Table of Contents

IRS Form 7203 – S Corporation Shareholder Stock and Debt Basis Limitations – As an S corporation shareholder, managing your tax obligations requires careful tracking of your investment in the company. One critical tool for this is IRS Form 7203, officially titled “S Corporation Shareholder Stock and Debt Basis Limitations.” This form helps you calculate your stock and debt basis, which directly impacts the deductions, losses, and credits you can claim on your personal tax return. Introduced in 2021, Form 7203 ensures compliance with basis limitation rules under Internal Revenue Code sections 1366 and 1367, preventing you from claiming more losses than your actual economic investment in the S corp.

In this article, we’ll break down everything you need to know about IRS Form 7203, including who must file it, how to calculate your basis, a step-by-step guide to completing the form, and tips for avoiding common pitfalls. Whether you’re a small business owner or an investor in an S corp, understanding these basis limitations can help you maximize tax benefits while staying IRS-compliant. This guide is based on the latest 2025 revisions to the form and instructions.

What Is IRS Form 7203 and Why Does It Matter?

IRS Form 7203 is a required attachment for certain S corporation shareholders filing their individual tax returns (Form 1040). Its primary purpose is to compute and report your adjusted basis in the S corp’s stock and any loans you’ve made to the company. Basis acts as a cap on the amount of passthrough losses, deductions, and credits you can deduct from the S corp’s Schedule K-1.

Without sufficient basis, excess losses are suspended and carried forward to future years when basis is restored. This prevents shareholders from claiming tax benefits exceeding their at-risk investment, aligning with the at-risk rules under IRC Section 465 and passive activity loss rules under Section 469. Failing to track basis accurately can lead to IRS audits, penalties, or disallowed deductions, making Form 7203 essential for tax planning in S corporations.

For the 2025 tax year, the form has been revised as of December 2025, with updates primarily clarifying calculations for complex scenarios like debt restorations and partial stock dispositions.

Who Needs to File IRS Form 7203?

Not every S corp shareholder must file Form 7203 annually, but it’s required in specific situations. According to IRS guidelines, you must attach Form 7203 to your tax return if you:

- Claim a deduction for your share of the S corp’s losses (including carryover losses from prior years limited by basis).

- Receive a non-dividend distribution from the S corp.

- Dispose of any S corp stock (regardless of whether you recognize a gain or loss).

- Receive a repayment on a loan you made to the S corp.

Even if filing isn’t mandatory, the IRS recommends completing and retaining the form annually to maintain accurate basis records. This is especially useful for multi-year tracking, as basis adjustments occur at the end of the S corp’s tax year.

File the form with your personal tax return by the due date (typically April 15, or October 15 if extended). If you’re using tax software like TurboTax or TaxSlayer, it may generate the form automatically based on your K-1 inputs.

Understanding Stock Basis in S Corporations

Your stock basis starts with your initial investment (e.g., the cost of purchased shares or carryover basis in tax-free transfers). It adjusts annually based on S corp activity reported on your Schedule K-1. Increases include:

- Ordinary business income.

- Separately stated income items (e.g., interest, dividends).

- Tax-exempt income.

- Excess depletion deductions.

Decreases include:

- Distributions (cash or property).

- Nondeductible expenses.

- Losses and deductions.

- Oil and gas depletion.

Basis can’t go below zero, and adjustments follow a specific order to prioritize income increases before losses. If you elect under Regulations section 1.1367-1(g), you can alter this order, allowing nondeductible expenses to be deferred.

Understanding Debt Basis in S Corporations

Debt basis applies to loans you personally make to the S corp (not guarantees or bank loans). It starts with the loan amount and adjusts similarly to stock basis, but only after stock basis is exhausted. Key points:

- Increases: New loans or advances.

- Decreases: Losses and nondeductible expenses exceeding stock basis; principal repayments.

- Restorations: Net increases from income can restore reduced debt basis, up to the original loan face value.

Open account debt (informal loans) is tracked net, while formal notes are separate. Repayments on reduced-basis debt can trigger gain recognition.

