Table of Contents

IRS Form 8962 – Premium Tax Credit (PTC) – As tax season approaches in 2025, many Americans who purchased health insurance through the Health Insurance Marketplace are navigating the intricacies of the Affordable Care Act (ACA). One critical form in this process is IRS Form 8962, used to calculate and reconcile the Premium Tax Credit (PTC). This refundable credit helps lower the cost of health coverage, but getting it right can mean the difference between a bigger refund or an unexpected tax bill. In this comprehensive guide, we’ll break down everything you need to know about Form 8962 Premium Tax Credit reconciliation, including eligibility, step-by-step instructions, and tips to avoid common pitfalls. Whether you’re claiming the credit for the first time or reconciling advance payments, this article has you covered.

What Is the Premium Tax Credit (PTC) and Why Do You Need Form 8962?

The Premium Tax Credit (PTC) is a refundable tax credit designed to make health insurance more affordable for individuals and families who buy coverage through the Marketplace (also known as the ACA exchange). It reduces the amount you pay in monthly premiums for qualified health plans, such as bronze, silver, gold, or platinum options.

If you received Advance Premium Tax Credit (APTC) payments during 2024—meaning the government paid part of your premiums directly to your insurer—you must use IRS Form 8962 to reconcile those advances with the actual credit you’re eligible for based on your final income. This process ensures you’re not over- or under-claiming the benefit. Attach Form 8962 to your Form 1040, 1040-SR, or 1040-NR when filing your 2024 taxes.

Key purposes of Form 8962 include:

- Calculating your allowable PTC for the year.

- Comparing it to APTC received.

- Determining if you owe repayment (for excess APTC) or can claim an additional credit.

For tax years 2023 through 2025, a major update allows households with income exceeding 400% of the federal poverty line (FPL) to qualify for the PTC, removing the previous cap. You’ll need Form 1095-A from the Marketplace to complete this form, which details your coverage and payments.

Who Must File IRS Form 8962?

Not everyone with Marketplace coverage needs to file Form 8962, but most do if they’ve interacted with the PTC system. You must file if:

- You’re claiming the PTC on your tax return.

- APTC was paid on your behalf or for anyone in your tax family (even if you didn’t claim the credit).

- APTC was allocated to you for someone who ended up not being in your tax family.

Even if you’re not required to file a tax return otherwise, attach Form 8962 if APTC was involved. Exceptions apply if you’re not an “applicable taxpayer” (e.g., married filing separately without qualifying exceptions like domestic abuse or spousal abandonment), in which case you may still need to repay APTC but won’t claim the credit.

Your tax family includes you, your spouse (if filing jointly), and any dependents you claim. Household income is based on modified adjusted gross income (AGI), including tax-exempt interest, foreign earned income, and non-taxable Social Security benefits.

Eligibility Requirements for the Premium Tax Credit (PTC)

To qualify for the PTC in 2024, you must meet these criteria:

- Enrollment in a Qualified Health Plan: At least one member of your tax family was enrolled in a Marketplace plan for at least one month, and premiums were paid by the tax return due date (including extensions, or within 120 days for retroactive coverage).

- Income Thresholds: Household income must be at least 100% of the FPL for your family size (e.g., $14,580 for a single person in the contiguous U.S.). There’s no upper limit for 2024–2025.

- No Other Coverage: You weren’t eligible for minimum essential coverage (MEC) like employer-sponsored plans, Medicaid, or Medicare during the enrollment month (except for individual market plans).

- Filing Status: If married at year-end, you generally must file jointly. Exceptions include head of household status (if living apart all year) or victims of domestic abuse/spousal abandonment.

- U.S. Residency: You must be lawfully present in the U.S.; unlawfully present individuals are ineligible.

Use the IRS’s FPL tables to check your percentage—tools like Publication 974 can help with calculations. Report income changes to the Marketplace mid-year to adjust APTC and avoid surprises at tax time.

Step-by-Step Guide to Completing IRS Form 8962

Form 8962 is divided into five parts. Gather your Form 1095-A (Health Insurance Marketplace Statement) first—it shows monthly premiums, the second lowest cost silver plan (SLCSP) premium, and APTC amounts. Round all dollar entries to the nearest whole number.

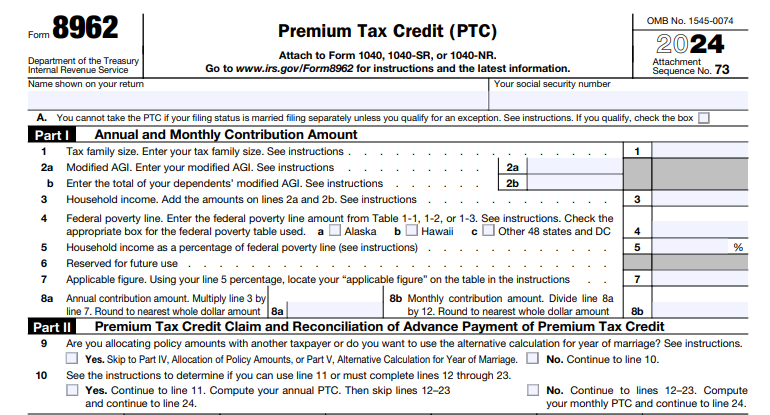

Part I: Annual and Monthly Contribution Amount

This section calculates your household’s expected contribution toward premiums.

