Table of Contents

IRS Form 1023-EZ – Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code – Starting a nonprofit organization is an exciting step toward making a positive impact, but navigating the IRS bureaucracy can feel overwhelming. If your group is small-scale with modest finances, the IRS Form 1023-EZ offers a fast-track to 501(c)(3) tax-exempt status. This streamlined application simplifies the process, slashing paperwork and wait times compared to the full Form 1023. In this comprehensive guide, we’ll cover everything from eligibility to filing tips, updated for 2025 changes. Whether you’re launching a local charity or community initiative, understanding IRS Form 1023-EZ can save you time, money, and headaches.

What Is IRS Form 1023-EZ?

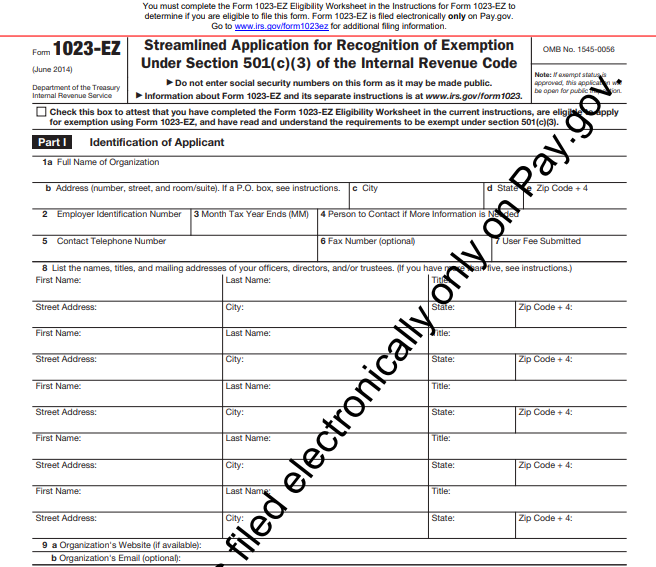

IRS Form 1023-EZ, officially titled the “Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code,” is a shortened version of the traditional Form 1023. Introduced in 2014 to ease the burden on small nonprofits, it allows eligible organizations to self-certify their compliance with 501(c)(3) requirements without submitting extensive narratives or financial projections.

The form’s purpose is straightforward: to obtain IRS recognition of your organization’s tax-exempt status under Section 501(c)(3). This exemption means your nonprofit won’t pay federal income tax on mission-related income and can receive tax-deductible donations from supporters. It’s ideal for grassroots groups, but remember—it’s not automatic. The IRS reviews submissions and can request more info if needed.

Key benefits include:

- Shorter form: Just three pages versus the 12+ pages of Form 1023.

- Lower cost: $275 user fee (versus $600 for the full form).

- Faster approval: 80% of applications processed within 22 days.

Who Is Eligible for IRS Form 1023-EZ in 2025?

Not every nonprofit qualifies for this shortcut. Eligibility hinges on size, structure, and activities—determined via the Form 1023-EZ Eligibility Worksheet in the instructions. Answer “Yes” to any question? You’re ineligible and must file the full Form 1023.

Core Financial Thresholds

To qualify, your organization must meet both:

- Projected annual gross receipts of $50,000 or less for each of the next three years (and actual receipts under $50,000 in the past three years if applicable).

- Total assets of $250,000 or less at filing.

Structural and Activity Restrictions

Beyond finances, exclusions include:

- Certain organization types: Churches, schools, hospitals, supporting organizations, private operating foundations, donor-advised funds, and more.

- Business structures: LLCs, for-profits, or successors to suspended entities.

- International elements: Formed outside the U.S. or with a foreign mailing address.

- Prior issues: Previously revoked status (except automatic revocations for non-filing, with reinstatement rules).

- Complex activities: Involvement in partnerships sharing losses, carbon credit trading, HMOs, ACOs, credit counseling, or non-publicly traded investments.

The 2025 Eligibility Worksheet adds questions on annual gross receipts, total assets, and public charity classification to ensure accurate self-assessment. For reinstated organizations, Question 29 now requires applying for the same foundation classification as before revocation.

Key 2025 Updates to IRS Form 1023-EZ

The IRS revised Form 1023-EZ in early 2025 to better support small charities while maintaining the $275 fee. These tweaks, effective January 2025, stem from recommendations by the IRS National Taxpayer Advocate.

