Table of Contents

IRS Form 1116 – Foreign Tax Credit (Individual, Estate, or Trust) – If you’re a U.S. taxpayer with income from overseas, you may be eligible for the foreign tax credit to avoid double taxation. IRS Form 1116, also known as the Foreign Tax Credit (Individual, Estate, or Trust), is the key document for claiming this relief. In this comprehensive guide, we’ll break down everything you need to know about Form 1116, including eligibility, step-by-step filing instructions, limitations, and updates for tax year 2025. Whether you’re an expat, investor, or estate manager, understanding how to use this form can significantly reduce your U.S. tax liability.

What Is the Foreign Tax Credit and Why Claim It?

The foreign tax credit (FTC) allows U.S. citizens, resident aliens, estates, and trusts to offset U.S. taxes on foreign-sourced income with taxes already paid to foreign governments. This credit aims to prevent double taxation, where the same income is taxed by both the U.S. and another country. Unlike a deduction, which reduces taxable income, the credit directly lowers your tax bill dollar-for-dollar, making it often more advantageous.

For example, if you earned dividends from a foreign company and paid taxes on them abroad, you can use the FTC to reduce your U.S. tax on that income. The credit applies to qualifying foreign income taxes, war profits taxes, or excess profits taxes, but not to penalties, interest, or non-creditable taxes like those from sanctioned countries.

Who Needs to File IRS Form 1116?

You must file Form 1116 if you’re an individual, estate, or trust claiming the FTC and don’t qualify for the simplified election. Nonresident aliens typically can’t claim it, except in specific cases like Puerto Rico residents or those with U.S.-connected business income.

However, there’s an exception: If your foreign taxes are $300 or less ($600 for married filing jointly), all from passive income, and reported on a qualified payee statement like Form 1099-DIV, you can claim the credit directly on Form 1040 without filing Form 1116. If your taxes exceed these limits or come from other categories, Form 1116 is required.

U.S. expats living abroad, investors in foreign stocks, or those with foreign business income are common filers. Estates and trusts with foreign assets may also need to file.

Eligibility Requirements for the Foreign Tax Credit

To qualify, you must have paid or accrued foreign taxes on foreign-sourced income that is also taxable in the U.S. Eligible taxes include those imposed by foreign countries or U.S. possessions, but exclude:

- Taxes not legally owed.

- Taxes eligible for refunds or subsidies.

- Taxes from boycotted or sanctioned countries (e.g., under section 901(j)).

You can’t claim the credit for taxes on excluded income, such as via the Foreign Earned Income Exclusion (Form 2555). Additionally, for dividends, you must meet holding period requirements to avoid disqualification.

Categories of Foreign Source Income on Form 1116

The IRS requires separate Forms 1116 for each income category to prevent cross-crediting between high- and low-tax sources. Key categories include:

- Passive Category Income: Dividends, interest, royalties, and rents not tied to active business.

- General Category Income: Wages, business profits, and other active income.

- Section 951A Category Income: Global intangible low-taxed income (GILTI) from controlled foreign corporations (CFCs).

- Foreign Branch Category Income: Profits from foreign branches, excluding passive income.

- Certain Income Re-Sourced by Treaty: U.S.-sourced income treated as foreign under tax treaties.

- Section 901(j) Income: From sanctioned countries (credit not allowed, but tracked separately).

- Lump-Sum Distributions: From foreign pensions.

High-taxed passive income may be reclassified to avoid limitations. Look-through rules apply for CFC shareholders.

How to Fill Out Form 1116: Step-by-Step Instructions

Filing Form 1116 involves four parts. You’ll need records of foreign income, taxes paid, and exchange rates. Use a separate form per category.

Part I: Foreign Source Income

- Report gross foreign income by country.

- Deduct related expenses, such as apportioned interest or losses.

- Adjust for capital gains and qualified dividends using worksheets.

Part II: Foreign Taxes Paid or Accrued

- List taxes in foreign currency and convert to USD (use payment date rate or average annual rate).

- Reduce for any non-creditable amounts or section 909 suspensions.

Part III: Figuring the Credit

- Apply adjustments, carryovers, and reductions (e.g., 10% penalty for not filing Form 5471).

