Table of Contents

IRS Form 706 (Schedule Q) – Credit for Tax on Prior Transfers – The IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, is a critical document for executors handling large estates. Among its schedules, Schedule Q (Form 706) stands out for offering a valuable credit that can significantly reduce estate tax liability. Titled “Credit for Tax on Prior Transfers,” this schedule allows estates to claim credits for federal estate or gift taxes previously paid on assets now included in the current decedent’s gross estate. In 2025, with the basic exclusion amount reaching $13.99 million, fewer estates may need to file Form 706, but those that do can benefit from this credit to avoid double taxation on transferred property.

This SEO-optimized guide breaks down everything you need to know about IRS Form 706 Schedule Q, including eligibility, calculation methods, filing requirements, and 2025 updates. Whether you’re an estate planning professional, executor, or navigating probate, understanding this credit can save your estate thousands in taxes. Read on for expert insights backed by official IRS resources.

What Is IRS Form 706 Schedule Q?

Schedule Q (Form 706) is a supporting schedule attached to the main Form 706 to compute and claim a credit under Internal Revenue Code (IRC) Section 2013. This credit offsets the current estate’s tax bill for taxes already paid on “prior transfers”—assets gifted or transferred earlier that are now pulled back into the taxable estate. The goal? Prevent the IRS from taxing the same property twice, once in a prior estate or gift tax return and again upon the current decedent’s death.

Key purposes include:

- Crediting gift taxes on pre-1977 transfers included in the gross estate.

- Accounting for estate taxes paid on life insurance, trusts, or gifts within three years of death.

- Providing relief for property received from a prior transferor (e.g., a parent) whose estate paid taxes on it.

Without this credit, estates could face unfair double taxation, especially in multi-generational wealth transfers. For 2025 filings, the credit flows to Form 706, Part 2—Tax Computation, line 14, reducing the net estate tax.

Who Needs to File Schedule Q on Form 706?

Not every Form 706 filer requires Schedule Q. It’s mandatory if your estate claims the credit for tax on prior transfers. Common scenarios include:

- Pre-1977 Gift Taxes: If the decedent made taxable gifts before January 1, 1977, that are now included in the gross estate (e.g., under IRC Sections 2035–2038), you’re eligible.

- Recent Gifts (Within 3 Years of Death): Gifts made within three years of death are includible and may qualify for a credit based on gift taxes paid via Form 709.

- Retained Interests or Life Insurance: Property in trusts where the decedent retained income or control (Section 2036), or life insurance proceeds (Section 2042) taxed in a prior return.

- Transfers from Prior Decedents: If the decedent received property from someone who died within 10 years before or 2 years after the decedent’s death, and that transferor’s estate paid tax on it.

Executors of estates for U.S. citizens or residents must file if the gross estate exceeds the 2025 exclusion ($13.99 million). Non-residents use Form 706-NA but can still attach Schedule Q. Always consult a tax advisor—missing eligibility could mean overpaying taxes.

Eligibility Requirements for the Credit for Tax on Prior Transfers

To qualify for the Schedule Q credit, the prior transfer must meet strict IRS criteria under Section 2013:

- Taxable in the Prior Estate: The property must have been subject to federal estate tax in the transferor’s estate (or gift tax for pre-1977 gifts).

- Included in Current Gross Estate: The asset (or its value) must now be part of the decedent’s gross estate, even if sold or transformed.

- Time Limits: For transfers from a prior decedent, the transferor’s death must be within 10 years before or 2 years after the current decedent’s death. No credit applies beyond 10 years.

- Beneficial Ownership: The decedent must have held a beneficial interest (e.g., life estate, annuity, or power of appointment), not just bare legal title.

- No Double-Dipping: No credit if a marital deduction was claimed on the prior transfer to a spouse, or for the same taxes claimed elsewhere.

Special rules apply for non-citizen spouses or qualified domestic trusts (QDOTs). The credit is nonrefundable but can reduce your tax to zero. Attach proof, like prior Forms 706 or 709, to substantiate claims.

How to Calculate the Credit on Schedule Q: Step-by-Step Guide

Calculating the credit for tax on prior transfers involves worksheets and prorations—it’s not plug-and-play. Use the Schedule Q Worksheet (not filed, but kept for records) or Form 4808 for gift tax credits. Here’s a simplified breakdown:

Step 1: Identify Prior Taxes Paid

- Gather prior Forms 706 (estate tax) or 709 (gift tax).

- For gifts within 3 years: Review Forms 709 for the three years pre-death (e.g., for a July 2025 death, check 2022–2025 returns).

Step 2: Determine Includible Value

- Calculate the net value of the prior transfer included in the current estate (gross value minus debts, encumbrances, and applicable deductions).

Step 3: Apply Proration Formula

The credit is limited to the lesser of:

- The tax attributable to the prior transfer.

- The current estate tax on the included property.

Basic formula for prior estate transfers: [ \text{Credit} = \text{Prior Tax Paid} \times \left( \frac{\text{Current Includible Value}}{\text{Prior Includible Value}} \right) ] Adjust for time-based reductions if the transferor predeceased (see table below).

