Table of Contents

IRS Form 843 – Claim for Refund and Request for Abatement – Navigating tax issues can be daunting, especially when overpayments, penalties, or IRS errors leave you owing more than you should. Enter IRS Form 843, officially known as the Claim for Refund and Request for Abatement. This versatile form is your key to recovering overpaid taxes, interest, penalties, fees, and additions to tax in specific situations. Whether you’re an individual taxpayer, business owner, or employee dealing with excess withholdings, Form 843 can help resolve discrepancies without amending your entire return.

In this comprehensive guide, we’ll break down everything you need to know about IRS Form 843—from its purpose and eligibility to step-by-step filing instructions. Updated for the latest 2024 revision (applicable through 2025), this article draws from official IRS resources to ensure accuracy. If you’re searching for “how to file IRS Form 843” or “claim refund for penalties,” you’ve come to the right place.

What Is IRS Form 843?

IRS Form 843 is a multipurpose document used to request a refund of overpaid amounts or an abatement (waiver) of certain taxes, penalties, interest, fees, and additions to tax under Internal Revenue Code (IRC) sections 6402 and 6404. Unlike Form 1040-X for income tax amendments, Form 843 targets non-income taxes, such as employment taxes, excise taxes, or specific penalties.

Key uses include:

- Refunding excess Social Security, Medicare, or Railroad Retirement Tax Act (RRTA) withholdings.

- Abating penalties due to reasonable cause or IRS errors.

- Requesting zero net interest on overlapping overpayments and underpayments.

- Recovering fees like the branded prescription drug fee or health insurance provider annual fee.

Importantly, Form 843 cannot be used for income, estate, gift taxes; FICA withholdings by employers; or routine return amendments—those require separate forms like 1040-X or 941-X.

When Should You Use IRS Form 843?

Not every tax hiccup qualifies for Form 843. It’s ideal for targeted claims where the IRS has assessed something incorrectly or you’ve overpaid in error. Common scenarios include:

- Excess Withholdings: If multiple jobs caused your Social Security or Medicare taxes to exceed annual limits, and your employer won’t adjust your W-2.

- Penalty Abatements: Due to reasonable cause (e.g., illness, natural disaster), reliance on erroneous IRS advice, or inability to read standard IRS notices because of a visual impairment.

- Interest Due to IRS Delays: For delays in processing returns or refunds that unfairly accrue interest on income, estate, gift, or certain excise taxes.

- Trust Fund Recovery Penalty (Section 6672): Waiving the 100% penalty for responsible persons who willfully fail to pay trust fund taxes.

- Special Fees: Refunds for overpaid branded prescription drug fees (Form 8947) or health insurance provider fees.

- Net Interest Rate of Zero: When an overpayment and underpayment in the same period result in zero net interest under IRC Section 6621(d).

If your situation doesn’t match these, check your IRS notice for specific instructions—don’t default to Form 843.

Who Is Eligible to File IRS Form 843?

Virtually any taxpayer can file, including:

- Individuals (with SSN or ITIN).

- Businesses (with EIN).

- Estates, trusts, or decedents’ representatives (attach Form 1310 or letters testamentary).

- Nonresident aliens claiming erroneous Social Security/Medicare withholdings (see Pub. 519).

Authorized representatives must attach Form 2848. Paid preparers signing for a fee must include their PTIN and provide you a copy. For joint returns, both spouses must sign.

Step-by-Step Guide: How to Fill Out IRS Form 843

The form is straightforward but requires precision. Download the latest PDF from IRS.gov (Rev. December 2024). Here’s how to complete each section:

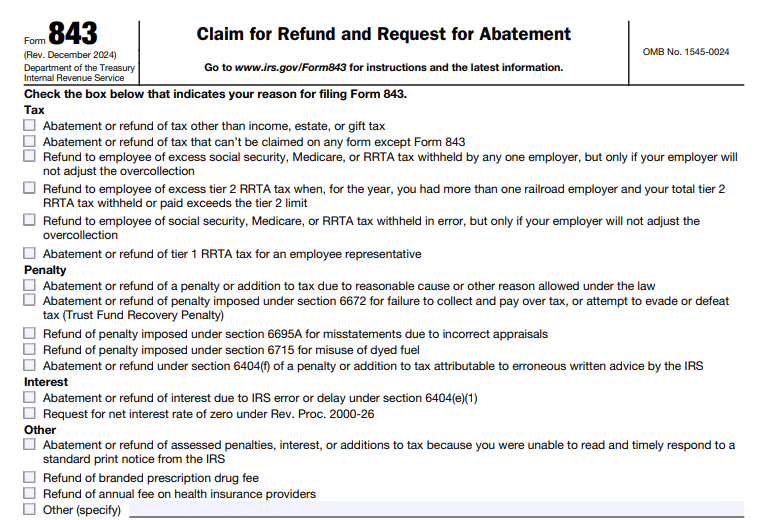

- Select Your Reason (Top Checkboxes): Choose the box that best describes your claim, such as “Abatement or refund of penalty or addition to tax due to reasonable cause” or “Refund of excess social security and Medicare tax to employee.” If none fit, check “Other” and explain. Remember: One form per tax period or fee year, unless exceptions apply (e.g., net interest claims).

