Table of Contents

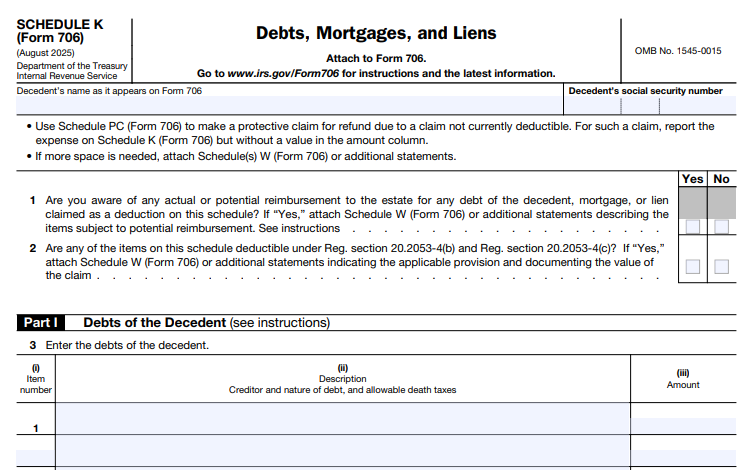

IRS Form 706 (Schedule K) – Debts, Mortgages, and Liens – When navigating the complexities of estate taxes, executors often face a maze of forms and schedules. One critical component is IRS Form 706 Schedule K, which allows deductions for debts of the decedent, mortgages, and liens—potentially reducing the taxable estate and saving your heirs significant tax liability. If you’re searching for “IRS Form 706 Schedule K explained” or “how to deduct mortgages on estate tax return,” this guide breaks it down step by step using the latest 2025 IRS instructions.

As of December 2025, the IRS has updated Form 706 for decedents dying in 2025, with the basic exclusion amount set at $13.99 million (adjusted for inflation). Schedule K remains a key tool for claiming allowable deductions under Internal Revenue Code (IRC) Section 2053, ensuring only enforceable claims against the estate are subtracted from the gross estate value. Whether you’re an executor handling a modest estate or a large one requiring portability elections, understanding Schedule K is essential for compliance and optimization.

What Is IRS Form 706?

IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, is filed by the executor to calculate federal estate taxes on a decedent’s assets exceeding the exclusion amount. It’s due nine months after death, with possible extensions, and must be filed if the gross estate plus adjusted taxable gifts exceeds the threshold.

The form includes multiple schedules for detailing assets and deductions. Schedule K (Form 706) specifically addresses deductions for:

- Debts of the decedent (e.g., unpaid loans, credit cards, medical bills).

- Mortgages on real or personal property.

- Liens (e.g., tax liens, mechanic’s liens).

These deductions lower the taxable estate, directly impacting the estate tax owed (up to 40% on amounts over the exclusion). For 2025, note the reduced estate tax closing letter fee of $56 (effective May 21, 2025), which applies post-audit. Always download the latest version from IRS.gov, as 2025 revisions separate schedules from the main form for easier assembly.

The Purpose of Schedule K on Form 706

Schedule K ensures fairness by allowing the estate to subtract legitimate liabilities from the gross estate before taxation. Without these deductions, heirs could face inflated taxes on encumbered assets—like a home with a mortgage—leading to forced sales or undue burdens.

Under IRC Section 2053, deductions are limited to:

- Enforceable claims against the estate under state law.

- Amounts contracted bona fide and for adequate consideration.

- Obligations where the estate (not just beneficiaries) is liable.

Key rule: Do not deduct debts where the estate isn’t liable (e.g., report only the property’s equity on Schedule A for real estate). Foreign death taxes can also be deducted here if elected, with credit options on Schedule P. This schedule feeds into Form 706, Part V (Recapitulation), lines 15 (debts) and 16 (mortgages/liens), reducing the tentative tax.

What Can You Deduct on IRS Form 706 Schedule K?

Schedule K divides deductions into two parts: Debts of the Decedent (Part I) and Mortgages and Liens (Part II). Only valid, documented claims qualify—disputed items require court concessions or settlements.

Part I: Debts of the Decedent

These are unsecured or personal obligations owed at death. Common examples include:

| Debt Type | Description | Deductibility Notes |

|---|---|---|

| Unpaid Loans & Notes | Personal loans, credit card balances, promissory notes. | Full amount if enforceable; include interest accrued to date of death. |

| Medical & Professional Fees | Unpaid doctor bills, attorney fees for pre-death services. | Deductible if billed before death; attach invoices. |

| Taxes & Judgments | Accrued property taxes, federal income taxes on pre-death income, court judgments. | Property taxes only if due before death; post-death income taxes go on Schedule J. |

| Utility & Service Claims | Bills for services (e.g., December 2024 electric bill: $150). | List creditor, amount, and date incurred. |

| Claims Against the Estate | Former spouse claims (if settled via divorce agreement within 3 years). | Must meet IRC 2053(e) requirements; charitable pledges if enforceable as bequests. |

| Joint Liabilities | Shared debts (e.g., co-signed loans). | Deduct decedent’s portion; explain co-obligor’s share. |

Limits: No deduction for contested claims until resolved (report on Schedule PC for protective claims without a value). Total from Part I goes to line 4, plus any Schedule W totals to line 6.

