Table of Contents

IRS Form 706 (Schedule I) – Annuities – If you’re navigating the complexities of estate tax filing, IRS Form 706—the United States Estate (and Generation-Skipping Transfer) Tax Return—plays a pivotal role. Among its various schedules, Schedule I (Form 706) stands out for its focus on annuities, a common asset in many estates. Whether you’re an executor, estate planner, or beneficiary, understanding how to accurately report annuities on Schedule I can prevent costly errors and ensure compliance with IRS regulations.

In this guide, we’ll break down everything you need to know about Schedule I, from its purpose and eligibility rules to step-by-step completion instructions and 2025-specific updates. Drawing from official IRS resources, we’ll help you optimize your estate tax strategy while minimizing surprises. Let’s dive in.

What Is IRS Form 706 Schedule I for Annuities?

Schedule I of Form 706 is dedicated to reporting the value of annuities included in a decedent’s gross estate. An annuity is a financial contract that provides a stream of payments, typically for life or a set period, often used for retirement income or legacy planning. Unlike other assets, annuities are only includible in the estate if payments (or a lump sum) continue after the decedent’s death, making Schedule I essential for estates with retirement accounts, pensions, or commercial annuities.

This schedule feeds into the overall gross estate calculation on Form 706, Part 5 (Recapitulation), line 7, influencing the taxable estate and potential estate tax liability. For 2025 decedents, with the basic exclusion amount rising to $13,990,000, many estates won’t owe tax—but accurate reporting is still required if filing for portability of the deceased spousal unused exclusion (DSUE).

Key Fact: Annuities aren’t just insurance products; they include IRAs, 401(k)s, pensions, and deferred compensation plans where benefits extend post-death.

When Do You Need to File Schedule I on Form 706?

Not every estate requires Schedule I. File it if the decedent held any annuity interests immediately before death that qualify for inclusion. Common triggers include:

- Surviving Beneficiary Payments: Annuities where payments continue to a spouse, child, or other beneficiary.

- Retirement Benefits: IRAs, 401(k)s, or pensions payable upon death.

- Joint and Survivor Annuities: Especially those eligible for qualified terminable interest property (QTIP) treatment under IRC Section 2056(b)(7)(C).

If no such annuities exist, simply note “None” on the schedule. However, for estates over the $13,990,000 threshold (or filing for DSUE election), full disclosure is mandatory to avoid IRS audits or penalties.

Pro Tip: Review the decedent’s financial statements and beneficiary designations early. Overlooking an IRA could inflate the taxable estate unexpectedly.

Types of Annuities Reported on Schedule I

Schedule I covers a broad range of annuity-like interests. Here’s a breakdown:

| Type of Annuity | Description | Includible in Gross Estate? | Example |

|---|---|---|---|

| Commercial Annuities | Purchased from insurers for fixed or variable payments. | Yes, if payments continue post-death. | A deferred annuity with survivor benefits to a spouse. |

| Qualified Retirement Plans | IRAs, 401(k)s, 403(b)s. | Full fair market value (FMV) if decedent owned it. | Rollover IRA payable to heirs. |

| Pensions and Deferred Compensation | Employer-sponsored plans. | Yes, for the actuarial value of remaining payments. | Defined benefit pension with survivor option. |

| Joint and Survivor Annuities | Shared annuities between spouses. | Decedent’s portion; potential QTIP election. | 50% joint annuity under a qualified plan. |

| Private Annuities | Informal agreements for periodic payments. | Actuarial value based on IRS tables. | Family arrangement funding a private annuity. |

Source: IRS Instructions for Form 706 (Rev. September 2025)

Joint and survivor annuities often qualify for the marital deduction on Schedule M, but require careful election to avoid automatic QTIP treatment.

