Table of Contents

IRS Form 706 (Schedule A) – Real Estate – When a loved one passes away, navigating the estate tax process can feel overwhelming, especially when it comes to valuing and reporting assets like real estate. IRS Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return, is the key document executors use to calculate federal estate taxes under Chapter 11 of the Internal Revenue Code. Within this form, Schedule A – Real Estate plays a crucial role for estates that include property such as homes, land, farms, or commercial buildings. If you’re searching for “how to fill out IRS Form 706 Schedule A” or “real estate valuation on Form 706,” this guide breaks it down step by step, using the latest 2025 instructions from the IRS.

Whether your estate exceeds the 2025 basic exclusion amount of $13,990,000 or you’re filing solely to elect portability of the deceased spouse unused exclusion (DSUE), accurate reporting on Schedule A ensures compliance and minimizes IRS scrutiny. Let’s dive into what Schedule A entails, how to complete it, and tips for avoiding common pitfalls.

What is IRS Form 706 Schedule A?

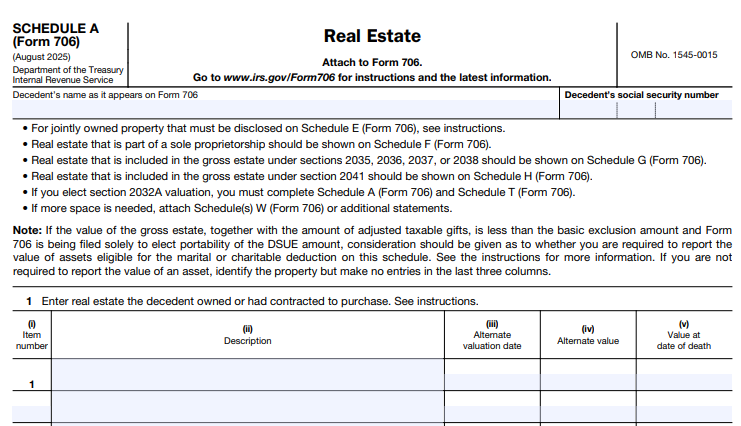

Schedule A of Form 706 is dedicated to listing and valuing all real estate owned by the decedent at the time of death or contracted to purchase. This includes fee simple interests, life estates, remainders, or joint tenancies (though jointly held property may also require Schedule E). Real estate encompasses residential homes, rental properties, vacant land, farms, and commercial buildings—both domestic and foreign.

The purpose? To include these assets in the gross estate’s fair market value (FMV), which determines if estate taxes apply. For 2025 decedents, estates below $13,990,000 generally owe no tax, but filing is required for portability or if gifts push the adjusted taxable estate over the threshold. Note: Real estate under sections 2035–2038 (e.g., transfers with retained interests) goes on Schedule G, not A.

In 2025, Form 706 and its schedules underwent a redesign for better efficiency, but Schedule A’s core requirements remain unchanged: detailed descriptions, valuations, and supporting documents.

When Do You Need to File Schedule A with Form 706?

File Schedule A if the gross estate includes any real estate, regardless of value—especially for portability elections. Even if the estate is below the exclusion, report assets eligible for marital or charitable deductions to claim portability properly.

Key triggers:

- Taxable Estates: Gross estate + adjusted taxable gifts > $13,990,000 (2025 threshold).

- Portability: To transfer DSUE to a surviving spouse (extended filing deadline: up to 5 years post-death under Rev. Proc. 2022-32).

- Generation-Skipping Transfer (GST) Tax: If real estate involves direct skips to skip persons.

File Form 706 within 9 months of death (extendable 6 months via Form 4768). Late filings risk penalties, but protective elections for special valuations are allowed.

Step-by-Step Guide: How to Fill Out Schedule A

Completing Schedule A requires precision. Use the August 2025 version (Rev. 9-2025) from IRS.gov. Number each item sequentially, and if space runs short, attach Schedule W or additional sheets.

Step 1: Gather Essential Documents

- Deeds, titles, and legal descriptions.

- Appraisals (required for values over $3,000 or unique properties).

- Mortgage statements (for encumbrances).

- Rental records (for accrued income).

- For farms/businesses: Proof of qualified use under section 2032A.

Step 2: Describe the Property (Column ii)

Provide a detailed description so the IRS can locate and verify it:

- Location: Street address, city, county, state, ZIP; legal details (lot, block, township, range).

- Nature of Interest: Fee simple, life estate, remainder; percentage owned.

- Acquisition: Date and method (purchase, inheritance).

- Encumbrances: Mortgages, liens (note if estate is liable).

- Other: Improvements (e.g., buildings), zoning, comparable sales.

Example: “House and lot at 123 Main St., Anytown, USA (Lot 5, Block 2, Square 10); fee simple; acquired by purchase on January 1, 2010; subject to $100,000 mortgage (estate liable).”

For trusts or entities, attach a statement with the EIN.

Step 3: Value the Property (Columns iii–v)

Report fair market value (FMV) as of the date of death (default) or alternate date (if elected). FMV is the price between a willing buyer and seller, neither compelled.

| Column | Description | Key Notes |

|---|---|---|

| (iii) Alternate Valuation Date | Enter 6 months post-death (or sale date if earlier). Leave blank unless electing §2032. | Election must reduce gross estate and tax; irrevocable once filed. |

| (iv) Alternate Value | FMV on alternate date. | Include principal and income separately for rents collected post-death. |

| (v) Value | Full FMV (date of death or alternate). | – Mortgaged (estate liable): Full value here; deduct debt on Schedule K. – Not liable: Equity (value minus debt, not below $0). – Contracted purchase: Full value; deduct unpaid on Schedule K. |

Add Accrued Items: Include unpaid rent or interest as of death (e.g., $5,400 accrued rent).

Attach appraisals explaining the method (e.g., comparable sales, income approach). Discounts (10–25%) may apply for fractional interests; explain and attach support.

Step 4: Handle Special Cases

- Partial Interests: Use actuarial tables in Reg. §20.2031-7 for life estates.

- Portability-Only Filings: Estimate values for deduction-eligible property; no detailed columns needed under Reg. §20.2010-2(a)(7)(ii).

- More Space Needed: Total on attachments and carry to Schedule A.

Step 5: Total and Transfer

Sum columns (iv) and (v); enter on Form 706, Part 5 (Recapitulation), lines 1–9.

IRS Form 706 (Schedule A) Download and Printable

Download and Print: IRS Form 706 (Schedule A)

Special-Use Valuation: Reducing Real Estate Taxes Under Section 2032A

For family farms or closely held business real property, elect special-use valuation to value at actual use (not FMV), potentially saving up to $1,420,000 in 2025. Requirements:

- Used in farming/business for 5 of 8 years pre-death.

- Material participation by decedent/heirs.

- Passes to qualified heir (e.g., family member).

How to Elect:

- Complete Schedule A at FMV initially.

- File Schedule T (formerly A-1) with notice, agreement, and worksheets (e.g., gross cash rental method: subtract taxes from rentals, divide by Rev. Rul. 66-70 rate).

- Protective election: Check “Yes” on Form 706, Part 3, line 2; supplement within 60 days if qualified.

Recapture applies if heirs sell or cease qualified use (file Form 706-A).

Common Mistakes to Avoid When Filing Schedule A

- Inaccurate Descriptions: Vague details lead to IRS inquiries—be specific.

- Valuation Errors: Skipping appraisals or ignoring discounts/understating FMV can trigger 20% penalties under §6662.

- Missing Attachments: Always include appraisals and explanations.

- Alternate Valuation Oversights: Applies estate-wide; ensure it reduces taxes.

- Joint Property Mix-Up: Report on Schedule E if jointly held.

2025 Updates for IRS Form 706 Schedule A

- Inflation Adjustments: Basic exclusion $13,990,000; special-use ceiling $1,420,000; installment tax portion $1,900,000.

- Form Redesign: Streamlined layouts; Schedule T for special-use elections.

- Closing Letter Fee: Reduced to $56 (from $67) for requests after May 21, 2025—request via Pay.gov after 9 months.

- Interest Rates: Use Tables 1–2 from Rev. Rul. 2025-16 for special valuations.

Final Thoughts: Seek Professional Help for Smooth Filing

Mastering IRS Form 706 Schedule A real estate valuation ensures your estate tax return is accurate and timely. With potential penalties for errors, consult a CPA, estate attorney, or appraiser—especially for complex properties or special elections. Download the latest forms and instructions at IRS.gov, and remember: proper documentation is your best defense.

Filing estate taxes honors your loved one’s legacy while securing your family’s future. If you have questions on “Form 706 Schedule A examples” or need personalized advice, professional guidance is invaluable. For more resources, visit the IRS Estate and Gift Tax page.

This article is for informational purposes only and not tax advice. Always refer to official IRS publications for your situation.