Table of Contents

IRS Form 706 (Schedule F) – Other Miscellaneous Property Not Reportable Under Any Other Schedule – Navigating estate taxes can be daunting, especially when dealing with assets that don’t fit neatly into standard categories. For executors handling IRS Form 706—the United States Estate (and Generation-Skipping Transfer) Tax Return—Schedule F serves as the catch-all for “Other Miscellaneous Property Not Reportable Under Any Other Schedule.” This schedule ensures that every asset in the decedent’s gross estate is accounted for, helping to accurately calculate potential estate tax liabilities.

As of 2025, the IRS has redesigned Form 706 and its schedules for greater efficiency, with the basic exclusion amount rising to $13,990,000 for decedents dying this year. Understanding Schedule F is crucial for compliance, avoiding penalties, and maximizing deductions like portability of the deceased spouse’s unused exclusion (DSUE). In this guide, we’ll break down what Schedule F entails, when to use it, valuation methods, examples, and tips to sidestep common pitfalls.

What Is IRS Form 706 Schedule F?

Schedule F is a dedicated attachment to Form 706 used to report miscellaneous assets that aren’t covered by Schedules A (real estate), B (stocks and bonds), C (mortgages, notes, and cash), D (insurance on the decedent’s life), or E (jointly owned property). Its primary purpose is to capture the fair market value (FMV) of these items as of the decedent’s date of death (or alternate valuation date if elected), contributing to the total gross estate reported in Part V of Form 706.

This schedule is essential for estates exceeding the filing threshold—generally, when the gross estate plus adjusted taxable gifts surpasses the basic exclusion amount ($13,990,000 in 2025). Even if no tax is due, filing Form 706 with Schedule F may be required to elect DSUE portability, allowing a surviving spouse to use the decedent’s unused exemption on future transfers.

Key questions on Schedule F include whether the estate includes section 2044 property (e.g., qualified terminable interest property or QTIP from prior elections), digital assets, or interests in partnerships and close corporations. Answering “Yes” triggers detailed reporting and potential attachments.

When Do You Need to File Schedule F?

File Schedule F if the decedent’s estate includes any miscellaneous property not fitting other schedules. This is mandatory for complete Form 706 returns, but if values are zero across all items, you may skip it—though you must still answer the preliminary questions. For portability elections under the special rule of Reg. §20.2010-2(a)(7)(ii), estimate values for marital or charitable deduction-eligible assets without full Schedule F details.

The overall Form 706 deadline is nine months after death, with a six-month extension via Form 4768. Late filings risk penalties, interest, and invalidating DSUE elections. Attach Schedule F to the main form and mail to the IRS address in the instructions.

Types of Property Reported on Schedule F

Schedule F covers a broad array of assets, ensuring nothing slips through the cracks. Here’s a breakdown of common categories, drawn from IRS guidelines:

| Category | Description and Examples | Reporting Notes |

|---|---|---|

| Digital Assets | Cryptocurrencies, NFTs, stablecoins, digital wallets, online accounts on distributed ledgers. | Report FMV on date of death; treated as intangible property for transfer taxes. |

| Section 2044 Property | QTIP from prior marital/gift tax elections (full value includible if surviving spouse retains interest). | Qualifies for marital deduction if requirements met; report full date-of-death value. |

| Business Interests | Partnerships (e.g., family limited), LLCs, unincorporated businesses, sole proprietorships. | Attach EIN, 5-year financials, and goodwill valuation; real estate in proprietorships described like Schedule A. |

| Corporate Stock | Shares in inactive/close corporations (limited shareholders, no public market). | Value per Reg. §20.2031-2; similar to Schedule B but for non-marketable stock. |

| Claims & Rights | Debts/refunds due decedent (e.g., tax refunds, judgments), royalties, leaseholds, reversionary/remainder interests. | Exclude notes/mortgages (Schedule C); checks payable to decedent included. |

| Personal & Collectibles | Household goods, apparel, vehicles, farm products/livestock/machinery, art/jewelry/coins (> $3,000 requires appraisal). | Safe-deposit box contents reported here; expert sworn appraisal for valuables. |

| Insurance & Accounts | Policies on another’s life (attach Form 712); Archer MSAs/HSAs (unless to spouse). | Full economic value for single-premium policies per Rev. Rul. 78-137. |

| Other Interests | Fractional real estate interests, trust shares, rights not elsewhere classified. | Attach trust instruments; use Schedule W for extras. |

These assets must be detailed with descriptions, values, and supporting documents. If discounts apply (e.g., for lack of control/marketability), answer “Yes” on Form 706 Part IV, line 11b, and attach a statement with percentages.

How to Value Property on Schedule F

Valuation is the cornerstone of Schedule F, using FMV—the price a willing buyer/seller would agree upon. Key rules:

- Date of Death vs. Alternate Valuation: Use death date FMV unless electing six-month alternate valuation (reduces tax if values drop post-death).

- Digital Assets: Exchange rate or blockchain data on valuation date.

