Table of Contents

IRS Form 706 (Schedule J) – Funeral Expenses and Expenses Incurred In Administering Property Subject to Claims – Estate administration often involves significant outlays for final arrangements and settling affairs, but these costs aren’t lost—they can reduce your estate tax liability. IRS Form 706 Schedule J—Funeral Expenses and Expenses Incurred in Administering Property Subject to Claims—allows executors to itemize and deduct these essential expenditures from the gross estate, potentially saving thousands in federal estate taxes for qualifying estates. With the 2025 basic exclusion amount at $13,990,000, only larger estates face taxation, but accurate Schedule J reporting is vital for compliance and portability elections.

As of December 2025, the IRS has streamlined Form 706 with redesigned schedules for easier filing, including separate attachments for Schedule J. This guide draws from official IRS resources to explain Schedule J’s role, eligible deductions, valuation rules, step-by-step completion, real examples, and pitfalls to avoid. Whether you’re an executor navigating a complex estate or a professional advisor, mastering Schedule J ensures deductions are maximized while minimizing audit risks.

What Is IRS Form 706 Schedule J?

Schedule J is a key deduction schedule attached to Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return. It captures two main categories: funeral expenses and administration costs related to property subject to claims—meaning assets available to pay debts, taxes, and administrative fees. These deductions reduce the taxable estate under IRC Section 2053, directly lowering the estate tax rate (up to 40%) applied to amounts over the $13,990,000 exclusion.

Unlike income tax deductions for individuals (where funeral costs are generally nondeductible), estates can claim these on Form 706 if the gross estate exceeds the filing threshold. However, if deducted here, they cannot be claimed on the estate’s income tax return (Form 1041) without a waiver—preventing double-dipping. Schedule J totals flow to Form 706, Part V, line 14, contributing to the overall deductions in the tax computation.

For 2025 decedents, filing is required if the gross estate plus adjusted taxable gifts exceeds $13,990,000, or to elect deceased spousal unused exclusion (DSUE) portability—even for smaller estates. Always attach receipts and evidence; estimates are allowed if exact amounts aren’t yet known, but protective claims via Schedule PC may be needed for contingent expenses.

When Do You Need to File Schedule J?

Complete Schedule J if the estate claims any funeral or administration expenses for property subject to claims. Even if totals are zero, answer the preliminary reimbursement question (line 1) on the schedule. This applies to all Form 706 filers, but it’s especially critical for taxable estates where deductions can slash liabilities.

The Form 706 deadline is nine months after death, extendable six months via Form 4768 (automatic for payment, but not filing). Late deductions risk disallowance, penalties (up to 25% of underpayment), and interest. For portability-only filings, estimate but don’t fully itemize marital/charitable assets under Reg. §20.2010-2(a)(7)(ii). Mail to the IRS per instructions, with Schedule J attached.

Expenses must be “necessary and reasonable” under local law, paid from estate funds, and not reimbursed (e.g., subtract Social Security’s $255 death benefit unless to the spouse).

Types of Deductions on Schedule J

Schedule J divides into funeral expenses (lines 1-5) and administration expenses (lines 6-11), with a total on line 12. Only claim costs for property subject to claims here; non-claim property goes to Schedule L. Here’s a breakdown of common deductible items:

| Category | Description and Examples | Reporting Notes |

|---|---|---|

| Funeral Expenses | Costs for burial, cremation, memorial services, caskets, plots, monuments, and transportation. | Itemize on line A; subtract reimbursements (e.g., VA benefits). Perpetual care fees included. |

| Executor Commissions | Fees to the personal representative for managing the estate (e.g., 2-5% of estate value per state law). | Line B; attach Form 4421 declaration. Taxable income to executor. |

| Attorney and Accountant Fees | Legal/probate costs, tax preparation (Form 706/1041), and accounting services. | Lines C and D; must be court-approved or reasonable. Include final 1040 prep. |

| Appraisal and Valuation Fees | Professional valuations for real estate, art, businesses, etc., required for Form 706. | Line E; essential for FMV reporting. |

| Other Administration | Bonds, court filing fees, brokers/auctioneers (if necessary for debts/taxes), insurance during probate, interest on estate loans. | Line F; exclude post-death interest on §6166 installments. |

| Miscellaneous | Storage/preservation of assets, advertising for creditors, travel for administration. | Use Schedule W if space limited; must be directly tied to claims payment. |

These must be itemized with payee details and amounts; totals from continuations (Schedule W) carry over.

How to Value and Substantiate Deductions on Schedule J

Deductions are valued at actual or estimated amounts paid/incurred by the filing date, based on “reasonable” costs under IRC §2053. Attach receipts, invoices, court orders, and Form 4421 for commissions/fees. For unpaid items (e.g., pending attorney bills), estimate conservatively; use Schedule PC for protective claims on contingent expenses without entering a value.

