Table of Contents

IRS Form 1099-SB – Seller’s Investment in Life Insurance Contract – In the complex world of tax reporting, life insurance policies can sometimes lead to unexpected filing obligations. If you’re an insurance issuer dealing with policy sales or transfers, understanding IRS Form 1099-SB is crucial. This form, officially titled “Seller’s Investment in Life Insurance Contract,” helps ensure compliance with IRS rules under Section 6050Y. Whether you’re navigating a reportable policy sale or a transfer to a foreign person, this guide breaks down everything you need to know about Form 1099-SB for tax year 2025. We’ll cover who files it, how to complete it, deadlines, and more—based on the latest IRS guidance.

What Is IRS Form 1099-SB?

IRS Form 1099-SB is an information return used by life insurance issuers to report a seller’s investment in a life insurance contract when that contract (or an interest in it) is transferred in a “reportable policy sale” or to a foreign person. It’s part of the broader 1099 series, which tracks various types of non-wage income and transactions for the IRS.

The form specifically captures two key figures:

- The seller’s investment in the contract: This is essentially the net premiums paid minus any tax-free distributions received.

- The surrender amount: The cash value the seller would receive if they surrendered the policy on the transfer date.

This reporting helps the IRS monitor potential taxable events, such as gains from life insurance sales, which might otherwise go unreported. Unlike Form 1099-R (used for distributions from pensions and annuities), Form 1099-SB focuses solely on sales or transfers of life insurance interests.

For tax year 2025, the form’s revision date is April 2025, with no major recent developments announced by the IRS.

Who Must File Form 1099-SB?

Not everyone involved in life insurance needs to file Form 1099-SB—it’s targeted at specific parties. Generally, you must file if you are the issuer of a life insurance contract and one of these events occurs:

- You receive a statement from an acquirer in a reportable policy sale (often via Form 1099-LS, Reportable Life Insurance Sale).

- You get notice of a transfer of the contract to a foreign person (e.g., via address changes or other indicia of foreign ownership).

Key Definitions for Filers

- Issuer: Any person or entity that bears risk under the contract or administers it (e.g., collects premiums, pays death benefits). This includes designees acting on behalf of the issuer.

- Seller: The person transferring an interest in the contract via sale or to a foreign party.

- Acquirer: The buyer in a reportable policy sale, who must provide the statement triggering your filing.

- Reportable Policy Sale: A direct or indirect acquisition of a life insurance interest where the acquirer has no substantial family, business, or financial ties to the insured (beyond the policy itself). This excludes certain exchanges under Section 1035.

If you’re not the administering issuer or if another party handles reporting under unified rules, you may be exempt. Always check Regulations Section 1.6050Y-3 for exceptions, such as sales to foreign beneficial owners or rescinded transactions.

What Triggers Filing Form 1099-SB?

Filing is event-driven. Common triggers include:

- Reportable Policy Sales: These often involve viatical settlements (sales by terminally ill insureds) or life settlements (sales by healthy insureds). The acquirer sends you a Section 6050Y(a) statement, prompting your 1099-SB filing.

- Transfers to Foreign Persons: Any notice suggesting foreign ownership, like a new overseas address on premium statements or loan requests, unless you confirm it’s a U.S. person.

- Indirect Acquisitions: Sales of interests in entities (e.g., partnerships) that hold life insurance contracts.

File a separate Form 1099-SB for each seller. If a sale is rescinded, file a corrected form within 15 days of notice.

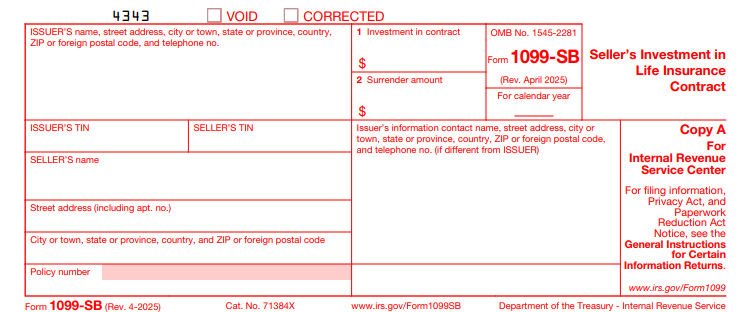

IRS Form 1099-SB Download and printable

Download and Print: IRS Form 1099-SB

How to Complete IRS Form 1099-SB: A Step-by-Step Guide

The form is straightforward, with just two main reporting boxes. Use the April 2025 revision for accuracy. Here’s the layout and what to enter:

Form Layout Overview

- Header: Includes the form title, IRS details, and revision info.

