Table of Contents

IRS Form 8949 – Sales and Other Dispositions of Capital Assets – If you’ve sold stocks, real estate, cryptocurrency, or any other capital asset this year, you’re likely staring at a stack of Form 1099-Bs and wondering how to report those transactions on your taxes. Enter IRS Form 8949—the essential tool for detailing sales and other dispositions of capital assets. This form helps the IRS reconcile what brokers report to them with what you declare on your return, ensuring accurate capital gains tax calculations.

In 2025, with evolving rules around digital assets and basis reporting, getting Form 8949 right is more crucial than ever. This guide breaks it down step by step, drawing from official IRS resources. Whether you’re a first-time investor or a seasoned trader, you’ll learn how to file correctly, avoid penalties, and maximize deductions. Let’s dive in.

What Is IRS Form 8949?

IRS Form 8949, Sales and Other Dispositions of Capital Assets, is a tax form used to report the sale or exchange of capital assets like stocks, bonds, mutual funds, real estate, and digital assets (e.g., Bitcoin or NFTs). It’s not a standalone form—instead, it feeds directly into Schedule D (Form 1040), where your overall capital gains or losses are summarized and taxed.

The primary purpose of Form 8949 is reconciliation. Brokers and other payers send you (and the IRS) Form 1099-B for securities or Form 1099-S for real estate sales. These may include errors in cost basis or other details. Form 8949 lets you adjust those figures to match your records, preventing discrepancies that could trigger audits.

Key facts:

- Tax Year Applicability: For transactions in 2025, file with your 2025 tax return (due in 2026).

- Who Reports: Individuals, estates, trusts, partnerships, and corporations with capital transactions.

- Digital Assets Note: Starting in 2025, crypto sales may appear on new Form 1099-DA, integrating seamlessly with Form 8949.

Without Form 8949, your Schedule D would be incomplete, potentially leading to underreported gains and IRS penalties up to 20% for substantial underpayments.

Who Needs to File IRS Form 8949?

Not every taxpayer touches capital assets, but if you do, Form 8949 is often required. You must file if:

- You received a Form 1099-B, 1099-DA, or 1099-S reporting a sale or exchange.

- You sold or disposed of any capital asset, even if no gain or loss occurred (e.g., gifting appreciated property).

- You’re claiming adjustments to reported proceeds or basis, like wash sales or home sale exclusions.

Exceptions exist (detailed below), but generally, anyone with reportable capital transactions beyond simple summary totals needs this form. For example:

- Investors: Stock trades via brokerage accounts.

- Real Estate Owners: Home or rental property sales.

- Crypto Holders: Dispositions of virtual currency, now explicitly treated as property.

If your only transactions qualify for exceptions, you can skip the full form and report aggregates on Schedule D. Always check IRS Publication 550 (Investment Income and Expenses) for specifics.

Short-Term vs. Long-Term Capital Gains: The Basics

Form 8949 splits transactions into two parts based on holding period, which determines your tax rate:

| Transaction Type | Holding Period | Tax Rate (2025) | Form Section |

|---|---|---|---|

| Short-Term | 1 year or less | Ordinary income rates (10%-37%) | Part I |

| Long-Term | More than 1 year | 0%, 15%, or 20% (plus 3.8% NIIT for high earners) | Part II |

- Holding Period Calculation: Starts the day after acquisition and includes the sale date. Inherited assets are automatically long-term; gifted assets carry the donor’s holding period.

- Netting Rules: Short-term gains offset short-term losses first; long-term follows suit. Overall net losses can deduct up to $3,000 ($1,500 if married filing separately) against ordinary income.

Pro tip: Track your holding periods meticulously—software like TurboTax can automate this, but manual filers beware of errors.

How to Complete IRS Form 8949: A Step-by-Step Guide

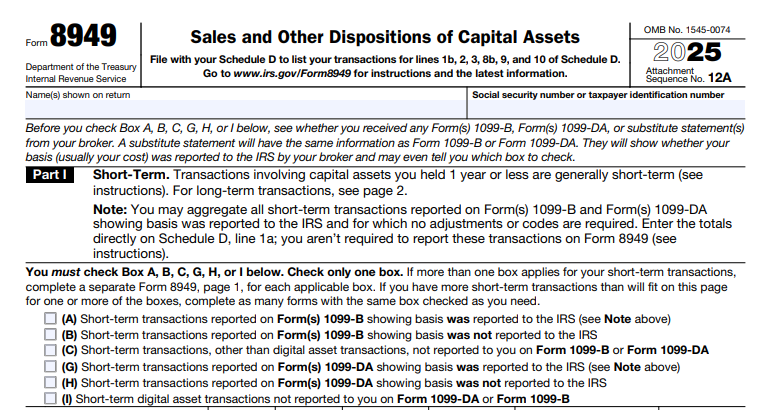

Form 8949 has a straightforward structure: Part I for short-term and Part II for long-term, each with checkboxes (A-L) based on basis reporting and asset type. Use a separate form for each checkbox category if needed. Here’s how to fill the columns.

