Table of Contents

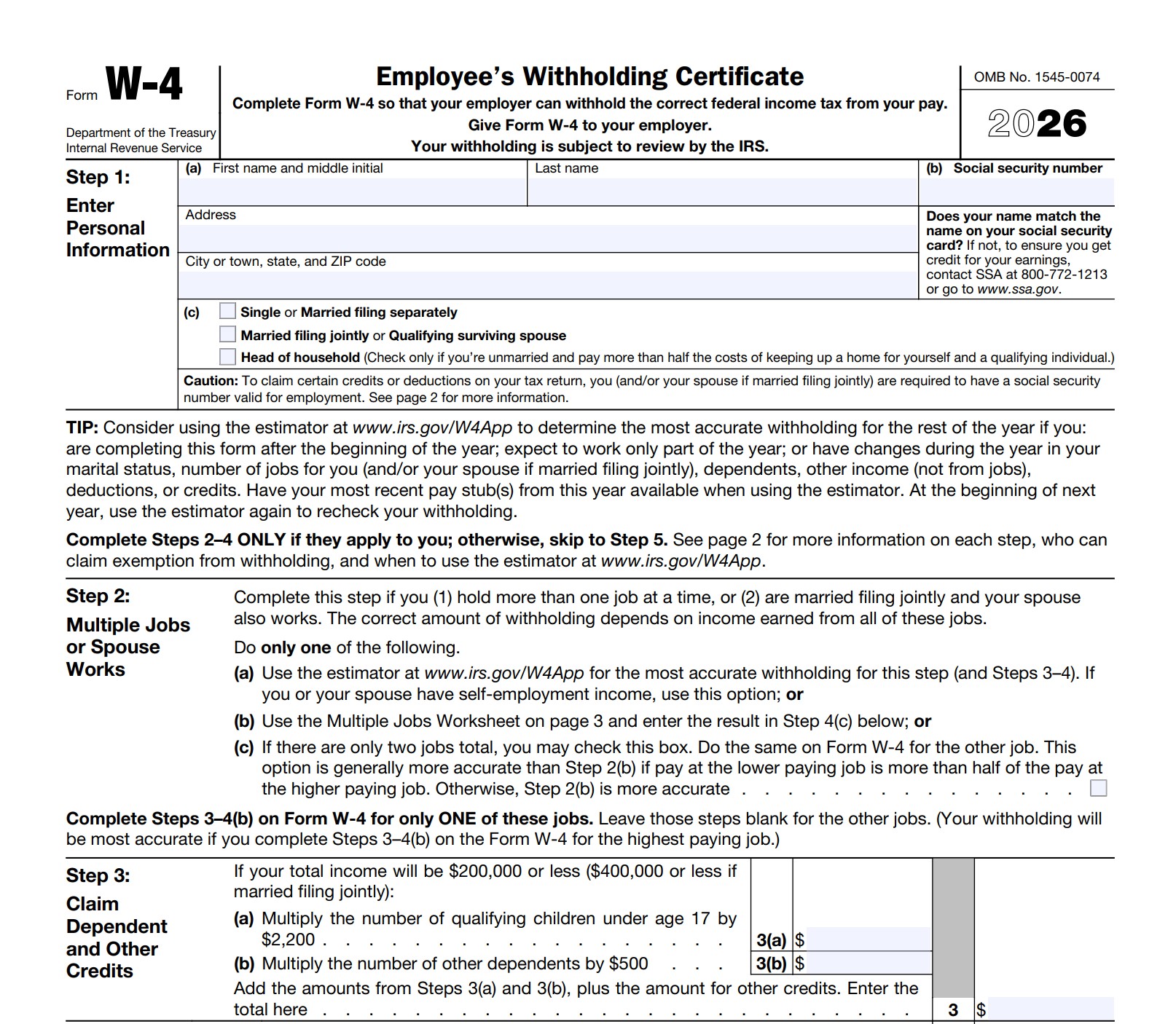

As tax season approaches, staying ahead of federal income tax withholding is crucial for avoiding surprises come filing time. The W4 Form 2026 printable version, officially known as the Employee’s Withholding Certificate, helps employees inform their employers about the correct amount of federal taxes to deduct from paychecks. With recent tax law changes under the One Big Beautiful Bill Act (OBBBA), the IRS has released a draft of the 2026 W-4 form, incorporating inflation adjustments and expanded deduction options. This guide covers everything you need to know about downloading and completing the IRS W4 Form 2026, ensuring accurate withholding for the upcoming year.

Whether you’re starting a new job, welcoming a child, or adjusting for multiple income sources, updating your W-4 can maximize your take-home pay while minimizing under- or over-withholding. Let’s dive in.

What’s New in the W4 Form 2026?

The 2026 draft W-4 introduces several updates to reflect OBBBA provisions and inflation adjustments, making it more comprehensive for modern tax situations. Key highlights include:

- Expanded Child Tax Credit: The credit for qualifying children under 17 increases to $2,200 per child (up from $2,000), directly impacting Step 3 calculations.

- New Deduction Categories in the Worksheet: The Deductions Worksheet now includes lines for qualified tips (up to $25,000), overtime pay (up to $12,500), and passenger vehicle loan interest (up to $10,000), subject to income limits.

- Higher Standard Deductions: For 2026, the standard deduction rises to $32,200 for married filing jointly, $16,100 for single filers, and $24,150 for head of household—figures baked into the form’s tables.