- Issuer Section: Your business name, address, phone, and TIN (Taxpayer Identification Number).

- Seller Section: Recipient’s name, address, TIN, and policy number.

- Reporting Boxes: Boxes 1 and 2 for financial amounts.

- Contact Info: Issuer’s information contact (can be a call center) for IRS inquiries.

- Footer: IRS website and warnings against cutting the form.

Box-by-Box Instructions

- Policy Number: Enter the unique ID assigned by the administering issuer.

- Box 1 – Investment in Contract: Report the seller’s net investment (premiums paid minus excludable amounts received). For non-original policyholders, use your best estimate based on available data.

- Box 2 – Surrender Amount: The hypothetical payout if the seller surrendered the policy on the transfer date.

Truncation Rules: You can truncate the seller’s TIN on Copy B (sent to them) for privacy, but never on IRS copies. Include your information contact’s details—they must be able to answer reporting questions.

For detailed calculations, refer to Section 72(e)(6) for investment basis and issuer records for surrender values.

Filing Requirements and Due Dates for Form 1099-SB

Follow the General Instructions for Certain Information Returns alongside 1099-SB specifics.

- Who to Send Copies To:

- Copy A: To the IRS.

- Copy B: To the seller (statement required).

- Copies 1, 2, C, D: For state filing and your records, as applicable.

- Electronic Filing (E-Filing): Mandatory if filing 10 or more returns (aggregated across all 1099s). Use the IRS IRIS system for tax year 2025. Threshold lowered in 2024 via T.D. 9972.

- Paper Filing: Allowed for fewer than 10 returns; order scannable forms from IRS.gov.

- Due Dates:

- Furnish Copy B to sellers by March 2, 2026 (or March 31 if e-filing).

- File with IRS by March 2, 2026 (paper) or March 31, 2026 (electronic).

- Special Rule: For reportable policy sales, see Reg. 1.6050Y-3(c) for potential extensions.

Use Form 1096 as a transmittal summary for paper filings. Online fillable Copies B, 1, 2, C, and D are available at IRS.gov.

Exceptions, Special Rules, and Corrections

- Exceptions: No filing if the transfer is a Section 1035 exchange reported as a sale, or if unified reporting applies (e.g., third-party contractors). Forward notices to the administering issuer if you’re not them.

- Rescissions: Correct and refile within 15 days; furnish corrected statements similarly.

- Foreign Transfers: Only report if foreign indicia is present without contrary evidence.

Penalties for Not Filing or Late Filing Form 1099-SB

Failure to file timely or furnish statements can trigger penalties under IRC Sections 6721 and 6722:

- Small Business Relief: Up to $60 per return if reasonable cause is shown.

- Maximums: Up to $310 per return (intentional disregard) or 10% of proceeds for certain failures.

- Aggregated Caps: $1,290,500 for large filers.

Consult the General Instructions for full details and waiver requests.

Frequently Asked Questions About IRS Form 1099-SB

What if I’m the seller—do I get a 1099-SB?

Yes, the issuer sends you Copy B, which you use to report any gain on your tax return (Form 1040, Schedule D).

Is Form 1099-SB required for all life insurance sales?

No, only reportable ones without close ties between buyer and insured.

How does 1099-SB differ from 1099-LS?

Form 1099-LS is filed by acquirers to report the sale; 1099-SB is the issuer’s response with investment details.

Where can I get Form 1099-SB?

Download the PDF from IRS.gov or order paper versions.

Final Thoughts: Stay Compliant with Life Insurance Reporting

Navigating IRS Form 1099-SB ensures accurate reporting of life insurance transactions, avoiding penalties and supporting transparent tax compliance. As policies evolve with market demands for settlements, issuers should review records annually. For personalized advice, consult a tax professional or the IRS at 800-829-1040. Always reference the official Instructions for Form 1099-SB for the most current rules.

This article is for informational purposes only and not tax advice. Verify with IRS.gov for your situation.