Table of Contents

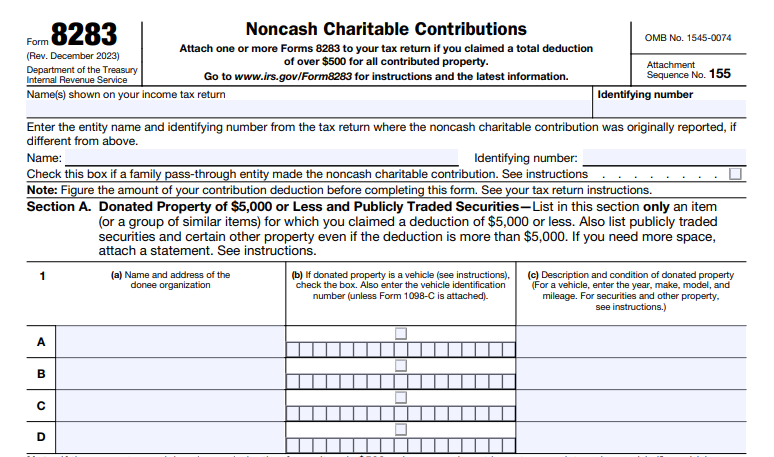

IRS Form 8283 – Noncash Charitable Contributions – Donating clothing, vehicles, artwork, or other property to charity can provide valuable tax deductions while supporting causes you care about. However, to claim a deduction for noncash charitable contributions exceeding $500, you must file IRS Form 8283 with your tax return.

This SEO-optimized guide explains everything you need to know about Form 8283, including when to file, key requirements, and how to avoid common pitfalls. Based on the latest IRS instructions (Revised December 2024) and Publication 526, this information is current as of 2025.

What Is IRS Form 8283?

IRS Form 8283, titled Noncash Charitable Contributions, is the official document used to report details about donated property (noncash gifts) to substantiate your charitable deduction on Schedule A (Form 1040) or other returns.

It applies to individuals, partnerships, S corporations, and C corporations. The form helps the IRS verify the fair market value (FMV) of donated items and ensures compliance with substantiation rules.

You do not use Form 8283 for cash donations, payroll deductions, or out-of-pocket volunteer expenses.

When Do You Need to File Form 8283?

You must file Form 8283 if your total deduction for all noncash contributions exceeds $500 in a tax year.

Key thresholds:

- Over $500 total: File the form (Section A or B depending on value).

- Over $5,000 per item or group of similar items: Use Section B, which requires a qualified appraisal.

- Over $500,000: Additional reporting and appraisal attachment required.

File with your tax return for the year you claim the deduction, including carryover years.

Pass-through entities (like partnerships) file with their return, and partners/shareholders attach copies to personal returns.

Section A vs. Section B: Understanding the Differences

Form 8283 divides into two sections based on donation value and type.

Section A: Donations of $5,000 or Less (and Certain Other Property)

Use for:

- Items or groups of similar items valued at $5,000 or less.

- Publicly traded securities.

- Qualified vehicles (with acknowledgment).

- Intellectual property or certain inventory.

Required details include donee name/address, property description, date acquired, cost basis, FMV, and valuation method. No appraisal needed.

Section B: Donations Over $5,000

Use for most items exceeding $5,000 (except exceptions above). Requires:

- A qualified appraisal by an independent appraiser.

- Donee organization signature (acknowledging receipt and intended use).

- Separate form for each item/group and each donee.

Special checkboxes for art ($20,000+ requires attached appraisal), qualified conservation contributions, digital assets, and more.

Qualified Appraisal Requirements

For Section B donations:

- Obtain a qualified appraisal no earlier than 60 days before the contribution.

- Appraiser must meet IRS standards (education, experience, no conflicts).

- Appraisal must include detailed property description, valuation method, and FMV.

Exceptions: Publicly traded securities, certain vehicles, inventory.

Attach the full appraisal for art ≥$20,000, non-good condition household items >$500, or deductions >$500,000.

Common Types of Noncash Contributions

Clothing and Household Items

Must be in “good used condition or better.” Items not meeting this standard over $500 require appraisal and Section B.

Vehicles (Cars, Boats, Airplanes)

Deduction often limited to sale proceeds by the charity. Attach Form 1098-C.

Artwork and Collectibles

High-value art (≥$20,000) needs attached appraisal. Digital assets (non-publicly traded) go in Section B.

Qualified Conservation Contributions

Special rules apply, including potential disallowance if exceeding 2.5x basis in pass-through entities (with exceptions for 3-year holds or certified historic structures).

IRS Form 8283 Download and Printable

Download and Print: IRS Form 8283

How to Fill Out Form 8283 Step-by-Step

- Identify donor and tax year.

- Choose Section A or B.

- List donee organizations.

- Describe property in detail (condition, VIN for vehicles, etc.).

- Provide acquisition date, cost basis, FMV, and valuation method.

- For Section B: Include appraiser info and obtain donee signature.

- Attach appraisals/statements as required.

Incomplete forms (e.g., “available upon request”) can lead to denied deductions.

Common Mistakes to Avoid

- Failing to get donee signature (Section B).

- No qualified appraisal for >$5,000 items.

- Overvaluing items (penalties for substantial overstatements).

- Not grouping similar items properly.

- Forgetting contemporaneous written acknowledgment for ≥$250 donations.

FAQs About IRS Form 8283

Q: Can I file Form 8283 electronically?

Yes, but include signed PDFs for appraisals and signatures.

Q: What if the charity sells the property soon after?

They may need to file Form 8282, and you could face recapture.

Q: Are there limits on charitable deductions?

Yes – generally 60% of AGI, with variations by property type and organization.

Always consult a tax professional for your situation, as rules can change. Download the latest Form 8283 and instructions from IRS.gov.