For pre-1977 gifts, use: [ \text{Credit} = \text{Adjusted Gift Tax} \times \left( \frac{\text{Included Gift Value}}{\text{Gross Estate Value}} \right) ] (Attach Form 4808 computation.)

Time-Based Percentage Limits

If the prior decedent died before the current one, apply this percentage to the credit:

| Years Between Deaths | Allowable Credit Percentage |

|---|---|

| 2 or fewer | 100% |

| More than 2, up to 4 | 80% |

| More than 4, up to 6 | 60% |

| More than 6, up to 8 | 40% |

| More than 8, up to 10 | 20% |

| More than 10 | 0% |

Step 4: Aggregate Multiple Transfers

For multiple prior transfers, list each on Schedule Q (up to three; attach extras) and sum on line 6.

Example: Suppose a decedent dies in 2025 with a $500,000 life insurance policy included in the estate. The policy was taxed at $400,000 in a 2020 estate return, with $10,000 tax paid. Credit = $10,000 × ($500,000 / $400,000) = $12,500 (assuming no time limit applies).

Complex cases (e.g., special-use valuation under Section 2032A) require adjustments—use IRS examples in the instructions.

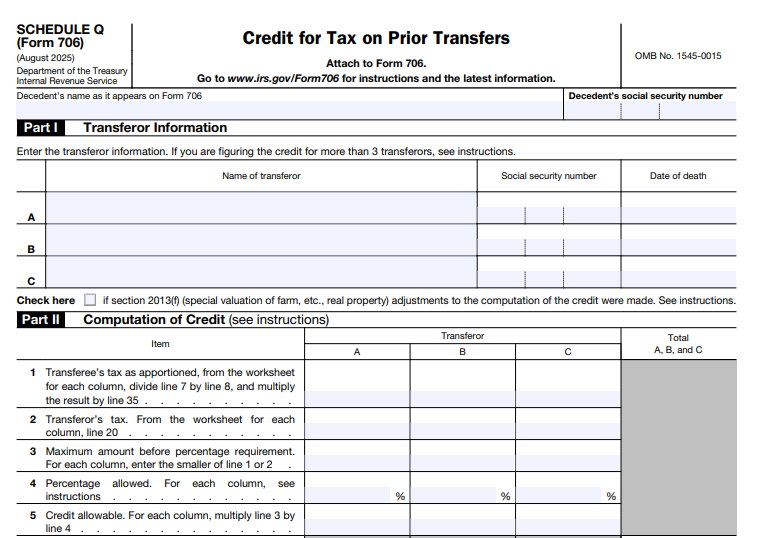

IRS Form 706 (Schedule Q) Download and Printable

Download and Print: IRS Form 706 (Schedule Q)

Filing Schedule Q: Requirements and Deadlines for 2025

- Attach to Form 706: Complete Schedule Q and file with the full return by nine months after death (extensions via Form 4768).

- Documentation: Include copies of prior returns (marked “Exhibit”), tax receipts, and computations. For gifts, attach marked Forms 709.

- Where to Report: Transfer the total credit from Schedule Q, line 6, to Form 706, line 14.

- Amendments: If prior returns change, file an amended Form 706-NA or 706.

E-file if possible, or mail to the IRS address in the instructions. Penalties apply for late filing.

2025 Updates to Form 706 and Schedule Q

The IRS redesigned Form 706 for 2025, separating schedules into standalone PDFs for easier use—no substantive changes to Schedule Q rules or calculations. The basic exclusion rises to $13.99 million (from $13.61 million in 2024), potentially reducing filers, but credits remain unchanged. The ETCL user fee dropped to $56 (from $67) for closing letter requests. Draft Schedule Q is available; final versions expected soon. Portability elections and GST exemptions align at $13.99 million.

Common Mistakes to Avoid When Claiming the Schedule Q Credit

- Overlooking Time Limits: Forgetting the 10-year window can zero out your credit.

- Incomplete Documentation: Always attach prior forms—audits are common.

- Miscalculating Prorations: Double-check values; software errors happen.

- Ignoring Marital Deductions: No credit if previously deducted.

- Forgetting Adjustments: Account for inflation, special valuations, or split gifts.

FAQs About IRS Form 706 Schedule Q

What is the maximum credit on Schedule Q?

The credit is capped at the tax attributable to the included property, prorated and time-adjusted—never more than the current estate tax liability.

Does Schedule Q apply to GST taxes?

Indirectly; it’s an estate tax credit, but GST computations (Schedule R) may interact.

Can I claim this credit retroactively?

Yes, via amended returns if prior taxes are adjusted.

Is professional help required?

For complex estates, yes—errors can trigger audits or penalties.

Conclusion: Maximize Your Estate Tax Savings with Schedule Q

IRS Form 706 Schedule Q is a powerful tool for equitable taxation in estate planning, ensuring prior payments aren’t wasted. With the 2025 redesign streamlining filings and the exclusion amount at $13.99 million, now’s the time to review transfers. Consult a CPA or estate attorney to calculate your credit accurately and avoid pitfalls. For official forms and instructions, visit IRS.gov. Proper use of this credit can preserve more wealth for heirs—start planning today.

This article is for informational purposes only and not tax advice. Always refer to IRS Publication 559 and consult professionals for your situation.