Table of Contents

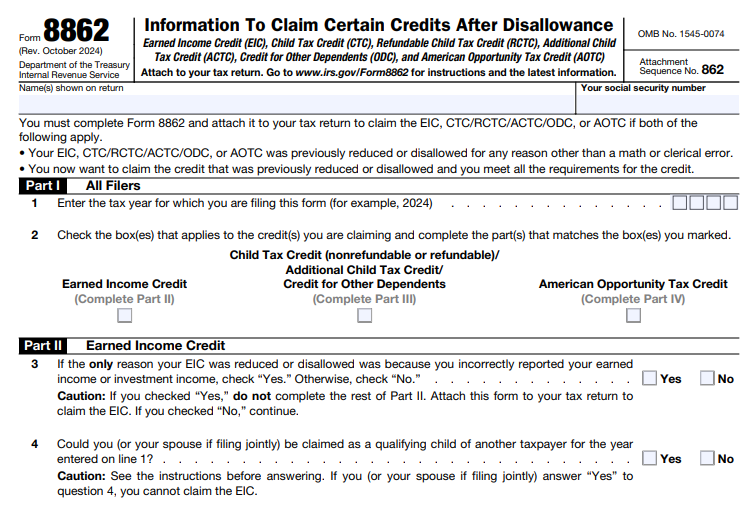

IRS Form 8862 – Information To Claim Certain Credits After Disallowance – If you’ve ever had a valuable tax credit like the Earned Income Credit (EIC) or Child Tax Credit (CTC) reduced or denied by the IRS for reasons beyond a simple math error, you know how frustrating it can be. Fortunately, IRS Form 8862 provides a pathway to reclaim these credits in future tax years once you meet the eligibility requirements. This form, officially titled “Information To Claim Certain Credits After Disallowance,” is essential for taxpayers looking to reinstate disallowed credits. In this guide, we’ll break down everything you need to know about Form 8862, including who needs it, how to fill it out, and tips for avoiding common pitfalls—updated for the 2025 tax filing season.

Whether you’re searching for “how to claim EIC after disallowance” or “filing Form 8862 for Child Tax Credit,” this article will help you navigate the process with confidence. Let’s dive in.

What Is IRS Form 8862?

IRS Form 8862 is a recertification form that taxpayers must submit to reclaim specific refundable and nonrefundable tax credits after they’ve been previously disallowed or reduced. The form verifies that you now meet the eligibility criteria for these credits, ensuring compliance with IRS rules. It’s not required for every tax return but becomes mandatory if the IRS has flagged issues in past filings, excluding cases of mere math or clerical errors.

The purpose of Form 8862 is to provide additional information to the IRS, demonstrating that you’re entitled to the credits in question. Without it, your claim for these credits could be denied again, potentially delaying your refund or reducing your tax benefits. For the 2025 tax year (returns filed in 2026), the form remains largely unchanged from its October 2024 revision, with no major updates noted beyond the removal of Part V for tax years starting in 2024.

Key points about the form:

- It’s attached to your federal tax return (Form 1040, 1040-SR, or 1040-NR).

- Filing it doesn’t guarantee approval; the IRS may request additional documentation.

- Refunds for returns claiming EIC or Additional Child Tax Credit (ACTC) are often delayed until mid-February.

Who Needs to File Form 8862?

Not everyone claiming tax credits needs Form 8862. You must file it if:

- Your EIC was reduced or disallowed in a tax year after 1996 for any reason other than a math or clerical error.

- Your CTC, Refundable Child Tax Credit (RCTC), ACTC, Credit for Other Dependents (ODC), or American Opportunity Tax Credit (AOTC) was reduced or disallowed after 2015 for similar reasons.

- You’re now claiming one or more of these credits and meet the current eligibility rules.

Exceptions where you don’t need to file include:

- If the disallowance was only due to a math or clerical error.

- If you’ve already filed Form 8862 in a previous year, the credit was allowed, and it hasn’t been disallowed again.

- For EIC, if the disallowance was solely because a child listed on Schedule EIC wasn’t qualifying.

Additionally, there are disallowance periods to consider: 2 years for reckless or intentional disregard of rules, and 10 years for fraud. If you’re in one of these periods, you can’t claim the credit until it expires. Always check your IRS notices for details on why a credit was denied and how to appeal.