- Calculate the limitation: (Foreign source taxable income / Worldwide taxable income) × U.S. tax liability.

- The credit is the lesser of foreign taxes paid or this limit.

Part IV: Summary of Credits

- Aggregate if multiple forms are filed; enter total on Form 1040.

Attach schedules like Schedule B for carryovers or Schedule C for redeterminations. For contested taxes, use Form 7204.

Computing the Foreign Tax Credit: Limitations and Examples

The FTC is limited to your U.S. tax on foreign income to prevent crediting against U.S.-sourced taxes. For instance, if your foreign income is $10,000, worldwide income $50,000, and U.S. tax $10,000, your limit is ($10,000 / $50,000) × $10,000 = $2,000. If you paid $3,000 in foreign taxes, you can only credit $2,000.

Excess taxes can be carried back 1 year or forward 10 years (except for section 951A). Recapture rules apply for prior losses.

Carryback and Carryover Rules

Unused credits carry back to the prior year and forward up to 10 years. Track them on Schedule B. Pre-2018 carryovers have special allocation rules to post-2017 categories.

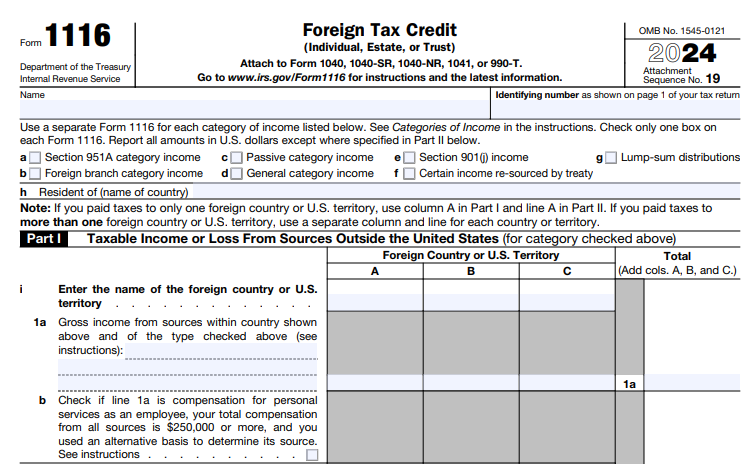

IRS Form 1116 Download and Printable

Download and Print: IRS Form 1116

Recent Changes to Form 1116 for Tax Year 2025

For 2025, there are no sweeping overhauls to Form 1116, but note these updates:

- Schedule C (revised December 2025) continues to handle foreign tax redeterminations and changes in credits.

- IRS Notice 2025-72 adjusts tax year alignment for foreign corporations, impacting U.S. shareholders of CFCs and potentially GILTI calculations on Form 1116.

- General expat tax adjustments, like increased Foreign Earned Income Exclusion, may interact with FTC claims but don’t directly alter Form 1116.

Always check IRS.gov for the latest forms, as final 2025 instructions may include minor tweaks.

Common Mistakes to Avoid When Filing Form 1116

- Not separating income categories, leading to disallowed credits.

- Incorrect currency conversions or failing to use the proper exchange rate.

- Overlooking reductions for non-filing of related forms (e.g., Form 5471).

- Claiming credits on excluded income or ineligible taxes.

- Forgetting to attach required statements or schedules.

Consult a tax professional for complex situations, like CFCs or treaties.

Foreign Tax Credit vs. Deduction: Which Is Better?

You can elect to deduct foreign taxes on Schedule A instead of crediting them, but the credit is usually preferable as it provides a direct offset. Switching between credit and deduction requires IRS consent in some cases, with time limits (10 years for credit, 3 for deduction).

Final Thoughts on IRS Form 1116

Claiming the foreign tax credit via Form 1116 can save you significant money if you have international income. For 2025, ensure your filings account for any CFC timing changes under Notice 2025-72 and use the updated schedules. Gather all documentation early, and consider software like TurboTax for guidance. If unsure, seek advice from a certified tax expert to maximize your benefits and stay compliant.

This guide is for informational purposes; refer to official IRS resources for personalized tax advice.