Table of Contents

IRS Form 13614-NR – Nonresident Alien Intake and Interview Sheet – Navigating U.S. taxes as a nonresident alien can feel overwhelming, especially with forms like IRS Form 13614-NR. If you’re a student, researcher, or temporary worker on a visa, this intake sheet is your gateway to accurate tax preparation through free IRS programs. In this comprehensive guide, we’ll break down what IRS Form 13614-NR is, who needs it, how to fill it out step by step, and tips to avoid common pitfalls. Whether you’re searching for “IRS Form 13614-NR instructions” or “nonresident alien tax intake sheet,” you’ve come to the right place. Updated for the October 2025 revision, this article draws from official IRS sources to help you file confidently.

What Is IRS Form 13614-NR?

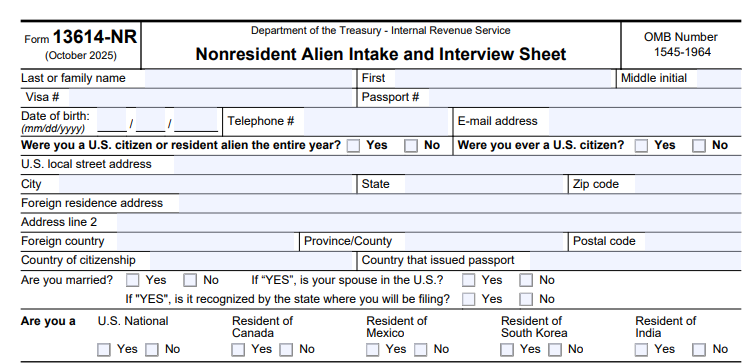

IRS Form 13614-NR, officially titled the Nonresident Alien Intake and Interview Sheet, is a multi-page worksheet designed to gather essential details from nonresident aliens during tax preparation. Released in its latest revision in October 2025, the form serves as a structured interview tool to ensure all relevant tax information is collected before preparing returns like Form 1040-NR. Unlike standard U.S. resident forms, it focuses on immigration status, U.S. presence days, and treaty benefits unique to nonresidents.

This voluntary form is not filed with your tax return but is crucial for volunteers in the IRS Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs. It helps prevent errors in determining your tax residency and calculating liabilities.

Who Needs to Complete IRS Form 13614-NR?

Not every nonresident alien must use this form, but it’s essential if you’re seeking free tax help or have U.S.-sourced income to report. Specifically:

- Nonresident aliens with U.S. income: Anyone earning wages, scholarships, dividends, or other U.S.-source income reported on forms like W-2 or 1042-S.

- VISA holders filing Form 1040-NR: Students (F-1, M-1), exchange visitors (J-1), temporary workers (H-1B), and others who need to file a nonresident tax return.

- Those claiming tax treaty benefits: If you’re exempting income under a U.S. treaty with your home country.

- Exempt individuals for Form 8843: Visa holders (F, J, M, Q) who must report their U.S. presence, even without income.

U.S. residents for tax purposes should use Form 13614-C instead. If you have no U.S. income and aren’t claiming exemptions, you may skip it—but consulting a VITA site is still recommended.

The Purpose of Form 13614-NR in VITA/TCE Programs

Form 13614-NR is the backbone of the nonresident alien intake process in VITA/TCE, free IRS-sponsored programs offering tax prep for low- to moderate-income individuals, including international students and workers. Its primary goals are:

- Ensure accuracy: By confirming every detail, volunteers can correctly assess your residency status under the substantial presence test or green card rules.

- Streamline interviews: It combines with source documents to create a complete picture, reducing errors like misclassifying students as residents for education credits.

- Protect claims: Details on visas and treaties help validate exemptions, avoiding audits or penalties.

Volunteers must discuss unchecked items and revisit incomplete sections to maintain quality standards. In 2025, with rising international enrollment, VITA sites emphasize this form to handle complex cases efficiently.

IRS Form 13614-NR Download and printable

Download and Print: IRS Form 13614-NR

Key Sections of IRS Form 13614-NR

The October 2025 version spans several pages, organized into logical sections. Here’s a breakdown of what each collects:

1. Personal Information

Basic identifiers: Full name, date of birth, contact details, U.S. and foreign addresses, passport/visa numbers, citizenship country, and prior U.S. residency history.

2. Marital and Dependent Status

Filing status details: Married status, spouse’s U.S. presence, state-recognized marriage, and dependent info (names, DOB, support provided, income levels).

3. Entry and Immigration Status

Visa journey: First entry date, initial/current status (e.g., F-1 student, H-1B worker), changes with dates, visa types from 2019–2024, J-1 subtypes, and primary visit activity (e.g., studying, research).

