Table of Contents

IRS Form 8971 (Schedule A) – Beneficiary Information Regarding Property Acquired From a Decedent – Inheriting property from a loved one is often bittersweet, but it comes with important tax responsibilities. One key document in this process is IRS Form 8971, particularly its attached Schedule A, which provides critical information about the fair market value (FMV) of assets you receive from a decedent’s estate. This form ensures compliance with the consistent basis reporting rules under Internal Revenue Code (IRC) Section 1014(f), helping beneficiaries like you accurately report the tax basis of inherited property on future returns.

As of August 2025, the IRS has updated the instructions for Form 8971 and Schedule A to reflect minor procedural changes, including an updated mailing address for filings. Understanding this form is essential to avoid penalties and maximize your tax benefits. In this guide, we’ll break down everything you need to know about IRS Form 8971 Schedule A, from its purpose to filing deadlines and common pitfalls.

What Is IRS Form 8971 and Schedule A?

IRS Form 8971, titled “Information Regarding Beneficiaries Acquiring Property from a Decedent,” is an informational return filed by the executor of an estate. It reports the final estate tax values of property distributed (or to be distributed) from the estate to the IRS. Attached to it is Schedule A (Form 8971), which serves as a personalized notice to each beneficiary detailing the property they acquired and its estate tax value.

The primary goal of Schedule A is to provide you, the beneficiary, with the “consistent basis” information required by law. This means the tax basis of the property you inherit must match the value reported on the estate’s Form 706 (United States Estate Tax Return) or Form 706-NA (for nonresidents). This value becomes your starting point for calculating capital gains if you sell the asset later.

For example, if you inherit stock valued at $100,000 on the estate tax return, your basis is $100,000—regardless of the property’s original purchase price. Retain your Schedule A indefinitely, as it’s your proof for IRS audits.

Who Needs to File Form 8971 and Furnish Schedule A?

Not every estate requires Form 8971. It’s mandatory only if the executor files Form 706 or 706-NA after July 31, 2015, and the gross estate (plus adjusted taxable gifts) exceeds the federal estate tax exclusion amount—$13.61 million per individual in 2025. Exceptions include estates filing solely for portability elections, protective returns, or allocations without actual tax liability.

The executor (or any co-executor) must:

- File the complete Form 8971 with the IRS, including copies of all Schedules A.

- Furnish one Schedule A to each beneficiary who acquires “reportable property.”

Multiple executors may need to file separate Forms 8971 for the same estate. Beneficiaries don’t file this form themselves but must use the provided Schedule A for their tax records.

What Property Must Be Reported on Schedule A?

Schedule A covers “non-excepted” property acquired from the decedent. This includes assets included in the gross estate and any property with a basis derived from it (e.g., via like-kind exchanges). Reportable items typically encompass:

- Real estate

- Stocks, bonds, and other securities

- Business interests

- Tangible personal property requiring appraisal (e.g., art, jewelry)

Excepted property— which doesn’t require reporting—includes:

- Cash (U.S. dollars, demand deposits, money market funds)

- Life insurance proceeds payable to the beneficiary

- Household effects not needing appraisal

- Property sold by the estate before distribution

- Income in respect of a decedent (e.g., unpaid wages)

Even if all property is excepted, the executor must still file Form 8971 (without Schedules A). Optional Schedules A can be provided for property not yet distributed if the executor anticipates the beneficiary will receive it.

IRS Form 8971 (Schedule A) Download and Printable

Download and print: IRS Form 8971 (Schedule A)

