Table of Contents

IRS Form 712 – Life Insurance Statement – In the realm of estate planning and tax compliance, understanding the intricacies of life insurance policies is crucial. One key document that often comes into play is IRS Form 712, also known as the Life Insurance Statement. This form plays a vital role in reporting the value of life insurance policies for estate and gift tax purposes, ensuring accurate tax calculations and compliance with federal regulations. Whether you’re an executor handling an estate or a donor transferring policy ownership, knowing how to navigate Form 712 can save time and prevent costly errors. In this guide, we’ll break down everything you need to know about IRS Form 712, from its purpose to step-by-step filing instructions.

What is IRS Form 712?

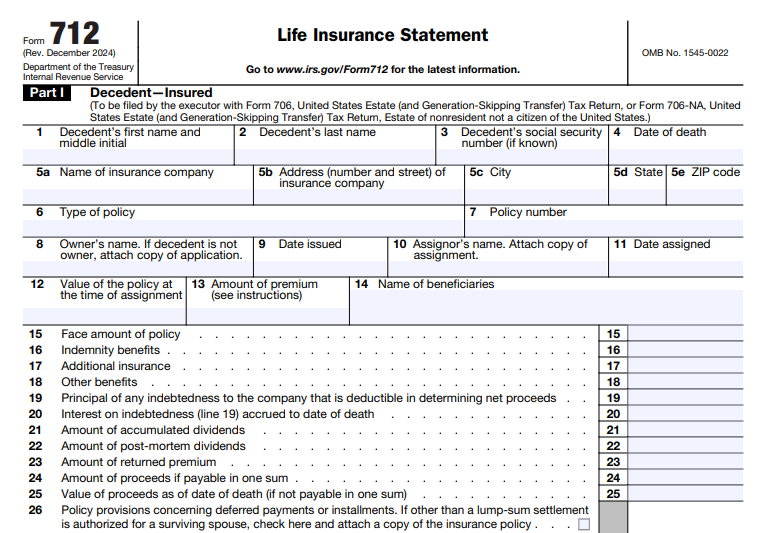

IRS Form 712 is an informational statement provided by life insurance companies to report the details and value of a life insurance policy. It includes essential data such as the policy’s face amount, accumulated dividends, outstanding loans, and net proceeds. The form is divided into two main parts: Part I for policies where the decedent is the insured, and Part II for policies involving a living insured, often used in gift scenarios.

This form is not filed independently but is attached to other tax returns like Form 706 (United States Estate Tax Return) or Form 709 (United States Gift Tax Return). A separate Form 712 must be completed for each life insurance policy involved. The latest revision of the form is from December 2024, making it current for 2025 tax filings.

Purpose of IRS Form 712

The primary purpose of Form 712 is to establish the fair market value of a life insurance policy at a specific point in time—either the date of death for estate taxes or the date of transfer for gift taxes. For estates, it helps determine if life insurance proceeds are includable in the gross estate, which could impact estate tax liability. In gift tax scenarios, it verifies the value of the policy being transferred, ensuring proper reporting on Form 709.

Key details reported include:

- Policy ownership and transfers within three years of death.

- Beneficiary information.

- Financial elements like premiums, dividends, and indebtedness.

- Valuation basis for installment payments or deferred benefits.

This information aids the IRS in verifying compliance under Internal Revenue Code sections like 6501(d) and 6109.

Who Needs to File IRS Form 712?

Form 712 is typically requested and certified by an officer of the life insurance company, not the taxpayer directly. However, the following parties are involved:

- Executors of Estates: Must attach Form 712 to Form 706 or 706-NA for any life insurance on the decedent’s life.

- Donors Making Gifts: Required for Form 709 when transferring ownership of a life insurance policy.

- Advisors or Representatives: Often handle requests on behalf of estates or donors.

If the estate’s value approaches or exceeds the federal estate tax exemption (currently $13.61 million for 2025, adjusted for inflation), filing becomes particularly important to minimize tax exposure.

When and Where to File IRS Form 712

Form 712 is filed as an attachment to the relevant tax return:

- With Form 706: Due nine months after the date of death, with possible extensions.

- With Form 709: Due April 15 of the year following the gift, or with an extension.

It is not sent separately to the IRS but returned to the executor or donor who requested it. Request the form early from the insurance carrier, as preparation can take time.

IRS Form 712 Download and Printable

Download and Print: IRS Form 712

How to Obtain IRS Form 712

To get Form 712:

- Download the blank PDF from the official IRS website (irs.gov).

- Contact the life insurance company directly, providing policy details and the date of death or transfer.

- For specific carriers like Protective Life, call their customer service line and specify the need for Form 712 due to a death or transfer.

There are no direct costs mentioned for obtaining the form, but processing times vary by insurer.

Step-by-Step Guide to Filling Out IRS Form 712

Filling out Form 712 requires accurate data from insurance records. An authorized company officer must certify it. Estimated completion time: About 18 hours for recordkeeping, plus preparation. Here’s a breakdown:

Part I: Decedent-Insured

Used for estate tax returns (Form 706/706-NA).

- Lines 1-4: Enter decedent’s name, SSN, and date of death.

- Lines 5-7: Insurance company details, policy type, and number.

- Lines 8-12: Owner, issue date, assignor, assignment date, and value at assignment.

- Line 13: Annual premium (not cumulative).

- Lines 14-25: Beneficiaries, face amount, benefits, indebtedness, dividends, and proceeds.

- Lines 26-30: Installment provisions, amounts, and valuation basis.

- Lines 31-35: Yes/No questions on transfers, annuities, ownership, and other policies. Attach copies of applications, assignments, or policies as needed.

Part II: Living Insured

Used for gift tax returns (Form 709) or estates with policies on others.

- Section A (Lines 36-40): Donor/decedent name, SSN, gift/death dates.

- Section B (Lines 41-57): Insured details, company info, policy specifics, premiums, assignee, and beneficiary.

- Line 58 (Non-paid-up policies): Calculate interpolated terminal reserve, add premiums/dividends, subtract indebtedness for net value.

- Line 59 (Paid-up/single premium): Compute single-premium cost, adjust for dividends/indebtedness.

Sign and date the certification at the bottom.

Valuation Methods and Common Issues

Valuation often involves the interpolated terminal reserve for ongoing policies or single-premium equivalents for paid-up ones. Common issues include:

- Transfers within three years of death, which may include proceeds in the estate.

- Incidents of ownership retained by the decedent.

- Delays in obtaining the form from insurers.

If proceeds are not includable, explain why on the tax return.

Tips and Best Practices for IRS Form 712

- Plan Ahead: Consult tax advisors before transferring policies to avoid unintended estate inclusion.

- Avoid Common Mistakes: Use annual premiums only on Line 13; attach all required documents.

- For Large Estates: Consider gifting policies to irrevocable trusts to remove them from the taxable estate.

- If No Form Available: Provide alternative documentation like policy copies or proceeds checks.

- Retain records as long as they may be relevant for tax purposes.

Recent Updates to IRS Form 712

As of December 2024, there are no significant updates to Form 712. However, always check the IRS website for the latest version, especially with ongoing adjustments to estate tax exemptions.

Conclusion

Mastering IRS Form 712 is essential for anyone dealing with life insurance in estate or gift planning. By accurately reporting policy values, you ensure compliance and potentially reduce tax burdens. If you’re unsure about any aspect, consult a tax professional. For the official form and instructions, visit the IRS website today.

This article is for informational purposes only and not tax advice. Always verify with current IRS guidelines.