- Name and Taxpayer Identification Number (TIN): Enter your full name (and spouse’s for joint claims), TIN (SSN/ITIN/EIN), and current address. Use Form 8822 to update addresses separately.

- Line 1: Tax Period: Specify the period (e.g., MM/DD/YYYY to MM/DD/YYYY) or fee year start date.

- Line 2: Amount Requested: Enter the exact dollar amount for refund or abatement.

- Line 3: Date(s) of Payment: List payment dates; attach a sheet if multiple.

- Line 4: Type of Tax/Fee: Check the appropriate box (e.g., Employment Tax, Excise Tax) and note if it relates to interest or penalties.

- Line 5: Form or Fee Type: Indicate the related form (e.g., Form 1040) or fee (e.g., Branded Prescription Drug Fee).

- Line 6: IRC Section: For penalties, enter the section from your IRS notice (e.g., 6651 for late filing).

- Line 7: Reason for Abatement: Check boxes for reasonable cause, Trust Fund Recovery Penalty, erroneous advice, or other.

- Line 8: Explanation and Evidence: This is crucial—provide a detailed narrative, computations, and supporting facts. For example, explain IRS delays with dates and impacts, or attach W-2s for excess withholdings.

- Signature: Sign and date; include title for businesses or fiduciaries. Both spouses sign joint claims.

Pro tip: Use clear, concise language in Line 8 to strengthen your case. Attach computations for complex refunds, like excess RRTA taxes using Pub. 505 worksheets.

IRS Form 843 Download and Printable

Download and print: IRS Form 843

Required Supporting Documents for IRS Form 843

Evidence is key to approval. Gather these based on your claim:

- W-2 Copies and Employer Statements: For excess withholdings or erroneous taxes.

- IRS Notices and Correspondence: For penalty abatements or interest claims.

- Payment Proofs: Canceled checks or bank statements.

- Computations: Worksheets for net interest or overpayments.

- Special Cases:

- Erroneous Advice: Copies of your request to IRS and their response.

- Visual Impairment: Doctor’s note on disability and notice details.

- Fees: Prior Form 8947 for drug fees.

File originals only if requested; photocopies suffice initially.

Where and How to File IRS Form 843

Mail your completed form—e-filing isn’t available. Addresses vary:

- Per IRS Notice: Use the return address on your notice for most claims.

- Specific Types:

- Estate/Gift Taxes (Forms 706/709): Internal Revenue Service, Attn: E&G, Stop 824G, 7940 Kentucky Drive, Florence, KY 41042-2915.

- Branded Prescription Drug Fee: Internal Revenue Service, Mail Stop 4921 BPDF, 1973 N. Rulon White Blvd., Ogden, UT 84201-0051.

- Health Insurance Fee: Internal Revenue Service, Mail Stop 4921 IPF, 1973 N. Rulon White Blvd., Ogden, UT 84201.

- Form 8300 Penalties: Internal Revenue Service, P.O. Box 32621, Detroit, MI 48232.

- Default: The service center for your most recent related tax return (check form instructions).

Outdated addresses will be forwarded, but use current ones to avoid delays.

Filing Deadlines and Limitations for IRS Form 843

Time is critical:

- Refunds/Credits: Within 3 years of filing the original return or 2 years of payment, whichever is later (Pub. 556).

- Penalty Abatements: Generally within the collection period; for erroneous advice, align with refund statutes.

- Interest Claims: No strict deadline, but file promptly after identifying the issue.

Late filings are typically denied, so act fast.

Common Mistakes to Avoid When Filing IRS Form 843

- Using the wrong form (e.g., 1040-X instead).

- Incomplete Line 8 explanations—be specific!

- Missing signatures or TINs.

- Filing one form for unrelated claims.

- Ignoring notice instructions.

Review everything twice, and consider consulting a tax professional for complex cases.

Frequently Asked Questions (FAQs) About IRS Form 843

Can I use Form 843 for income tax refunds?

No—use Form 1040-X for that.

How long does processing take?

Typically 6-8 weeks, but up to 12 for complex claims. Track via IRS.gov “Where’s My Refund?”

What if my claim is denied?

Appeal via the notice instructions or request an audit reconsideration.

Are there 2025 updates to Form 843?

No major changes; the December 2024 revision remains current.

Final Thoughts: Take Control of Your Tax Refunds with Form 843

IRS Form 843 empowers taxpayers to correct errors and reclaim what’s yours, from overwithheld taxes to unfair penalties. By following these steps and gathering solid evidence, you can navigate the process confidently. Always reference the latest IRS instructions, and if in doubt, seek professional advice to maximize your chances of success.

Ready to file? Download Form 843 today from IRS.gov and start your claim. For more tax tips, explore our guides on penalty relief and withholding adjustments.

This article is for informational purposes only and not tax advice. Consult a qualified professional for your situation.