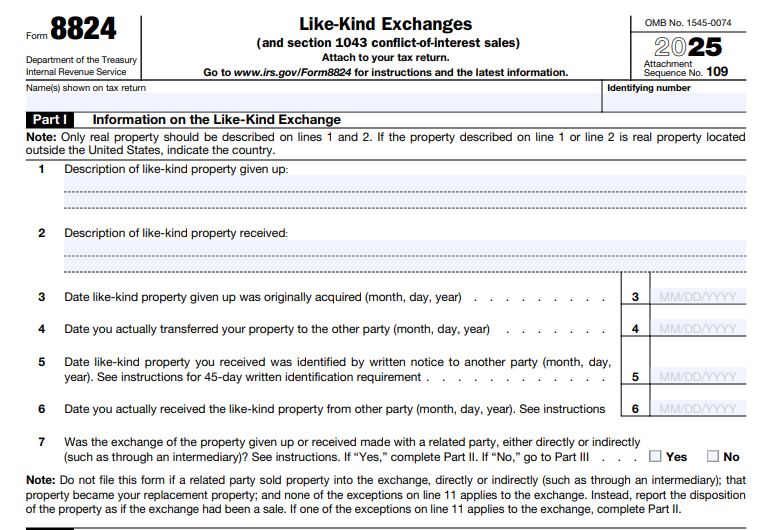

Part I: Information on the Like-Kind Exchange

Describe the transaction basics.

- Line 1: Like-kind property given up (address, type; country if outside U.S.).

- Line 2: Like-kind property received (same details).

- Line 3: Date given up.

- Line 4: Date received (for simultaneous; use identification date for deferred).

- Line 5: Written identification date (within 45 days for deferred).

- Line 6: Actual receipt date (within 180 days or return due date).

- Lines 7-11: Related-party checks; explain exceptions (e.g., no tax avoidance) if early disposition.

Tip: For deferred exchanges, use a QI to hold proceeds—direct receipt disqualifies deferral.

Part II: Figure Gain or Loss

Calculate realized vs. recognized gain.

- Lines 12-14: Non-like-kind property given up (FMV, basis, gain/loss—report as sale).

- Line 15: Boot received (cash + non-like-kind FMV + net liabilities relieved – expenses).

- Line 15a: Describe non-like-kind received.

- Line 16: FMV of like-kind received.

- Line 17: Total FMV received (15 + 16).

- Line 18: Adjusted basis given up + expenses + net boot paid.

- Line 19: Realized gain/loss (17 – 18).

- Line 20: Recognized gain (lesser of boot or realized gain).

- Line 21: Ordinary income recapture (e.g., depreciation under Sections 1245/1250).

- Line 22: Report recognized gain (Form 4797 for business; Schedule D for capital).

- Line 23: Total recognized (21 + 22).

- Line 24: Deferred gain/loss (19 – 23).

For multi-asset exchanges, attach a statement.

Part III: Basis of Like-Kind Property Received

Determine the new basis to carry forward.

- Line 25: Basis = (Line 18 + 23) – 15. Allocate via 25a-25c for depreciable types (e.g., Section 1250 property).

Example: You exchange a $500,000 basis rental (FMV $800,000) for a $900,000 property, receiving $100,000 cash boot. Realized gain: $400,000. Recognized: $100,000. Deferred: $300,000. New basis: $500,000 + $100,000 – $100,000 = $500,000.

Part IV: Section 1043 Conflict-of-Interest Sales

For eligible officials: Elect deferral by buying U.S. obligations or funds. Lines 26-36 mirror Parts II-III, reducing basis by deferred gain.

Common Mistakes to Avoid When Filing Form 8824

- Missing Deadlines: 45/180-day rules are unforgiving—extensions don’t apply.

- Related-Party Oversights: 2-year holding requirement; resales trigger retroactive tax.

- Boot Miscalculation: Include relieved debt as boot.

- E-Filing Errors: Use updated lines 12a/15a/25a-c; no separate sheets needed.

- Non-Qualifying Property: Inventory or foreign/U.S. mixes disqualify.

Penalties include full gain recognition plus interest. Consult a tax pro for complex deals.

Filing Deadlines and Tips for 2025

Attach Form 8824 to your 2024 return, due April 15, 2025 (or October 15 with extension). E-file for faster processing. Track basis meticulously for future sales—use software like TurboTax or consult Publication 544.

For multi-year tracking (e.g., related-party), file in the exchange year and next two.

Conclusion: Maximize Your 1031 Exchange with Proper Form 8824 Filing

IRS Form 8824 is your gateway to tax-efficient real estate growth via like-kind exchanges. By deferring gains, you can scale your portfolio strategically—but accuracy is non-negotiable. With TCJA rules solidified and no 2025 overhauls, now’s the time to plan your next swap.

Ready to execute a 1031 exchange? Download the latest Form 8824 from IRS.gov and pair it with a qualified intermediary. For personalized advice, reach out to a CPA. Stay compliant, invest wisely, and watch your wealth compound.

This article is for informational purposes only and not tax advice. Consult a professional for your situation.