IRS Form 7203 Download and Printable

Download and Print: IRS Form 7203

How to Calculate Your S Corporation Shareholder Basis

To calculate basis, start with last year’s ending basis and apply adjustments in order:

- Add income and contributions.

- Subtract distributions.

- Subtract nondeductible expenses (unless electing deferral).

- Subtract losses and deductions.

Use data from your Schedule K-1 (boxes for income, distributions, etc.). For multiple shares or loans, prorate adjustments. Tools like spreadsheets or tax software can help, but always verify against IRS rules.

| Adjustment Type | Effect on Basis | K-1 Box Reference |

|---|---|---|

| Income Items | Increase | Boxes 1-10 |

| Contributions | Increase | N/A (Enter manually) |

| Distributions | Decrease | Box 16, Code D |

| Nondeductible Expenses | Decrease | Box 16, Code C |

| Losses/Deductions | Decrease | Boxes 1-12 |

Step-by-Step Guide to Filling Out IRS Form 7203

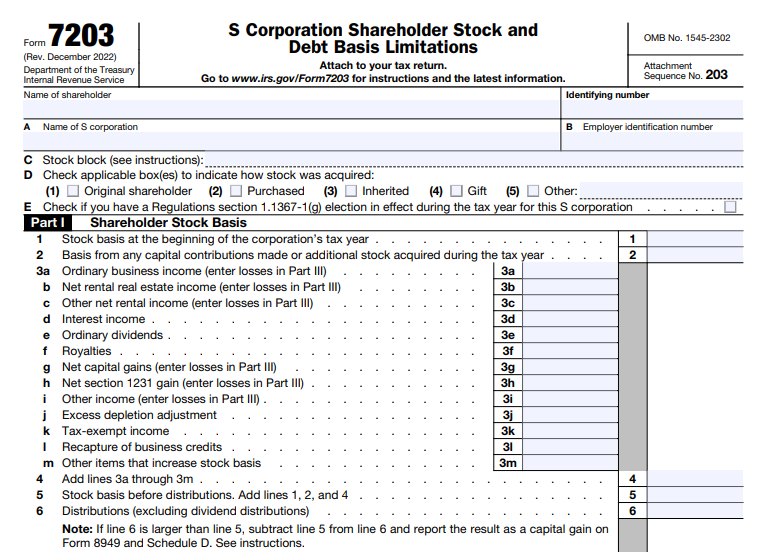

Form 7203 has three parts. Gather your prior-year basis, current K-1, and loan details before starting.

Part I: Shareholder Stock Basis

- Line 1: Enter beginning stock basis (prior year’s ending).

- Lines 2-5: Add contributions, income, and excess depletion.

- Line 6: Subtract distributions (excess over basis is gain).

- Lines 7-9: Subtract nondeductible items if no election.

- Line 11: Enter allowable losses from Part III.

- Line 12: Add debt basis restorations from Part II.

Part II: Shareholder Debt Basis

- Track up to three loans; use extras for more.

- Lines 16-20: Loan balances and adjustments.

- Lines 21-25: Basis calculations and restorations.

- Lines 26-33: Reductions for expenses and losses.

Part III: Shareholder Allowable Loss and Deduction Items

- Enter K-1 losses in columns (a) and (b).

- Allocate allowable amounts to stock (c) and debt (d); carry forward excess (e).

Report allowable items on your return; suspend the rest.

Common Mistakes When Handling S Corp Basis Limitations

Avoid these pitfalls:

- Forgetting to track basis annually, leading to overclaimed losses.

- Misclassifying loans (e.g., including guarantees).

- Ignoring the order of adjustments.

- Not prorating for partial dispositions.

- Failing to report gains on debt repayments.

Always keep records and consider professional help for complex cases.

Recent Changes and Updates for 2025

The 2025 revision (posted November 2025) includes minor clarifications on debt restoration rules and elections under section 1.1367-1(g). No major structural changes, but check the IRS website for any late updates.

In summary, IRS Form 7203 is your key to properly limiting S corp deductions based on your investment. By mastering stock and debt basis calculations, you can optimize your tax strategy. However, tax laws are complex—consult a CPA or tax advisor for personalized guidance to ensure accuracy and compliance. For the official form and instructions, visit the IRS website.