How to Complete Schedule A: Step-by-Step Guide

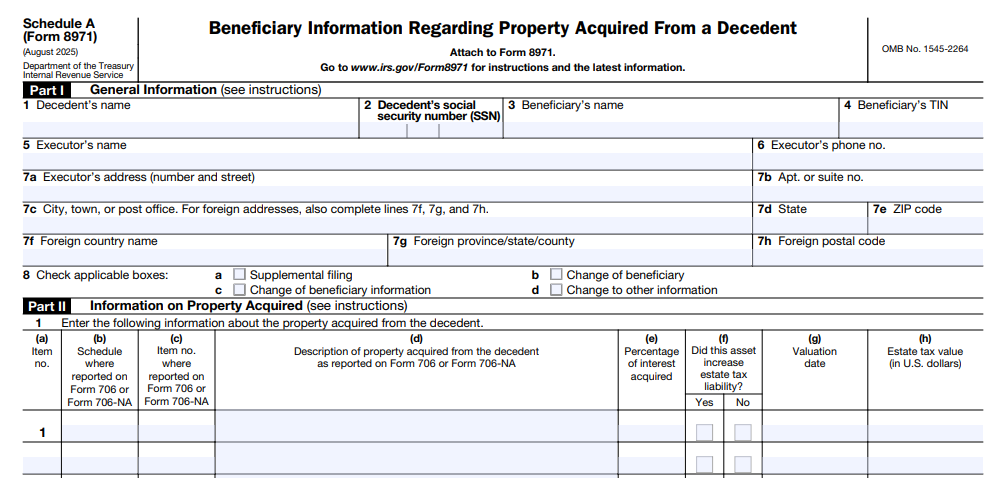

Schedule A is straightforward but requires precise details from the estate’s Form 706. Here’s a breakdown of its sections based on the August 2025 revision.

Part I: General Information

- Lines 1–2: Enter the decedent’s name and Social Security Number (SSN).

- Lines 3–4: Your name and Taxpayer Identification Number (TIN) as the beneficiary.

- Lines 5–7: Executor’s name, phone, and full address.

- Line 8: Check boxes if this is a supplemental filing, change of beneficiary, or update to other info.

Part II: Information on Property Acquired

Use columns (a)–(h) for each asset:

- (a)–(d): Item number, schedule from Form 706, description (e.g., “100 shares of XYZ Corp. stock”).

- (e): Your percentage interest acquired (e.g., 50% if shared).

- (f): Yes/No if the asset increased the estate’s tax liability.

- (g): Valuation date (alternate date if elected on Form 706).

- (h): Estate tax value in U.S. dollars.

Sum the values on Lines 2–4 for totals. The executor must certify the accuracy and provide this to you—no later than the filing deadline.

Executors: Use the IRS’s accessible PDF version for electronic or printed forms. Beneficiaries: Keep it safe; it’s your key to stepped-up basis under IRC Section 1014(a).

Filing Deadlines and Procedures for Form 8971

Timing is critical to avoid penalties. File Form 8971 and furnish required Schedules A by the earlier of:

- 30 days after the due date (including extensions) for Form 706.

- 30 days after actually filing Form 706.

If the deadline falls on a weekend or holiday, it shifts to the next business day. Mail to the IRS at: Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0026 (updated August 2025). Electronic filing isn’t available; it’s paper-only, separate from other returns.

Proof of mailing (e.g., certified mail) is recommended for executors.

Supplements and Updates to Form 8971 Schedule A

Life happens—property may be acquired after the initial filing, or values may change (e.g., due to a Form 706 supplement). In these cases:

- For new acquisitions: Furnish Schedule A and file a supplement by January 31 of the following year.

- For changes: Update within 30 days of the information becoming available.

Mark the supplemental checkboxes on Line 8. The duty to update continues until all values are final.

Common Mistakes to Avoid with IRS Form 8971 Schedule A

- Overlooking excepted property: Remember, even cash inheritances might trigger filing if other assets exist.

- Incorrect basis reporting: Beneficiaries using pre-death values instead of Schedule A figures can face audits and penalties up to 40% of underpayments.

- Missing deadlines: Late furnishing can lead to executor penalties of $290 per form per month.

- Not retaining records: Lose your Schedule A? Request a copy from the executor—don’t guess the basis.

Always cross-reference with Form 706 schedules for accuracy.

Frequently Asked Questions (FAQs) About IRS Form 8971 Schedule A

Do I need Schedule A if the estate is below the exemption threshold?

No, if no Form 706 is required, Form 8971 isn’t filed.

What if I’m a nonresident alien beneficiary?

The rules apply similarly, but use Form 706-NA values.

Can Schedule A values be adjusted later?

Only through supplements if facts change; otherwise, they’re final for basis purposes.

Where can I download the latest forms?

Visit IRS.gov/Form8971 for the August 2025 revisions.

Final Thoughts: Stay Compliant and Maximize Your Inheritance

IRS Form 8971 Schedule A bridges the gap between estate settlement and your personal tax obligations, ensuring fair and consistent reporting of inherited property values. By understanding its requirements, you can confidently handle your basis calculations and avoid costly errors. For complex estates, consult a tax professional or estate attorney—especially with 2025’s exclusion amount in play.

For the most current guidance, download the official forms and instructions from the IRS website. Proper planning today saves headaches tomorrow.

This article is for informational purposes only and not tax advice. Always refer to IRS publications for your situation.