Table of Contents

IRS Form 944 – Employer’s Annual Federal Tax Return – As a small business owner or employer, navigating payroll taxes can feel overwhelming, but IRS Form 944 offers a streamlined solution for those with minimal tax liability. Known as the Employer’s Annual Federal Tax Return, Form 944 allows eligible small employers to report and pay federal income tax withholding, Social Security, and Medicare taxes once a year instead of quarterly. This guide breaks down everything you need to know about IRS Form 944 for tax year 2025, including eligibility, filing deadlines, step-by-step instructions, and key updates. Whether you’re a sole proprietor, freelancer with employees, or micro-business, understanding Form 944 can save you time and reduce administrative burdens.

If you’re searching for “IRS Form 944 instructions 2025” or “who qualifies for Form 944,” you’ve come to the right place. Let’s dive in.

What Is IRS Form 944?

IRS Form 944 is an annual tax return designed specifically for the smallest employers to simplify compliance with federal employment taxes. It consolidates reporting of:

- Federal income tax withheld from employee wages.

- Social Security taxes (6.2% each for employer and employee, up to the 2025 wage base of $176,100).

- Medicare taxes (1.45% each for employer and employee, with no wage base limit).

- Additional Medicare Tax (0.9% on employee wages over $200,000).

Unlike the more common Form 941 (Employer’s Quarterly Federal Tax Return), which requires four filings per year, Form 944 lets qualifying businesses file and pay annually. This reduces paperwork and potential errors for micro-employers. However, it’s not for everyone—only those with an annual liability of $1,000 or less qualify without IRS notification.

Form 944 must be filed once per calendar year, and it’s tied to your Employer Identification Number (EIN). Always reconcile it with your Forms W-2 and W-3 for accuracy.

Who Must File IRS Form 944 in 2025?

Not every employer files Form 944—it’s reserved for small operations. Here’s a breakdown:

Eligible Employers

- IRS-Notified Businesses: If the IRS sends you a written notice (typically after your first year of filing), you must use Form 944, even if your liability exceeds $1,000. This notification usually comes if your prior-year taxes were under $1,000.

- Voluntary Request: If you’re filing Forms 941 quarterly but expect 2025 liability of $1,000 or less, request to switch to Form 944 by calling 800-829-4933 (or 267-941-1000 from outside the U.S.) between January 1 and April 1, 2025, or mailing a request postmarked by March 17, 2025. The IRS will confirm in writing.

- Small Businesses: Based on 2025 rates, if you pay $5,000 or less in W-2 wages subject to Social Security, Medicare, and federal income tax withholding, you’re likely under the $1,000 threshold.

Ineligible Employers

- Larger Businesses: If your annual liability exceeds $1,000, file quarterly Forms 941 instead. The IRS will notify you to switch back if needed.

- Special Categories:

- Household employers (use Schedule H of Form 1040).

- Agricultural employers (use Form 943).

- Businesses in U.S. territories like Puerto Rico or Guam (may use Form 941-PR/SS).

- Seasonal employers or those with deferred taxes from prior years.

- Third-Party Payers: If a Certified Professional Employer Organization (CPEO) handles your payroll, they file on your behalf.

| Employer Type | Form Required | Filing Frequency |

|---|---|---|

| Small employers (≤$1,000 liability) | Form 944 | Annual |

| Most employers (>$1,000 liability) | Form 941 | Quarterly |

| Household employers | Schedule H (Form 1040) | Annual |

| Agricultural employers | Form 943 | Annual |

If your business grows mid-year and pushes you over the threshold, you still file Form 944 for the full year but may need to make quarterly deposits.

Key Changes to IRS Form 944 for 2025

The IRS has introduced several updates to modernize Form 944 for 2025, focusing on efficiency and electronic processes. Here’s what’s new:

- Social Security Wage Base Increase: The limit rises to $176,100 (from $168,600 in 2024), affecting taxable wages.

- Direct Deposit for Refunds: Per Executive Order 14247 (issued March 25, 2025), refunds are now issued electronically via direct deposit to your checking or savings account—faster and more secure than paper checks.

- Electronic Payments Mandatory for Balances: All balance due payments must use Electronic Funds Transfer (EFT) via EFTPS.gov or your IRS business tax account.

- Expired COVID-19 Credits: Lines for qualified sick and family leave wages have been removed, as the program ended. Rare claims for pre-2021 leave paid in 2025 require Form 944-X.

- Enhanced Payroll Tax Credit: The Qualified Small Business Payroll Tax Credit for Increasing Research Activities (from Form 8974) is now up to $500,000 annually, applied first to employer Social Security taxes.

- Electronic Transcripts: Access 2023+ Form 944 transcripts via your IRS online account.

These changes emphasize digital filing—over 90% of small employers now e-file for quicker processing.

