Table of Contents

IRS Form 1041-V – Payment Voucher for Estates and Trusts – If you’re managing an estate or trust, navigating IRS tax forms is a critical part of ensuring compliance and avoiding penalties. One key document in this process is IRS Form 1041-V, the Payment Voucher for Estates and Trusts. This simple yet vital form accompanies payments for any balance due on Form 1041, the U.S. Income Tax Return for Estates and Trusts. As we head into the 2025 tax season, understanding Form 1041-V can streamline your filing and help you stay organized.

In this comprehensive guide, we’ll break down everything you need to know about IRS Form 1041-V 2025, including its purpose, who must use it, step-by-step instructions, deadlines, and tips for accurate submission. Whether you’re a fiduciary, executor, or trustee, this resource will equip you to handle payments efficiently. For the most up-to-date details, always refer to the official IRS resources.

What Is IRS Form 1041-V?

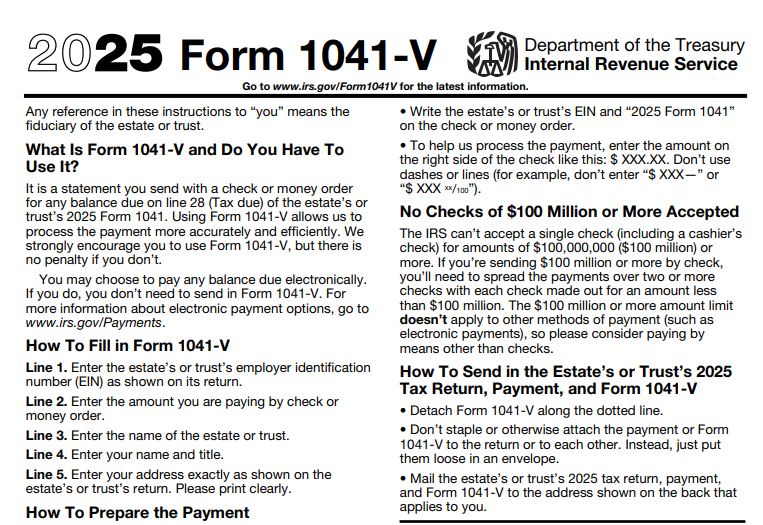

IRS Form 1041-V is a payment voucher designed specifically for estates and trusts to submit checks or money orders alongside their Form 1041 tax return. It’s not a tax return itself but a detachable statement that ensures the IRS processes your payment quickly and accurately. By including Form 1041-V, you help the IRS link the payment directly to the correct estate or trust account, reducing errors and potential delays in processing.

The form is straightforward, typically one page, and includes fields for basic identifying information and the payment amount. It’s particularly useful for paper filers, though electronic payments bypass the need for it entirely. According to the IRS, using Form 1041-V is encouraged for check or money order payments to improve efficiency.

For tax year 2025, the form remains largely unchanged from prior years, with no major revisions noted as of late 2025. However, fiduciaries should confirm the latest version on the IRS website to incorporate any minor updates.

Who Needs to File Form 1041-V?

Not every estate or trust filing Form 1041 requires Form 1041-V. Here’s a quick overview of who it applies to:

- Fiduciaries of Domestic Estates and Trusts: If your estate or trust owes a balance of tax on line 28 of Form 1041 (Tax Due), and you’re paying by check or money order, attach Form 1041-V.

- Bankruptcy Estates: These also fall under Form 1041 filing requirements and may need the voucher for payments.

- Exemptions: If you’re making an electronic payment (e.g., via EFTPS or IRS Direct Pay), you don’t need Form 1041-V. Simple trusts or estates with no tax due also skip it.

In essence, Form 1041-V is for those settling balances via traditional mail. If your entity reports income, deductions, gains, losses, or distributions on Form 1041, review line 28 to determine if a payment—and thus the voucher—is necessary.

IRS Form 1041-V Download and Printable

Download and Print: IRS Form 1041-V

Step-by-Step Guide: How to Fill Out IRS Form 1041-V for 2025

Filling out Form 1041-V 2025 is quick and error-proof if you follow these steps. Download the latest PDF from the IRS website (available as of November 26, 2025). You’ll need your completed Form 1041 handy.

1. Gather Required Information

- Employer Identification Number (EIN) of the estate or trust.

- Full name and address of the estate or trust.

- Tax year (e.g., 2025).

- Amount due from Form 1041, line 28.

2. Complete the Form Sections

- Header: Enter the tax year (2025) and “Form 1041-V, Payment Voucher.”

- Identifying Information: Input the estate or trust’s name, address, city, state, ZIP code, and EIN. Match this exactly to Form 1041 to avoid mismatches.

- Payment Amount: Write the exact dollar amount from Form 1041, line 28. Use numerals and spell it out below for clarity.

- Signature: Not required—it’s a voucher, not a return.

3. Detach and Prepare for Mailing

- Tear along the dotted line to separate the voucher.

- Do not staple it to your check, money order, or Form 1041. Place them loose in the envelope.

Common Mistakes to Avoid

- Mismatched EIN or name, which can delay processing.

- Forgetting to include the check—send both together.

- Using an outdated form version; always use the 2025 edition.

For visual aid, refer to the IRS sample in the Form 1041-V PDF.

Filing Deadlines and Payment Options for 2025

Timely submission is crucial to avoid interest and penalties. Key dates for tax year 2025:

| Entity Type | Form 1041 Due Date | Payment Due Date (with Form 1041-V) |

|---|---|---|

| Calendar-Year Estates/Trusts | April 15, 2026 | April 15, 2026 |

| Fiscal-Year Estates/Trusts (e.g., ending June 30, 2025) | 15th day of 4th month after year-end (e.g., October 15, 2025) | Same as Form 1041 due date |

Extensions for Form 1041 (via Form 7004) extend filing up to September 15, 2026, for calendar-year filers, but payments are still due by the original deadline. Electronic payments are due by 8 p.m. ET on the due date.

Payment Methods

- Electronic (Recommended): Use IRS Direct Pay, EFTPS, or credit/debit card. No Form 1041-V needed—faster and more secure.

- Check or Money Order: Mail with Form 1041-V to the address in Form 1041 instructions (varies by state).

- Estimated Taxes: Quarterly payments may apply; use Form 1041-ES for vouchers if needed.

Recent Changes and Updates for IRS Form 1041-V in 2025

As of December 2025, there are no substantive changes to Form 1041-V itself. The IRS released the 2025 version on November 26, 2025, with minor XML schema updates for e-filing compatibility (effective December 7, 2025, in the Assurance Testing System). These tweaks support broader Form 1041 enhancements but don’t impact paper voucher users.

Broader context: Form 1041 instructions emphasize electronic filing incentives, and the due date remains April 15, 2026, for calendar-year returns. Always check IRS.gov/Form1041V for legislative updates, as tax laws can evolve.

Tips for Fiduciaries: Best Practices for Estates and Trusts

- Go Digital When Possible: Electronic payments reduce errors and provide instant confirmation.

- Double-Check Form 1041 First: Ensure line 28 is accurate before preparing the voucher.

- Track Deadlines: Use IRS reminders or tax software calendars.

- Seek Professional Help: If your estate involves complex distributions or foreign assets, consult a tax advisor.

- Resources: Download forms at IRS.gov, or use Publication 559 for executor guidance.

By mastering IRS Form 1041-V, you’ll ensure smooth tax compliance for your estate or trust. For personalized advice, contact a certified tax professional or the IRS at 800-829-1040.

Last Updated: December 2025. This article is for informational purposes only and not tax advice.