Reimbursements (e.g., insurance, government benefits) reduce deductibility—attach a statement if potential (line 1 “Yes”). Overstatements can trigger 20% accuracy penalties under §6662; under local law, non-allowable items (e.g., excessive luncheons) get disallowed. Retain records for three years post-filing.

Step-by-Step Guide to Completing Schedule J

- Preliminary Question (Line 1): Check “Yes” if any expense might be reimbursed; attach details.

- Funeral Expenses (Lines 2-5): List itemized costs on line A (or Schedule W); total on line 5.

- Administration Expenses (Lines 6-11): Break out executors (B), attorneys (C), accountants (D), appraisers (E), other (F), and miscellaneous; subtotal on line 11.

- Grand Total (Line 12): Add lines 5 and 11; carry to Form 706, Part V, item 14.

- Attachments: Include evidence; use Schedule W for extras. Sign Form 706.

- Review: Ensure no double-dipping with Form 1041; elect via waiver if needed.

For digital filing (e-file available for 2025), use IRS-approved software.

Real-World Examples of Schedule J Deductions

- Funeral Costs: Estate pays $12,000 for casket, service, and plot; receives $255 SSA benefit. Deduct $11,745 on line A.

- Executor and Legal Fees: $20,000 commission (2% of $1M estate) + $15,000 probate attorney. Total $35,000 on lines B/C; attach Form 4421.

- Appraisals and Misc: $3,000 real estate appraisal + $2,500 bond premium. Deduct $5,500 on lines E/F.

- Full Admin Suite: For a $15M estate, total Schedule J: $25,000 funeral (net), $50,000 fees, $10,000 misc = $85,000 deduction, reducing taxable estate by that amount.

These illustrate how itemization supports IRS scrutiny.

Common Mistakes to Avoid on Schedule J

Executors frequently err on Schedule J, inviting audits or disallowances. Key pitfalls:

- Misclassifying Expenses: Claiming non-claim property costs here (use Schedule L instead).

- Forgetting Reimbursements: Not subtracting benefits like SSA/VA payments.

- Double-Dipping: Deducting on both Form 706 and 1041 without waiver.

- Unsubstantiated Claims: Skipping receipts or Form 4421; e.g., vague “luncheon” costs disallowed as non-eulogistic.

- Overestimating: Inflating “reasonable” fees beyond state norms, triggering penalties.

Consult professionals to verify.

Recent Changes and 2025 Updates for Schedule J

The September 2025 Form 706 revision separates schedules into standalone PDFs for efficiency, with Schedule J retaining its structure but benefiting from clearer formatting. The estate tax closing letter fee dropped to $56 (from $67) effective May 21, 2025. No Schedule J-specific overhauls, but inflation adjustments raise the exclusion to $13,990,000 and special-use ceiling to $1,420,000. Enhanced e-filing and portability rules emphasize timely, accurate deductions.

Final Thoughts: Optimize Your Estate with Schedule J

Schedule J transforms funeral and administration burdens into valuable estate tax shields, essential for 2025’s high-exclusion landscape. By itemizing meticulously, executors not only comply but also preserve more for heirs—potentially via DSUE portability. Start with detailed records, estimate wisely, and seek expert guidance for complex cases.

Download the latest at IRS.gov/Form706. Proper Schedule J use honors the decedent while streamlining probate.

This article provides general information, not tax advice. Consult a qualified estate professional for personalized guidance.# IRS Form 706 Schedule J: A Complete Guide to Deducting Funeral Expenses and Administration Costs in 2025

Estate administration often involves significant outlays for final arrangements and settling affairs, but these costs aren’t lost—they can reduce your estate tax liability. IRS Form 706 Schedule J—Funeral Expenses and Expenses Incurred in Administering Property Subject to Claims—allows executors to itemize and deduct these essential expenditures from the gross estate, potentially saving thousands in federal estate taxes for qualifying estates. With the 2025 basic exclusion amount at $13,990,000, only larger estates face taxation, but accurate Schedule J reporting is vital for compliance and portability elections.

As of December 2025, the IRS has streamlined Form 706 with redesigned schedules for easier filing, including separate attachments for Schedule J. This guide draws from official IRS resources to explain Schedule J’s role, eligible deductions, valuation rules, step-by-step completion, real examples, and pitfalls to avoid. Whether you’re an executor navigating a complex estate or a professional advisor, mastering Schedule J ensures deductions are maximized while minimizing audit risks.

What Is IRS Form 706 Schedule J?

Schedule J is a key deduction schedule attached to Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return. It captures two main categories: funeral expenses and administration costs related to property subject to claims—meaning assets available to pay debts, taxes, and administrative fees. These deductions reduce the taxable estate under IRC Section 2053, directly lowering the estate tax rate (up to 40%) applied to amounts over the $13,990,000 exclusion.

Unlike income tax deductions for individuals (where funeral costs are generally nondeductible), estates can claim these on Form 706 if the gross estate exceeds the filing threshold. However, if deducted here, they cannot be claimed on the estate’s income tax return (Form 1041) without a waiver—preventing double-dipping. Schedule J totals flow to Form 706, Part V, line 14, contributing to the overall deductions in the tax computation.

