Table of Contents

IRS Form 2210 – Underpayment of Estimated Tax by Individuals, Estates and Trusts – IRS Form 2210, Underpayment of Estimated Tax by Individuals, Estates, and Trusts, helps determine if you owe a penalty for not paying enough estimated tax during the year. Many self-employed individuals, freelancers, investors, retirees, estates, and trusts face this issue when income isn’t subject to regular withholding.

The U.S. tax system requires paying taxes as you earn income. If you underpay estimated taxes quarterly, the IRS may charge a penalty—even if you get a refund or owe little when filing. This guide covers 2025 rules, based on official IRS sources.

What Is IRS Form 2210?

Form 2210 calculates the underpayment penalty for individuals, estates, and trusts. The IRS often computes the penalty and sends a bill, so you don’t always need to file the form. However, file it if you want to calculate the penalty yourself, use special methods like the annualized income installment method, or request a waiver.

The form includes:

- Part I: Required annual payment

- Part II: Reasons for filing (e.g., waiver or annualized method)

- Part III: Short/regular method for penalty calculation

- Part IV: Regular method details

- Schedule AI: Annualized income installment method for uneven income

Who Needs to Pay Estimated Taxes?

You generally need to make estimated tax payments if you expect to owe at least $1,000 in tax for 2025 (after withholding and credits) and withholding/credits cover less than 90% of your 2025 tax or 100% of your 2024 tax.

This applies to:

- Self-employed individuals

- Investors with capital gains/dividends

- Retirees with pension/IRA distributions

- Estates and trusts

Estimated payments are due quarterly: April 15, June 15, September 15, 2025, and January 15, 2026.

When Do You Owe an Underpayment Penalty?

The penalty applies if you don’t pay enough tax through withholding or estimated payments on time. It’s calculated on the underpaid amount for each quarter, using the applicable interest rate.

For 2025, the underpayment penalty rate is 7% (compounded daily on the unpaid amount until paid).

Exceptions: No Penalty Applies If

- You owed no tax in 2024 (and were a U.S. citizen/resident for the full year)

- Your 2025 tax liability (after withholding) is less than $1,000

- Special rules for estates/trusts within 2 years of decedent’s death

- Farmers/fishermen with at least 2/3 income from those activities (use Form 2210-F instead)

Safe Harbor Rules to Avoid the Penalty

Meet one of these “safe harbor” rules to avoid the penalty, even if you underpay relative to 2025 tax:

- Pay at least 90% of your 2025 tax liability through withholding/estimated payments

- Pay 100% of your 2024 tax liability (or 110% if your 2024 AGI exceeded $150,000—or $75,000 if married filing separately)

The safe harbor uses the smaller of these amounts.

IRS Form 2210 Download and Printable

Download and Print: IRS Form 2210

How Is the Underpayment Penalty Calculated?

The penalty is interest charged on each underpaid installment from its due date until paid. Use Form 2210’s regular method (equal quarterly installments) or short method if eligible.

If income varies (e.g., seasonal business or large year-end bonus), use Schedule AI (annualized income installment method) to potentially reduce or eliminate the penalty by showing lower required payments earlier in the year.

Waivers and Penalty Relief

The IRS may waive the penalty if:

- Underpayment was due to casualty, disaster, or unusual circumstances

- You retired (after age 62) or became disabled in 2024/2025, with reasonable cause

- You live/work in a federally declared disaster area (often automatic relief)

To request a waiver, check the appropriate box in Part II, attach Form 2210, and include a statement with supporting documentation.

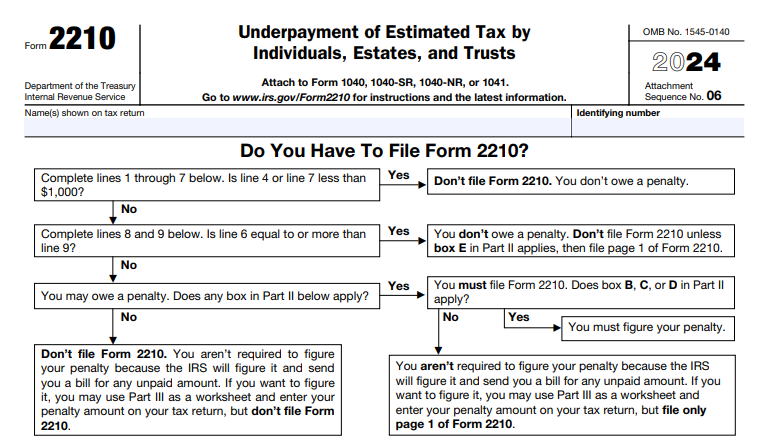

Do You Need to File Form 2210?

Most taxpayers don’t need to file— the IRS will calculate and bill any penalty. However, you must file if:

- Using the annualized method (check box C)

- Requesting a waiver due to retirement/disability (box B)

- Income varied and you want to show lower penalty

Otherwise, leave the penalty line blank on your return.

Tips to Avoid the Underpayment Penalty in 2025 and Beyond

- Use safe harbor: Base payments on 100% (or 110%) of prior year’s tax.

- Adjust withholding from wages/pensions to cover other income.

- If income is uneven, use the annualized method on Form 2210.

- Make timely quarterly payments via IRS Direct Pay or EFTPS.

- Monitor income changes and adjust estimates mid-year.

- Use IRS Form 1040-ES for estimated payment vouchers.

For the latest Form 2210 and instructions, visit IRS.gov. Always consult a tax professional for your specific situation, as rules can be complex.

This article is for informational purposes only and based on IRS guidance as of December 2025. Tax laws may change.