Table of Contents

IRS Form 706 (Schedule R) – Generation-Skipping Transfer Tax – In the complex world of estate planning, the Generation-Skipping Transfer (GST) Tax often catches families off guard. If you’re dealing with a large estate, transfers to grandchildren or beyond, or trusts that span generations, IRS Form 706 Schedule R is a critical component of your United States Estate (and Generation-Skipping Transfer) Tax Return. This schedule helps calculate and report GST taxes on direct skips—transfers to “skip persons” two or more generations below the decedent—ensuring compliance with federal tax laws.

As of 2025, with the GST exemption rising to $13,990,000, proper use of Schedule R can significantly reduce your tax burden. In this guide, we’ll break down everything you need to know about IRS Form 706 Schedule R, from its purpose to step-by-step completion, backed by official IRS resources. Whether you’re an executor, estate planner, or simply researching GST tax implications, this article provides actionable insights to navigate estate taxes effectively.

What Is the Generation-Skipping Transfer Tax?

The GST tax is a federal tax imposed on transfers of property to “skip persons,” such as grandchildren, great-grandchildren, or trusts where all beneficiaries are skip persons. It’s designed to prevent families from avoiding estate and gift taxes by skipping a generation. Under Chapter 13 of the Internal Revenue Code, the GST tax rate is a flat 40% on the taxable amount after exemptions.

Key concepts include:

- Direct Skip: A transfer directly to a skip person that’s includible in the decedent’s gross estate.

- Skip Person: Natural persons two or more generations below the transferor (e.g., grandchildren) or certain trusts.

- Generation Assignment: Based on lineage, birth dates (within 12.5 years = same generation), and special rules for deceased parents or charities.

Unlike traditional estate taxes, GST tax applies to property interests anywhere in the world if they’re part of the U.S. gross estate. It’s reported on Form 706, with Schedule R handling calculations for estate-level direct skips.

Purpose of Schedule R on IRS Form 706

Schedule R (Form 706) serves multiple roles in managing GST tax liabilities:

- Calculate GST Tax: Figures the 40% tax on direct skips to skip persons.

- Allocate GST Exemption: Irrevocably assigns the decedent’s unused exemption to skips or trusts, reducing future taxes.

- Handle Special Valuations: Computes GST tax savings for property under Section 2032A (special-use valuation for farms or businesses).

- Reconcile Allocations: Tracks prior exemptions from gift taxes (Form 709) and deemed allocations to inter vivos transfers.

This schedule integrates with Form 706‘s overall estate tax return, ensuring the executor reports GST taxes payable by the estate or trusts. For direct skips from certain trusts, use Schedule R-1 as a payment voucher.

Who Needs to File IRS Form 706 Schedule R?

Not every estate requires Schedule R, but it’s mandatory in these scenarios:

- The gross estate includes property transferred directly to a skip person.

- A Section 2032A election is made for special-use valuation, potentially creating GST liability on future dispositions.

- Direct skips occur from trusts includible in the gross estate (e.g., QTIP trusts, marital deduction powers of appointment, or property under Sections 2035–2039, 2041, or 2042).

- For ordinary trusts (where executor isn’t trustee), report all direct skips on Schedule R-1; for non-ordinary trusts, only if tentative maximum direct skips exceed $250,000.

Executors must attach Schedule R to Form 706 if any GST-exempt property is involved. Trustees handle trust-specific skips via Schedule R-1, sending a copy to the fiduciary.

Pro Tip for Estate Planners: Always review the decedent’s prior Form 709 filings to reconcile unused GST exemptions—deemed allocations apply first to lifetime direct skips.

IRS Form 706 (Schedule R) Download and Printable

Download and Print: IRS Form 706 (Schedule R)

Step-by-Step Guide to Completing Schedule R

Filling out IRS Form 706 Schedule R requires values from Form 706 Schedules A–I (gross estate details). Use estate tax valuations, applying alternate or special-use values if elected. Here’s a streamlined walkthrough:

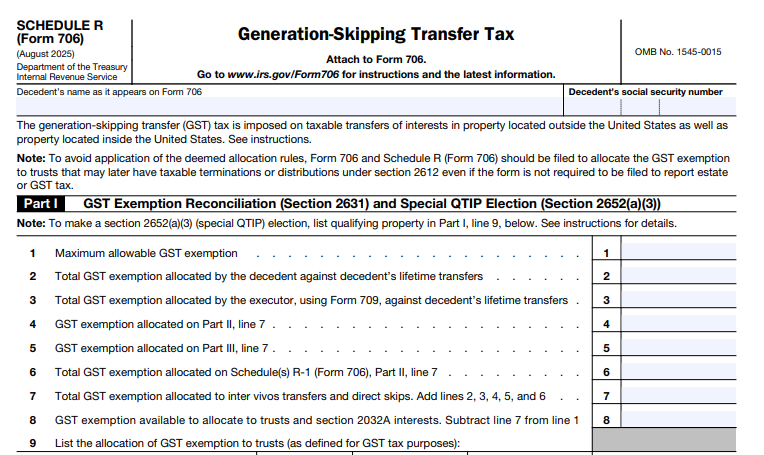

Part 1: GST Exemption Reconciliation

- Line 1: Enter total available GST exemption (from Form 706, Part 2, line 11—$13,990,000 for 2025 decedents).

