Table of Contents

IRS Form 706 (Schedule U) – Qualified Conservation Easement Exclusion – In the world of estate planning, preserving natural lands while minimizing tax liabilities is a powerful strategy for environmentally conscious individuals. Enter IRS Form 706 Schedule U, the key tool for claiming the qualified conservation easement exclusion. This provision under Section 2031(c) of the Internal Revenue Code allows executors to exclude up to $500,000 of a decedent’s estate value tied to qualifying conservation easements, potentially slashing federal estate tax bills. As of the 2025 tax year, this exclusion remains a vital option for landowners passing down farms, forests, or open spaces.

Whether you’re an estate executor navigating Form 706 or a planner advising on conservation strategies, understanding Schedule U is essential. This guide breaks down everything from eligibility to filing steps, drawing on the latest IRS resources for accuracy. Let’s explore how this exclusion can protect your legacy—and your heirs’ wallets.

What Is a Qualified Conservation Easement?

A qualified conservation easement is a legal agreement that permanently limits the use of real property to preserve its natural, scenic, or ecological value. Donated to a qualified organization (like a land trust), it restricts development, ensuring the land remains open for public benefit, such as wildlife habitat protection or recreational access.

Under IRS rules, the easement must meet strict criteria from Section 170(h):

- Perpetual Restriction: The easement is binding forever, prohibiting non-conservation uses.

- Conservation Purpose: It supports goals like protecting natural habitats, preserving open space, or maintaining farmland/forests for scenic enjoyment.

- Qualified Organization: The recipient must be a tax-exempt entity focused on conservation, such as a charitable foundation or government agency.

The exclusion applies when this easement encumbers land included in the decedent’s gross estate on IRS Form 706 (United States Estate Tax Return). By attaching Schedule U, you reduce the taxable estate value by the easement’s worth, up to the calculated limit.

This isn’t just a tax break—it’s a way to honor environmental stewardship while easing the financial burden on heirs.

Eligibility Requirements for Schedule U Exclusion

Not every easement qualifies. To claim the qualified conservation easement exclusion on IRS Form 706 Schedule U, the estate must satisfy these core requirements:

- Ownership Period: The decedent or a “member of the family” must have owned the land for at least three years before the date of death.

- Easement Timing: The easement must be granted by the decedent, a family member, the executor, or a trust trustee—no later than the date Schedule U is filed.

- Location: The land must be in the U.S. or its possessions.

- Inclusion in Estate: Report the land’s value on Schedules A, B, E, F, G, or H of Form 706.

- Election Rules: The exclusion is elective and irrevocable once claimed on a timely filed Form 706 (including extensions).

Indirect ownership through a partnership, corporation, or trust counts if the decedent held at least 30% interest. For joint or undivided interests, you can elect for one heir’s portion without affecting others, provided thresholds are met.

If the easement was granted before death but its value differed from the estate tax valuation, use a special worksheet based on contribution-date values.

Pro Tip: For protective elections (when qualification is uncertain), check “Yes” on Form 706 Part III, line 2, and file a supplemental return within 60 days if needed.

Who Qualifies as a “Member of the Family”?

The three-year ownership rule hinges on “family” ties, defined broadly under IRS guidelines:

- Ancestors: Parents, grandparents, etc.

- Spouse: Current or surviving.

- Lineal Descendants: Children, grandchildren (including stepchildren and legally adopted children), and their spouses.

- Descendants of Parents: Lineal descendants of the decedent’s parents.

This inclusive definition ensures family farms and estates can leverage the exclusion across generations.

Step-by-Step Guide to Completing IRS Form 706 Schedule U

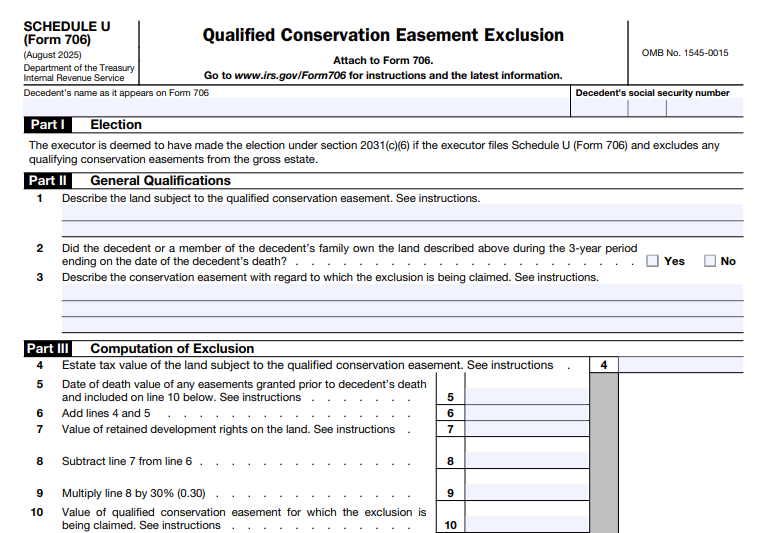

Filing Schedule U is straightforward but requires precise valuations and documentation. Attach it to Form 706 and enter the exclusion on Part V, line 12. Here’s how to fill it out for 2025:

Part I: Election

- Simply filing Schedule U with an exclusion amount constitutes the election under Section 2031(c)(6). No separate statement needed.

