Table of Contents

IRS Form 433-F – Collection Information Statement – IRS Form 433-F, known as the Collection Information Statement, is a key document used by the Internal Revenue Service (IRS) to assess a taxpayer’s financial situation. This simplified form helps determine how wage earners or self-employed individuals can resolve outstanding tax liabilities through payment plans, delays in collection, or other alternatives.

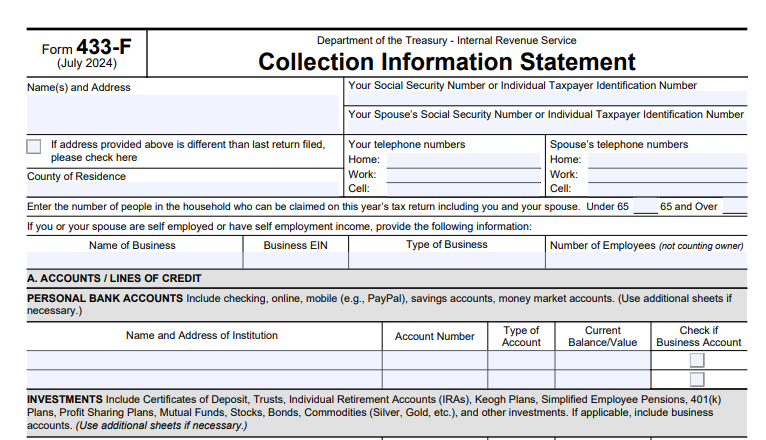

As of December 2025, the current version is Form 433-F (Rev. July 2024). This two-page form provides the IRS with a snapshot of your income, expenses, assets, and liabilities to evaluate your ability to pay taxes owed.

What Is IRS Form 433-F?

Form 433-F collects current financial information to help the IRS decide on collection options for unpaid taxes. It is a streamlined version designed specifically for wage earners and self-employed individuals, making it shorter and less complex than Form 433-A (for individuals) or Form 433-B (for businesses).

The form is often required when:

- Applying for an installment agreement (payment plan), especially if you cannot set one up online or are submitting Form 9465 by mail.

- Requesting a temporary delay in collection (e.g., “currently not collectible” status) due to financial hardship.

- Exploring other collection alternatives.

Unlike online payment agreements (available for balances up to $25,000 in some cases), larger debts or complex situations may require this form.

When Do You Need to Submit Form 433-F?

You typically need Form 433-F in these scenarios:

- Your tax debt prevents full immediate payment, and you’re seeking an installment agreement via Form 9465.

- The IRS contacts you about collection actions and requests financial details.

- You’re applying for hardship status to pause enforced collection.

Note: Making a large down payment can speed up approval for payment plans and reduce penalties and interest.

Key Differences: Form 433-F vs. 433-A vs. 433-B

- Form 433-F: Simplified (2 pages), for wage earners/self-employed; used for basic financial snapshots.

- Form 433-A: More detailed (6 pages), for individuals; requires extensive documentation.

- Form 433-B: For businesses.

The IRS often starts with Form 433-F for simpler cases.

How to Fill Out IRS Form 433-F: Step-by-Step Guide

Download the latest form from the official IRS website: Form 433-F PDF.

Here’s a breakdown of the sections (based on the July 2024 revision):

Header and Personal Information

Provide names, address, SSN/ITIN, phone numbers, household size (including dependents under/over 65), and business details if self-employed.

Section A: Accounts/Lines of Credit

List bank accounts, investments (e.g., IRAs, stocks), including balances and whether business-related.

Section B: Real Estate

Detail primary residence and other properties, including value, owed amounts, equity, and monthly payments.

Section C: Other Assets

Include vehicles (make/model/year), boats, whole life insurance, and other assets with equity calculations.

Section D: Credit Cards

List all cards/lines of credit, limits, balances, and minimum payments.

Digital Assets

Report cryptocurrency holdings, including type, value in USD, and storage locations.

Section E: Business Information

List accounts receivable and credit card processing details if self-employed.

Section F: Employment Information

Provide employer details, pay frequency, gross pay, and taxes withheld (or attach pay stubs).

Section G: Non-Wage Household Income

Report monthly amounts from alimony, child support, self-employment net income, rentals, pensions, etc. Attach profit/loss statements if applicable.

Section H: Monthly Necessary Living Expenses

List expenses in categories like food/personal care, transportation, housing/utilities, medical, and others. Use IRS allowable standards where applicable (found at IRS Collection Financial Standards) or actual amounts if higher (with substantiation).

Sign and date under penalty of perjury.

IRS Form 433-F Download and Printable

Download and Print: IRS Form 433-F

Tips for Completing Form 433-F Accurately

- Be honest and thorough — inaccuracies can delay processing or lead to denial.

- Use IRS standards for expenses (e.g., food, housing) to avoid overclaiming unless you can substantiate higher actual costs.

- Attach supporting documents like pay stubs, bank statements, or bills when requested.

- Convert non-monthly expenses (e.g., quarterly to monthly by dividing by 3).

- Keep copies of everything submitted.

- If self-employed, include current profit/loss statements.

Common mistakes: Underreporting assets (including crypto), overstating expenses without proof, or forgetting digital assets.

Where to Submit Form 433-F

Submit with Form 9465 for installment agreements, or as directed by IRS correspondence. Mail to the address provided in IRS notices or Form 9465 instructions.

Frequently Asked Questions (FAQ)

Is Form 433-F the same as Form 433-A?

No — 433-F is simpler and for basic cases.

Do I need documentation?

Yes, the IRS may request verification later (e.g., bank statements, bills).

Can I submit Form 433-F online?

No, it’s typically mailed, though some payment agreements are set up online without it for smaller debts.

What if my expenses exceed IRS standards?

You can claim actual amounts, but be prepared to provide proof.

Is there a Spanish version?

Yes, Form 433-F (SP).

For the most current standards and forms, visit IRS.gov directly.

Conclusion

IRS Form 433-F is an essential tool for taxpayers facing collection actions who need to demonstrate their financial situation. By providing accurate information, you can work toward manageable resolution options like installment agreements or hardship status. Always use the latest version from IRS.gov and consider consulting a tax professional for complex situations.

Sources: Official IRS Form 433-F (Rev. July 2024) and related IRS publications.