- Business Interests: Follow Reg. §§20.2031-2/3; include net earnings history and expert appraisals for close entities.

- Collectibles/Art: Qualified appraisals under Reg. §20.2031-6(b) for items over $3,000; attach appraiser qualifications.

- Discounts: Calculate effective rate (e.g., (pro-rata value – discounted value) / pro-rata value); substantiate with facts.

Understatements trigger 20% penalties under §6662 if values are 65% or less of actual FMV. Always retain records for IRS audits.

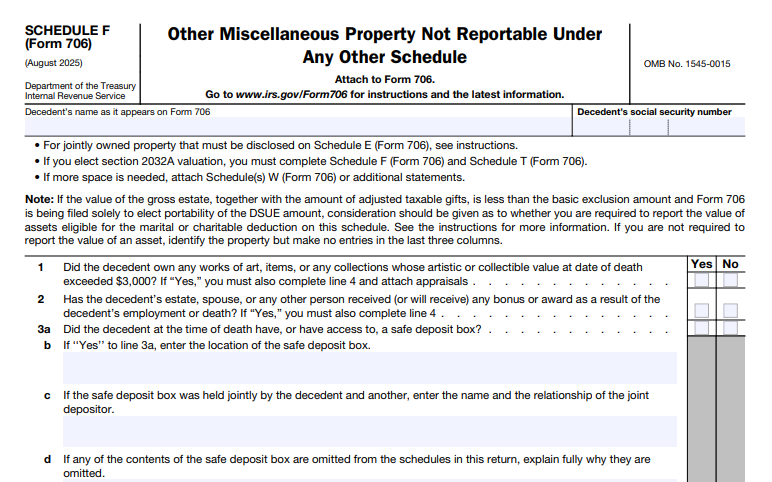

IRS Form 706 (Schedule F) Download and Printable

Download and Print: IRS Form 706 (Schedule F)

Step-by-Step Guide to Completing Schedule F

- Answer Preliminary Questions: On Form 706 Part IV, disclose section 2044 property, digital assets, etc.

- List Assets: Use columns for item description, alternate valuation value, and death-date value. Total in the recapitulation.

- Attach Evidence: Include appraisals, Form 712 (insurance), trust docs, business financials.

- Handle Discounts: If applicable, attach explanatory statement.

- Integrate with Form 706: Carry totals to Part V; estimate for portability if under special rules.

- Sign and File: Executor signs; paper-file with all attachments.

For space issues, use Schedule W or additional sheets.

Real-World Examples of Schedule F Reporting

- Digital Assets: A decedent held $50,000 in Bitcoin and an NFT collection valued at $20,000 on death date. Report descriptions (e.g., wallet addresses) and FMVs on Schedule F, citing exchange data.

- Family Business: 40% interest in a family LLC worth $200,000 pro-rata, discounted 25% for marketability to $150,000. Attach EIN and 5-year P&Ls.

- Collectibles: Jewelry appraised at $10,000; attach sworn expert report. Household items like a $5,000 car listed separately.

- QTIP Property: $300,000 home from prior spouse’s QTIP election; full value reported, eligible for marital deduction.

- Tax Refund Claim: $15,000 IRS refund due; report as a claim against the government.

These examples highlight Schedule F’s versatility for non-traditional assets.

Common Mistakes to Avoid on Schedule F

Executors often trip up on Schedule F, leading to audits or penalties. Watch for:

- Misclassification: Placing business interests on Schedule B instead of F; always check if marketable.

- Inaccurate Valuations: Skipping appraisals for valuables or ignoring discounts; results in 20% penalties.

- Missing Attachments: Forgetting Form 712 or business financials; triggers IRS requests.

- Overlooking Digital Assets: Failing to report crypto/NFTs, now explicitly required.

- Math Errors: Totalling columns incorrectly; cross-check with Part V.

Consult a tax professional early to mitigate risks.

Recent Changes and 2025 Updates for Schedule F

The 2025 Form 706 revision (September 2025) includes a redesigned layout for easier navigation, with separated schedules and updated thresholds: basic exclusion at $13,990,000, special-use valuation ceiling at $1,420,000. Digital assets get explicit mention on Schedule F, aligning with growing holdings. The estate tax closing letter fee dropped to $56 (effective May 21, 2025). No major Schedule F-specific overhauls, but enhanced portability rules emphasize timely filing.

Final Thoughts: Mastering Schedule F for a Smooth Estate Process

Schedule F ensures comprehensive reporting of miscellaneous property on IRS Form 706, safeguarding against underreporting and supporting DSUE elections. With the 2025 exclusion at $13.99 million, most estates avoid tax, but accurate Schedule F completion is key to compliance. Gather appraisals early, document everything, and consider professional help for complex assets like businesses or digital holdings.

For the latest forms and instructions, visit IRS.gov/Form706. Proper handling not only minimizes taxes but honors the decedent’s legacy efficiently.

This article is for informational purposes only and not tax advice. Consult a qualified estate tax professional for your situation.