4. Presence in the U.S.

Day counts: Years as teacher/student (2019–2024), prior presence before 2019, daily tallies for 2023–2025, and entry/departure dates for 2025.

5. Prior Tax Filing

History check: Previous U.S. returns (year and form), green card applications, or status change requests in 2025.

6. Tax Treaty Benefits

Exemption claims: Country, treaty article, prior months claimed, current-year exempt income amount, and foreign tax on that income.

7. Academic Information (If Applicable)

For students/scholars: Institution name/address, program director contacts.

8. Payment and Refund Options

Preferences: Direct deposit for refunds or electronic payments for balances due.

9. Income and Deductions

Checklist: Sources like wages, scholarships, interest, unemployment; deductions for student loans, charity, IRA contributions; health insurance details (Form 1095-A).

This structure ensures nothing is overlooked.

Step-by-Step Guide: How to Fill Out IRS Form 13614-NR

Completing Form 13614-NR takes 30–45 minutes. Download the PDF from IRS.gov and prepare documents in advance. Follow this checklist:

- Gather Essentials: Passport/visa scans, I-94 travel history (from CBP.gov), income forms (W-2, 1042-S, 1098-T), prior returns.

- Personal Details: Enter exact passport name and numbers; list all addresses used in 2025.

- Immigration Timeline: Note entry status, changes, and grid out visas from 2019–2024. Select J-1 subtype if applicable.

- Track U.S. Days: Use I-94 for precise counts (include partial days, exclude transit <24 hours). Total for substantial presence test.

- Treaty Section: Specify country/article; match exempt amounts to 1042-S Box 12 codes.

- Income/Deductions: Mark all “yes” sources and attach forms; note health coverage.

- Review and Sign: Scan for errors (e.g., day mismatches); keep a copy. For virtual VITA, sign Form 14446.

Work with a VITA volunteer to confirm everything—it’s not submitted to the IRS but retained for your records.

Required Documents for Form 13614-NR

To breeze through the process, bring:

- Identity/Immigration: Passport ID page, visa page, I-94 record (5-year history).

- Income Proof: W-2 (wages), 1042-S (scholarships/treaty income), 1099 series (interest/dividends).

- Education: 1098-T (tuition/scholarships).

- Other: Prior U.S. returns, treaty support letters from employers.

Digital uploads are ideal for hybrid VITA sites.

Common Mistakes to Avoid When Using IRS Form 13614-NR

- Inaccurate Day Counts: Forgetting partial days or exempt periods (e.g., Canadian commuters) can flip your residency status.

- Visa Mismatches: Listing wrong subtypes for J-1 (e.g., professor vs. student) affects treaty eligibility.

- Incomplete Treaties: Omitting prior-year claims or foreign tax details may invalidate exemptions.

- Overlooking Dependents: Not verifying support >50% or income thresholds.

- Rushing the Checklist: Unchecked income items lead to missed deductions like student loan interest.

Double-check against I-94 and source docs to stay audit-proof.

Claiming Tax Treaty Benefits with Form 13614-NR

Many nonresidents qualify for reduced or zero tax on U.S. income via treaties (e.g., India-Article 21 for students). The form’s treaty section captures:

- Home country and article number.

- Prior months claimed (to avoid exceeding limits, like 5 years for students).

- Exempt income amount (must match 1042-S).

Tips: Use 1042-S Box 12 to verify; consult Publication 901 for treaty texts. VITA volunteers can help compute but can’t advise on eligibility—back claims with docs.

Important Deadlines for Nonresident Aliens in 2025

For 2024 taxes (filed in 2025):

- Form 1040-NR: April 15, 2025 (if wages withheld); June 16, 2025 (no wages). Extend with Form 4868, but pay owed tax by April 15 to avoid interest.

- Form 8843: Attach to 1040-NR or mail separately by the same deadline for exempt individuals.

File early to claim refunds—deadlines are firm for nonresidents.

Final Thoughts: Simplify Your Taxes with Form 13614-NR

IRS Form 13614-NR demystifies tax prep for nonresident aliens, ensuring you get every benefit you’re entitled to. Head to a VITA site (find one at IRS.gov) or download the form today to start. Remember, accurate completion saves time and money—don’t go it alone.

FAQs About IRS Form 13614-NR

Q: Is Form 13614-NR mandatory?

A: It’s voluntary but required for VITA/TCE assistance.

Q: Can I e-file with this form?

A: No, it’s an intake tool only; e-file your actual return via approved software.

Q: What if I’m a dual-status taxpayer?

A: Discuss with a volunteer—the form helps identify transitions.

Q: Where can I find VITA sites for nonresidents?

A: Search IRS.gov/VITA; many universities host international-focused programs.

For the latest updates, visit IRS.gov/forms. If you have questions, consult a tax professional. Happy filing!