Table of Contents

IRS Form 8288-B – Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests – Selling U.S. real property as a foreign investor? Navigating the Foreign Investment in Real Property Tax Act (FIRPTA) can feel like a maze, but IRS Form 8288-B offers a key escape route. This application for a withholding certificate allows you to potentially reduce or eliminate the hefty 15% withholding tax on dispositions of U.S. real property interests (USRPI). In 2025, with international real estate markets booming, understanding Form 8288-B is essential for foreign sellers, buyers, and tax professionals to avoid over-withholding and cash flow pitfalls.

Whether you’re a nonresident alien, foreign corporation, or partnership disposing of U.S. real estate, this guide breaks down everything you need to know about IRS Form 8288-B. We’ll cover its purpose, eligibility, step-by-step filing instructions, and tips to streamline your application—all backed by the latest IRS guidance as of December 2025.

What is IRS Form 8288-B?

IRS Form 8288-B, titled Application for Withholding Certificate for Dispositions by Foreign Persons of U.S. Real Property Interests, is a critical tool under FIRPTA (Internal Revenue Code Section 1445). It enables foreign persons to request a certificate from the IRS that adjusts the mandatory withholding tax on sales or transfers of U.S. real property.

Key Purpose of Form 8288-B

- Reduce or Eliminate Withholding: Default FIRPTA withholding is 15% of the gross sales price (or 10% for certain pre-1985 acquisitions). A withholding certificate can lower this based on your actual tax liability, exemptions, or nonrecognition provisions.

- Applicable Scenarios: Use it for claims of tax exemption, nonrecognition treatment (e.g., like-kind exchanges under Section 1031), or when your maximum tax liability is less than the withholding amount. It also supports special rules for installment sales.

This form does not apply to agreements with security for tax payments, blanket certificates for multiple transactions, or certain partnership dispositions under Section 1446(f). For those, consult IRS Revenue Procedure 2000-35 or specific guidelines.

As of October 2025, the form’s current revision (February 2016) remains in effect, with no major updates announced, but always check the IRS website for revisions.

Who Needs to File Form 8288-B?

Form 8288-B is primarily for foreign persons—non-U.S. residents, entities, or fiduciaries—selling or transferring U.S. real property interests. This includes:

- Individuals: Nonresident aliens disposing of U.S. real estate, such as rental properties or personal residences.

- Entities: Foreign corporations, partnerships, trusts, or estates involved in USRPI sales.

- Applicants: Either the transferor (seller) or transferee (buyer) can apply, but the transferor must notify the transferee in writing before the sale if an application is pending.

If you’re a U.S. person or the transaction doesn’t trigger FIRPTA (e.g., sales under $300,000 for principal residences with buyer certification), you won’t need this form. Foreign sellers without a U.S. Taxpayer Identification Number (TIN) must apply for an ITIN via Form W-7 attached to Form 8288-B.

Understanding FIRPTA Withholding and Why Form 8288-B Matters

FIRPTA requires buyers (transferees) to withhold 15% of the amount realized on USRPI dispositions by foreign sellers to ensure tax collection on gains. This applies to direct sales of land, buildings, or shares in U.S. real property holding corporations (USRPHCs).

Withholding Rates and Exceptions

- Standard Rate: 15% of gross proceeds (increased from 10% in 2016).

- Residence Exception: No withholding for sales of principal residences ≤$300,000 if the buyer certifies the seller’s use.

- Pre-1985 Properties: 10% rate for interests acquired before June 19, 1980.

Without a withholding certificate, buyers must remit withheld funds via Form 8288 within 20 days of the transfer. Delays from pending applications are allowed, but interest and penalties accrue if the goal is to defer payment. A successful Form 8288-B application can refund excess withholding post-sale or authorize reduced payment upfront.

IRS Form 8288-B Download and Printable

Download and Print: IRS Form 8288-B

When Should You Use Form 8288-B?

File Form 8288-B if your situation qualifies under one of these IRS categories for reduced withholding:

- Category 1: Exemption or Nonrecognition: You’re exempt from U.S. tax (e.g., foreign government entity) or qualify for nonrecognition (e.g., Section 1031 exchange).

- Category 2: Lower Tax Liability: Your calculated maximum tax (gain × applicable rate, minus credits) is below 15% of proceeds.

- Category 3: Installment Sales: For non-dealer sellers using installment reporting under Section 453, limit withholding to the down payment.