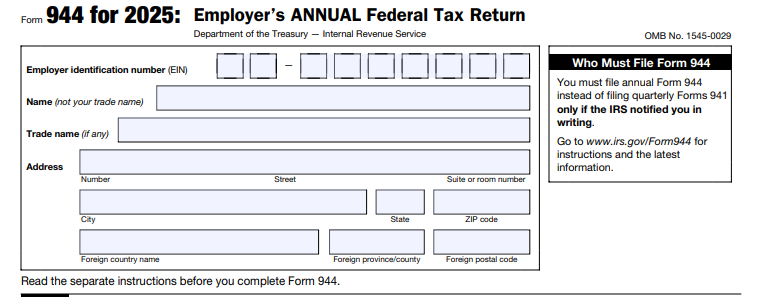

IRS Form 944 Download and Printable

Download and Print: IRS Form 944

Step-by-Step Guide: How to Fill Out IRS Form 944 for 2025

Filling out Form 944 is straightforward if you have your payroll records ready. Download the 2025 PDF from IRS.gov. Use payroll software like QuickBooks or Gusto to automate calculations. Here’s a line-by-line walkthrough:

Part 1: Annual Tax Return Information

- Line 1: Total Wages, Tips, and Other Compensation – Enter gross payments to employees (matches W-2, Box 1).

- Line 2: Federal Income Tax Withheld – Total withheld from wages (W-2, Box 2).

- Line 3: Check if No Wages/Tips Paid – Skip lines 1–2 if applicable (e.g., no employees).

- Lines 4a–4d: Taxable Social Security and Medicare Wages/Tips:

- 4a: Social Security wages (up to $176,100/employee) × 12.4% (6.2% employer + 6.2% employee).

- 4b: Social Security tips.

- 4c: Medicare wages/tips × 2.9%.

- 4d: Additional Medicare wages over $200,000 × 0.9% (employee only).

- Line 4e: Total from 4a–4d.

- Line 5: Add lines 2 + 4e.

- Line 6: Current Year Adjustments – Negative for fractions of cents, uncollected tips, or sick pay (if transferred to a third party).

- Line 7: Line 5 + line 6.

- Line 8: Qualified Small Business Payroll Tax Credit – From Form 8974 (up to $500,000).

- Line 9: Total Taxes After Adjustments and Credits – Line 7 – line 8 (minimum $0).

Part 2: Deposits and Payments

- Line 10: Total Deposits – Include timely deposits and prior overpayments.

- Line 11: Balance Due – If line 9 > line 10, pay immediately via EFT.

- Line 12: Overpayment – If line 10 > line 9, choose refund (direct deposit) or credit to 2026.

Parts 3–5: Business and Signature

- Line 13: Third-party designee (optional).

- Line 14: Check if final return (attach successor details).

- Part 5: Sign and date (owner for sole props, officer for corporations). Include preparer info if applicable.

Pro Tip: Round to the nearest dollar; use negative signs for adjustments. File electronically via IRS-approved software for free or low cost.

When Is the IRS Form 944 Filing Deadline for 2025?

- Standard Deadline: February 2, 2026 (for tax year 2025).

- Extended if Deposits Timely: February 10, 2026, if you made full, on-time deposits throughout the year.

Mail paper returns to IRS addresses based on your location (e.g., without payment: Department of the Treasury, Internal Revenue Service, Kansas City, MO 64999-0044). E-filing is encouraged and available through the IRS Employment Tax E-file program.

Deposit Rules (Even for Form 944 Filers)

If your total tax (line 9) is under $2,500, pay with the return—no deposits needed. Otherwise:

- $2,500–$100,000 annually: Monthly deposits by the 15th.

- Over $100,000 in a day: Next-day deposits.

Use Form 945-A for semiweekly schedules if required.

Common Mistakes to Avoid When Filing Form 944

- Filing the Wrong Form: Don’t file Form 944 without IRS approval—penalties apply.

- Mismatched W-2s: Ensure totals align with SSA filings.

- Late Deposits: Even annual filers face underpayment penalties (up to 5% monthly).

- Forgetting Adjustments: Miss line 6, and you could overpay.

- Paper Filing Errors: Use 12-point Courier font if typing; no staples.

Penalties for late filing can reach 5% per month, plus interest. If you can’t pay, request an installment agreement online if under $25,000.

FAQs About IRS Form 944

What if my liability exceeds $1,000 mid-year?

File Form 944 for the full year but make required deposits. The IRS will notify you for 2026.

Can I e-file Form 944?

Yes—it’s free via IRS.gov/EmploymentEfile and processes faster.

What’s the difference between Form 944 and Form 940?

Form 944 covers income, Social Security, and Medicare taxes; Form 940 is for FUTA (unemployment) taxes.

How do I request Form 944 if I’m on Forms 941?

Contact the IRS by April 1, 2025, for confirmation.

Final Thoughts: Simplify Your Payroll Taxes with Form 944

For small employers, IRS Form 944 is a game-changer, cutting quarterly headaches into one annual task. With 2025 updates like direct deposit refunds and a higher Social Security wage base, staying compliant is easier than ever. Download the form and instructions from IRS.gov today, and consider payroll software to automate the process.

If your business is growing, monitor your liability—the switch to quarterly Forms 941 is simple with IRS guidance. Questions? Call the IRS Business Hotline at 800-829-4933 or consult a tax professional.

This article is for informational purposes only and not tax advice. Always verify with the IRS for your situation.