Table of Contents

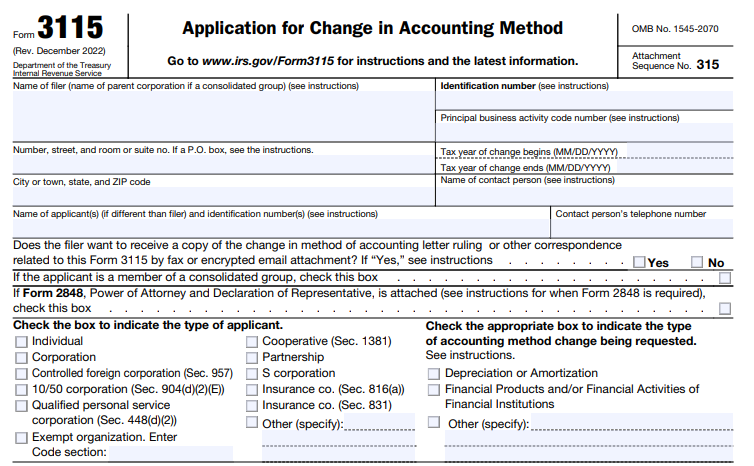

IRS Form 3115 – Application for Change in Accounting Method – In the ever-evolving world of tax compliance, businesses and individuals often need to adjust their accounting practices to better align with IRS regulations, improve financial reporting, or adapt to new business realities. IRS Form 3115, officially titled “Application for Change in Accounting Method,” serves as the key document for requesting such changes. Whether you’re switching from cash to accrual basis, updating depreciation methods, or making inventory adjustments, this form ensures your transition is IRS-approved and properly documented. This SEO-optimized guide covers everything you need to know about Form 3115, including eligibility, filing steps, and the latest 2025 updates, drawing from official IRS sources and recent revenue procedures.

What Is IRS Form 3115 and Why Is It Important?

IRS Form 3115 is the formal application taxpayers use to request permission from the IRS to change either their overall method of accounting (e.g., from cash to accrual) or the accounting treatment of specific items (e.g., inventory valuation or depreciation). Accounting methods determine when income and expenses are recognized for tax purposes, directly impacting your taxable income and tax liability.

Changing methods without IRS consent can lead to penalties, audits, or disallowed deductions. Form 3115 provides a structured way to make these changes, often resulting in a Section 481(a) adjustment to prevent income or expense duplication or omission. Common reasons to file include complying with new tax laws, correcting impermissible methods, or optimizing for business growth—such as small businesses qualifying for cash method under inflated gross receipts thresholds (up to $31 million in 2025).

For example, if your business has grown and now exceeds the threshold for cash accounting, you might need to switch to accrual using Form 3115. This form is essential for farmers, manufacturers, retailers, and service providers alike.

Who Needs to File Form 3115?

Any taxpayer—individuals, corporations, partnerships, or estates—must file Form 3115 if they intend to change their accounting method for federal income tax purposes. This includes:

- Businesses Switching Overall Methods: Such as from cash to accrual (or vice versa) under Section 446, especially for those hitting the $31 million gross receipts test in 2025.

- Depreciation or Amortization Changes: Updating methods for assets like buildings, vehicles, or intangibles under Sections 167 or 168.

- Inventory-Related Adjustments: Changing valuation methods, LIFO to FIFO, or complying with uniform capitalization rules under Section 263A.

- Specific Item Treatments: Like advance payments, research expenditures, or bad debts.

Exemptions apply for certain elections that don’t require Form 3115, such as some de minimis rules, but most substantive changes mandate it. Qualified small taxpayers (average annual gross receipts of $31 million or less) often benefit from reduced filing requirements for many changes.

Automatic vs. Non-Automatic Accounting Method Changes

Accounting method changes fall into two categories:

Automatic Changes

These don’t require advance IRS approval—just file the form, and it’s considered granted if eligibility is met. They cover hundreds of scenarios listed in Rev. Proc. 2025-23, each with a Designated Change Number (DCN). Examples include:

- DCN 7: Depreciation changes under Section 168.

