Table of Contents

IRS Form 7004 – Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns – Business owners and tax professionals often need extra time to prepare accurate tax returns. IRS Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns, provides an automatic extension for many business filings.

This guide explains everything you need to know about Form 7004 for the 2025 tax year, including eligibility, filing methods, deadlines, and key requirements. Information comes directly from official IRS sources as of December 2025.

What Is IRS Form 7004?

Form 7004 allows businesses, partnerships, estates, trusts, and other entities to request an automatic extension of time to file specific federal tax returns. The IRS grants the extension automatically if you file the form correctly and on time—no approval notice is sent unless the request is denied.

Important: Form 7004 extends only the filing deadline. It does not extend the time to pay any taxes owed. Pay any estimated balance due by the original return deadline to avoid penalties and interest.

Who Should File Form 7004?

File Form 7004 if your entity needs more time to file one of the eligible business returns. Common filers include:

- Corporations (C corps, S corps)

- Partnerships

- Estates and certain trusts (except bankruptcy estates or Form 1041-A filers, who use Form 8868)

- Real Estate Investment Trusts (REITs)

- Regulated Investment Companies (RICs)

- Foreign entities with U.S. filing requirements

Some entities qualify for automatic extensions without filing Form 7004 under specific regulations (e.g., certain foreign or domestic corporations/partnerships with books outside the U.S.).

Which Tax Returns Are Eligible for Extension with Form 7004?

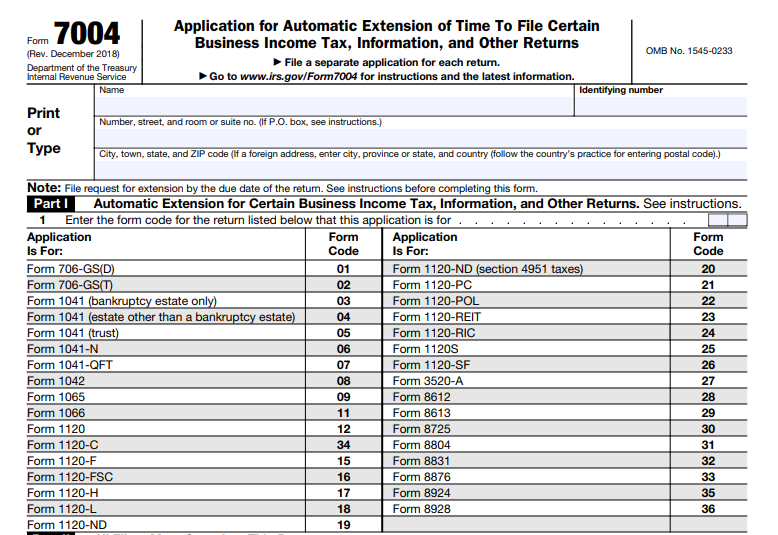

Form 7004 covers a wide range of business and information returns, including:

- Form 1065 (U.S. Return of Partnership Income)

- Form 1120 series (various corporate returns, including 1120, 1120-S, 1120-C, 1120-REIT, 1120-RIC, etc.)

- Form 1041 (U.S. Income Tax Return for Estates and Trusts, excluding certain types)

- Form 1042 (Annual Withholding Tax Return for U.S. Source Income of Foreign Persons)

- Form 8804 (Annual Return for Partnership Withholding Tax)

- Form 706-GS(D) and 706-GS(T) (Generation-Skipping Transfer Tax Returns)

- Form 3520-A (Annual Information Return of Foreign Trust)

- And others (see full list in Form 7004 instructions)

Enter the specific form code on line 1 of Form 7004 to indicate the return type.

File a separate Form 7004 for each different return type.

How Long Is the Extension?

The extension period varies by return type:

- 6 months — Most returns (standard automatic extension)

- 5½ months — Estates (other than bankruptcy) and certain trusts filing Form 1041

- 7 months — C corporations with tax years ending June 30 (for years beginning before January 1, 2026)

- Special cases — Additional 3-4 months for entities with books/records outside the U.S. and Puerto Rico

Check the specific instructions for your return type.

When to File Form 7004

File Form 7004 on or before the original due date of the tax return you’re extending. Due dates vary:

- Calendar year corporations/partnerships: Typically March 15 or April 15

- Fiscal year filers: 15th day of the 4th month after year-end (with variations)

- Special rules apply for foreign entities or June 30 year-ends

Refer to the IRS due date charts or your return’s instructions for exact dates.

How to File Form 7004: E-Filing vs. Paper

Electronic Filing (Recommended)

Most returns qualify for e-filing through the IRS Modernized e-File (MeF) platform. Benefits include faster processing and immediate confirmation.

Exceptions: Certain forms (e.g., 706-GS(D), 8612, 8613, 8725, 8831, 8876) require paper filing.

Paper Filing

Mail to the appropriate IRS address based on your return type and location (e.g., Ogden, UT or Kansas City, MO). Use the IRS “Where to File” table for details.

Payment Requirements and Penalties

Form 7004 does not extend the payment deadline. Estimate and pay any tax due by the original return due date.

- Use EFTPS for electronic payments

- Corporations paying at least 90% on time may avoid late payment penalties

- Interest accrues on unpaid amounts

- Late payment penalty: 0.5% per month (up to 25%)

Pay as much as possible to minimize costs.

Step-by-Step: How to Complete Form 7004

- Enter your name, address, and EIN/SSN

- Enter the form code for the return being extended (line 1)

- Check applicable boxes (e.g., foreign corporation, consolidated return)

- Provide tax year dates if not calendar year

- Estimate total tax liability (line 6)

- Subtract payments/credits (line 7)

- Calculate balance due (line 8) and pay it

- Attach required schedules (e.g., for consolidated groups)

Round to whole dollars and ensure accuracy.

Common Mistakes to Avoid

- Filing late → Extension denied

- Using one form for multiple return types → Must file separately

- Forgetting to pay estimated tax → Penalties and interest

- Incorrect form code or EIN → Processing delays

- Not updating address changes separately (use Form 8822-B)

Frequently Asked Questions About Form 7004

Q: Do I need to explain why I need an extension?

A: No. The extension is automatic—no reason required.

Q: Will I receive confirmation?

A: No approval notice is sent. Only denials are notified.

Q: Can I get more than one extension?

A: Generally, only one automatic extension per return.

Q: What if I file the return before the extended due date?

A: The return supersedes the extension.

Final Thoughts

Form 7004 provides valuable breathing room for preparing complex business tax returns, but remember: pay taxes on time to avoid costly penalties. Always download the latest form and instructions from IRS.gov.

For personalized advice, consult a tax professional. Visit IRS.gov for the current Form 7004 and instructions.

IRS Form 7004 Download and Printable

Download and Print: IRS Form 7004