Major changes:

- New mission description box: Part III now includes a 250-character field for your organization’s mission or key activities, helping the IRS quickly grasp your exempt purposes.

- Added self-certification questions: Directly on the form for gross receipts, assets, and public charity status—mirroring the worksheet for transparency.

- Reinstatement clarification: Stricter rules for automatically revoked groups to prevent mismatches in classification.

These updates make the form more user-friendly without altering core eligibility. Download the latest PDF instructions from IRS.gov for full details.

Step-by-Step Guide: How to File IRS Form 1023-EZ

Filing is 100% electronic via Pay.gov—no paper accepted. Expect 1-2 hours to complete if prepared. Here’s the breakdown:

Step 1: Confirm Eligibility and Gather Documents

- Finish the Eligibility Worksheet.

- Obtain an EIN (free at IRS.gov/EIN).

- Prepare organizing documents (articles of incorporation with 501(c)(3)-compliant purpose and dissolution clauses) and bylaws.

Step 2: Register on Pay.gov

- Create an account at Pay.gov.

- Search for “Form 1023-EZ” and start the application.

Step 3: Complete the Form

The form has six parts—keep responses concise:

- Part I: Identification: Name, address, EIN, officers (up to 5).

- Part II: Structure: Entity type (corp, association, trust), formation details, purpose/dissolution clauses.

- Part III: Activities (Updated in 2025): Mission description, NTEE code, exempt purposes, yes/no on lobbying, private inurement, foreign grants, etc.

- Part IV: Classification: Public charity or private foundation (use 5-year support tests if needed).

- Part V: Reinstatement: For revoked orgs only.

- Part VI: Signature: Electronic by an authorized principal.

Step 4: Pay and Submit

- Pay the $275 fee via Pay.gov.

- Submit and print a copy for records. Track status at IRS.gov/teos.

Processing Time: Most approvals in under a month, but full reviews can take 8-12 weeks. Expedited requests aren’t available for 1023-EZ.

IRS Form 1023-EZ Download and Printable

Download and Print: IRS Form 1023-EZ

Common Mistakes to Avoid When Filing Form 1023-EZ

Even with its simplicity, errors can delay approval or lead to denial. Top pitfalls:

- Ineligibility oversights: Skipping the worksheet and filing anyway—results in rejection.

- Non-charitable mission: Activities that seem private-benefit focused (e.g., benefiting insiders).

- Incomplete docs: Forgetting compliant articles or bylaws.

- Underestimating thresholds: Projecting growth that pushes over $50k receipts.

- Missing disclosures: Not flagging potential unrelated business income or foreign activities.

Consult a tax pro for complex cases to sidestep these.

Form 1023 vs. 1023-EZ: When to Choose Each in 2025

Stuck between forms? Use 1023-EZ for simple, small orgs under the thresholds—it’s quicker and cheaper. Opt for the full Form 1023 if:

- You’re larger (over $50k receipts/assets).

- Complex structure (e.g., schools, hospitals).

- Need detailed IRS feedback for grants/funding.

| Feature | Form 1023-EZ | Form 1023 |

|---|---|---|

| Length | 3 pages | 12+ pages + attachments |

| Fee | $275 | $600 |

| Eligibility | Small/simple orgs | All 501(c)(3) applicants |

| Processing | 22 days (80%) | 3-6 months average |

| Best For | Startups under $50k | Established/complex nonprofits |

FAQs About IRS Form 1023-EZ

Q: Can I file Form 1023-EZ retroactively?

A: Exemption starts from your formation date if approved, but file within 27 months for retro benefits.

Q: What if my application is denied?

A: You can refile with Form 1023 or appeal—common for eligibility errors.

Q: Do I need a lawyer?

A: Not always, but recommended for first-timers to ensure compliance.

Final Thoughts: Unlock Your Nonprofit’s Potential with Form 1023-EZ

IRS Form 1023-EZ democratizes tax exemption for small do-gooders, letting you focus on impact over paperwork. With 2025’s user-friendly updates, now’s the perfect time to apply. Head to Pay.gov, double-check eligibility, and get exempt—your mission awaits. For the latest, visit IRS.gov/charities-non-profits.

This article is for informational purposes; consult a tax advisor for personalized advice.