Table of Contents

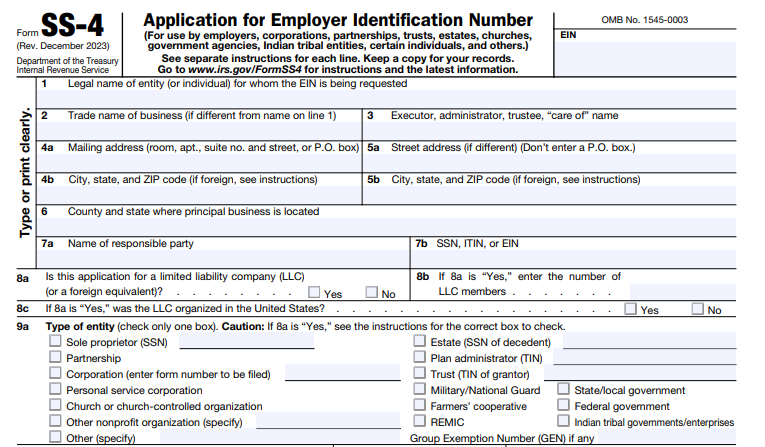

IRS Form SS-4 – Application for Employer Identification Number – Starting a business, hiring employees, or managing an estate? One of the first steps you’ll need is obtaining an Employer Identification Number (EIN)—the IRS’s version of a Social Security Number for your business. This 9-digit identifier (formatted like 12-3456789) is essential for tax filings, opening bank accounts, and complying with federal regulations. Enter IRS Form SS-4, the official Application for Employer Identification Number.

In this comprehensive 2025 guide, we’ll break down everything you need to know about Form SS-4: what it is, who needs it, step-by-step filing instructions, application methods, and tips to avoid common pitfalls. Whether you’re a sole proprietor launching a side hustle or a corporation scaling up, getting your EIN right ensures smooth IRS interactions. Let’s dive in.

What Is IRS Form SS-4 and Why Do You Need It?

IRS Form SS-4 is the primary document used to request an EIN from the Internal Revenue Service. An EIN identifies your business entity for federal tax purposes, allowing you to file returns, pay employment taxes, and report income without using your personal Social Security Number (SSN).

Unlike an SSN or Individual Taxpayer Identification Number (ITIN), an EIN is strictly for business activities—it’s not a substitute for personal tax IDs. You can only apply for one EIN per entity, though exceptions exist (e.g., when a sole proprietorship incorporates). If your business details change, like your responsible party’s info, update them within 60 days using Form 8822-B to keep your records current.

As of December 2025, the latest draft revision of Form SS-4 (Rev. December 2025) maintains the core structure but incorporates minor updates, such as refined guidance for Indian tribal entities and the absorption of Form SS-4PR for Puerto Rico applicants (now use the standard SS-4 or Spanish version SS-4(sp)). Recent enhancements include reinstating Line 14’s election for annual Form 944 filing and updates to territorial wage thresholds.

IRS Form SS-4 Download and Printable

Download and Print: IRS Form SS-4

Who Needs to File IRS Form SS-4?

Not every individual or entity requires an EIN, but most businesses do. Here’s a quick overview of who should apply:

- Sole Proprietors: If you file Schedule C (Form 1040) or hire employees.

- Corporations and Partnerships: All domestic or foreign entities operating in the U.S.

- Limited Liability Companies (LLCs): Single-member LLCs are often disregarded entities (using the owner’s SSN), but multi-member or those electing corporate status need an EIN.

- Estates and Trusts: Estates of decedents or certain trusts (e.g., those filing Form 1041).

- Nonprofits and Tax-Exempt Organizations: Including churches, schools, and §527 political groups.

- Government Entities: State/local agencies, federal branches, or Indian tribal governments.

- Other Cases: Plan administrators, REMICs (real estate mortgage investment conduits), withholding agents for foreign payees, or household employers.

If you’re unsure, check the IRS’s EIN eligibility tool. Remember: You don’t need an EIN if your business is a hobby or has no employees and no excise tax liability.

| Entity Type | When to Apply | Example |

|---|---|---|

| Sole Proprietor | Hiring first employee or filing excise taxes | Freelancer adding a virtual assistant |

| LLC | Multi-member or electing S-corp status | Startup with two founders |

| Nonprofit | Seeking tax-exempt status via Form 1023 | New charity organization |

| Estate | Administering a decedent’s assets | Handling inheritance taxes |

How to Complete IRS Form SS-4: Line-by-Line Instructions

Filling out Form SS-4 is straightforward but requires precision—use black ink, type or print clearly, and enter “N/A” for inapplicable lines. The form has 18 lines plus certification sections. Base your responses on legal documents like charters or trust agreements. Here’s a detailed walkthrough based on the latest instructions (Rev. December 2023, with 2025 draft alignments).

Basic Entity Information (Lines 1–6)

- Line 1: Legal Name: Enter the exact name from your formation documents (e.g., “John Doe” for individuals; avoid nicknames).