For 2025 decedents, filing is required if the gross estate plus adjusted taxable gifts exceeds $13,990,000, or to elect deceased spousal unused exclusion (DSUE) portability—even for smaller estates. Always attach receipts and evidence; estimates are allowed if exact amounts aren’t yet known, but protective claims via Schedule PC may be needed for contingent expenses.

When Do You Need to File Schedule J?

Complete Schedule J if the estate claims any funeral or administration expenses for property subject to claims. Even if totals are zero, answer the preliminary reimbursement question (line 1) on the schedule. This applies to all Form 706 filers, but it’s especially critical for taxable estates where deductions can slash liabilities.

The Form 706 deadline is nine months after death, extendable six months via Form 4768 (automatic for payment, but not filing). Late deductions risk disallowance, penalties (up to 25% of underpayment), and interest. For portability-only filings, estimate but don’t fully itemize marital/charitable assets under Reg. §20.2010-2(a)(7)(ii). Mail to the IRS per instructions, with Schedule J attached.

Expenses must be “necessary and reasonable” under local law, paid from estate funds, and not reimbursed (e.g., subtract Social Security’s $255 death benefit unless to the spouse).

Types of Deductions on Schedule J

Schedule J divides into funeral expenses (lines 1-5) and administration expenses (lines 6-11), with a total on line 12. Only claim costs for property subject to claims here; non-claim property goes to Schedule L. Here’s a breakdown of common deductible items:

| Category | Description and Examples | Reporting Notes |

|---|---|---|

| Funeral Expenses | Costs for burial, cremation, memorial services, caskets, plots, monuments, and transportation. | Itemize on line A; subtract reimbursements (e.g., VA benefits). Perpetual care fees included. |

| Executor Commissions | Fees to the personal representative for managing the estate (e.g., 2-5% of estate value per state law). | Line B; attach Form 4421 declaration. Taxable income to executor. |

| Attorney and Accountant Fees | Legal/probate costs, tax preparation (Form 706/1041), and accounting services. | Lines C and D; must be court-approved or reasonable. Include final 1040 prep. |

| Appraisal and Valuation Fees | Professional valuations for real estate, art, businesses, etc., required for Form 706. | Line E; essential for FMV reporting. |

| Other Administration | Bonds, court filing fees, brokers/auctioneers (if necessary for debts/taxes), insurance during probate, interest on estate loans. | Line F; exclude post-death interest on §6166 installments. |

| Miscellaneous | Storage/preservation of assets, advertising for creditors, travel for administration. | Use Schedule W if space limited; must be directly tied to claims payment. |

These must be itemized with payee details and amounts; totals from continuations (Schedule W) carry over.

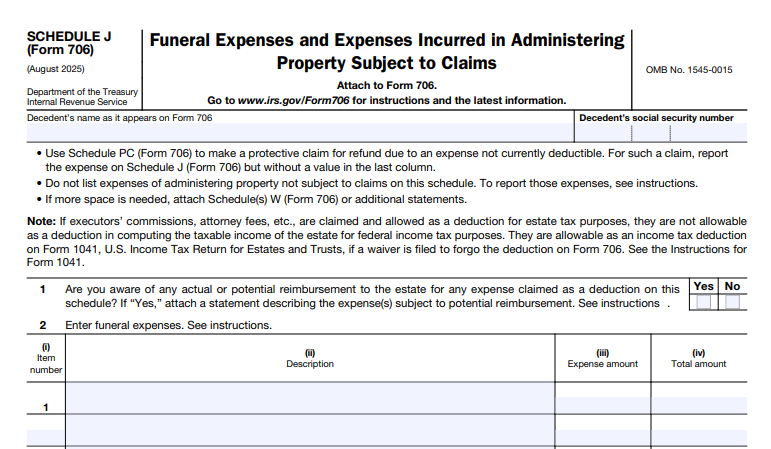

IRS Form 706 (Schedule J) Download and Printable

Download and Print: IRS Form 706 (Schedule J)

How to Value and Substantiate Deductions on Schedule J

Deductions are valued at actual or estimated amounts paid/incurred by the filing date, based on “reasonable” costs under IRC §2053. Attach receipts, invoices, court orders, and Form 4421 for commissions/fees. For unpaid items (e.g., pending attorney bills), estimate conservatively; use Schedule PC for protective claims on contingent expenses without entering a value.

Reimbursements (e.g., insurance, government benefits) reduce deductibility—attach a statement if potential (line 1 “Yes”). Overstatements can trigger 20% accuracy penalties under §6662; under local law, non-allowable items (e.g., excessive luncheons) get disallowed. Retain records for three years post-filing.

Step-by-Step Guide to Completing Schedule J

- Preliminary Question (Line 1): Check “Yes” if any expense might be reimbursed; attach details.

- **Funeral Expenses