Table of Contents

IRS Form 14310 – Partner and Volunteer Sign Up – Are you passionate about helping others navigate tax season? Whether you’re an individual looking to volunteer your time or an organization eager to host free tax preparation sites, IRS Form 14310 is your gateway to joining the Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. As tax filing deadlines approach for the 2025 season, now is the perfect time to get involved. This SEO-optimized guide breaks down everything you need to know about Form 14310, including eligibility, step-by-step instructions, and the impact you can make. Discover how this simple sign-up form can turn your skills into community support.

What Is IRS Form 14310?

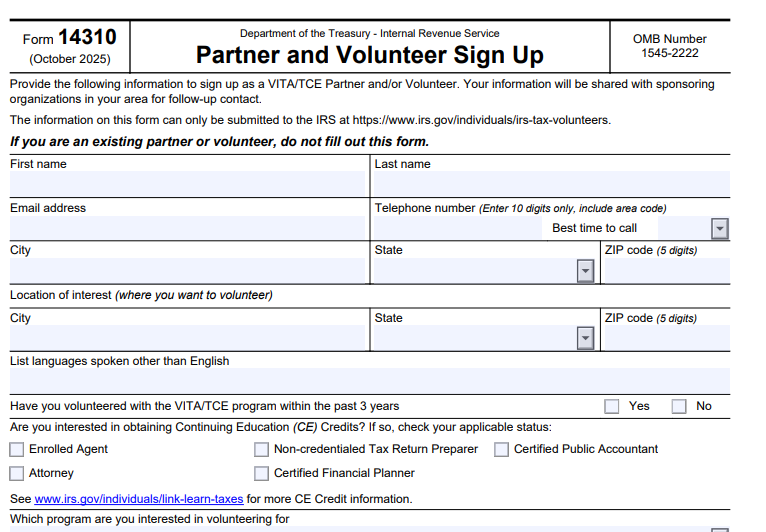

IRS Form 14310, titled “Partner and Volunteer Sign Up,” is an official document from the Internal Revenue Service (IRS) designed for new participants interested in the VITA and TCE programs. Released in its latest revision (Rev. 10-2025), this form collects basic contact information to connect aspiring volunteers and partners with local IRS coordinators and sponsoring organizations.

Unlike complex tax returns, Form 14310 is straightforward and voluntary—your submission helps the IRS match you with opportunities without any penalties for non-participation. It’s not for existing volunteers or partners; if you’re already involved, contact your site coordinator directly to avoid duplicates.

Purpose of Form 14310

The form serves two main goals:

- Volunteer Sign-Up: For individuals ready to prepare taxes, greet clients, or review returns.

- Partner Sign-Up: For organizations (like non-profits, libraries, or credit unions) wanting to sponsor VITA/TCE sites by providing space, equipment, or recruitment support.

By submitting, you’ll receive follow-up from IRS partners, including training details via the IRS’s Link & Learn platform. This ensures you’re equipped to handle real-world tax prep starting in late January 2026 for the 2025 tax year.

Who Should Use IRS Form 14310 in 2025?

If you’re motivated to give back but unsure if you qualify, here’s a quick eligibility overview:

Ideal for Individuals

- Tax Preparers: Anyone comfortable with basic tax rules—no prior experience required, as free IRS training is provided.

- Support Roles: Greeters, interpreters, or quality reviewers for those with limited English or disabilities.

- Professionals: Enrolled agents or tax pros seeking continuing education (CE) credits—up to 15 hours available per year.

VITA targets low- to moderate-income earners (generally $67,000 or less in 2025), people with disabilities, and limited-English speakers. TCE, sponsored by AARP, focuses on seniors aged 60+ with specialized pension and retirement guidance.

Ideal for Organizations

- Community groups, faith-based entities, or businesses with space for tax sites.

- Groups serving underserved populations, like Spanish-speaking families or small business owners needing ITIN help.

No formal qualifications? No problem—the IRS certifies everyone through annual training.

| Role Type | Program Focus | Training Required | CE Credits Available? |

|---|---|---|---|

| Tax Preparer | VITA/TCE | Basic/Advanced Tax Law | Yes (for credentialed pros) |

| Site Coordinator | VITA Sites | Management & Oversight | Up to 15 hours |

| Greeter/Reviewer | All | Client Intake & Quality Check | No, but flexible hours |

| Partner Sponsor | VITA Hosting | Site Setup & Recruitment | N/A |

Step-by-Step Guide: How to Complete IRS Form 14310 (Rev. 10-2025)

Filling out Form 14310 takes just 5-10 minutes. Always use the October 2025 version to avoid delays—older editions (like 2020) won’t process correctly. Download it from the official IRS site and submit online via the volunteer portal.

Key Sections and Tips

- Personal/Organizational Info:

- Enter your full name, email, phone (10 digits with area code), and preferred contact time.

- For partners: Include organization name, address, and contact details.

- Tip: Use a professional email; this is how coordinators reach you.

- Program Interest:

- Select VITA, TCE, AARP Tax-Aide, or “No Preference.”

- Indicate if you’re an IRS employee (yes/no).

- CE Credits (If Applicable):

- Check your status (e.g., Enrolled Agent) if pursuing credits. Visit IRS.gov for details on earning them through volunteering.

- Partner Questions (Organizations Only):

- Answer “Yes” if sponsoring a site: Detail available space, computers/printers, and volunteer numbers.

- Tip: Be specific—e.g., “10×10 room with Wi-Fi and 2 laptops”—to speed up matching.

- Review and Submit:

- Double-check for accuracy; save a copy.

- Submit via the IRS VITA/TCE sign-up page at IRS.gov—not by email. Expect a response in days to weeks.

Pro Tip: If you’re bilingual or tech-savvy, highlight it—these skills are in high demand for 2025 sites.

IRS Form 14310 Download and Printable

Download and print: IRS Form 14310

Benefits of Joining as a VITA/TCE Volunteer or Partner

Volunteering through Form 14310 isn’t just rewarding—it’s flexible and skill-building:

- Flexible Schedule: Choose evenings/weekends from January to April; average 3-5 hours per shift.

- Free Training: IRS provides certification in tax law, ethics, and software—no cost to you.

- CE Credits: Tax professionals can count hours toward renewal requirements.

- Community Impact: In 2024, volunteers prepared over 2.5 million returns, returning $6.1 billion to low-income families—help continue this in 2025.

- For Partners: Gain visibility, build goodwill, and access IRS resources like printed materials.

One volunteer shared: “Submitting Form 14310 got me connected to a local site in days—now I’m certified and helping families claim credits they never knew about.”

Common Mistakes to Avoid When Using Form 14310

- Outdated Form: Stick to Rev. 10-2025; prior versions cause rejections.

- Email Submission: Always use the online portal for secure routing.

- Skipping Details: Incomplete partner info delays site setup.

- For Existing Users: Don’t resubmit—contact your coordinator instead.

If issues arise, email [email protected] for guidance.

Get Started Today: Download and Submit Form 14310

Ready to make a difference in 2025? Head to the IRS VITA/TCE Volunteer and Partner Sign-Up page to access Form 14310 (Rev. 10-2025) and submit securely. Thousands of sites nationwide need your help—volunteers prepare millions of returns annually, ensuring no one faces tax stress alone.

For more on VITA/TCE, explore IRS.gov’s volunteer resources. Your sign-up could unlock refunds, credits, and confidence for your neighbors. Join the movement—submit IRS Form 14310 now and become a tax hero!

Last Updated: December 2025. Information based on official IRS guidance; consult IRS.gov for the latest revisions.