Table of Contents

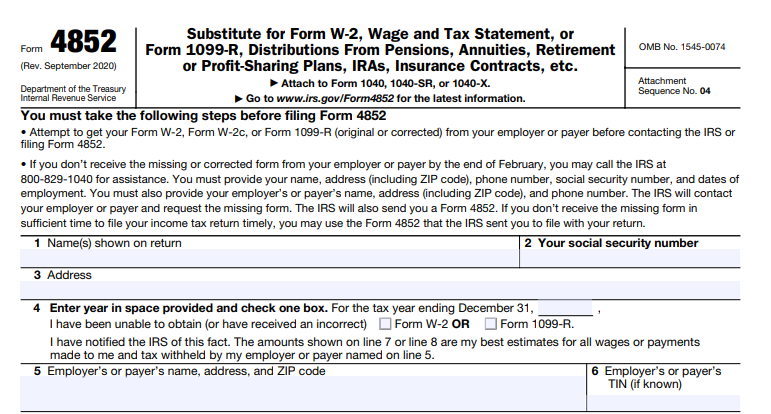

IRS Form 4852 – Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. – Navigating tax season can be stressful, especially if you’re missing a critical document like Form W-2 (Wage and Tax Statement) or Form 1099-R (Distributions from Pensions, Annuities, Retirement Plans, etc.). Fortunately, the IRS provides Form 4852 as a substitute to help you file your return accurately and on time. This guide explains everything you need to know about IRS Form 4852, including when to use it, how to fill it out, and important warnings.

Form 4852 allows taxpayers to report wages or retirement distributions when the original forms are unavailable or incorrect.

What Is IRS Form 4852?

IRS Form 4852 (Substitute for Form W-2, Wage and Tax Statement, or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.) is an official IRS document that acts as a replacement for:

- Form W-2

- Form W-2c (corrected W-2)

- Form 1099-R (original or corrected)

You or your tax representative complete it when your employer or payer fails to provide the required form, or when the issued form contains errors.

The current version is Revision September 2020, and it remains in use as of December 2025 with no major updates.

When Should You Use Form 4852?

Use Form 4852 only as a last resort in these situations:

- Your employer or payer does not issue a W-2 or 1099-R by the deadline (typically late January).

- You receive an incorrect W-2 or 1099-R, and the issuer won’t provide a corrected version.

- You’ve made reasonable efforts to obtain the correct form but were unsuccessful.

Do not use Form 4852 to avoid reporting income or for frivolous tax protests—the IRS imposes severe penalties for misuse.

Steps to Take Before Filing Form 4852

The IRS requires you to make genuine efforts to get the original form first:

- Contact your employer or payer directly to request the missing or corrected form.

- If you haven’t received it by the end of February, call the IRS at 800-829-1040. Provide your details and employer/payer information—the IRS will contact them and may send you a pre-filled Form 4852.

- Document all attempts (calls, emails, dates) as you’ll need to explain them on the form.

Always try to resolve the issue with the issuer before using Form 4852.

IRS Form 4852 Download and Printable

Download and Print: IRS Form 4852

How to Fill Out IRS Form 4852: Step-by-Step

Download the latest Form 4852 from the IRS website (irs.gov). Attach it to the back of your federal tax return (Form 1040 or 1040-SR).

Here’s a breakdown of the key lines:

- Lines 1–3: Enter your name, Social Security number, and address.

- Line 4: Specify the tax year and check the box for W-2 or 1099-R.

- Line 5: Enter the employer or payer’s name, address, and ZIP code.

- Line 6: Enter the employer/payer’s TIN (EIN or SSN) if known—use prior year’s form if available.

- Line 7 (for W-2 substitute): Report wages, tips, withheld taxes, etc. Use your final pay stub or prior-year W-2 for estimates.

- Include Social Security and Medicare wages accurately.

- Line 8 (for 1099-R substitute): Report gross distributions, taxable amount, withheld taxes, etc. Use plan statements if available.

- Line 9: Explain how you determined the amounts (e.g., “Based on final pay stub” or “Same as prior year”).

- Line 10: Detail your efforts to obtain the original form (this is required!).

Use your best estimates based on reliable sources like pay stubs or prior forms.

Tip: If you receive the correct W-2 or 1099-R after filing, amend your return with Form 1040-X.

Potential Risks and Penalties

The IRS scrutinizes Form 4852 filings. Improper use (e.g., underreporting income) can trigger:

- Accuracy-related penalty: 20% of underpaid taxes.

- Civil fraud penalty: 75% of underpaid taxes.

- Frivolous return penalty: $5,000.

Keep copies of Form 4852 for your records, especially for Social Security verification.

Where to Get Form 4852

- Download directly from IRS.gov: Search for “Form 4852.”

- Call the IRS for assistance if needed.

FAQs About IRS Form 4852

Can I e-file with Form 4852?

No—most tax software doesn’t support e-filing with Form 4852. You typically need to mail a paper return.

What if my pay stub is incomplete?

Use the most reliable information available, but avoid guessing. Pro-rate from prior years if income was consistent.

Does Form 4852 delay my refund?

Possibly—the IRS may verify the information, extending processing time.

Is Form 4852 available in Spanish?

Yes, there’s a Spanish version (Form 4852 (sp)).

For the most accurate and up-to-date information, always refer to official IRS sources.

If you’re dealing with a missing W-2 or 1099-R this tax season, Form 4852 can help you stay compliant—just follow the rules carefully to avoid issues. Consult a tax professional for complex situations.