Step 1: Gather Your Documents

- Form 1099-B/1099-DA/1099-S from payers.

- Records of acquisition costs, fees, and adjustments (e.g., stock splits).

Step 2: Check the Appropriate Box

- Short-Term (Part I): A (basis reported to IRS on 1099-B), B (basis not reported), C (other non-digital), G (basis on 1099-DA), H (basis not on 1099-DA), I (digital not on forms).

- Long-Term (Part II): D, E, F, J, K, L (mirroring short-term).

Step 3: Fill the Columns

Each row represents one transaction (or aggregate under exceptions).

- (a) Description of Property: E.g., “100 sh. AAPL” or “0.5 BTC”.

- (b) Date Acquired: MM/DD/YYYY; use “VARIOUS” for multiple lots or “INHERITED”.

- (c) Date Sold or Disposed: Trade date for securities; closing date for real estate.

- (d) Proceeds: Sales price minus commissions (net amount from 1099).

- (e) Cost or Other Basis: Original cost + fees – depreciation; use fair market value for inherited property.

- (f) Code(s) from Instructions: For adjustments (see below).

- (g) Amount of Adjustment: Positive for additions (e.g., wash sale disallowance); negative in parentheses for subtractions.

- (h) Gain or (Loss): (d) – (e) + (g); losses in parentheses.

Step 4: Total and Transfer

Sum columns (d), (e), (g), and (h) on line 2. Carry to Schedule D (e.g., line 1b for Box A).

Basis Tips: If your broker’s basis is wrong, enter the reported amount in (e) and adjust in (g). For crypto, include transaction fees in basis.

Common Adjustment Codes for Column (f)

Adjustments explain discrepancies. Use codes alphabetically if multiple apply:

- B: Basis reported incorrectly to IRS.

- C: Gain from collectibles (28% max rate; not for digital in 2025).

- E: Subtract nondeductible expenses (e.g., home improvements not qualifying for exclusion).

- H: Home sale exclusion under Section 121.

- W: Wash sale (disallowed loss; add to new basis).

- Z: Qualified Opportunity Fund (QOF) deferral.

- New for 2025: G/H/I for short-term digital; J/K/L for long-term digital (avoid C/F for crypto).

Worksheets in the instructions help calculate (g) for complex cases like market discount bonds.

IRS Form 8949 Download and Printable

Download and Print: IRS Form 8949

Exceptions to Filing: When You Can Skip the Details

Save time with these shortcuts:

- Exception 1: If all transactions have basis reported to IRS, no adjustments, and no collectibles/QOF—report totals directly on Schedule D lines 1a/8a.

- Exception 2: Attach a statement mimicking Form 8949 for multiples; use code “M” in (f) and totals on one row.

Corporations and partnerships have similar aggregation rules if over five transactions. E-filers can attach PDFs of statements.

What’s New for IRS Form 8949 in 2025?

The IRS updated Form 8949 to address digital assets and farmland sales:

- Digital Asset Codes: Dedicated boxes (G-I, J-L) and Form 1099-DA integration; crypto is now “property” with standard holding rules.

- Farmland Election: If you sold qualifying farmland to a farmer after July 4, 2025, elect installment payments for tax liability via Form 1062 (four equal parts).

No major structural changes, but enhanced guidance on average basis for mutual funds and DRIPs.

Common Mistakes to Avoid When Filing Form 8949

- Forgetting Adjustments: Always reconcile 1099 basis with your records—unadjusted errors can inflate taxes.

- Misclassifying Holding Periods: Double-check dates; one day can shift short- to long-term rates.

- Omitting Digital Transactions: Report all crypto dispositions, even small ones.

- Aggregation Errors: Don’t lump ineligible transactions under exceptions.

- Rounding Issues: Use exact amounts; the IRS matches to the penny.

Penalties for inaccuracies? Up to $290 per form for failure to file, plus accuracy-related fines. Use tax software or a CPA for peace of mind.

Related Forms and Resources

- Schedule D (Form 1040): Summarizes Form 8949 totals for your 1040.

- Form 1099-B: Broker reporting for securities.

- Form 1099-S: Real estate sales.

- Publication 550: Full details on investment income.

- Download forms at IRS.gov/Form8949.

Final Thoughts: Master Your Capital Gains Taxes Today

Filing IRS Form 8949 doesn’t have to be daunting—it’s your gateway to accurate capital gains tax reporting and potential savings through losses. By understanding short-term vs. long-term rules, leveraging exceptions, and staying updated on 2025 changes like digital asset codes, you’ll file confidently.

Ready to tackle your return? Head to IRS.gov for the latest PDFs and instructions. If you’re dealing with complex portfolios, consult a tax professional. Questions on reporting capital asset sales? Drop them in the comments below!

This article is for informational purposes only and not tax advice. Consult the IRS or a qualified advisor for your situation.

Last Updated: December 13, 2025