- Line 1: Enter your tax family size.

- Lines 2a–3: Calculate modified AGI for you, your spouse, and filing-required dependents.

- Line 4: Enter the FPL amount for your family size and state.

- Line 5: Divide line 3 by line 4 and multiply by 100 to get your FPL percentage (e.g., 250%).

- Line 7: Use Table 2 to find your applicable percentage (e.g., 0.0400 for 200–250% FPL).

- Line 8a: Multiply household income (line 3) by line 7 for annual contribution.

- Line 8b: Divide by 12 for the monthly amount.

If your income is below 100% FPL, you may still qualify under certain rules.

Part II: Premium Tax Credit Claim and Reconciliation of APTC

Reconcile monthly or annually.

- Line 9: Check “Yes” if allocating policy amounts (e.g., shared coverage with an ex-spouse); complete Part IV.

- Line 10: Check “Yes” for full-year coverage with unchanged premiums/SLCSP—use annual totals on line 11. Otherwise, use monthly lines 12–23.

- For line 11 or lines 12–23: Enter enrollment premiums (column a), SLCSP premiums (column b, correct if inaccurate), subtract monthly contribution (column d), take the lesser of premiums or net SLCSP (column e), and APTC (column f).

Part III: Premium Tax Credit

- Line 24: Total your allowable PTC (sum of column e amounts).

Part IV: Allocation of Policy Amounts

For shared policies (e.g., divorce or marketplace roommates), allocate percentages for premiums, SLCSP, and APTC across tax families. Use Table 3 for scenarios like 50/50 splits for married filing separately.

Part V: Alternative Calculation for Year of Marriage

If you married in 2024 and received APTC, elect this to potentially reduce excess repayment. Use Worksheet 3 in the instructions.

Download the latest Form 8962 and instructions from the IRS website.

IRS Form 8962 Download and printable

Download and print: IRS Form 8962

Reconciling APTC: How to Claim or Repay the Premium Tax Credit

Once completed:

- If PTC > APTC: Claim the difference as a refundable credit on Schedule 3 (Form 1040), line 9—it lowers your tax bill or boosts your refund.

- If APTC > PTC: Repay the excess on Schedule 2 (Form 1040), line 2a. Repayment is capped based on income:| Household Income (% of FPL) | Single Repayment Limit | All Other Filers Limit | |—————————–|————————|————————| | Under 200% | $375 | $750 | | 200–300% | $950 | $1,900 | | 300–400% | $1,575 | $3,150 | | 400% or more | Full amount | Full amount |

No repayment if you’re not an applicable taxpayer but qualify for an exception. Report Marketplace errors (e.g., wrong SLCSP) to correct your Form 1095-A.

Common Mistakes to Avoid When Filing Form 8962

- Incorrect SLCSP Premium: Always verify and correct column B on Form 1095-A if blank or wrong.

- Wrong Tax Family Size or AGI: Include all required filers’ modified AGI—double-check dependents.

- Failing to Allocate Shared Policies: This leads to over- or under-reporting APTC.

- Math Errors: Round properly and use worksheets for complex scenarios like QSEHRA benefits.

- Ignoring Mid-Year Changes: Update the Marketplace to align APTC with actual income.

Consult a tax professional if your situation involves employer coverage affordability tests or individual coverage HRAs.

Frequently Asked Questions About IRS Form 8962 and the PTC

Do I need Form 1095-A to file Form 8962?

Yes—it’s essential for entering premiums and APTC. Request a replacement from Healthcare.gov if lost.

What if I didn’t get APTC but want to claim the PTC?

You can still file Form 8962 retroactively if eligible; it may increase your refund.

Can I e-file with Form 8962?

Most tax software supports it, but manual filers must attach it to Form 1040.

What are the deadlines for 2024 taxes?

File by April 15, 2025, or extend to October 15, 2025—but pay any owed taxes by April to avoid penalties.

Final Thoughts: Maximize Your PTC with Proper Reconciliation

Filing IRS Form 8962 is a key step to ensuring you get the full benefit of the Premium Tax Credit without surprises. With incomes over 400% FPL now eligible through 2025, more families can access this valuable credit. Review your Form 1095-A early, use the IRS worksheets, and consider free tax help from VITA or the Marketplace. For personalized advice, visit IRS.gov or consult a certified tax advisor. Stay compliant, and let the PTC work for you this tax season!

This article is for informational purposes only and not tax advice. Always refer to official IRS guidance.