Table of Contents

IRS Form 3949-A – Information Referral – In an era where tax compliance is crucial for maintaining economic fairness, knowing how to report suspected tax violations can make a significant difference. IRS Form 3949-A, also known as the Information Referral, empowers individuals to alert the Internal Revenue Service (IRS) about potential tax fraud without needing to be an expert. Whether it’s unreported income, false deductions, or other irregularities, this form provides a straightforward way to contribute to tax integrity. Updated processes in 2025, including online submission options, make reporting easier than ever.

This comprehensive guide covers everything you need to know about IRS Form 3949-A, from its purpose to step-by-step filing instructions. If you’re searching for “how to report tax fraud to IRS” or “anonymous tax violation reporting,” you’ve come to the right place.

What Is IRS Form 3949-A?

IRS Form 3949-A is a voluntary reporting tool designed for individuals or entities to notify the IRS of suspected tax law violations committed by a person, business, or both. It allows you to provide detailed information about alleged infractions, helping the IRS investigate and enforce tax laws effectively.

Common violations reported via this form include:

- False exemptions or deductions

- Unreported or unsubstantiated income

- False or altered tax documents

- Failure to file returns or pay taxes

- Kickbacks, wagering/gambling income, or narcotics-related income

- Organized crime, public corruption, or Earned Income Credit (EIC) abuses

Unlike other IRS forms, Form 3949-A is specifically for general tax referrals and does not apply to issues like identity theft (use Form 14039) or tax preparer misconduct (use Form 14157). It’s important to note that this form is not for disputing your own tax issues or responding to IRS notices—consult a tax professional for those matters.

When Should You Use Form 3949-A?

Use Form 3949-A when you have credible information about tax non-compliance that isn’t covered by more specialized forms. For instance:

- If you suspect a business is underreporting income or failing to withhold taxes.

- When an individual claims false deductions or engages in multiple fraudulent filings.

- For reporting income from illegal activities like gambling or drug-related earnings.

The IRS encourages reports only if you have specific details, such as names, addresses, or amounts involved. Vague or unsubstantiated claims may not lead to action. As of 2025, the form’s processing has been updated with minor procedural changes, including refined screening for tax years 2021-2024 in certain cases, but this doesn’t affect how you submit.

If your report involves whistleblowing with potential for rewards (e.g., for substantial underpayments), consider Form 211 instead, as Form 3949-A does not directly offer rewards.

How to Fill Out IRS Form 3949-A: Step-by-Step

Filling out Form 3949-A is straightforward and typically takes about 15 minutes. The form is divided into three sections. Provide as much detail as possible—blanks are okay for unknown information.

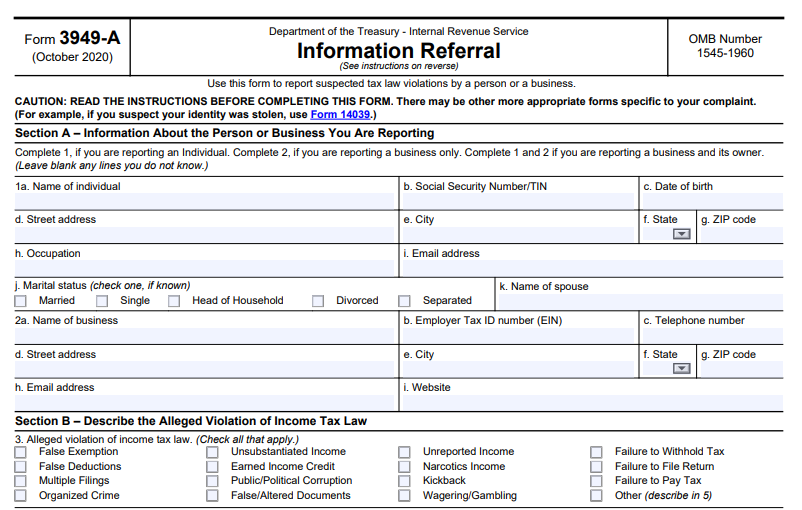

Section A: Information About the Person or Business You’re Reporting

- For Individuals: Include name, Social Security Number (SSN) or Taxpayer Identification Number (TIN), date of birth, address, occupation, email, marital status, and spouse’s name (if applicable).

- For Businesses: Provide name, Employer Identification Number (EIN), phone, address, email, and website.

Complete both if reporting a business and its owner.

Section B: Describe the Alleged Violation

- Check boxes for violation types (e.g., “Unreported Income,” “False Deductions”).

- Specify unreported income amounts and tax years.

- Add comments describing the violation, including how, when, and why you know about it.

- Note if books/records are available (do not send them) and if the taxpayer is considered dangerous.

Section C: Information About Yourself

This is optional for anonymous reporting. If you provide your name, address, phone, and email, the IRS may contact you for clarification.

Here’s a visual example of how the form looks when filled out:

Tip: Download the latest PDF from the IRS website to ensure you’re using the current version (revised as of recent updates).

IRS Form 3949-A Download and Printable

Download and Print: IRS Form 3949-A

How to Submit IRS Form 3949-A

In 2025, you have flexible submission options:

- Online: Use the IRS’s Form 3949-A Information Referral online experience through their digital platform. This is the fastest method and supports confidential uploads.

- By Mail: Send the completed form to Internal Revenue Service, PO Box 3801, Ogden, UT 84409.

Once submitted, the IRS screens referrals for credibility, researches details, and routes them to appropriate divisions (e.g., Criminal Investigation for fraud). Processing is confidential, and you won’t receive updates on the outcome.

Anonymity, Rewards, and Important Considerations

One of the key benefits of Form 3949-A is anonymity—simply skip Section C if you prefer not to be identified. However, providing contact info can help if the IRS needs more details.

For rewards, this form isn’t part of the IRS Whistleblower Program. If your information leads to collected taxes over $2,000 (for individuals) or higher thresholds, file Form 211 separately with the IRS Whistleblower Office.

Caution: Do not use this form for personal tax disputes or if another form fits better. Submitting false information could have legal consequences.

Frequently Asked Questions About IRS Form 3949-A

Can I report tax fraud anonymously?

Yes, by omitting your personal details in Section C.

Is there a deadline for filing Form 3949-A?

No, but report as soon as possible for timely investigation.

What happens after I submit?

The IRS reviews and may investigate, but you won’t be updated due to confidentiality.

Are there updates to Form 3949-A in 2025?

Yes, enhanced online submission and minor procedural tweaks for processing.

For more details, visit the official IRS website or consult a tax advisor.

By using IRS Form 3949-A, you’re helping ensure everyone pays their fair share. If you suspect tax fraud, take action today—it’s simple, secure, and impactful.