Table of Contents

IRS Form 12153 – Request for a Collection Due Process or Equivalent Hearing – If you’re facing IRS collection actions like a tax lien or levy, understanding your appeal rights is crucial. IRS Form 12153, officially titled “Request for a Collection Due Process or Equivalent Hearing,” allows taxpayers to challenge these actions through the IRS Independent Office of Appeals. This form can help you explore payment alternatives, dispute liabilities under certain conditions, and potentially halt aggressive collection efforts. In this comprehensive guide, we’ll break down everything you need to know about Form 12153, including when to use it, how to file, and what to expect—based on the latest IRS guidelines as of 2025.

Whether you’re dealing with unpaid taxes, a notice of federal tax lien, or an intent to levy, filing Form 12153 timely can protect your rights and provide breathing room. Let’s dive in.

What Is IRS Form 12153 and Why Is It Important?

IRS Form 12153 is the official document used to request a Collection Due Process (CDP) hearing or an Equivalent Hearing (EH) when the IRS notifies you of certain collection actions. This form applies if you’ve received a CDP notice under Internal Revenue Code (IRC) sections 6320 or 6330, such as a Notice of Federal Tax Lien or a Notice of Intent to Levy.

The primary purpose of a CDP hearing is to give you an impartial review by the IRS Appeals Office before or after the IRS takes enforced collection steps. During the hearing, you can:

- Discuss alternatives to collection, like installment agreements or offers in compromise.

- Challenge the appropriateness of the lien or levy.

- Dispute the underlying tax liability if you haven’t had a prior chance to do so.

Filing this form is important because a timely CDP request can suspend collection actions (like levies) and extend the 10-year statute of limitations on collections. Without it, you might face immediate asset seizures or property encumbrances, making it harder to resolve your tax issues.

When Should You File IRS Form 12153?

You should file Form 12153 upon receiving specific IRS notices that offer appeal rights. Common triggers include:

- Letter 11: Final Notice of Intent to Levy and Notice of Your Right to a Hearing.

- Letter 1058: Final Notice – Reply Within 30 Days (intent to levy).

- CP90 or CP297: Final Notice of Intent to Levy.

- Letter 3172 or Letter 3173: Notice of Federal Tax Lien Filing and Your Right to a Hearing Under IRC 6320.

- CP504: Urgent!! Intent to Levy Certain Assets (a precursor to formal levy notices).

The key deadline for a CDP hearing is 30 days from the date on the notice. If you miss this window, you may still qualify for an Equivalent Hearing by checking the appropriate box on the form and filing within one year (plus five business days for liens) from the notice date. However, an EH doesn’t provide the same protections, such as suspending collections or allowing judicial review.

File if you believe the IRS action is inappropriate, you’re facing financial hardship, or you want to propose payment options. Not all collection actions qualify—some may fall under the Collection Appeals Program (CAP) instead.

CDP Hearing vs. Equivalent Hearing: Key Differences

Understanding the distinction between a CDP Hearing and an Equivalent Hearing is essential for maximizing your rights:

| Aspect | CDP Hearing | Equivalent Hearing |

|---|---|---|

| Timing | Filed within 30 days of notice | Filed after 30 days, up to 1 year |

| Suspension of Collection | Yes, prohibits most levies and suspends 10-year collection period | No suspension |

| Judicial Review | Yes, you can appeal the decision in court | No court appeal available |

| Process | Full review by Appeals Office | Similar review, but fewer protections |

| Outcomes | Can lead to alternatives like installment plans; disputes liability if no prior opportunity | Same potential outcomes, but without halting collections |

A timely CDP request offers stronger safeguards, so act quickly.