Tax Credits Covered by Form 8862

Form 8862 applies to several key tax credits designed to provide financial relief to low- to moderate-income families, students, and dependents. Here’s a breakdown:

- Earned Income Credit (EIC): A refundable credit for working individuals and families. Eligibility requires a valid Social Security Number (SSN) by the return due date, and specific age, residency, and income rules apply.

- Child Tax Credit (CTC)/Refundable Child Tax Credit (RCTC)/Additional Child Tax Credit (ACTC)/Credit for Other Dependents (ODC): These credits support families with qualifying children or dependents. Children must have an SSN (ITIN or ATIN won’t suffice for qualifying child status), be under age 17 (or 18 in certain past years like 2021), and meet residency and dependency tests.

- American Opportunity Tax Credit (AOTC): A partially refundable credit for qualified education expenses. The student must not have claimed the credit for four prior years, be enrolled at least half-time, and have no felony drug convictions.

For 2025, ensure all Taxpayer Identification Numbers (TINs), such as SSNs or ITINs, are issued by the return due date to avoid disallowance.

Step-by-Step Guide to Filling Out Form 8862

Filling out Form 8862 is straightforward but requires attention to detail. The form has four main parts, depending on the credits you’re claiming. Always use the year you’re claiming the credit for (e.g., 2024 for returns filed in 2025).

- Part I – All Filers:

- Line 1: Enter the tax year (e.g., 2024).

- Line 2: Check boxes for the credits you’re claiming that were previously disallowed.

- Part II – Earned Income Credit:

- Answer questions about being a qualifying child of another taxpayer.

- If claiming with a qualifying child: List the child’s name, SSN, and days lived with you (use 365/366 if the child was born or died during the year).

- Without a qualifying child: Confirm U.S. residency and age (25–64 at year-end).

- Part III – Child Tax Credit and Related Credits:

- Verify residency (more than half the year), relationship, age, support, and dependency status for each child.

- Part IV – American Opportunity Tax Credit:

- Confirm student eligibility, including enrollment status and prior credit claims.

Attach relevant schedules like Schedule EIC or Form 8863 for education credits. If space is limited, include a separate statement. Keep records like school attendance or residency proofs handy, as the IRS may request them.

How to File Form 8862

Attach Form 8862 to your tax return and file electronically or by mail. If appealing a disallowance, file a paper return and challenge any math error notice within 60 days. Use tax software like TurboTax for guided filing, which can help ensure accuracy.

For 2025 filings, expect potential refund delays for EIC or ACTC claims. If you’re a startup founder or business owner, consult a tax professional to align this with other credits like R&D.

IRS Form 8862 Download and Printable

Download and Print: IRS Form 8862

Common Mistakes to Avoid When Filing Form 8862

Avoid these pitfalls to prevent further disallowances:

- Using an ITIN instead of an SSN for qualifying children on CTC/ACTC claims.

- Failing to meet residency or age requirements.

- Entering the wrong tax year on Line 1.

- Claiming credits during a 2- or 10-year ban period.

- Not attaching required schedules or documentation.

Double-check eligibility and consider professional help if your situation is complex.

FAQs About IRS Form 8862

Do I need Form 8862 if my credit was denied due to a math error?

No, only for disallowances beyond math or clerical errors.

Can I e-file with Form 8862?

Yes, most tax software supports it.

What if I don’t have all the required documents?

Keep what you have; the IRS may contact you for more.

Is there a deadline for filing Form 8862?

File it with your tax return by the due date (typically April 15, or October 15 with extension).

How do I appeal a credit disallowance?

File Form 8862 with your return and respond to IRS notices promptly.

Final Thoughts on Reclaiming Your Tax Credits

Navigating IRS Form 8862 can seem daunting, but it’s a crucial step for reclaiming credits like the EIC or CTC after disallowance. By understanding the requirements and avoiding common errors, you can maximize your tax benefits in 2025. Always refer to official IRS resources and consider consulting a tax advisor for personalized advice. If you’ve faced a disallowance, acting quickly with Form 8862 can put you back on track for future refunds.