Table of Contents

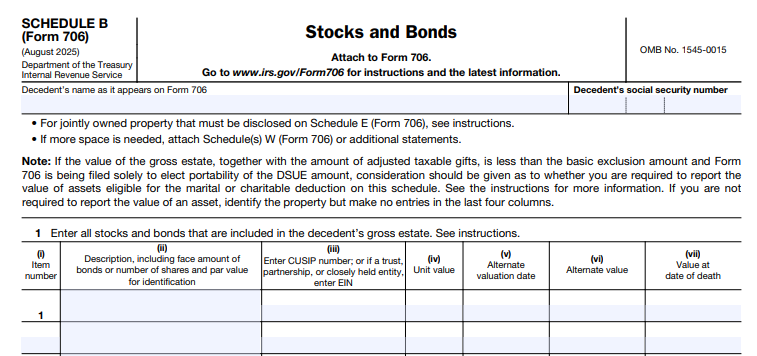

IRS Form 706 (Schedule B) – Stocks and Bonds – When it comes to estate planning, accurately valuing and reporting assets like stocks and bonds is crucial for minimizing tax liabilities and ensuring compliance with IRS regulations. IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, requires executors to detail the decedent’s gross estate, and Schedule B specifically handles stocks and bonds. As of 2025, with the basic exclusion amount raised to $13,990,000, more estates may qualify for filing, especially for portability elections. This SEO-optimized guide breaks down everything you need to know about IRS Form 706 Schedule B, including instructions, valuation methods, and common pitfalls, based on the latest IRS publications.

Whether you’re an executor navigating a complex portfolio or a financial advisor preparing clients, understanding Schedule B for stocks and bonds can save time and avoid audits. Let’s dive in.

What Is IRS Form 706 and When Is Schedule B Required?

IRS Form 706 is filed by the executor of a U.S. citizen or resident decedent’s estate to calculate federal estate tax under Chapter 11 of the Internal Revenue Code, as well as generation-skipping transfer (GST) tax on direct skips. It’s due nine months after the date of death, with an automatic six-month extension available via Form 4768. For 2025 decedents, filing is mandatory if the gross estate plus adjusted taxable gifts exceeds the $13,990,000 basic exclusion amount—or even if below that threshold to elect portability of the deceased spouse unused exclusion (DSUE) amount to a surviving spouse.

Schedule B (Form 706) is a supporting schedule used exclusively to report stocks and bonds included in the gross estate. Attach it to Form 706 if the estate contains any such assets, even if filing solely for portability. It feeds into Part 5 of Form 706 (Recapitulation) to tally the total gross estate value. Exemptions like municipal bonds are still reported at full fair market value (FMV), though their interest may be tax-exempt.

| Key Form 706 Thresholds (2025) | Amount |

|---|---|

| Basic Exclusion Amount | $13,990,000 |

| Special-Use Valuation Reduction Limit | $1,420,000 |

| Estate Tax Closing Letter Fee (effective May 21, 2025) | $56 |

Failure to complete Schedule B accurately can trigger IRS scrutiny, penalties, or delays in closing the estate.

What Assets Are Reported on Schedule B?

Schedule B covers taxable stocks and bonds owned by the decedent at death, including those in brokerage accounts, inactive corporations, or closely held entities. It excludes jointly held property (report on Schedule E) or real estate interests (Schedule A).

Stocks on Schedule B

- Common and Preferred Shares: Corporate stocks, mutual funds, and equity in partnerships or LLCs.

- Closely Held or Inactive Stocks: Family-owned companies with ≤45 shareholders and no established market; include 20%+ voting stock or equity in businesses.

- Fractional Interests: Partial shares or rights in real estate entities.

- Accrued Dividends: Declared but unpaid dividends if the decedent was the stockholder of record.

Bonds on Schedule B

- Corporate and Government Bonds: Including U.S. Treasuries, corporate debt, and municipal bonds (full FMV, despite income tax exemption).

- Accrued Interest: Interest earned up to the date of death.

- Other Debt Instruments: Notes or obligations with fixed maturity.

Special cases include stocks in trade or business corporations and bonds in trusts. For portability-only filings, report assets eligible for marital or charitable deductions but leave valuation columns blank if not required.

IRS Form 706 (Schedule B) Download and Printable

Download and Print: IRS Form 706 (Schedule B)

Step-by-Step Guide: How to Complete IRS Form 706 Schedule B

Completing Schedule B requires detailed listings to ensure IRS compliance. Use the August 2025 revision (attached to Form 706) and the September 2025 instructions. Number items sequentially starting from 1, and use Schedule W as a continuation sheet if needed.