- Line 2: List prior allocations from Form 709 (deemed to inter vivos skips first).

- Lines 4–6: Allocate exemption to current direct skips, prorating based on skip persons’ interests.

- Line 9: Allocate unused exemption to trusts (columns C–E: exemption amount, trust value, inclusion ratio = 1 – (exemption / adjusted value)).

- Special Elections: Elect QTIP treatment (line 9) or special-use allocation (line 11) for Section 2032A property.

Part 2: Direct Skips Where GST Tax Is Borne by Transferred Property

- Line 2: Value of property transferred to skip persons (FMV from Schedules A–I).

- Line 3: Taxable amount after exemption allocation.

- Line 4: Add GST taxes from other parts if payable from the property.

- Tax Calculation: (Taxable amount × 40%) minus any adjustments.

Part 3: Direct Skips Where GST Tax Is Not Borne by Transferred Property

- Similar to Part 2, but adjust line 4 for taxes from Schedule R-1. Multiply the result by 40% on line 9 if applicable.

For Schedule R-1 (trust skips):

- Part 1: Trust details and filing info.

- Part 2: Mirror Part 2 of Schedule R; issue as a payment voucher.

Examples of Direct Skips:

- $100,000 cash bequest to a grandchild: Report on Schedule R as a direct skip.

- Irrevocable trust to grandchildren (no non-skip interests): Full value on Schedule R.

- Life estate to child, remainder to grandchildren: Not a direct skip (interest to non-skip first).

Attach worksheets for complex allocations, especially under Section 2032A.

Key Calculations and the 2025 GST Exemption

GST tax is straightforward: Taxable GST Amount × 40%. The taxable amount is the transfer value minus allocated exemption.

- Inclusion Ratio for Trusts: Determines future GST tax on distributions/terminations. Formula: 1 – (Allocated Exemption ÷ Adjusted Trust Value).

- Section 2032A Savings: GST tax at FMV minus tax at special-use value, prorated per skip person. Use dual worksheets: one with -0- for special-use lines, another adjusting FMV for taxes.

Here’s a quick reference table for GST exemption amounts:

| Year | Basic Exclusion Amount (GST Exemption) |

|---|---|

| 2025 | $13,990,000 |

| 2024 | $13,610,000 |

| 2023 | $12,920,000 |

| 2022 | $12,060,000 |

Note: Exemptions are inflation-indexed from 1999–2024 levels; only increases apply to post-adjustment transfers or appreciation.

Deemed allocations prioritize lifetime skips, and unused exemptions prorate unless specified otherwise.

Special Considerations: Section 2032A and Portability

For family farms or businesses, Section 2032A allows special-use valuation, but it triggers potential GST recapture on disposition or non-qualified use. Schedule R calculates savings by comparing FMV and special-use GST taxes.

Portability Integration: Unused GST exemption from a predeceased spouse can be claimed via Form 706 Part 6, boosting available allocation on Schedule R.

Windsor Ruling Update: Per Notice 2017-15, same-sex spouses can reduce exemptions for transfers affected by the 2013 Obergefell decision.

Recent Updates to Schedule R and GST Tax (2025)

The IRS revised Form 706 instructions in September 2025, reflecting the GST exemption increase to $13,990,000 (up ~2.8% from 2024 due to inflation). No major structural changes to Schedule R, but enhanced guidance on portability and Section 2032A worksheets emphasizes dual valuations for accuracy. Draft Schedule R (August 2025) is available for preview.

Final Thoughts: Mastering GST Tax with Schedule R

Navigating IRS Form 706 Schedule R ensures your estate minimizes Generation-Skipping Transfer Tax while complying with IRS rules. With the 2025 exemption at $13,990,000, strategic allocations can shield millions from the 40% rate. However, GST rules are nuanced—consult a tax professional or estate attorney for personalized advice.

Ready to file? Download Form 706 and Schedule R from IRS.gov. For more on estate planning, explore our guides on Form 709 gift taxes or Section 2032A valuations.

This article is for informational purposes only and not tax advice. Always refer to official IRS publications for your situation.