- Enhanced Senior Credits: A $6,000 credit per person aged 65+ (for both spouses if joint) is now available, boosting Step 3 options.

- Updated Itemized Deductions: Higher limits for state and local taxes (SALT) at $40,400 for joint filers, mortgage interest on debt up to $750,000, and cash charitable gifts up to $1,000 ($2,000 joint) even if taking the standard deduction.

- Form Length: The draft extends to five pages, with more detailed worksheets and tables for precision.

These changes aim to align withholding with the latest tax code, including a top marginal rate of 37% for incomes over $640,600 (single). Note: This is a draft version released on December 8, 2025—finalized amounts may be revised before 2026 payroll setup. If your situation changes, submit a new W-4 by February 16, 2027, to claim exemption or adjust withholding.

How to Download the Printable W4 Form 2026?

Downloading the W4 Form 2026 printable PDF is straightforward from official IRS sources. The draft is available now for preview and testing:

- Official Draft Link: IRS Draft Form W-4 (2026) – Use this for planning; marked “DRAFT – DO NOT FILE.”

- Current Version (Applicable Until 2026 Updates): Form W-4 PDF (Rev. 2025) – Valid through early 2026.

Print on standard 8.5 x 11-inch paper for submission to your employer. For digital filing, many payroll systems like ADP or Gusto integrate W-4 uploads. Always verify the revision date on the form to ensure compliance.

Pro Tip: Use the IRS Tax Withholding Estimator at www.irs.gov/W4App alongside the printable form—input recent pay stubs for personalized recommendations.

Step-by-Step Guide: How to Fill Out the W4 Form 2026

Completing the downloadable W4 2026 takes about 10-15 minutes. Follow these steps based on the draft form. Gather your SSN, filing status details, and income estimates beforehand.

Step 1: Enter Personal Information

- 1(a): Fill in your full name, address, city, state, and ZIP code.

- 1(b): Enter your Social Security Number (SSN). If your name doesn’t match your SSN card, contact the Social Security Administration at 800-772-1213.

- 1(c): Select your filing status:

- Single or Married filing separately

- Married filing jointly or Qualifying surviving spouse

- Head of household (if unmarried and supporting a qualifying person)

This step sets your standard deduction and tax brackets. If your situation has changed (e.g., marriage or new job), use the IRS estimator.

Step 2: Multiple Jobs or Spouse Works

Applicable if you (or your spouse) have more than one job. Choose one:

- 2(a): Use the IRS estimator (best for complex scenarios like self-employment).

- 2(b): Complete the Multiple Jobs Worksheet (detailed below) and enter the extra withholding in Step 4(c).

- 2(c): If you have exactly two jobs and the lower-paying one is more than half the higher-paying, check the box. Only complete Steps 3-4(b) on your highest-paying job’s form.

This prevents under-withholding on combined incomes.

Step 3: Claim Dependent and Other Credits

For incomes under $200,000 ($400,000 joint):

- 3(a): Number of qualifying children under 17 × $2,200.

- 3(b): Other dependents × $500.

- Add lines 3(a) + 3(b) + other credits (e.g., education or foreign tax credits from Pub. 505).

- Enter the total in Step 3.

Qualifying dependents need valid SSNs and must meet IRS rules in Publication 501. This reduces withholding but could mean a smaller refund.

Step 4: Other Adjustments (Optional)

Fine-tune for accuracy:

- 4(a): Add expected non-job income (e.g., investments, unemployment) to increase withholding.

- 4(b): If itemizing deductions beyond the standard, use the Deductions Worksheet (below) and enter the amount.

- 4(c): Specify extra withholding per pay period (e.g., $50 biweekly) for over-withholding if needed.

Step 5: Sign Here

Sign and date under penalty of perjury. The form is invalid without this. Employers complete their section separately.

Claiming Exemption

If you had no tax liability in 2025 and expect none in 2026, write “Exempt” below Step 4(c). Complete only Steps 1(a), 1(b), and 5. Re-certify annually by February 16, 2027.

Understanding the Worksheets for W4 2026

The draft includes enhanced worksheets for precision:

- Multiple Jobs Worksheet: For 2-3 jobs, use updated tables (page 5) based on 2026 wages. Calculate extra tax for the highest-paying job and divide by pay periods (e.g., 26 for biweekly). For 3+ jobs or high earners (> $120,000), consult Pub. 505.

- Deductions Worksheet: Now more robust:

-

- Add new qualified adjustments (tips, overtime, vehicle loans).

- Include age credits ($6,000 each for 65+).

- Estimate other adjustments (e.g., student loans, IRA).

- Detail itemized deductions (medical >7.5% AGI, SALT up to $40,400, mortgage interest).

- Apply phase-outs above thresholds ($768,700 joint).

- Subtract standard deduction and enter excess in Step 4(b).

These tools help if you’re itemizing or have unique income streams.

When to Update Your W4 Form 2026 and Final Tips

Submit a new printable W4 2026 if:

- Life events change (birth, marriage, divorce).

- Income shifts (raise, side gig).

- You want to adjust refund size.

Review annually, especially with OBBBA’s impacts. Nonresident aliens should see Notice 1392 for special rules.

For more, visit the IRS W-4 page or consult a tax pro. Download your W4 Form 2026 printable today and stay tax-smart!

This article is for informational purposes; tax advice should come from a qualified professional.