- DCN 122: Overall cash to accrual.

- DCN 265: Capitalizing research expenditures under Section 174 (effective for years after 2021).

Eligibility rules include no similar change in the prior five years and not being in the final year of business (with exceptions). Automatic changes often provide audit protection.

Non-Automatic Changes

These require IRS consent via advance ruling and involve a user fee (e.g., $12,600 standard, reduced for small entities). File as early as possible in the change year. Use if the change isn’t listed as automatic.

Step-by-Step: How to File IRS Form 3115

Filing Form 3115 involves careful preparation. Here’s a breakdown:

- Determine Your Change Type: Review Rev. Proc. 2025-23 for DCNs and eligibility.

- Complete the Form: Use the December 2022 revision. Key sections include:

- Part I: For automatic changes (enter DCN).

- Part II: General info, prior changes, and audit disclosures.

- Part IV: Section 481(a) adjustment calculation.

- Schedules A-E: Specific to change type (e.g., Schedule E for depreciation).

- Gather Documentation: Attach explanations, computations, and supporting authorities.

- File Copies:

- Original: Attach to your timely filed tax return (including extensions) for the year of change.

- Duplicate: Mail to IRS National Office (Ogden, UT for automatic) no earlier than the first day of the change year.

- Pay User Fee if Non-Automatic: Via Pay.gov.

- Electronic Filing: Not available; paper only.

For concurrent changes, use one form. Consult a tax professional for complex cases.

IRS Form 3115 Download and Printable

Download and Print: IRS Form 3115

Understanding the Section 481(a) Adjustment

A core component of Form 3115 is the Section 481(a) adjustment, which accounts for differences in income/expenses under old vs. new methods to avoid double-counting.

- Positive Adjustment: Spread over four years (or shorter if de minimis).

- Negative Adjustment: Taken entirely in the change year.

- Cut-Off Basis: Used for some changes (no adjustment for prior years).

Compute it in Part IV and attach a detailed statement.

Deadlines, User Fees, and Where to File

- Automatic Changes: File by the return due date (with extensions). Duplicate no later than that date. No user fee.

- Non-Automatic: File during the change year; user fees apply ($300–$59,500 based on type).

- Late Filings: Possible six-month extension for automatic under certain conditions.

Mail duplicate to: Internal Revenue Service, Attn: CC:PA:LPD:DRU, Room 5336, 1111 Constitution Ave. NW, Washington, DC 20224 (non-automatic) or Ogden for automatic.

2025 Updates: Rev. Proc. 2025-23 and Beyond

The IRS released Rev. Proc. 2025-23 on June 9, 2025, updating the automatic changes list by removing obsolete items and incorporating Section 174 research expenditure changes. Key highlights:

- Effective for Forms 3115 filed on/after June 9, 2025, for years ending on/after October 31, 2024.

- New DCN 272: Allowance charge-off method for regulated financial companies.

- Transition rules for pre-June filings: No refiling needed if duplicate was submitted under prior proc.

- Enhanced guidance for SRE expenditures (DCN 265/271), requiring capitalization over 5/15 years.

Check IRS.gov for post-2025 developments, as legislative proposals could allow immediate expensing for domestic research.

Common Mistakes When Filing Form 3115

Avoid these pitfalls:

- Missing DCN or eligibility checks.

- Incomplete Section 481(a) computations.

- Late duplicate filing.

- Not attaching required schedules or statements.

- Ignoring concurrent change requirements.

Working with a CPA can help ensure accuracy.

Final Thoughts on IRS Form 3115

Navigating IRS Form 3115 can seem daunting, but it’s a powerful tool for tax optimization and compliance. With the 2025 updates in Rev. Proc. 2025-23, more changes qualify as automatic, simplifying the process for many taxpayers. Always use the latest form and instructions from IRS.gov, and consider professional advice for your specific situation. By filing correctly, you can minimize tax burdens and avoid costly errors. For more details, visit the official IRS page on Form 3115.