Step-by-Step Guide: How to Complete Schedule I (Form 706)

Completing Schedule I requires precision in valuation and description. Use the alternate valuation date (six months post-death) only if elected on Form 706, Part III, line 1, and it reduces both estate value and tax. Here’s how to fill it out based on the 2025 form:

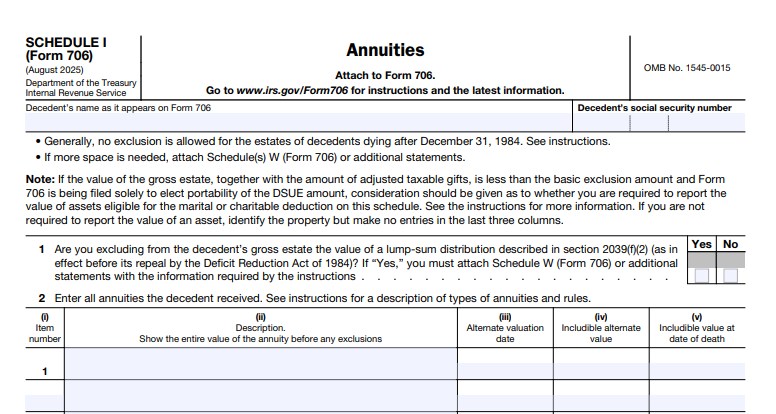

- Header Information: Enter the decedent’s name, EIN (if applicable), and the form’s OMB number (1545-0015). Indicate if using alternate valuation.

- Part 1: Qualified Pensions, Annuities, etc. (Under IRC Sections 2039(a) and (b))

- List each annuity.

- Column (a): Description (e.g., “Vanguard IRA #12345”).

- Column (b): Decedent’s interest (e.g., “Full ownership”).

- Column (c): Beneficiary (e.g., “Surviving spouse”).

- Column (d): Date of death value.

- Column (e): Alternate value (if elected).

- Total on line 5.

- Part 2: Other Annuities

- For non-qualified annuities, repeat the process.

- Total on line 9.

- Grand Total: Add lines 5 and 9; carry to Form 706, Part 5, line 7.

Attach Schedule W (Form 706) for overflow items. Use IRS actuarial tables in Publication 1457 for valuations of life estates or remainders.

Example: A decedent held a $500,000 IRA payable 100% to their spouse. Report the full FMV on line 1, column (d). If QTIP-elected on Schedule M, it may qualify for the unlimited marital deduction.

For software users, tools like UltimateTax streamline entry but verify against IRS PDFs.

2025 Updates to Form 706 and Schedule I

The IRS redesigned Form 706 and its schedules for 2025 to enhance efficiency, separating schedules from the main form for easier assembly. Key changes affecting Schedule I:

- Inflation Adjustments: Basic exclusion amount: $13,990,000; special-use valuation ceiling: $1,420,000.

- QTIP Annuity Elections: Enhanced clarity on electing out of QTIP for joint annuities on Schedule M, line 3.

- Filing Thresholds: No major shifts for annuities, but portability elections now emphasize optional reporting for low-value estates.

Download the latest drafts from IRS.gov/Form706; final versions are available as of September 2025.

Common Mistakes When Filing Schedule I and How to Avoid Them

Even seasoned professionals trip up on Schedule I. Here are pitfalls to sidestep:

- Incorrect Valuation: Using cost basis instead of FMV or ignoring actuarial tables. Fix: Consult IRS Publication 1458 for single premium rates.

- Omitting Beneficiary Details: Failing to specify if payments cease at death. Fix: Confirm with providers; only report continuing annuities.

- QTIP Oversights: Automatic inclusion without electing out on Schedule M. Fix: Review line 3 of Schedule M for joint annuities.

- Math Errors: Misadding totals across schedules. Fix: Cross-check with Form 706’s Recapitulation.

- Missing Attachments: No statements from annuity providers. Fix: Include Form 712 or account summaries.

Audits often flag undervalued retirement annuities, so document everything.

Final Thoughts: Mastering Annuities for a Smoother Estate Tax Process

Accurately completing IRS Form 706 Schedule I ensures your estate tax return withstands scrutiny while maximizing deductions like the marital one for spousal annuities. With 2025’s higher exclusion and redesigned forms, now’s the time to review your planning.

Consult a tax professional for complex cases, especially involving QTIP elections or non-U.S. annuities. For the latest, visit IRS.gov/Form706.

This article is for informational purposes only and not tax advice. Always refer to official IRS guidance.

IRS Form 706 (Schedule I) Download and Printable

Download and Print: IRS Form 706 (Schedule I)