Table of Contents

IRS Form 990 (Schedule H) – Hospitals – Nonprofit hospitals play a vital role in delivering community-focused healthcare while enjoying tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. However, this privilege comes with strict accountability requirements, particularly around demonstrating “community benefits” through financial assistance, health education, and other initiatives. At the heart of this reporting is IRS Form 990 Schedule H (Hospitals), a mandatory attachment to Form 990 that provides detailed insights into a hospital’s operations, policies, and contributions to public health.

As of 2025, with ongoing IRS scrutiny and calls for greater transparency, mastering Schedule H is crucial for compliance and maintaining tax-exempt status. This SEO-optimized guide breaks down everything you need to know about Form 990 Schedule H—from its purpose and filing requirements to key components, recent updates, and best practices for 2025 filings. Whether you’re a hospital administrator, compliance officer, or healthcare policy enthusiast, this resource will help you navigate the complexities of hospital community benefit reporting.

What Is IRS Form 990 Schedule H?

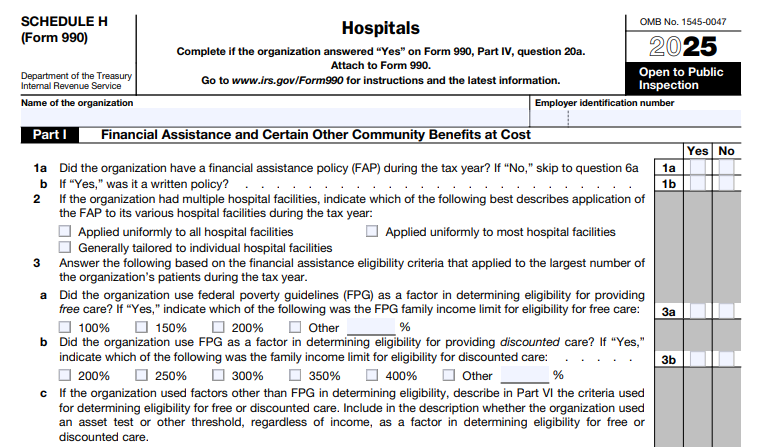

IRS Form 990 Schedule H is a specialized schedule filed by tax-exempt hospital organizations to report on their community benefit activities, financial assistance policies, and compliance with Section 501(r) requirements under the Affordable Care Act (ACA). Enacted in 2010, Section 501(r) mandates that nonprofit hospitals provide accessible care, conduct community health needs assessments (CHNAs), and limit aggressive billing practices to justify their exemption.

Unlike the core Form 990, which covers general financials for nonprofits, Schedule H focuses exclusively on hospitals. It requires quantitative data on costs, revenues, and qualitative descriptions of policies, ensuring transparency about how hospitals use their tax advantages—estimated at $26 billion annually in forgone federal revenue—to benefit communities. Publicly available via the IRS website or tools like ProPublica’s Nonprofit Explorer, Schedule H data informs stakeholders, regulators, and researchers on whether hospitals are fulfilling their charitable mission.

In essence, Schedule H transforms vague “community benefit” concepts into measurable metrics, helping hospitals prove they operate for the public good rather than private gain.

Who Must File Form 990 Schedule H?

Not every nonprofit hospital files Schedule H—it’s triggered by specific criteria:

- Hospital Organizations Only: Any Section 501(c)(3) organization that operated at least one “hospital facility” during the tax year must complete it if answering “Yes” to Form 990, Part IV, line 20a. A hospital facility includes any licensed, registered, or state-recognized inpatient care provider (e.g., general medical-surgical, children’s, or critical access hospitals). Multiple buildings under one license count as a single facility.

- Inclusions and Exclusions:

- Direct Operations: Facilities run directly by the hospital or its disregarded entities (e.g., single-member LLCs).

- Joint Ventures: Proportionate shares from partnerships where the hospital holds an interest.

- Exclusions: Foreign hospitals (report in Part VI only) and non-hospital healthcare facilities (listed in Part V, Section D, but not aggregated in Parts I–III).

- Group Filings: For affiliated systems, data can be consolidated, but individual facilities must be listed in Part V.

Failure to file accurately can lead to penalties, excise taxes under Section 4959 ($50,000 per facility for CHNA failures), or even revocation of tax-exempt status. In 2025, with heightened IRS audits, over 3,000 hospitals filed Schedule H in recent years, underscoring its ubiquity.

Key Components of Schedule H: A Breakdown

Schedule H spans six parts, plus worksheets for calculations. Here’s a concise overview:

| Part | Focus | Key Reporting Elements |

|---|---|---|

| Part I: Financial Assistance and Other Community Benefits at Cost | Quantifies net community benefit expenses | – Financial assistance (e.g., charity care at cost). – Means-tested programs (e.g., Medicaid shortfalls). – Health improvement services, education, subsidized care, research. – Use worksheets for cost-to-charge ratios; report net after offsetting revenue. |

| Part II: Community Building Activities | Non-health investments in community infrastructure | – Grants for housing, economic development, environmental improvements. – Exclude joint venture shares to avoid double-counting. |

| Part III: Bad Debt, Medicare, & Collection Practices | Financial policies and shortfalls | – Bad debt methodology (e.g., % of revenue). – Medicare allowable costs vs. revenue. – Debt collection policies, including protections for FAP-eligible patients. |

| Part IV: Management Companies and Joint Ventures | Conflicts of interest | – List entities owned ≥10% by key personnel; disclose ownership shares. |

| Part V: Facility Information | Per-facility details | – Section A: List all hospitals (name, address, type). – Section B: CHNA status, FAP details, billing practices. – Section C: CHNA implementation strategies. – Section D: Non-hospital facilities (e.g., clinics). |

| Part VI: Supplemental Information | Narratives and explanations | – Methodologies for costing, bad debt, and Medicare. – Promotion of community health; affiliate roles. |

Worksheets (1–8) are critical for Parts I and III, calculating costs using audited financials or ratios (e.g., patient care cost to gross charges). Hospitals must attach audited financial statements to Form 990.

