Table of Contents

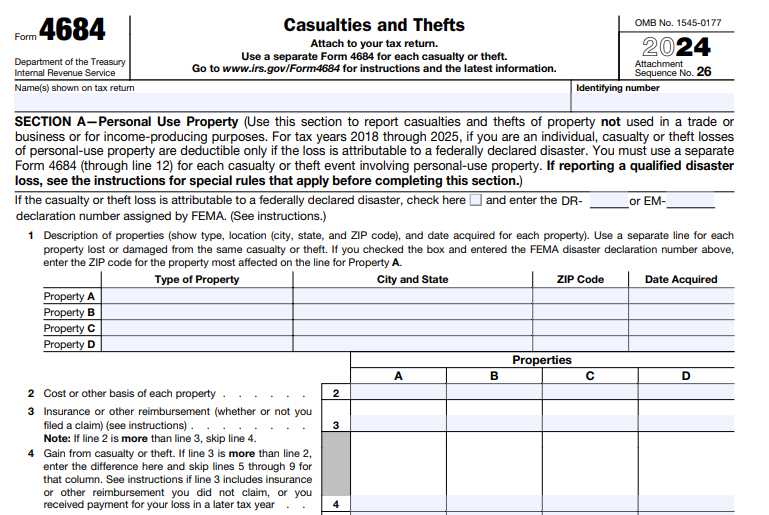

IRS Form 4684 – Casualties and Thefts – IRS Form 4684, officially titled “Casualties and Thefts,” is the key tax form used to report gains and losses from property damage, destruction, or theft. Whether you’ve experienced a natural disaster, accident, or theft, understanding Form 4684 can help you claim potential deductions on your federal income tax return. This guide covers eligibility, filing requirements, and step-by-step instructions based on the latest IRS rules for tax years through 2025.

What Is IRS Form 4684?

Form 4684 allows taxpayers to calculate and report casualty and theft losses or gains. You attach it to your tax return (such as Form 1040 or 1040-SR) to claim deductions for unreimbursed losses. The form has sections for:

- Personal-use property (Section A): Homes, vehicles, household items.

- Business or income-producing property (Section B): Rental properties, business assets.

Key resources include IRS Publication 547 (Casualties, Disasters, and Thefts) and Publication 584 (Casualty, Disaster, and Theft Loss Workbook).

Key Changes to Casualty and Theft Loss Deductions (2018–2025)

The Tax Cuts and Jobs Act of 2017 significantly limited personal casualty and theft loss deductions. For tax years 2018 through 2025:

- Personal-use property losses are deductible only if attributable to a federally declared disaster (as defined by FEMA).

- Non-disaster personal losses (e.g., a car accident or theft not in a disaster area) are generally not deductible.

- Exceptions apply for Ponzi-scheme theft losses or if you have personal casualty gains (which can offset non-disaster losses).

Business or income-producing property losses remain fully deductible without disaster requirements.

For qualified disaster losses (certain federally declared disasters with incident periods generally between late 2019 and early 2025), special rules apply:

- No 10% of adjusted gross income (AGI) threshold.

- Reduced by $500 per casualty (instead of the old $100).

- Can be claimed without itemizing deductions.

Check IRS.gov for current federally declared disasters and FEMA codes.

Who Can File Form 4684?

You may need to file if you have:

- A casualty loss (sudden, unexpected event like fire, storm, or accident).

- A theft loss.

- Property in a federally declared disaster area (for personal losses).

Businesses, individuals, estates, trusts, and partnerships can use the form.

How to Calculate a Casualty or Theft Loss

The basic formula for loss amount (per property) is the lesser of:

- Decrease in fair market value (FMV) before vs. after the event, or

- Your adjusted basis in the property (usually cost plus improvements).

Then subtract:

- Insurance or other reimbursements received or expected.

- Salvage value.

For qualified disasters:

- Reduce each loss by $500.

- No further 10% AGI reduction.

Use Publication 584 to document FMV and basis with photos, appraisals, or receipts.

IRS Form 4684 Download and Printable

Download and Print: IRS Form 4684

Step-by-Step Guide to Filing IRS Form 4684

- Gather Documentation:

- Proof of loss (police reports for theft, photos, appraisals).

- Insurance statements.

- FEMA disaster declaration number (if applicable—enter at the top of the form).

- Complete Section A (Personal-Use Property):

- Use a separate form for each major event if needed.

- Describe property, cost/basis, FMV before/after, insurance reimbursement.

- Calculate loss per property (lines 1–12).

- Total losses and apply rules for disaster vs. non-disaster.

- Section B (Business/Income-Producing Property):

- Separate forms for each event.

- Includes inventory losses.

- Summary Lines (13–18):

- Combine totals.

- Apply $500 reduction for qualified disasters.

- Report net gain or loss.

- Reporting on Your Tax Return:

- Personal losses: Schedule A (if itemizing) or directly if qualified disaster.

- Gains: Schedule D (capital gains).

- Business losses: Various schedules depending on entity.

- Special Elections:

- Deduct disaster losses in the prior year (amend return with Form 1040-X).

- Useful for faster refunds.

Download the latest Form 4684 and instructions from IRS.gov/Form4684.

Common Mistakes to Avoid

- Claiming non-disaster personal losses.

- Forgetting to subtract insurance reimbursements.

- Not entering FEMA code for disasters.

- Missing documentation—keep records for audits.

Additional IRS Resources

- IRS Topic No. 515: Casualty, Disaster, and Theft Losses.

- Disaster relief page: IRS.gov/DisasterTaxRelief.

- For Ponzi schemes: Special safe harbor rules in instructions.

Consult a tax professional for complex situations, especially multiple events or business property.

By properly filing IRS Form 4684, you can maximize eligible deductions and recover some financial losses from unfortunate events. Always use the most current forms and check for updates on IRS.gov.