Part II: Mortgages and Liens

These are secured obligations tied to estate property. Report if the estate assumes liability.

| Lien/Mortgage Type | Description | Deductibility Notes |

|---|---|---|

| Real Estate Mortgages | Home loans where estate pays balance. | Report full property value on Schedule A; deduct unpaid principal + accrued interest here. |

| Personal Property Liens | Auto loans, equipment liens. | Limited to lesser of lien amount or property FMV; list securing asset’s schedule/item. |

| Tax or Mechanic’s Liens | IRS liens, contractor claims on property. | Enforceable only if estate liable; include FMV of collateral. |

| Secured Notes | Loans backed by stocks/bonds (Schedule B). | Deduct up to security value; no double-dipping with asset valuation. |

| Purchase Contracts | Unpaid balance on property bought via contract. | Full purchase price on asset schedule; deduct remainder here. |

Key: For secured items, deduction = lesser of claim amount or FMV of securing property. Total from Part II (line 9) carries to Form 706.

IRS Form 706 (Schedule K) Download and Printable

Download and Print: IRS Form 706 (Schedule K)

Step-by-Step Guide: How to Complete Schedule K for Form 706

Filling out Schedule K requires precision—errors can trigger audits. Use the 2025 version (Rev. August 2025) and attach evidence like statements or appraisals.

- Gather Documentation: Collect creditor statements, loan agreements, bills, and FMV appraisals for securing property. Verify enforceability under state law.

- Identify Deductible Items: Review the decedent’s records for debts/liens. Exclude non-estate liabilities.

- Fill Part I (Debts):

- Column (a): Item number.

- Column (b): Creditor name/address and claim nature.

- Column (c): Date incurred/term.

- Column (d): Unpaid balance + interest to death.

- Column (e): Total deduction (lesser of claim or payable amount).

- For extras: Use Schedule W; sum on line 5.

- Fill Part II (Mortgages/Liens):

- Similar columns, plus (f): Securing property description (e.g., “Schedule A, Item 1”) and FMV.

- Column (g): Deduction amount.

- Note purchase contracts explicitly.

- Handle Special Cases:

- Contested claims: List without value; attach Schedule PC.

- Joint debts: Allocate fairly.

- Foreign taxes: Elect deduction vs. credit.

- Total and Transfer: Add lines 4+5 (debts) and 8+9 (mortgages/liens). Enter on Form 706, Part V, items 15/16. Sign under penalties of perjury.

- File: Attach to Form 706; mail to IRS Kansas City, MO 64999. E-file if eligible.

Pro tip: Software like TurboTax or professional preparers can automate this, but manual filers should cross-reference the 2025 instructions.

Common Mistakes to Avoid When Filing Schedule K

- Overstating Deductions: Only claim enforceable amounts; IRS scrutinizes family loans for adequate consideration.

- Missing Documentation: Always attach proofs—audits demand them.

- Double-Dipping: Don’t deduct on both Form 706 and estate income tax (Form 1041).

- Ignoring State Law: Deductions must be valid locally.

- Forgetting Protective Claims: Use Schedule PC for uncertain items to preserve refund rights.

Real-World Examples of Schedule K Deductions

- Mortgage on Family Home: Decedent’s $600,000 house has a $200,000 mortgage (estate liable). Report $600,000 FMV on Schedule A; deduct $200,000 on Schedule K, Part II. Taxable value: $400,000 equity.

- Credit Card Debt: $5,000 unpaid balance at death. List in Part I with creditor details; full deduction if valid.

- Secured Lien on Stocks: $50,000 note backed by bonds worth $40,000. Deduct $40,000 (lesser amount) in Part II.

- Contracted Land Purchase: $300,000 farm with $100,000 unpaid. Report $300,000 on Schedule A; deduct $100,000 on Schedule K.

These examples illustrate how Schedule K prevents taxing “phantom” value from liabilities.

2025 Updates and Key Reminders

The 2025 Form 706 (Rev. September 2025) features no major Schedule K changes, but schedules are now separate PDFs for streamlined filing. Inflation adjustments apply to exclusions, and Rev. Rul. 2025-16 updates interest rates for related elections (e.g., Section 6166 installments). Always check IRS.gov for drafts turning final.

Final Thoughts: Maximize Deductions with Schedule K

Mastering IRS Form 706 Schedule K can significantly lower estate taxes, preserving more for loved ones. For complex estates, consult a tax professional to avoid pitfalls and ensure compliance. Download the 2025 forms and instructions today from IRS.gov—your heirs will thank you.

This article is for informational purposes only and not tax advice. Verify with a qualified advisor for your situation.

Sources

- IRS Instructions for Form 706 (Rev. September 2025).

- IRS About Form 706 (Updated 2025).

- IRS Schedule K (Form 706) (Rev. August 2025).

- Griffin Bridgers, “2025 Changes to IRS Form 706” (October 2025).