Recent Changes and Updates to Schedule H in 2025

The 2025 Schedule H form (for tax year 2024) mirrors the 2024 version with minimal revisions, focusing on clarity rather than overhaul. Key updates from prior years include:

- Worksheet 4 Clarifications (Ongoing from 2023): Enhanced guidance on reporting community health improvement services, allowing inclusion of licensure-required activities if they address CHNAs or public health needs (e.g., vaccination drives during outbreaks).

- No Major Structural Changes: Final Section 501(r) regulations remain effective since 2016, emphasizing CHNAs every three years and FAP publicity. However, Treasury Inspector General for Tax Administration (TIGTA) reports highlight IRS oversight gaps, urging hospitals to bolster documentation amid rising audits.

State-level shifts, like New York’s new community benefit reporting effective October 1, 2025, may align with Schedule H but require additional submissions by July 1, 2026. Always check IRS.gov for interim guidance.

Why Schedule H Matters: The Importance of Compliance for Nonprofit Hospitals

Schedule H isn’t just paperwork—it’s a cornerstone of accountability. Nonprofit hospitals forgo billions in taxes annually, and Schedule H quantifies their return on investment through community benefits, estimated at $149 billion in 2022 alone (latest AHA data). Key reasons for its importance in 2025:

- Transparency and Public Trust: Reports reveal unreimbursed Medicare costs, bad debt from uninsured patients, and investments in workforce training—real community impacts often overlooked in debates. Critics argue vague definitions allow underreporting, but full Schedule H analysis shows $11 in benefits per $1 in tax exemptions.

- Regulatory Compliance: Ensures adherence to ACA rules, like emergency care for all and no excessive collections from low-income patients. Noncompliance risks excise taxes or status revocation, with TIGTA noting inconsistent IRS enforcement.

- Policy Influence: Data drives reforms, such as proposals for outcome-based metrics or minimum benefit thresholds. In 2025, amid federal budget talks, Schedule H could face scrutiny in tax bill revisions.

Ultimately, robust Schedule H reporting strengthens hospitals’ case for exemption, fostering community partnerships and equitable care.

Step-by-Step Guide: How to Complete and File Schedule H in 2025

- Gather Data: Collect audited financials, CHNA reports, FAP documents, and joint venture K-1s. Use cost accounting software for accuracy.

- Complete Worksheets: Start with Worksheet 2 (cost-to-charge ratio) to inform Parts I and III. Aggregate joint venture shares proportionally.

- Fill Parts I–VI: Report net benefits at cost (exclude bad debt from totals). List facilities in Part V; explain methodologies in Part VI.

- Review for Compliance: Ensure CHNA was conducted within the last three years; verify FAP covers emergency care.

- File with Form 990: Due May 15, 2025 (for calendar-year filers), with automatic three-month extension to August 15. E-file via IRS-approved providers like ExpressTaxExempt or Tax990 for validation.

Retain supporting docs (e.g., worksheets) for three years.

Best Practices and Common Pitfalls for 2025 Filings

- Best Practices:

- Align reporting with CHNA priorities to showcase targeted impacts.

- Use narrative in Part VI to highlight stories, like free clinics serving 5,000 low-income patients.

- Engage auditors early; consider third-party reviews for complex joint ventures.

- Publicize FAP via websites and billboards for Section 501(r) compliance.

- Pitfalls to Avoid:

- Double-counting expenses across categories or joint ventures.

- Underreporting Medicare shortfalls, which can skew net benefits.

- Vague Part VI explanations—IRS seeks specifics on methodologies.

- Ignoring state rules, like California’s community benefit plans.

Pro tip: Tools like the AHA’s Schedule H benchmark reports can benchmark your data against peers.

Conclusion: Prioritizing Community Benefit Through Schedule H

In 2025, IRS Form 990 Schedule H remains a powerful tool for nonprofit hospitals to affirm their charitable mission amid evolving scrutiny. By accurately reporting financial assistance, CHNAs, and other benefits, hospitals not only ensure compliance but also illuminate their indispensable role in public health. As debates on tax exemptions intensify, proactive Schedule H strategies can safeguard status and amplify community impact.

For the latest forms and instructions, visit IRS.gov/Form990. Consult a tax professional for tailored advice—your hospital’s exemption depends on it. Ready to optimize your filing? Download the 2025 Schedule H today and start planning your community benefit narrative.

Keywords: IRS Form 990 Schedule H, nonprofit hospital compliance 2025, community health needs assessment, financial assistance policy, tax-exempt hospitals reporting.

IRS Form 990 (Schedule H) Download and Printable

Download and Print: IRS Form 990 (Schedule H)