Required Columns on Schedule B

| Column | Description | Example |

|---|---|---|

| (a) Item No. | Sequential number | 1 |

| (b) Description | Full details of the asset | “100 shares common stock, XYZ Corp., CUSIP 123456789” |

| (c) EIN/CUSIP No. | 9-digit identifier (use EIN for unlisted) | 12-3456789 |

| (d) Unit Value (Date of Death) | FMV per unit | $50.00 |

| (e) Unit Value (Alternate Date) | If alternate valuation elected | $45.00 |

| (f) Total Value (Alternate Date) | Total for alternate | $4,500 |

| (g) Total Value (Date of Death) | Final FMV total | $5,000 |

Detailed Reporting for Stocks

- Description: Include corporation name, number of shares, class (common/preferred), par value, principal exchange (e.g., NYSE), and CUSIP number. For unlisted stocks, add the business office address and state of incorporation.

- Valuation: Use FMV at death (or alternate date). For listed stocks, average high/low prices from the date of death.

- Closely Held Stocks: Describe ownership (e.g., “Family limited, 10 shareholders”), attach balance sheets, 5-year dividend history, and appraisals. Reference Reg. §20.2031-2 for factors like earnings power and net worth.

Detailed Reporting for Bonds

- Description: Quantity/denomination, obligor name, maturity date, interest rate, due date, principal exchange, and CUSIP. For unlisted bonds, include the issuer’s business office.

- Valuation: FMV plus accrued interest. Calculate accrual: (Days since last payment / 365) × annual interest.

- Exempt Bonds: Report full value, e.g., municipal bonds at face + accrual.

Round values to the nearest dollar (drop cents under 50; round up 50+). Retain evidence like brokerage statements or WSJ quotes.

Valuation Methods for Stocks and Bonds on Schedule B

Valuation is the heart of Schedule B, governed by FMV rules under Reg. §20.2031-1: the price a willing buyer/seller would agree upon, without compulsion.

Stocks Valuation

- Publicly Traded: Mean of high/low closing prices on death date (or adjacent trading days if none). Use broker statements or services like the Wall Street Journal.

- Closely Held: No market? Factor in book value, recent irregular sales, dividends, and appraisals. Attach financial statements.

- Accrued Dividends: Report separately if declared pre-death but unpaid.

Bonds Valuation

- Listed Bonds: Mean of high/low quoted prices, or bid/asked average if no trades.

- Unlisted Bonds: FMV based on similar securities; add accrued interest prorated daily.

- Example: A $10,000 bond with 5% interest, last paid 90 days before death: Accrued = ($10,000 × 0.05 × 90/365) ≈ $1,232. Total FMV = Face + Accrued.

Alternate Valuation Election

Elect on Form 706 Part 3 to value assets six months post-death (or disposition date if sold earlier). Useful for volatile markets, but it applies estate-wide and requires adjustments for changes (e.g., dividends paid post-death).

For no/nominal value assets, list last with explanations.

Common Mistakes to Avoid When Filing Schedule B

- Omitting CUSIP/EIN: Always include; it’s mandatory for identification.

- Incorrect Accruals: Miscalculating bond interest can inflate values—use 365-day proration.

- Ignoring Closely Held Rules: Failing to attach financials for inactive stocks invites audits.

- Forgetting Evidence: Keep broker letters, appraisals, and sales records; IRS may request them.

- Portability Oversights: Even small estates must report deductible assets if electing DSUE.

2025 Updates for IRS Form 706 Schedule B

The September 2025 instructions reflect redesigned forms for efficiency, with inflation adjustments: basic exclusion at $13,990,000 and special-use cap at $1,420,000. The estate tax closing letter fee dropped to $56 starting May 21, 2025. No major changes to Schedule B valuation, but enhanced guidance on estimating under Reg. §20.2010-2(a)(7)(ii) for large estates. Always check IRS.gov/Form706 for legislation post-publication.

Conclusion: Master Schedule B for Smooth Estate Tax Filing

Navigating IRS Form 706 Schedule B ensures your estate tax return accurately reflects stocks and bonds, potentially saving thousands in taxes or penalties. With the 2025 exclusion hike, proactive filing for portability is key. Consult a tax professional for complex portfolios, and download the latest forms from IRS.gov.

Keywords: IRS Form 706 Schedule B, estate tax stocks bonds, 2025 Form 706 instructions, Schedule B valuation methods, estate tax reporting guide.

For official resources: