Table of Contents

IRS Form 706 (Schedule E) – Jointly Owned Property – When navigating the complexities of estate planning and taxation, jointly owned property often presents unique challenges. For executors and estate administrators, accurately reporting these assets is crucial to avoid IRS audits, penalties, or delays in probate. Enter IRS Form 706 Schedule E, a key component of the United States Estate (and Generation-Skipping Transfer) Tax Return. This schedule specifically addresses jointly owned property, ensuring the decedent’s interest is properly included in the gross estate.

In this comprehensive guide, we’ll break down what Schedule E entails, who needs to file it, how to complete it step by step, and tips for compliance in 2025. Whether you’re an estate professional or a family member stepping into the executor’s role, mastering Schedule E can streamline your Form 706 filing and help preserve tax benefits like portability of the deceased spouse’s unused exclusion (DSUE) amount.

What Is IRS Form 706?

Before diving into Schedule E, it’s essential to understand its parent form. Form 706 is the official IRS document used by the executor of a decedent’s estate to calculate federal estate taxes under Chapter 11 of the Internal Revenue Code, as well as generation-skipping transfer (GST) taxes under Chapter 13. It’s required when the gross estate—combined with adjusted taxable gifts and any specific exemptions—exceeds the basic exclusion amount.

For decedents dying in 2025, the basic exclusion amount is $13,990,000, up from prior years due to inflation adjustments. Even if no tax is due, Form 706 must be filed to elect portability, allowing a surviving spouse to use the decedent’s unused exclusion on their own future returns.

Form 706 includes multiple schedules for categorizing assets, deductions, and credits. Schedule E fits into this framework by focusing on jointly owned assets, which could otherwise be overlooked or misvalued.

The Purpose of Schedule E on Form 706

Schedule E: Jointly Owned Property is designed to report the portion of jointly held assets that must be included in the decedent’s gross estate. Joint ownership can take forms like joint tenancy with right of survivorship (JTWROS), tenancy by the entirety, or community property, and it applies to real estate, bank accounts, stocks, partnerships, and more.

Under Internal Revenue Code Section 2040, the full value of jointly owned property isn’t always includible—only the decedent’s attributable interest. Schedule E ensures transparency by requiring detailed disclosures, valuations, and justifications for the includible amount. This prevents underreporting, which could trigger IRS scrutiny, and supports accurate estate tax calculations.

Key assets reported here include:

- Real estate held jointly (cross-reference with Schedule A if fractional interests apply).

- Stocks and bonds (use CUSIP numbers, per Schedule B guidelines).

- Partnership or LLC interests (family limited partnerships often fall here).

- Personal property like vehicles or collectibles.

Failing to file Schedule E when required can invalidate elections, such as special-use valuation under Section 2032A or installment payments under Section 6166 for closely held businesses.

Who Must File Schedule E?

You must complete and attach Schedule E to Form 706 if:

- The decedent owned any jointly held property at death, regardless of whether their interest is fully includible.

- The answer to Part IV, Question 10 on Form 706 is “Yes”: “Did the decedent at the time of death own any property as a joint tenant with right of survivorship in which (a) one or more of the other joint tenants was someone other than the decedent’s spouse, and (b) less than the full value of the property is included on the return as part of the gross estate?”

Even for estates below the filing threshold filing solely for portability, consider reporting jointly owned assets eligible for marital or charitable deductions—though you may leave value columns blank under Reg. section 20.2010-2(a)(7)(ii).

Exceptions: Pure tenancies in common or solely owned partnership interests go on other schedules (e.g., Schedule F). Community property with a surviving spouse may qualify for special rules.

How to Complete Schedule E: Step-by-Step Instructions

Completing Schedule E requires precision in description, valuation, and documentation. Use the fair market value (FMV) as of the date of death (or alternate valuation date, if elected under Section 2032). For 2025 filers, attach appraisals, bank statements, or legal proofs as exhibits.

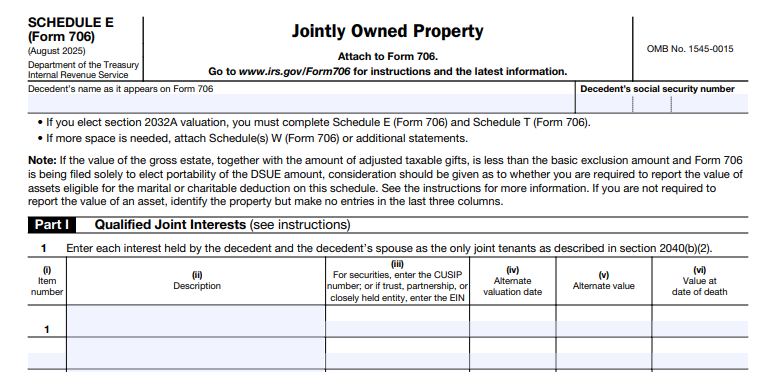

Part I: Qualified Joint Interests (With Surviving Spouse Only)

This section covers JTWROS or tenancy by the entirety where the decedent and spouse are the only joint tenants (Section 2040(b)(2)).

- Column (a): Describe the property (e.g., “Residence at 123 Main St., Anytown, USA” or “100 shares XYZ Corp. stock, CUSIP: 123456789”).

- Column (b): Enter the full FMV at date of death.

- Column (c): If electing alternate valuation (6 months post-death), enter that value here.

- Column (d): Leave blank (not applicable for qualified interests).

- Columns (e) and (f): Enter the full value from Column (b) or (c)—50% is automatically includible for U.S. citizen spouses.

Total on Line 1: Sum Columns (b) and (c); carry 50% of the total to Form 706, Part V, Item 4.

Note: If the spouse is not a U.S. citizen, report in Part II—no special 50% rule applies.

Part II: All Other Joint Interests

For joint ownership with non-spouses (e.g., children, siblings) or non-qualified setups.

- Column (a): List surviving co-owners’ names and addresses.

- Column (b): Describe the property, including how title was held.

- Column (c): Indicate the source of funds (e.g., “Decedent furnished 60%”).

- Column (d): Enter the percentage includible (e.g., based on contribution; default 100% minus co-tenants’ proven shares).

- Column (e): Alternate value, if elected.

- Column (f): FMV at death.

- Column (g): Multiply Column (f) by Column (d).

Total on Line 2: Sum includible values; carry to Form 706, Part V, Item 4.

Pro Tip: Attach an exhibit proving contributions (e.g., gift tax returns, bank records). Without proof, the IRS presumes 100% includible for gifted joint property.

If more space is needed, use Schedule W (Form 706) or additional statements.

IRS Form 706 (Schedule E) Download and Printable

Download and Print: IRS Form 706 (Schedule E)

Valuation Methods for Jointly Owned Property

Valuation is the cornerstone of Schedule E compliance. Use FMV—what a willing buyer would pay a willing seller—determined by:

- Professional appraisals for real estate or unique assets.

- Quoted market prices for stocks/bonds.

- Regulations sections 20.2031-2 (stocks) or 20.2031-3 (partnerships/LLCs) for business interests.

For alternate valuation (elected on Form 706, Part III), use values 6 months post-death or sale date. Special-use valuation (now on Schedule T) caps reductions at $1,420,000 for 2025, useful for family farms or businesses.

Joint interests in closely held entities may qualify for Section 6166 deferral (up to 14 years) if the decedent held ≥20% interest and ≤45 partners—report fully on Schedule E.

Common Mistakes to Avoid When Filing Schedule E

Even seasoned professionals slip up. Here’s how to sidestep pitfalls:

- Overlooking Documentation: Always attach proofs for non-100% inclusions—failure invites full inclusion.

- Confusing Schedules: Joint stocks go on Schedule E, not B alone; real estate cross-references Schedule A.

- Ignoring Portability Rules: For DSUE elections, report but don’t value deductible joint assets.

- Misclassifying Ownership: Verify title documents—JTWROS differs from tenancy in common.

- Forgetting Extensions: File by 9 months post-death; extend with Form 4768 (up to 6 months).

2025 Updates to Form 706 and Schedule E

The IRS has redesigned Form 706 for 2025, separating schedules into standalone PDFs for easier processing. Schedule E remains structurally similar but benefits from clearer formatting and inflation-indexed limits (e.g., exclusion at $13,990,000). No major rule changes affect jointly owned property, but note the estate tax closing letter fee drop to $56 (effective May 21, 2025) and Rev. Rul. 2025-16 updates on effective interest rates for special valuations.

Starting in 2026, the base exclusion rises to $15,000,000, potentially reducing Schedule E filings—but plan ahead for sunsetting provisions under the Tax Cuts and Jobs Act.

Final Thoughts: Ensuring Compliance for Jointly Owned Assets

Mastering IRS Form 706 Schedule E is vital for accurate estate tax reporting, especially with jointly owned property’s nuances. By detailing ownership, valuing interests correctly, and attaching robust documentation, you minimize risks and maximize deductions.

For personalized advice, consult a tax attorney or CPA familiar with estate law. Download the latest forms and instructions from IRS.gov/Form706. Timely filing not only avoids penalties but preserves legacy protections like portability.

Disclaimer: This article is for informational purposes only and not tax advice. Always refer to official IRS guidance for your situation.

Related Resources

- IRS Instructions for Form 706 (Rev. September 2025)

- Schedule E (Form 706) PDF

- Publication 559: Survivors, Executors, and Administrators

By optimizing your estate filings with tools like Schedule E, you honor the decedent’s wishes while navigating tax obligations seamlessly. Stay informed—estate laws evolve, and compliance today secures peace tomorrow.