Part II: General Qualifications

- Line 1: Describe the land (e.g., “100-acre farm in County X, used for conservation”).

- Line 2: Confirm Yes/No for the three-year ownership by decedent or family.

- Line 3: Detail the easement (e.g., grant date, grantor, restrictions).

Part III: Computation of Exclusion

This is where the math happens. Use date-of-death fair market values (FMVs) unless a worksheet applies.

| Line | Description | Calculation |

|---|---|---|

| 4 | Estate tax value of the land (unreduced by mortgages or easements). | Enter FMV from Form 706 schedules. |

| 5 | Value of pre-death easements included on line 10. | Date-of-death value. |

| 6 | Add lines 4 + 5. | Total pre-reduction land value. |

| 7 | Value of retained development rights (e.g., commercial building rights). | Subtract if not extinguished via agreement. |

| 8 | Subtract line 7 from line 6. | Adjusted base value. |

| 9 | Multiply line 8 by 30% (0.30). | Base exclusion threshold. |

| 10 | Value of the qualified conservation easement claimed. | FMV difference pre- vs. post-easement; attach appraisals. Reduce by any consideration received. |

| 11 | If line 10 < line 9: Divide line 10 by line 8 (to 3 decimals). | Easement ratio (stop if ≤0.100—no exclusion). |

| 12 | Subtract line 11 from 0.300; round thousandths up to hundredths. | Excess ratio adjustment. |

| 13 | Multiply line 12 by 2.0. | Additional percentage factor. |

| 14 | If line 10 ≥ line 9: Enter 0.40. Otherwise: 0.40 – line 13. | Applicable percentage (30%–40%). |

| 15 | Section 2055(f) deduction for the easement (from Schedule O). | Charitable deduction amount. |

| 16 | Acquisition indebtedness on the land (e.g., unpaid purchase loans). | Outstanding debt at death. |

| 17 | Add lines 7 + 15 + 16. | Total reductions. |

| 18 | Subtract line 17 from line 4. | Net land value. |

| 19 | Multiply line 18 by line 14. | Percentage-based exclusion. |

| 20 | Lesser of line 19 or $500,000. | Final exclusion; transfer to Form 706, Part V, line 12. |

Attachments: Include appraisals, easement deeds, and ownership proofs. If extinguishing development rights, file a signed agreement with all interested parties.

IRS Form 706 (Schedule U) Download and Printable

Download and Print: IRS Form 706 (Schedule U)

Benefits and Limitations of the Exclusion

Key Benefits:

- Tax Savings: Up to $500,000 off the gross estate, reducing estate taxes at 40% rates—potentially $200,000 in savings.

- Legacy Protection: Encourages land preservation, aligning with family values.

- Flexibility: Applies to post-death easements granted by executors (if no income tax deduction claimed).

Limitations:

- Capped at $500,000 per estate.

- Applicable percentage tops at 40% only if the easement value ≥30% of adjusted land value.

- Irrevocable election; no do-overs.

- Overlaps with special-use valuation (Section 2032A) require coordination.

For estates over $13.61 million (2025 exemption), this exclusion can be a game-changer alongside other deductions.

Common Mistakes to Avoid When Filing Schedule U

- Undervaluing Easements: Always attach qualified appraisals; IRS scrutiny is high.

- Missing Ownership Proof: Document the three-year period meticulously.

- Ignoring Reductions: Forget retained rights or debt, and your exclusion shrinks.

- Late Filing: Elections must be timely—extensions help, but plan ahead.

- Worksheet Oversights: If contribution values differ, compute separately and note “worksheet attached.”

Consult a tax professional or estate attorney to navigate complexities.

Frequently Asked Questions (FAQs) About IRS Form 706 Schedule U

What is the maximum exclusion under Schedule U?

Up to $500,000, limited by the applicable percentage (30%–40%) of the net land value.

Can the exclusion apply to land owned through a trust?

Yes, if the decedent had a 30%+ indirect interest and other rules are met.

Does granting an easement after death qualify?

Yes, if done by the executor before filing and no income deduction is claimed.

How does Schedule U interact with charitable deductions?

Enter the Section 2055(f) deduction on line 15; it reduces the exclusion base.

Is there a 2025 update to the exclusion amount?

No—the $500,000 cap remains unchanged, per current IRS forms.

Conclusion: Secure Your Legacy with Schedule U

The qualified conservation easement exclusion via IRS Form 706 Schedule U offers a smart, sustainable path to lower estate taxes while safeguarding America’s landscapes. For 2025 filers, timely action and accurate valuations are key to unlocking this benefit.

Ready to explore? Review the official IRS Instructions for Form 706 and download Schedule U. For personalized advice, consult a certified estate planner. Preserve the land, protect the plan—your heirs (and the environment) will thank you.

Last Updated: December 2025. This guide is for informational purposes; tax laws change, so verify with IRS sources.