- Line 2: Trade Name (DBA): Your “doing business as” name, if different.

- Line 3: Care Of Name: Trustee for trusts, executor for estates, or the person receiving IRS mail.

- Lines 4a–4b: Mailing Address: Full street or P.O. box, city, state, ZIP (include country if international).

- Lines 5a–5b: Physical Address: If different from mailing; no P.O. boxes.

- Line 6: County and State: Principal business location.

Responsible Party and Entity Type (Lines 7–9)

- Lines 7a–7b: Responsible Party: The individual (or agency for governments) who controls the entity. Provide their full name and SSN/ITIN/EIN.

- Lines 8a–8c: LLC Details: Check “Yes” if applicable; note member count and U.S. organization status. Single-member LLCs are disregarded by default.

- Line 9a: Type of Entity: Select one (e.g., “Sole Proprietor” with SSN; “Corporation” with Form 1120). For nonprofits, specify type and Group Exemption Number if applicable.

- Line 9b: Incorporation State/Country: For corporations only.

Application Details (Lines 10–18)

- Line 10: Reason for Applying: Check the box (e.g., “Started new business”) and specify details.

- Line 11: Start/Acquisition Date: MM/DD/YYYY format.

- Line 12: Accounting Year Close: Month number (e.g., 12 for calendar year).

- Line 13: Expected Employees: Break down by agricultural, household, and other (enter 0 if none).

- Line 14: Form 944 Election: Check if your annual tax liability is ≤$1,000 (wages ≤$5,000; ≤$6,536 in territories) to file annually instead of quarterly Form 941.

- Line 15: First Wages Paid: Date in MM/DD/YYYY; “N/A” if none.

- Line 16: Principal Activity: Select from 12 options (e.g., “Retail,” “Manufacturing”).

- Line 17: Business Description: Specific details (e.g., “E-commerce sales of handmade jewelry”).

- Line 18: Prior EIN: “Yes/No”; include old number if applicable.

Third-Party Designee and Signature

Optionally authorize someone (name, phone, address) to discuss your application. Sign and date as the principal officer, fiduciary, or authorized member—penalties apply for false info.

For entity-specific tweaks:

- Trusts: Use grantor’s TIN if applicable.

- Estates: Include decedent’s SSN.

- Disregarded Entities: Specify on Line 9a (e.g., “Disregarded entity—sole proprietorship”).

Download the latest form from IRS.gov/FormSS4.

Ways to Apply for Your EIN: Online, Fax, Mail, or Phone

The IRS offers multiple free methods—online is fastest for U.S.-based applicants. Limit: One EIN per responsible party per day.

- Online (Recommended): Visit IRS.gov/EIN (Mon–Fri, 7 a.m.–10 p.m. ET). Answer questions in one session (no saving); get your EIN instantly. Requires responsible party’s SSN/ITIN; print the confirmation. Not for international applicants without U.S. presence.

- Fax: Dial state-specific numbers (e.g., 855-641-6935 for most states); receive in 4 business days. 24/7 availability.

- Mail: Send to IRS EIN Operation in Cincinnati, OH; ~4 weeks processing.

- Phone (International Only): Call 267-941-1099 (6 a.m.–11 p.m. ET, Mon–Fri); immediate issuance, but mail signed form within 24 hours.

International applicants: Use fax/mail/phone; form legal entity first to avoid delays. Beware fee-charging scams—EINs are always free.

Common Mistakes to Avoid When Applying for an EIN

- Using a business name instead of legal name on Line 1.

- Forgetting to update responsible party changes (file Form 8822-B).

- Applying for multiple EINs unnecessarily (e.g., for new locations—use your existing one).

- Nonresident aliens entering “N/A” without U.S. income justification.

- Incomplete lines leading to delays—double-check against instructions.

Pro Tip: Apply early; if a return is due without an EIN, write “Applied For” and the date.

FAQs: IRS Form SS-4 and EIN Applications

How long does it take to get an EIN in 2025?

Online: Immediate. Fax: 4 days. Mail: 4 weeks.

Can I apply for an EIN without an SSN?

Yes, if you’re a government entity or international applicant without U.S. presence—use ITIN or “foreign” status.

What if my LLC is single-member?

It’s disregarded; use your SSN unless electing otherwise via Form 8832.

Is there a cost to file Form SS-4?

No—always free from the IRS.

How do I check EIN status?

Call 800-829-4933 or verify online post-issuance.

Final Thoughts: Secure Your EIN Today and Build Your Business Future

Obtaining an EIN via IRS Form SS-4 is a quick, essential step to legitimize your operations and stay IRS-compliant. With online tools making it easier than ever, there’s no excuse to delay—apply now at IRS.gov to unlock banking, hiring, and tax benefits.

For the most current details, always reference official IRS resources. If your situation is complex (e.g., foreign-owned entities), consult a tax professional. Ready to start? Head to the IRS EIN Assistant and get your number in minutes.

This guide is for informational purposes only and not tax advice. Consult IRS.gov or a qualified advisor for personalized guidance.