Submit before or on the transfer date for pre-approval, or post-transfer for refunds. The IRS processes complete applications within 90 days.

| Scenario | Withholding Without Certificate | Potential Reduction with 8288-B |

|---|---|---|

| Full Cash Sale (Gain: $200K on $1M Property) | $150K (15%) | Down to $30K (15% of gain at 15% rate) |

| Like-Kind Exchange | $150K | $0 (Nonrecognition) |

| Installment Sale ($300K Down on $1M) | $150K | $45K (15% of down payment) |

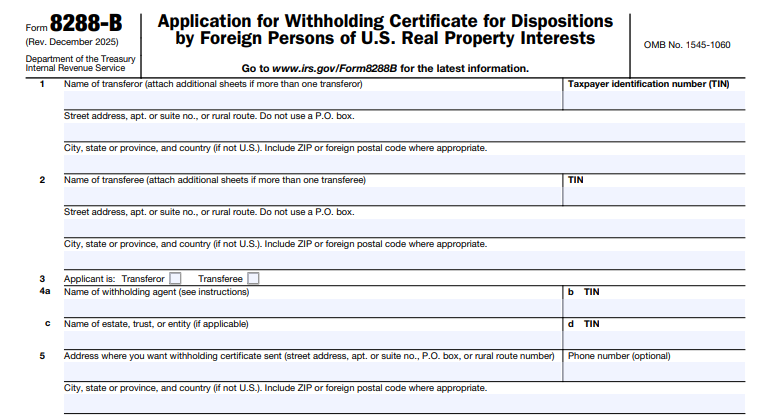

Step-by-Step Guide to Completing IRS Form 8288-B

The form is straightforward but requires detailed attachments. Download the latest PDF from IRS.gov. Estimated time: 1-2 hours for preparation, plus recordkeeping.

Part 1: Transferor and Transferee Information (Lines 1-2)

- Enter full names, TINs (SSN/ITIN/EIN), and U.S. addresses (no P.O. boxes). Apply for missing TINs via Form SS-4 (EIN) or W-7 (ITIN).

- Use attachments for multiple parties.

Part 2: Applicant and Withholding Agent Details (Lines 3-5)

- Specify if you’re the transferor or transferee.

- Name the withholding agent (usually the buyer) with their TIN and entity details.

- Provide your preferred mailing address for the certificate.

Part 3: Transaction Description (Line 6)

- Date and Price: Exact or estimated transfer date; full contract price in USD.

- Property Type: Check real property, associated personal property (e.g., furniture), or USRPHC interest.

- Use and Basis: Rental/commercial vs. personal; adjusted basis with supporting docs (e.g., depreciation schedules).

- Location/Description: Detailed (e.g., “5-acre commercial lot at 123 Main St., Miami, FL”).

- Prior Tax History: U.S. returns filed/paid in last 3 years? Include amounts and filing details.

Part 4: Basis for Certificate (Line 7)

Select your reason and attach evidence:

- Exemption/Nonrecognition (7a): Description, legal basis, facts, no prior unsatisfied liability proof, and property value estimate.

- Lower Liability (7b): Full tax calculation (proceeds – basis + recapture; apply rates/treaties/NOLs). Include contracts, appraisals for personal property.

- Installment (7c): Buyer agreement to future withholding via Forms 8288/8288-A.

Additional Lines

- Line 8: Confirm no unsatisfied prior withholding (attach proof like prior Forms 8288).

- Line 9: If under Section 1445(e) (e.g., distributions), specify type and applicant role.

Signature

Sign under penalties of perjury. Agents need Form 2848 (Power of Attorney).

Pro Tip: Attach everything—incomplete apps get rejected. For mixed-use properties, explain allocations clearly.

Filing Instructions, Deadlines, and Processing

- Where to File: Mail to Internal Revenue Service Center, P.O. Box 409101, Ogden, UT 84409. Use certified mail for tracking.

- Deadlines: Submit before transfer for advance ruling; post-transfer within 90 days for refunds. If pending, withhold but delay remittance until IRS response (20 days post-mailing).

- Processing Time: Up to 90 days for complete apps. You’ll receive a certificate (reducing withholding) or denial notice.

- Cost: No filing fee, but professional help (e.g., CPA) may run $1,000-$5,000.

Amendments go to the same address with a perjury-signed statement.

Common Mistakes to Avoid When Filing Form 8288-B

- Missing TINs: Always include or apply for them—delays applications.

- Incomplete Attachments: Vague descriptions or unappraised values lead to denials.

- Timing Errors: Late notifications to buyers trigger penalties.

- Overlooking Installment Rules: Ensure buyer consents to ongoing withholding.

- Ignoring Updates: Double-check IRS Pub 515 for treaty changes affecting your calculation.

Consult a tax advisor for complex cases, like multi-property portfolios.

Related Forms and Resources for FIRPTA Compliance

- Form 8288: Report and pay withheld taxes.

- Form 8288-A: Buyer statement to seller.

- Publication 515: Withholding on nonresidents—must-read for details.

- Revenue Procedure 2000-35: Advanced rules for agreements and security.

For ITINs, see Form W-7 instructions. Track your status via IRS.gov or call 1-800-829-1040.

Final Thoughts: Streamline Your FIRPTA Process with Form 8288-B

IRS Form 8288-B empowers foreign investors to reclaim control over their U.S. real estate proceeds, potentially saving thousands in unnecessary withholding. By preparing thoroughly and filing early, you can close deals smoother and focus on your next investment.

Ready to apply? Download Form 8288-B today and pair it with expert guidance. For the latest 2025 updates, visit IRS.gov’s international taxpayers page. If you’re selling U.S. property abroad, share your experience in the comments—what’s your biggest FIRPTA challenge?

This article is for informational purposes only and not tax advice. Consult a qualified professional for your situation.