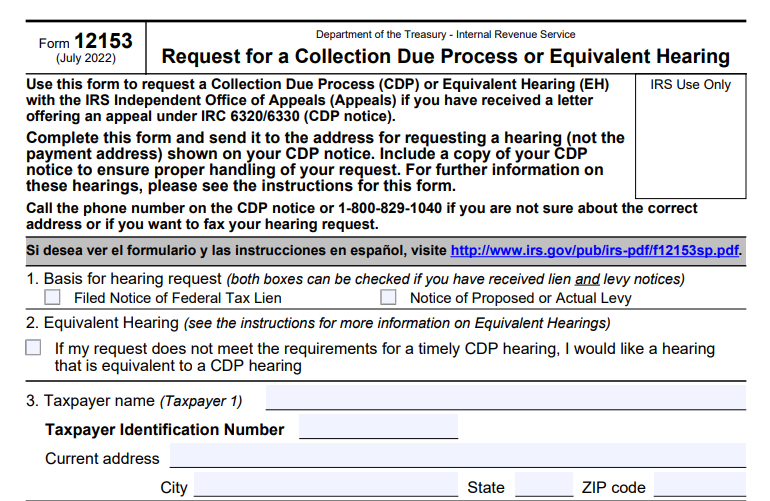

IRS Form 12153 Download and Printable

Download and Printable: IRS Form 12153

How to Fill Out and Submit IRS Form 12153

Filling out Form 12153 is straightforward but requires attention to detail to avoid invalidation. Here’s a step-by-step guide:

- Section 1: Basis for Request – Check boxes for “Filed Notice of Federal Tax Lien” and/or “Notice of Proposed or Actual Levy.” If both apply, check both.

- Section 2: Equivalent Hearing – Check this if your request is untimely for CDP.

- Sections 3-6: Personal Information – Provide your name(s), Taxpayer Identification Number (TIN), address, and contact details.

- Section 7: Tax Information – List the tax type, form number, and periods from your notice. Attach a copy of the notice to skip this if preferred.

- Section 8: Reason for Hearing – Explain your issues in detail (e.g., “I am not liable,” “Financial hardship,” or “Innocent spouse relief”). This is required; without it, your request is invalid.

- Section 9: Proposed Alternative – Suggest options like “Installment Agreement” or “Offer in Compromise.” Attach Form 433-A (individuals) or 433-B (businesses) with supporting documents for faster processing.

- Section 10: Signature – Sign and date. If represented, attach Form 2848 (Power of Attorney).

Submission Tips:

- Send to the hearing request address on your CDP notice (not the payment address).

- Include a copy of your notice.

- Keep proof of mailing (e.g., certified mail).

- For questions, call the number on your notice or 1-800-829-1040.

Submitting financial info early can expedite resolution, though it’s not mandatory.

What Happens After Filing Form 12153?

Once submitted, the IRS Appeals Office will review your request. For a timely CDP filing, collection actions are generally suspended. The hearing is typically conducted via phone or correspondence, where you’ll discuss your case with an impartial officer.

Possible outcomes include:

- Approval of a collection alternative (e.g., installment plan).

- Withdrawal or subordination of a lien.

- Determination on liability disputes (if eligible).

- Continuation of collection if no agreement is reached.

If you disagree with the outcome, you can petition the U.S. Tax Court (for CDP hearings only). Interest and penalties continue to accrue during this process.

Tips for a Successful CDP or Equivalent Hearing

- Act Fast: Meet the 30-day deadline for full CDP benefits.

- Be Detailed: Provide thorough explanations and documentation to strengthen your case.

- Seek Help: Consider Low Income Taxpayer Clinics (LITCs) or tax professionals for guidance.

- Explore Alternatives Early: Contact IRS Collections before filing to discuss options.

- Refer to Resources: Check IRS Publications 594 (The IRS Collection Process), 1660 (Collection Appeal Rights), and 2105 (Why Do I Owe Taxes?).

Remember, not all liability disputes can be raised in CDP—use audit reconsideration or refund claims if needed.

Final Thoughts on IRS Form 12153

Navigating IRS collection actions can be stressful, but Form 12153 empowers you to seek a fair review and explore resolution options. By filing promptly and preparing thoroughly, you can potentially avoid severe consequences like asset levies. Always consult the official IRS website for the most current form and instructions, as tax rules can evolve.

If you’re unsure about your situation, reach out to the IRS or a tax advisor. Taking proactive steps with Form 12153 could be the key to regaining control over your tax obligations.